$DMTK is a medtech co set to grow over 100% this year

Here's a quick pitch including concerns about gross margin, and why it's up 26% today

Here's a quick pitch including concerns about gross margin, and why it's up 26% today

1/ What they do

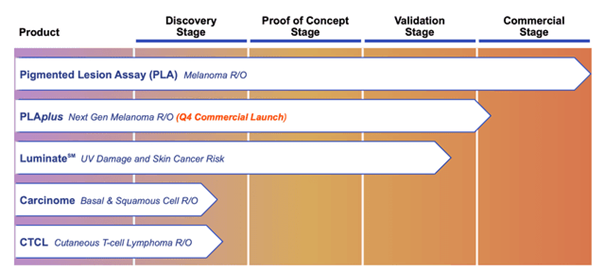

$DMTK developed a new approach to skin cancer screening.

Instead of cutting moles with a scalpel to analyze under a microscope, DMTK uses Pigmented Lesion Assays (PLA), which are like a band-aid that collects samples of skin.

$DMTK developed a new approach to skin cancer screening.

Instead of cutting moles with a scalpel to analyze under a microscope, DMTK uses Pigmented Lesion Assays (PLA), which are like a band-aid that collects samples of skin.

2/ these samples are analyzed in $DMTK's lab in california and evaluated based on tiny mutations in the DNA and RNA of the skin cells.

These are detected long before melanoma becomes visible to a microscope.

This is painless for the patient, unlike a regular scalpel biopsy.

These are detected long before melanoma becomes visible to a microscope.

This is painless for the patient, unlike a regular scalpel biopsy.

3/ The opportunity

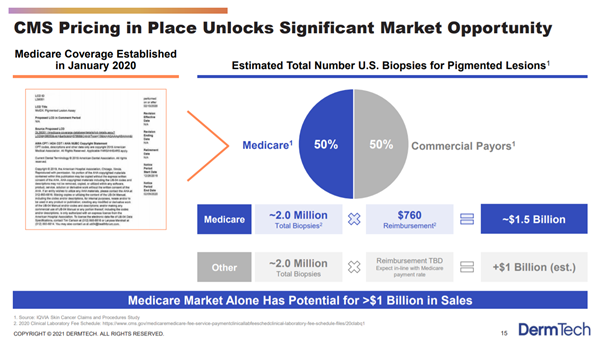

There are 11M melanoma biopsies performed annually in the US. Using $760 per sample (see below), this is an $8B opportunity.

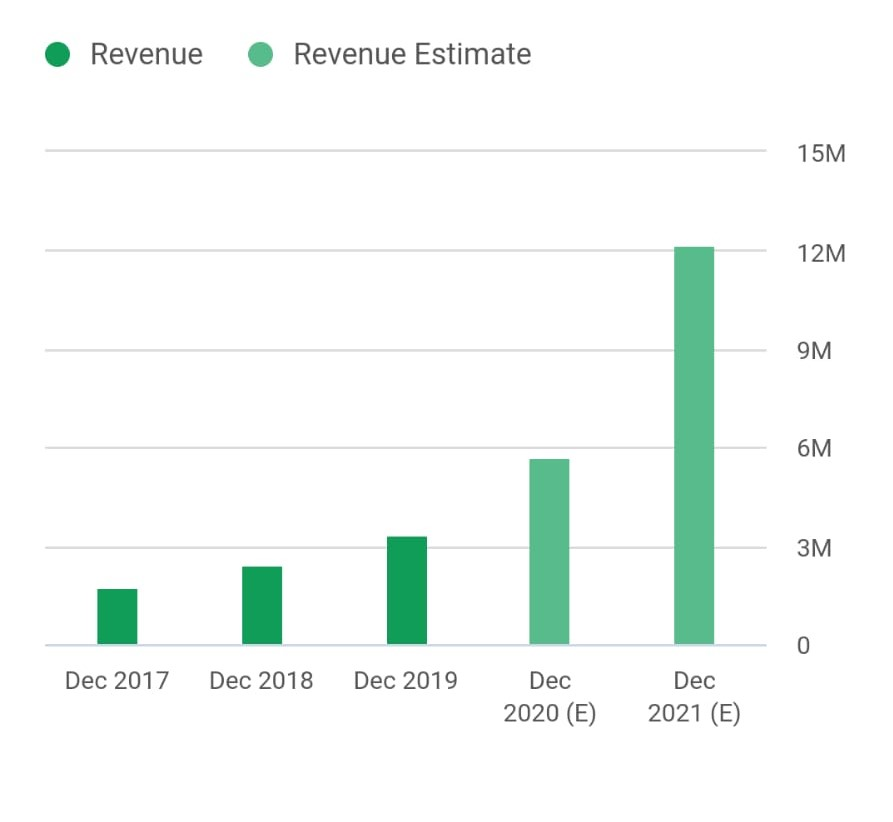

$DMTK is set to grow over 100% this year (analyst estimates). These estimates are conservative and some expect closer to $20M.

There are 11M melanoma biopsies performed annually in the US. Using $760 per sample (see below), this is an $8B opportunity.

$DMTK is set to grow over 100% this year (analyst estimates). These estimates are conservative and some expect closer to $20M.

4/ Gross margin concerns

$DMTK currently has negative gross margins. That's because the costs of analyzing the samples outweighs the reimbursement they get.

This is set to change:

$DMTK currently has negative gross margins. That's because the costs of analyzing the samples outweighs the reimbursement they get.

This is set to change:

5/ As you can see, $DMTK's price per sample has risen from $101 to $184 in recent quarters, with potentially more to come...

6/ $DMTK has achieved Medicare coverage with a reimbursement of $760 per sample.

They are still in negotiations with several other payors.

They are still in negotiations with several other payors.

7/ Which brings us to why $DMTK jumped 26% today. They inked an agreement with BCBS of Texas to cover DMTK's pigment assays for it's 6 million members. This is a big step towards future profitability.

While terms have not been disclosed, I expect them to be similar to Medicare.

While terms have not been disclosed, I expect them to be similar to Medicare.

8/ "Virtual" gross margin

If we assume $DMTK's revenue per sample goes to $760 while cost of revenue stays constant, this is what we get:

The gross margin would jump from negative 18% to positive 71%.

This is comparable to $EXAS which sports a GM of 77%.

If we assume $DMTK's revenue per sample goes to $760 while cost of revenue stays constant, this is what we get:

The gross margin would jump from negative 18% to positive 71%.

This is comparable to $EXAS which sports a GM of 77%.

9/ Valuation

At a market cap of $1.7B, $DMTK trades at 140x forward sales. This looks expensive, to say the least.

However, we have already established that they are growing fast and have potential to increase ASPs 3x.

As seen in Tweet 6, DMTK sees a path to $2.5B in sales.

At a market cap of $1.7B, $DMTK trades at 140x forward sales. This looks expensive, to say the least.

However, we have already established that they are growing fast and have potential to increase ASPs 3x.

As seen in Tweet 6, DMTK sees a path to $2.5B in sales.

10/ this does not include $DMTK's other products in the pipeline, which are the topic for another post

11/ Peer $EXAS trades at 19x TTM or 14x forward sales.

If $DMTK reaches $1B revenue, it can still be a 10-bagger from today's levels.

If $DMTK reaches $1B revenue, it can still be a 10-bagger from today's levels.

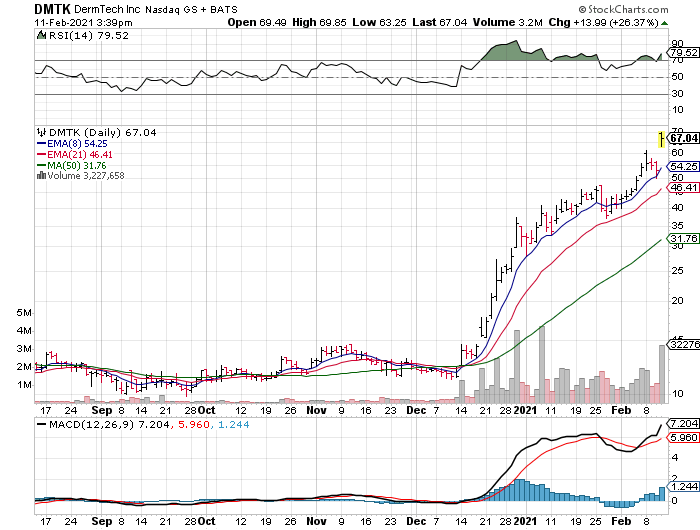

12/ Entry point

While the shares look over-extended in the short term, I see more potential in the long term.

I plan to add to my position if it drops to fill the gap from $56 to $62.

The 21 EMA at $46 would be an even better entry point, although it might not get there again.

While the shares look over-extended in the short term, I see more potential in the long term.

I plan to add to my position if it drops to fill the gap from $56 to $62.

The 21 EMA at $46 would be an even better entry point, although it might not get there again.

13/ Conclusion

$DMTK is an innovative medtech company that changes how melanoma is detected.

They are a small cap with under $2B market cap, over 100% revenue growth and a large TAM.

I am long and still adding. Thanks go out to @JonahLupton who brought this to my attention.

$DMTK is an innovative medtech company that changes how melanoma is detected.

They are a small cap with under $2B market cap, over 100% revenue growth and a large TAM.

I am long and still adding. Thanks go out to @JonahLupton who brought this to my attention.

Read on Twitter

Read on Twitter