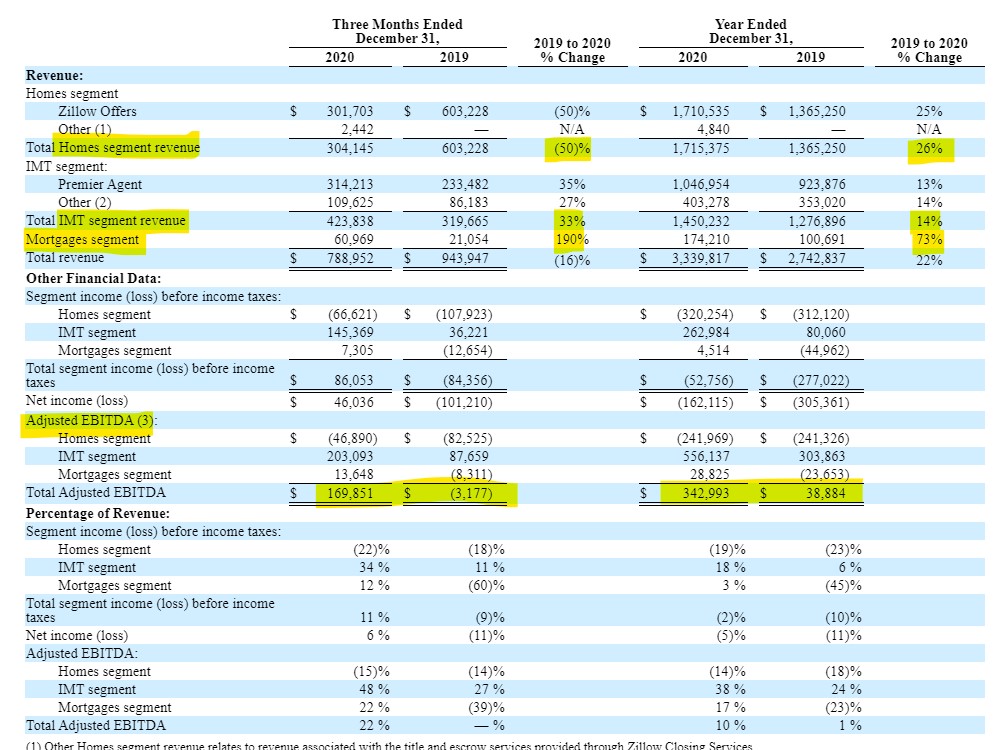

$Z owns the online home buying experience, is anchored by high-margin software revenues that leverage a dominant agent/mortgage marketplace, & trades at a $37B valuation (19x forward Gross Profit of >1.9B)... (2/6)

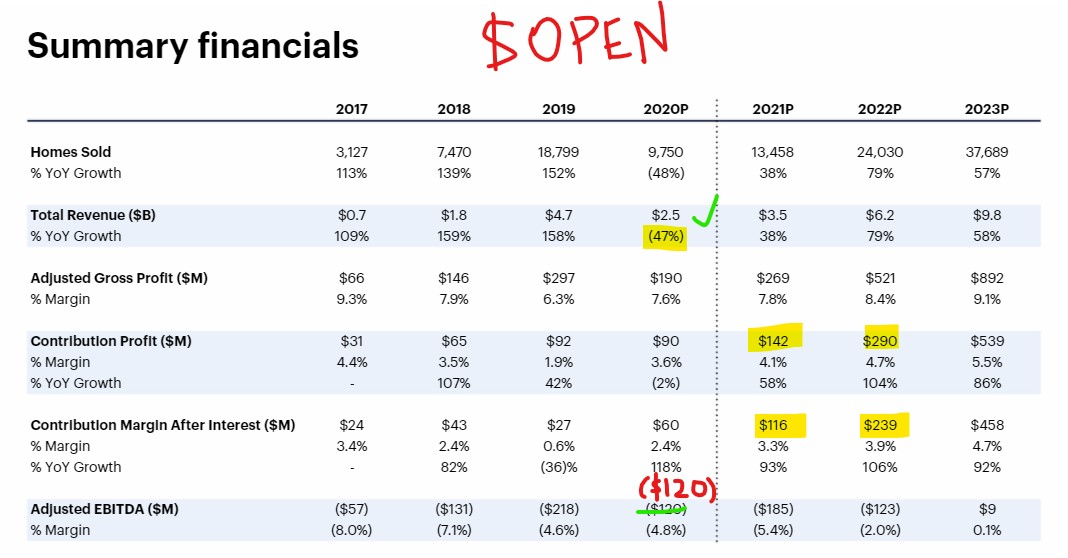

$OPEN is a start-up iBuying company trading at a $20B valuation (140x forward mgmt-projected Contribution Profit of $142M). That's 54% of $Z's valuation yet only has <7.5% of $Z's economics... (3/6)

Furthermore, $OPEN is struggling with -47% declines through the 2020 pandemic year, and investors need to believe in a recovery. But $Z on the other hand is printing >20% growth through the pandemic... (4/6)

So... why would we buy $OPEN at a 4-7x higher valuation than $Z, when $Z has better dominance, growth, margins, momentum, positioning, and diversification? Well... (5/6)

Read on Twitter

Read on Twitter

(6/6)

(6/6)