First thing I look at is revenue/margin.

Rev: 1,200,000 (round number-not specific)

EBITDA: 544,595 (very specific and EBITDA not a great way to judge an opportunity because.... Nuance)

High margins for an auto repair business.

Pretty diversified between fleet and personal

Rev: 1,200,000 (round number-not specific)

EBITDA: 544,595 (very specific and EBITDA not a great way to judge an opportunity because.... Nuance)

High margins for an auto repair business.

Pretty diversified between fleet and personal

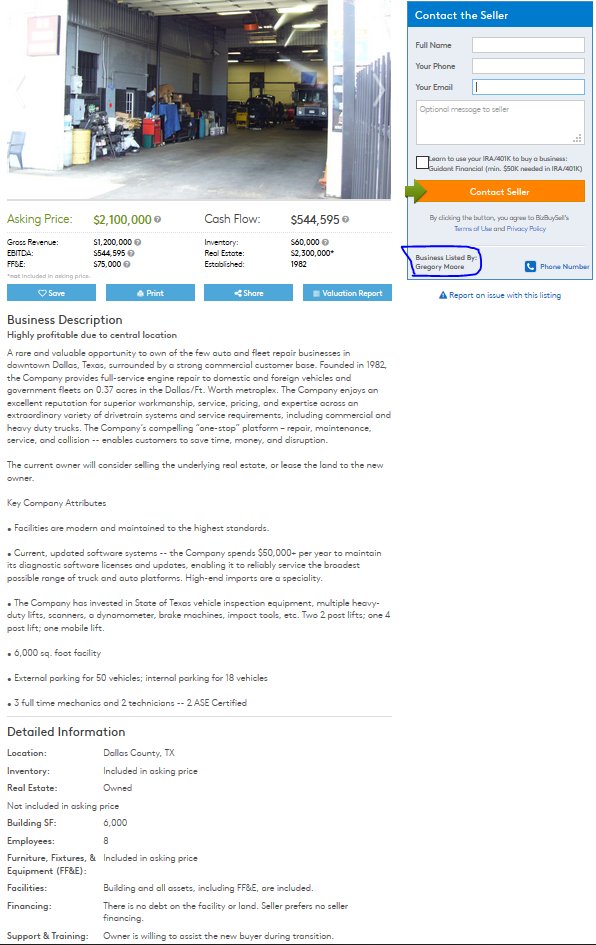

First thing that catches my eye--looks like it is listed by owner because no info for the broker (but you never know). This one is listed by a investment banker.

Real Estate: Not included 2.3m middle of Downtown Dallas

Age: 38 years old

Let's dig into the listing Language

Real Estate: Not included 2.3m middle of Downtown Dallas

Age: 38 years old

Let's dig into the listing Language

Indicates Engine repair, but also does all forms of repair including body work.

Owner is willing to sell 2.3acres of RE, but also lease long term for very good terms

Does Texas State inspections which is a huge way repair shops get leads. Inspection points out repairs needed.

Owner is willing to sell 2.3acres of RE, but also lease long term for very good terms

Does Texas State inspections which is a huge way repair shops get leads. Inspection points out repairs needed.

Tons of parking 50 vehicles which is a big benefit for auto repair and truck based service businesses in general.

5 Actual employees who are ASE certified who are willing to stay on.

6000 sqft is room to maintain current ops, but would have to study if room to grow ops

5 Actual employees who are ASE certified who are willing to stay on.

6000 sqft is room to maintain current ops, but would have to study if room to grow ops

Listing indicates that the Building IS included, but above that--RE NOT included (clarify this)

No Seller financing, so come with cash.

No Seller financing, so come with cash.

Here are my thoughts. Strong brand and presence in Dallas 38years. Strong cashflow-however, need to look into the contracts they have.

Would have to determine SDE or FCF, but if we are going off the EBITDA, 2.1M is high.

Doesn't look like they pay EEs enough...

Would have to determine SDE or FCF, but if we are going off the EBITDA, 2.1M is high.

Doesn't look like they pay EEs enough...

Value to me: Tops 1.6-1.8M based on longevity in the area and assuming Revenues are extremely consistent based on that longevity.

Main question other than financials: is there a path to scaling operations in the current location?

Worth a call since listed by owner (??)

Call.

Main question other than financials: is there a path to scaling operations in the current location?

Worth a call since listed by owner (??)

Call.

Read on Twitter

Read on Twitter