If you use your own vehicle, you are probably thinking that petrol will touch Rs 100/L soon. Somehow, there is no public angst against this tax-led price hike. Petrol is being taxed at 180% by Centre and states together. But where is your money going? 1/n

Both Centre and states, but the latter are being short-changed on the revenues earned through these taxes. Large part of tax to Centre will not be shared with states, who'd get Rs 14k cr against Rs 70-75k cr in usual scenario, as their share from Centre's fuel tax. How? 2/n

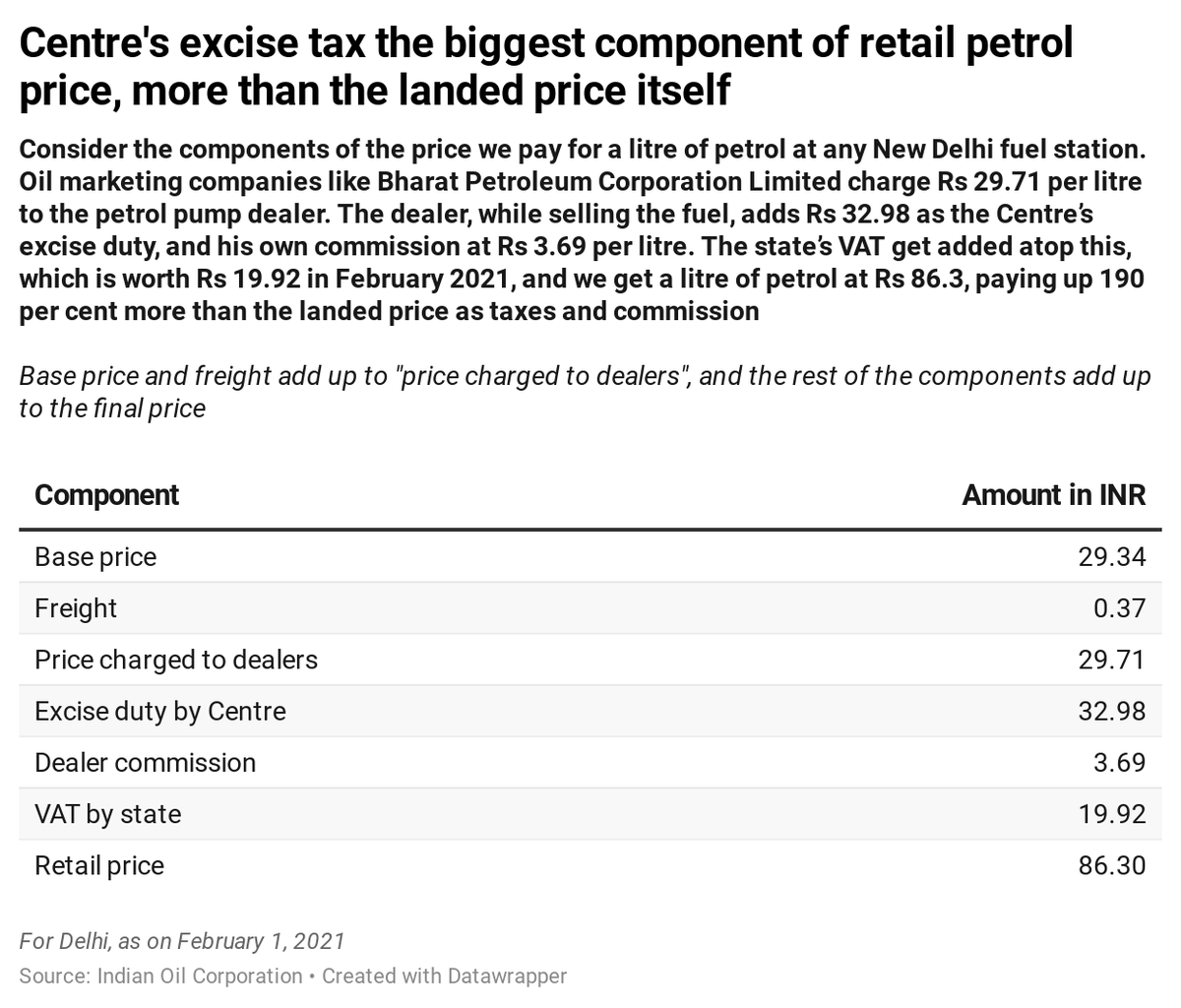

Dealer buys petrol at Rs 29.7 from oil co. Central govt taxes it with Rs 32.9, more than the cost itself! (This was intro during lockdown, but tax > orig price has happened before). Dealer commission is followed by state VAT of Rs 20/L. Centre's component is bigger. 3/n

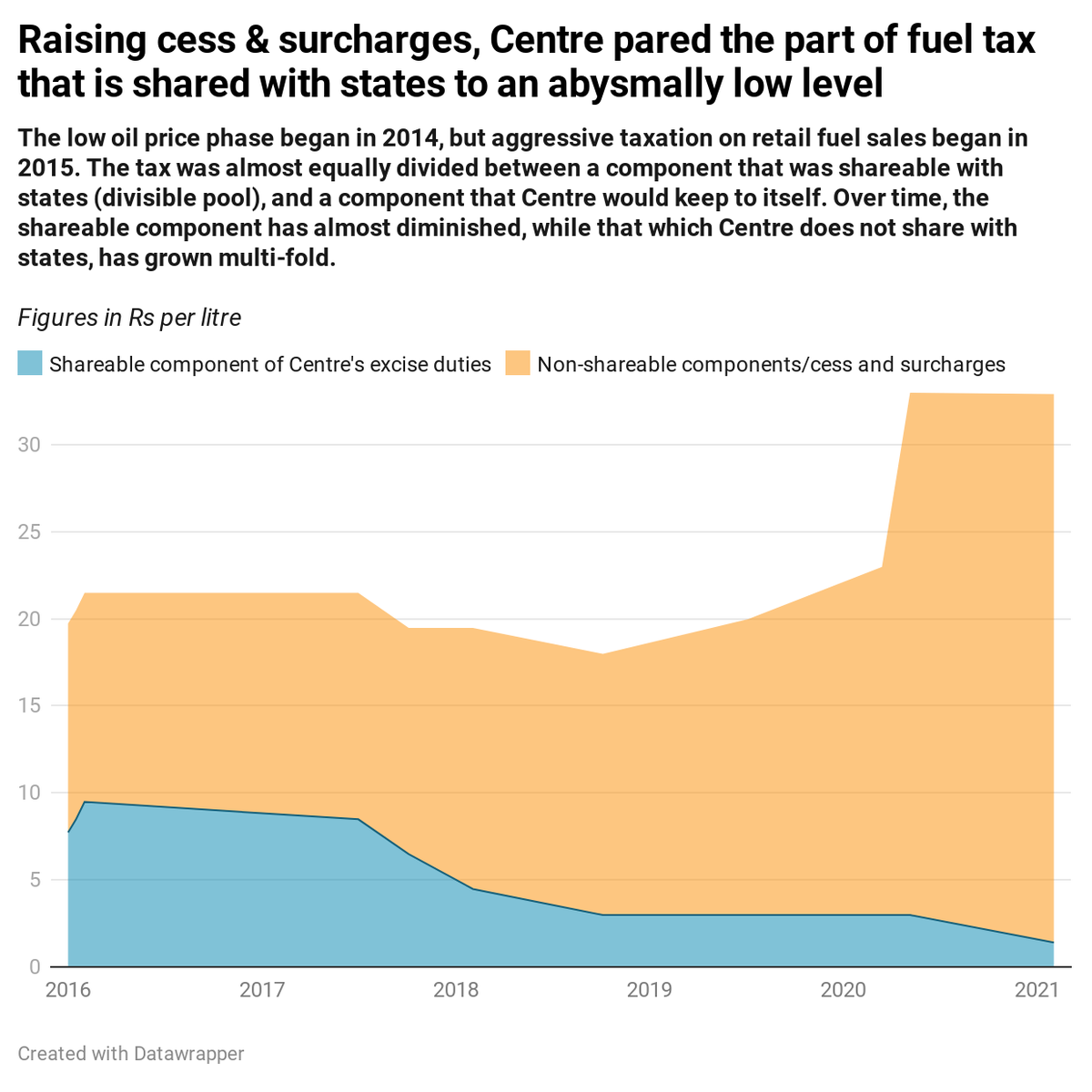

Now, taxes collected by Centre are to be shared with states as its their right. But there are some taxes which states do not have a claim on: those which are named as cess or surcharge. The Constitution allows Centre to keep all proceeds from them, to itself. 4/n

Centre reduced the incidence of basic excise duty (shared with states) and raised cess several times, and more so during lockdown and in the recent Budget, so much that the shareable part is now noise in the cess which has become the signal. 5/n

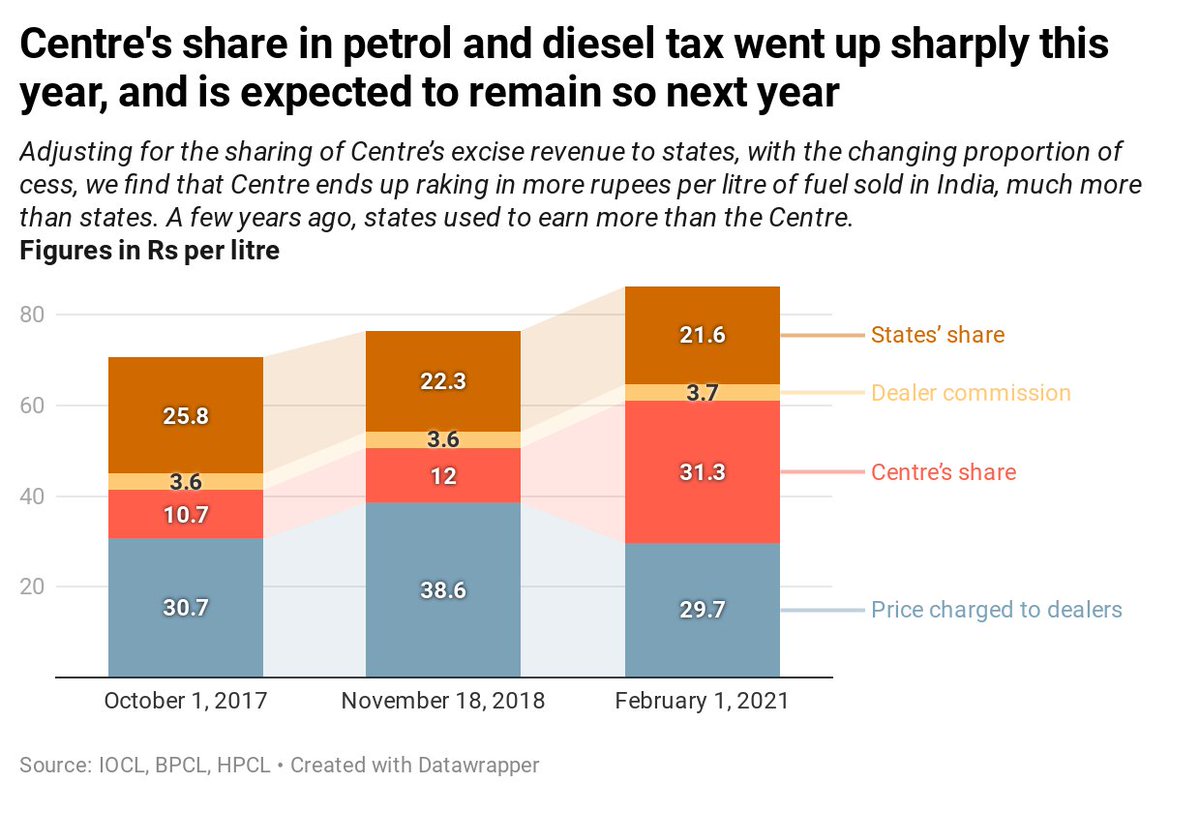

Thus, states's share from Centre's tax revenue from fuels will be negligible compared to the actual tax the former collects from them. To what extent? After adjusting for states' share using a proxy, this is how distribution of tax per litre of petrol would look like. 6/n

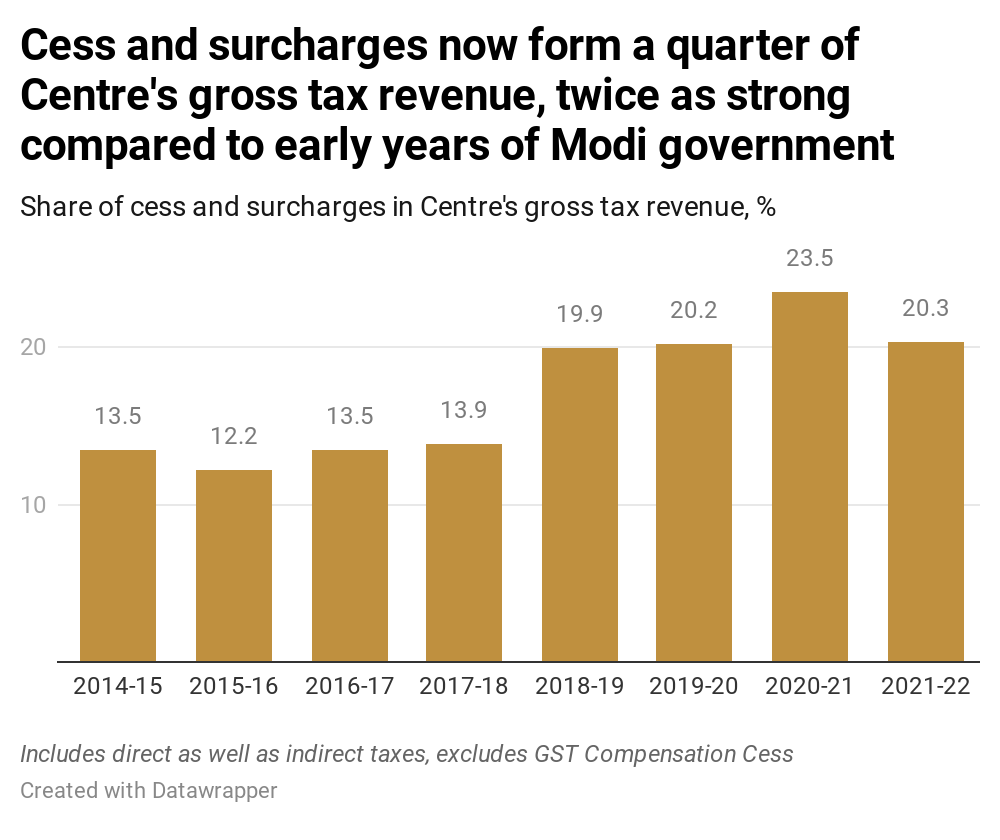

Cess and surcharges will form 23% of gross revenues of central govt this year, meaning, states will not have a claim on a fourth of revenues collected, just because they have been named as cess/surcharge, meant to be spent on predefined areas. 7/n

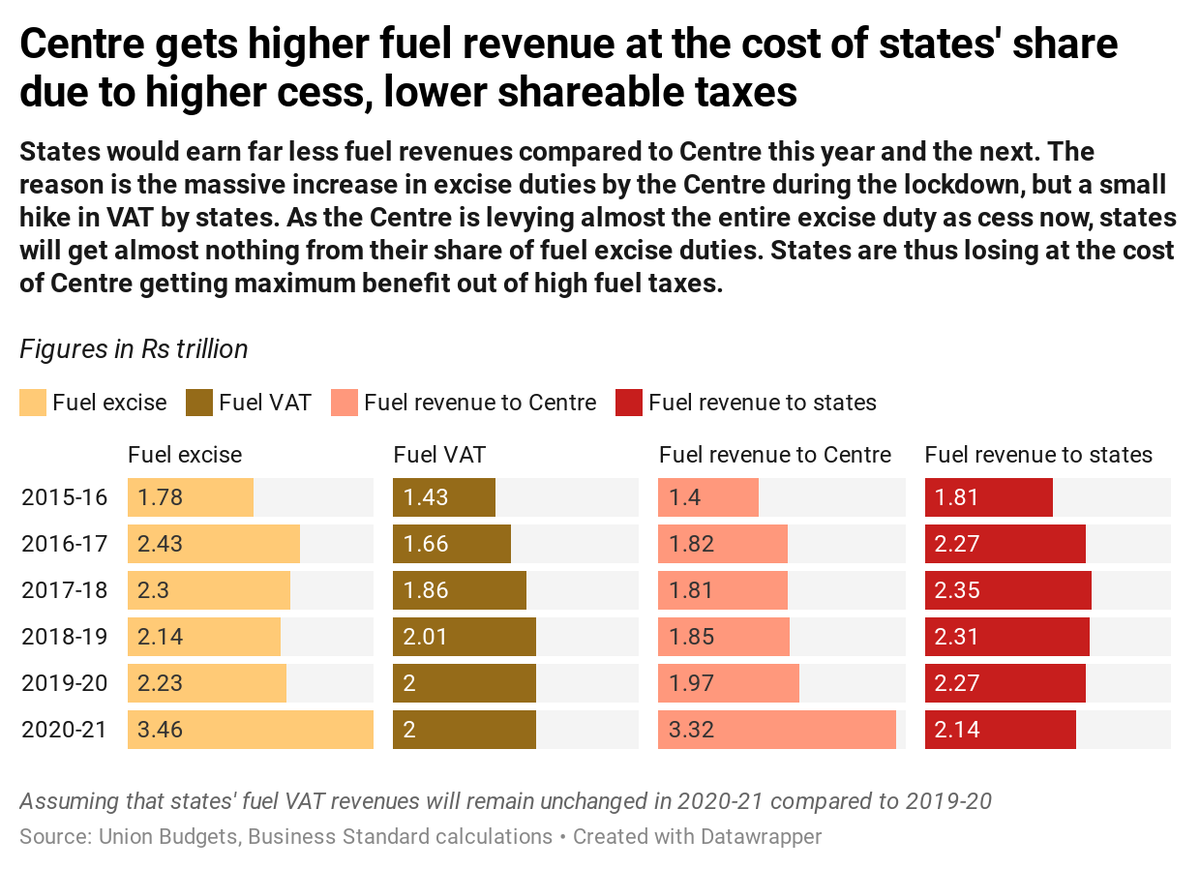

Assuming states' fuel VAT revenue remains intact in FY21 over FY20 (consumption  , tax marginally

, tax marginally  ), states will probably end up earning 20% less than Centre in FY21. They earned 30% more a few years ago, a simple calc adjusting for states' share in Centre's excise shows. n/n

), states will probably end up earning 20% less than Centre in FY21. They earned 30% more a few years ago, a simple calc adjusting for states' share in Centre's excise shows. n/n

, tax marginally

, tax marginally  ), states will probably end up earning 20% less than Centre in FY21. They earned 30% more a few years ago, a simple calc adjusting for states' share in Centre's excise shows. n/n

), states will probably end up earning 20% less than Centre in FY21. They earned 30% more a few years ago, a simple calc adjusting for states' share in Centre's excise shows. n/n

Read the story here: https://www.business-standard.com/article/economy-policy/why-rising-fuel-costs-should-particularly-concern-state-govts-and-you-121021001725_1.html

Read on Twitter

Read on Twitter