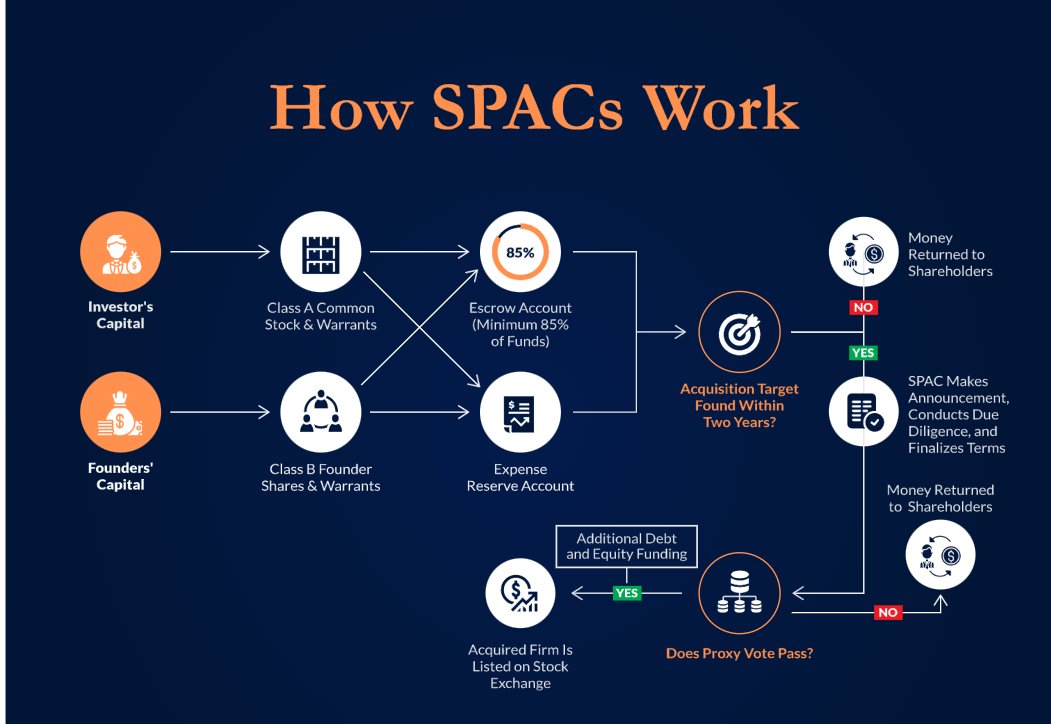

1. Special Purpose Acquisition Vehicle (SPAC) is a company formed specifically to raise money through an IPO for the sole purpose of acquiring a private company at a future date.

2. SPACs are formed by Individuals or Corporates called Sponsors who file the IPO process with the SEC (usually with less hassle) and owns a substantial share in the company.

3. Once the IPO process is completed, shareholders are usually entitled to a share and a fraction of warrant in the SPAC. So if you buy into a SPAC, you get a share and a possibility of buying more (warrants)

4. After the IPO, the funds received from investors are put in a Trust Account pending the time an acquisition is made with the funds. The Trustee usually invests the money in Government bonds.

5. Post-IPO, the Sponsors starts to search for potential companies to acquire with the fund. Acquisition targets are usually within the area of expertise of the Sponsors.

E.g. Fishermen SPAC now identifies a start-up firm in the food tech space called Nada Foods

E.g. Fishermen SPAC now identifies a start-up firm in the food tech space called Nada Foods

6. SPACs have a specified period to identify acquisition targets, usually within 2 years. If Fishermen SPAC doesn't make an acquisition between that period, the money in the trust account is returned to shareholders.

7. After choosing the acquisition target by Fishermen SPAC, a vote is usually done by the shareholders to vote on whether they approve or disapprove of the acquisition.

8. If they proceed with the acquisition of Nada Foods, the Company is then listed on the Stock Exchange hence becoming a Public Company.

Compared to the long process of a traditional IPO and registration with SEC, going public via SPAC is usually faster.

Also the acquired company gains the expertise of the Sponsors in going PUBLIC.

Also the acquired company gains the expertise of the Sponsors in going PUBLIC.

Can the SPAC structure work in Nigeria?

Definitely! For companies especially in emerging industries such as tech who are willing to go PUBLIC but doesn't want to go through SEC-related stress, going through SPAC is the best fit. Also on the plus side, the acquired companies...

Definitely! For companies especially in emerging industries such as tech who are willing to go PUBLIC but doesn't want to go through SEC-related stress, going through SPAC is the best fit. Also on the plus side, the acquired companies...

are usually bought at a premium.

NSE recently released a draft regulatory framework for the listing of SPACs in Nigeria, so fingers crossed.

NSE recently released a draft regulatory framework for the listing of SPACs in Nigeria, so fingers crossed.

Is there a SPAC Bubble?

In 2020, 247 newly formed SPACs raised $83 billion in capital through Initial Public Offerings. More SPACs have been formed within 2019 and 2020 than ever. So maybe YES!

In 2020, 247 newly formed SPACs raised $83 billion in capital through Initial Public Offerings. More SPACs have been formed within 2019 and 2020 than ever. So maybe YES!

One of the most popular SPAC booster is Chamath Palihapitiya who founded the SPAC that bought Virgin Galactic from Richard Branson and Opendoor (the online real estate company) in 2020.

Notable people who have cited interests in forming SPACs include:

1. Shaquille O'Neal

2. Colin Kapernick

3. Tidjane Thiam

4. Ava DuVernay

1. Shaquille O'Neal

2. Colin Kapernick

3. Tidjane Thiam

4. Ava DuVernay

Interested in knowing more, these articles may SPAC your interest https://www.google.com/amp/s/www.investopedia.com/amp/to-the-moon-spac-frenzy-continues-in-2021-5105307

Read on Twitter

Read on Twitter