The past month I've been focusing on monetizing meme stocks through algo trading. It's gone well (now ~12.2% ytd with .1% drawdown). Macro has been playing out too though - however - and for the purpose of mental clarity, wanted to talk qualitative trades. A thread

1/ First. Re: style. I subscribed to the Soros school, where I state my views in advance, track their outcomes and treat out of sample validation as 10x more important than back-fit narrative. My 2 pieces this year below:

https://goodalexander.com/2021/01/02/new-beginnings/ https://goodalexander.com/2021/01/11/week2-letsgo/

https://goodalexander.com/2021/01/02/new-beginnings/ https://goodalexander.com/2021/01/11/week2-letsgo/

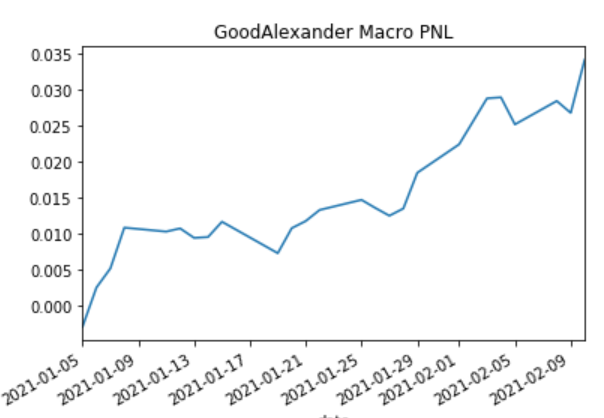

2/ Here's the PNL curve ytd on qualitative macro trading

Stats: +3.4% ytd (~1.2x leverage)

~10x Annual portfolio churn

Position #: 57

% UpDays: 69%

Avg Up Day: .28%

Avg Down Day: .21%

Max DD: .4%

(note the csv breakdowns that drive this are linked in the articles)

Stats: +3.4% ytd (~1.2x leverage)

~10x Annual portfolio churn

Position #: 57

% UpDays: 69%

Avg Up Day: .28%

Avg Down Day: .21%

Max DD: .4%

(note the csv breakdowns that drive this are linked in the articles)

3/ Now let's decompose what worked over the past cycle (since 2nd article)

Green Old Deal: +90 bps

Policy Initiatives: +80 bps

Virus Acceleration: +50 bps

IG Fixed Inc Short: +13 bps

UK Bull: + 11 bps

Decline and Fall: +6 bps

Commod Inflation: -13 bps

Green Old Deal: +90 bps

Policy Initiatives: +80 bps

Virus Acceleration: +50 bps

IG Fixed Inc Short: +13 bps

UK Bull: + 11 bps

Decline and Fall: +6 bps

Commod Inflation: -13 bps

4/ The very basic narrative behind the PNL is that the Biden administration is spending like crazy, and stocks that benefit from this spending are doing well while fixed income is trading quite poorly due to inflationary pressure and fiscal overhang. Not rocket science.

5/ The second narrative that worked was that Big Tech would benefit from the virus accelerating more so than harm from future regulation, which seems to be true (especially after Robinhood etc shifted focus away from Big Tech). Seems still true.

6/ The commodity inflation narrative didn't really work (Gold losses etc) and the story that the US would severely underperform foreign equities did not work either (despite it being the tagline of the 2nd blog post). I think this speaks to perhaps overthinking 2nd order effects

7/ One observation here - despite countless people decrying "how unintuitive the market is" due to meme trading etc - doing the common sense macro trades have actually worked just fine year to date. Given the wild nature of the news cycle - I think this is contrarian/interesting

8/ I continue to think that playing "Simon Says" with policy makers makes a lot of sense in macro. Oil production cuts as environmental consensus builds could be kicking off a major boom cycle in Brent Crude and Natural Gas -- for example.

9/ As funds grow scared of shorting equities due to the GME saga, I believe there will be increased demand to short High Yield and Emerging Markets credit which now are at narrows vs US30y. I think HYG and EMB shorts vs green debt longs (BGRN holdings) will work this year

10/ Re: regime shifts. I'm becoming increasingly concerned that China is dumping US treasuries at an accelerating pace which is driving some of the dollar's weakness. I plan on exploring this tinfoil hat theory in depth this weekend (suggested reading welcome).

10/ I'll likely update my macro views this weekend to reflect new ideas. From a total portfolio risk perspective my game plan is to keep market making meme stocks until the "stimmy" checks get cashed and Robinhood / FUTU start dropping off in the app stores. Good luck trading.

Read on Twitter

Read on Twitter