Treasury Wine Estates $TWE $TWE.AX is a global premium wine producer, owner of Penfolds Grange – a collector’s item. Recently it has been hit hard by Covid-19 and China-Australia trade wars. Earnings are down, but is there an asset play? Let’s take a deep dive.

1. Investment Thesis: I prefer stalwarts, but this looks like a decent one-sided asset bet with significant optionality (takeovers, divestments, new markets, completion of trade wars, or return to earnings). The sum-of-its-parts valuation shows it’s may be heavily undervalued.

2. Macro: The earliest remnants of wine date back to the Neolithic period (c.8500BC) – arguably one of the most disruption-proof industries. People will continue to drink wine I suspect for another 10,000 years toboot..

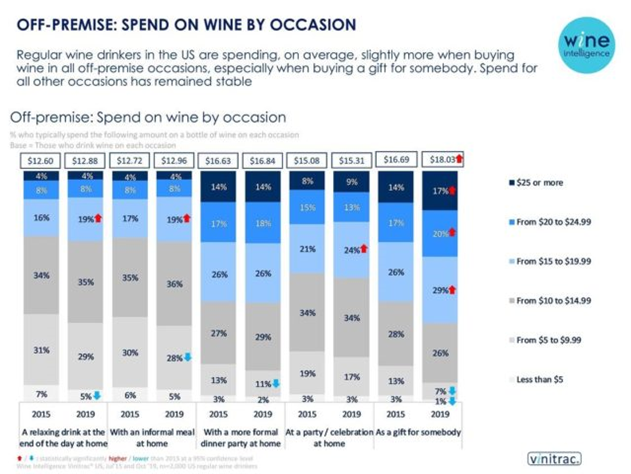

3. Macro: The premiumisation of wine is an ongoing trend. According to @TheIWSR, Super-premiums, Ultra-premiums, Prestige, Prestige-Plus have grown year on year in volume and average price (+1.2% CAGR) for the past 5 years. I suspect this will continue.

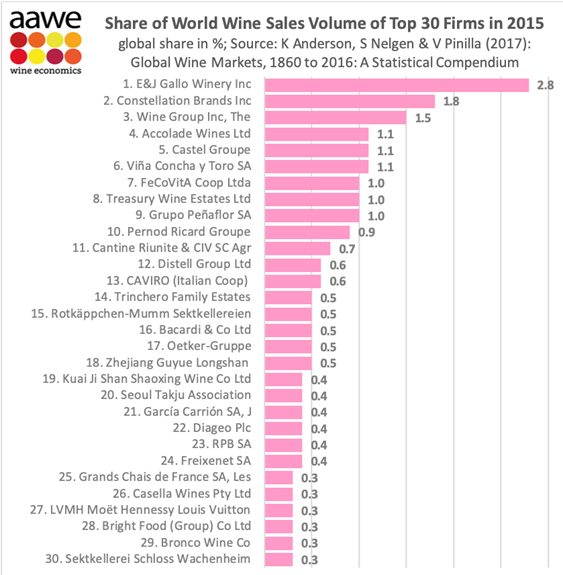

4. Market Dynamics: #wine is a fragmented market, with a long runway for future consolidation. The top 10 biggest companies are c.12% of production, with TWE around 1% ranked 8th. Market exhibits very low barriers to entry and switching costs (limited moats)...

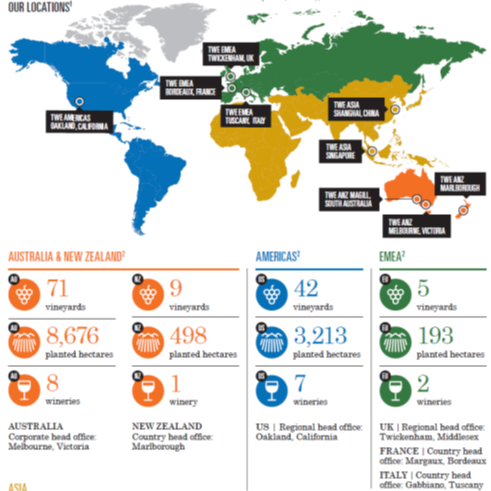

5. TWE: A global wine producer with vineyards in #Australia, #Europe, #US, #NewZealand, and exporting to 70+ countries. While some vineyards date back to 19th century, the company was a spinoff from Fosters Group in 2011.

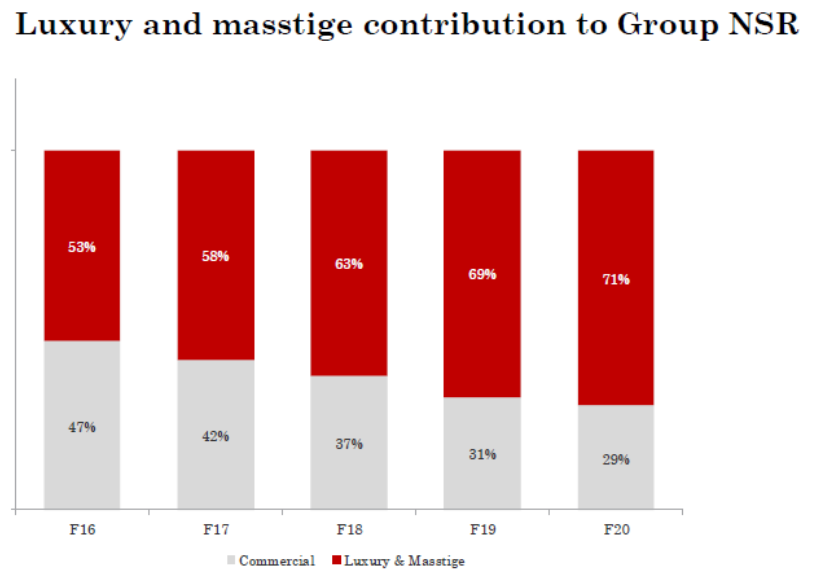

6. Premiumisation Strategy: Since 2014 TWE has sought to expand its exports and margins through premiumisation. This has been extremely effective at shifting the business away from commodification, and increasing margins from 15% (FY15) to 24% (FY19).

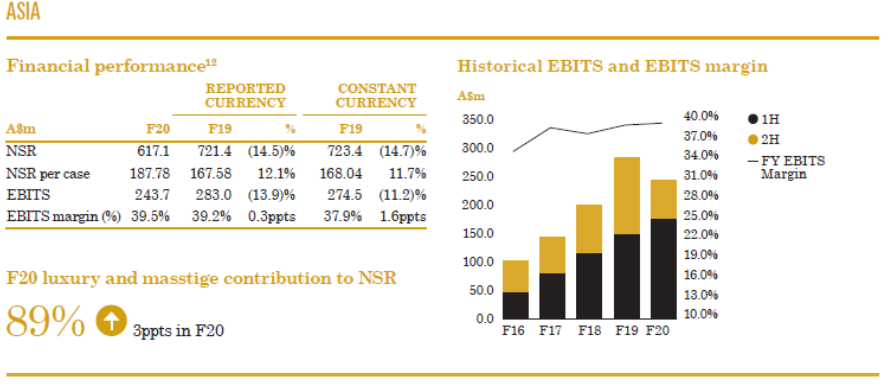

7. Covid then China, a year to forget: #COVID19 impacted sales particularly via restaurants (-25% NPAT in 2020), and then China (25% revenue, 45% EBITDA and c.80% future growth) announced trade barriers on Australian wine. Share price clearly tanks...

And that’s the set up – pretty simple really. Company doing well smashed in the face by two pretty substantial and uncommon exogenous events. So what’s the company worth now? And has the market priced this correctly? Let's dive deeper...

8a. DCF ex-China: One way to value TWE is to look through Covid and DCF the earnings/growth ex-China to provide a worst-case benchmark – and you get around $7-7.70 per share. But three things could happen:

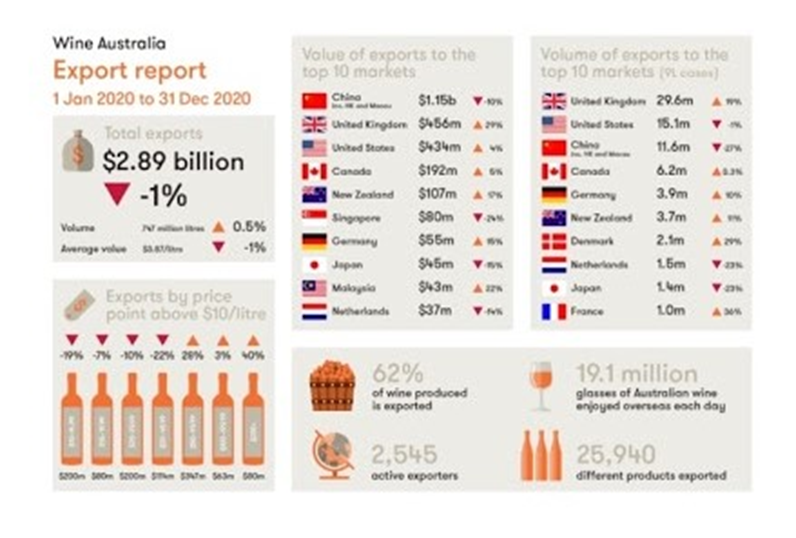

8b. First, alternative markets could be found with lower margins (likely). Second, China may continue buying despite the 169% tariff (recent data shows volume -27% but revenue -10%, so premium holding up). Third, the trade war may end (Biden to the rescue?)

9. Fair value on future earnings: The market has probably efficiently priced in future potential earnings at around $9-11 per share assuming limited upside on China. But what if there was another option… an acquirer? Divestments?

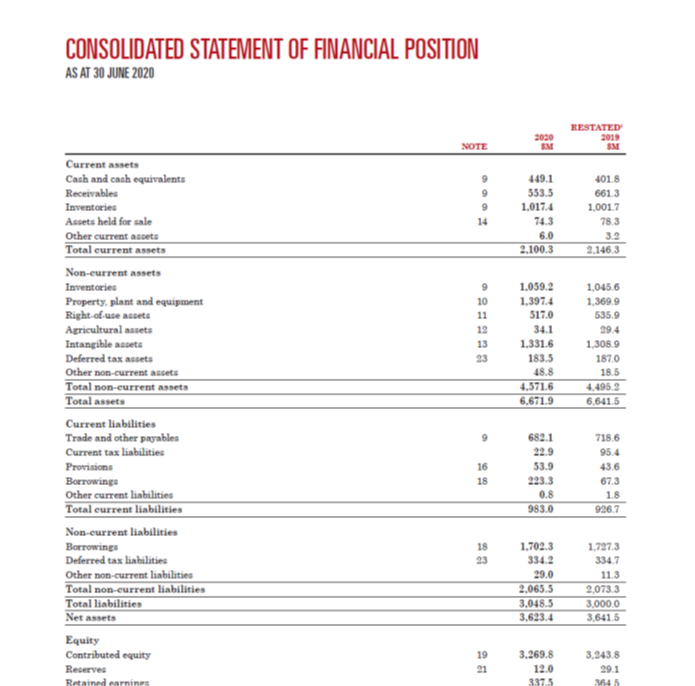

10. TWE Balance Sheet: There are some big assets like inventory (think: #Grange in cellars), vineyards and intangibles (think: brand values) – all of them are potentially yet substantially undervalued.

11. Inventory: “valued at the lower of their cost or estimated net realisible value”–imagine having $1.3bn of luxury wines aged in cellars valued at cost ($40/bottle?) rather than potential sale price ($250-$400/bottle?). Conservatively ~$2bn undervalued based on x4 cost basis.

12. Vineyards: Land is valued on cost basis less depreciation ($360m/9000ha, $30k/ha). Comparing with their leased land from $RFF (see other deep dive) - 666ha is valued at $64m. Nearby sales in NZ were also around NZ$100k/ha. Conservatively, +$600m in land value unrealized.

13. Brand value - Penfolds Grange Hermitage 1951: The 4th most expensive wine in the world valued at +$100k. Penfolds often ranks in Top 3 for wine by brand value. Other brands include #Beringer, #Lindemans, Wolf Blass, Chateau St Jean, etc. Yet only worth $970m on the books?

13b: @abroninvestor on @EquityMates did an interesting comparative analysis using PEs. TWE was PE=30 pre Covid. Comparing that to other luxury brands, $LVMH c.60; $RCO $RCO.PA c.95; $EL c.110, even $DGE.L Diageo which is most similar to TWE is 62. Potential +$1bn of intangibles.

14. The Sum of its Parts: the net assets are around $12-13 per share if you conservatively but more fairly value TWE’s assets. But this only matters if it is unlocked, and there are a range of options for that in the near term.

15. Corporate Raiders: The balance sheet is solid with potential to borrow against the Grange in the cellar. Anti trust could be an issue for Australia’s FIRB, but a starting price based on @Greenbackd Acquirer's Multiple I reckon could be $12.50 (see $CCL.AX as comparison)

16. TWE-REIT: To unlock the land value, creating a REIT that rents back to TWE would enable the balance sheet to realise the appreciations. Precedence with Telstra $TLS, opportunities with $RFF, and management has considered this previously.

17. Divestments: TWE management recently announced (Feb 8) the spinoff of Penfolds has been paused, but divesting assets may not be off the table. Though this could be killing the golden goose for short term benefits..

18. Overall, this looks like an asymmetric bet with lots of optionality. It was much more attractive in August-November ($8-9), though with an ugly set of results expected on Feb 17, I’ll be on the lookout for further weakness.

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR. Disclaimer, I'm long TWE.

A deep dive per week is my commitment to FinTwit.

Questions and feedback always welcome. DYOR. Disclaimer, I'm long TWE.

Read on Twitter

Read on Twitter