Accredited Investor requirements are the single biggest barrier preventing you from investing in startups, VC and other incredible asset classes.

What's the point of accreditation requirements?

Hint: It's NOT about preventing you from making risky bets.

What's the point of accreditation requirements?

Hint: It's NOT about preventing you from making risky bets.

I see this all the time on Twitter:

"You can buy lotto tickets, gamble away your savings at the roulette table, or buy OTM call options. So why do you have to be accredited to invest in startups?"

This simple answer is it's not just a question about risk

"You can buy lotto tickets, gamble away your savings at the roulette table, or buy OTM call options. So why do you have to be accredited to invest in startups?"

This simple answer is it's not just a question about risk

Lotteries, Gambling, Options = High risk, low ROI, but level playing field, and no fraud risk

Startup financing = High risk, high ROI

BUT

Fully unregulated startup financing = Un-level playing filed, and high fraud risk (see ICO craze)

Startup financing = High risk, high ROI

BUT

Fully unregulated startup financing = Un-level playing filed, and high fraud risk (see ICO craze)

Accredited requirements are in place to protect you from FRAUD risk, not to stop you from taking on risk.

NOT meant to aim at you & say "too risky, you can't invest"... They aim at the fundraiser & say, "to raise from all, meet one of these available bars to prove you're legit"

NOT meant to aim at you & say "too risky, you can't invest"... They aim at the fundraiser & say, "to raise from all, meet one of these available bars to prove you're legit"

Simply, a wild west of securities fundraising without fraud controls would be bad for the everyday investor.

Imagine a flashy ad (with no SEC oversight) shows off "the newest supersonic jet" and raises $100M. Turns out plane doesn't fly.

(Or truck doesn't have an engine )

)

Imagine a flashy ad (with no SEC oversight) shows off "the newest supersonic jet" and raises $100M. Turns out plane doesn't fly.

(Or truck doesn't have an engine

)

)

So, the rules exist to say "Register your securities with the SEC to raise from the public, OR fit into one of our exemptions"

So, what are the exemptions? There are many.

And the good news is the recent ones have been huge in improving access for non-accredited investors

So, what are the exemptions? There are many.

And the good news is the recent ones have been huge in improving access for non-accredited investors

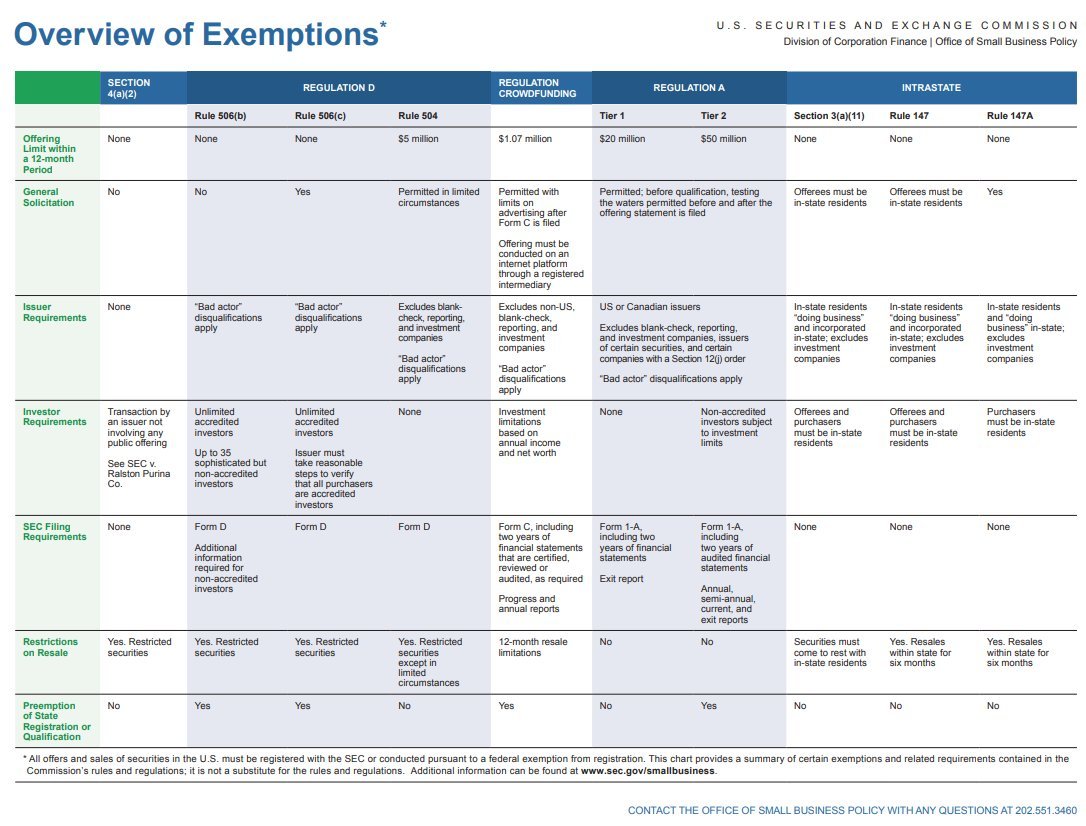

Here's SEC's list of exemptions

Reg D is what is used in most startup financing. Basically, "Raising from qualified investors? Cool, wild wild west, get after it"

Reg CF and Reg A are the newer ones coming from the JOBS Act over the last ~decade to start to open things up

Reg D is what is used in most startup financing. Basically, "Raising from qualified investors? Cool, wild wild west, get after it"

Reg CF and Reg A are the newer ones coming from the JOBS Act over the last ~decade to start to open things up

By lowering the barriers,  is opening new sources of capital for new businesses, and improving the ability for the everyday investor to take on these reasonably-fraud-limited risks

is opening new sources of capital for new businesses, and improving the ability for the everyday investor to take on these reasonably-fraud-limited risks

Side note: That photo is already out of date - Reg CF limit is going up to $5M and Reg A $75M

is opening new sources of capital for new businesses, and improving the ability for the everyday investor to take on these reasonably-fraud-limited risks

is opening new sources of capital for new businesses, and improving the ability for the everyday investor to take on these reasonably-fraud-limited risksSide note: That photo is already out of date - Reg CF limit is going up to $5M and Reg A $75M

And as a shameless plug, we're using one of these new exemptions, Reg A, to reinvent real estate investing for the everyday investor over at @investwithLEX. Check us out.

The future is bright.

The future is bright.

Read on Twitter

Read on Twitter