Going to do a small thread on “buying the dip.”

When you see this phrase your first instinct should NOT be to go buy it immediately!

Type in the ticker that was suggested and check your indicators. I use http://stockcharts.com

When you see this phrase your first instinct should NOT be to go buy it immediately!

Type in the ticker that was suggested and check your indicators. I use http://stockcharts.com

I use quite a few indicators but we’ll keep it simple today. These combined will do just fine. The RSI & MACD with these moving averages(5/10ema and the 20ma.)

Once you have these In you’re set to make the decision based off of the CHART not a tweet!

Continued.....

Once you have these In you’re set to make the decision based off of the CHART not a tweet!

Continued.....

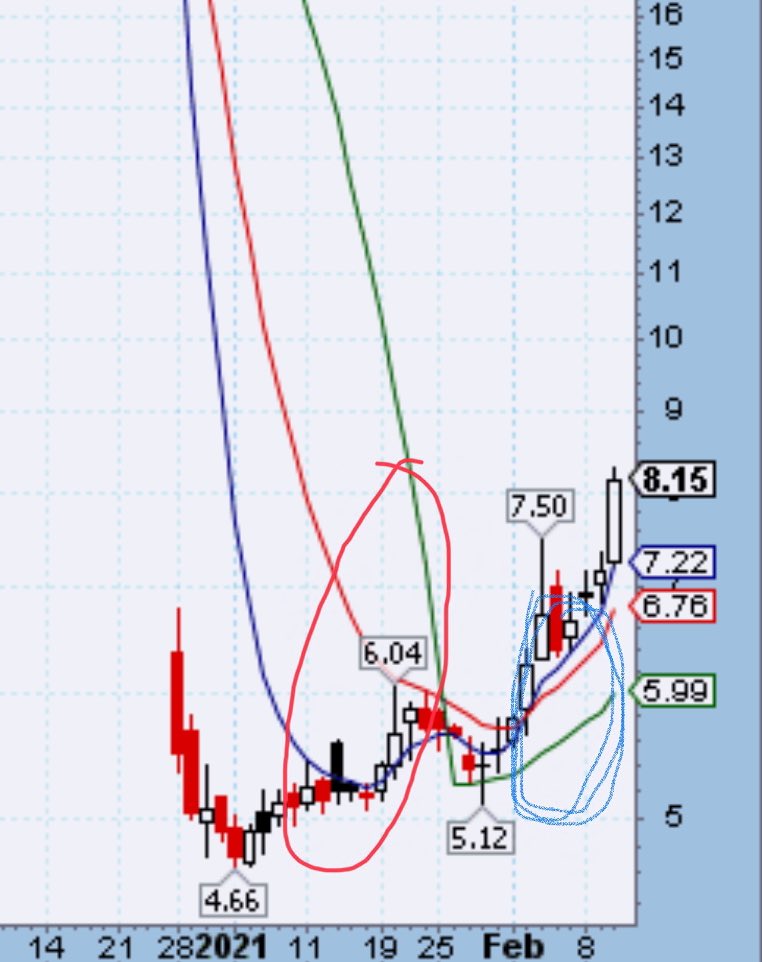

We’re going to use $APRE for an example: take a look at the chart locate the moving averages and indicators. On February 1st the market gave you a chance to buy at $4.66. If you missed that it was fine bc the key rule is to buy under the 20ma. You still had time.

Roughly Feb 8 the Macd started turning upward(blue circle) but it’s not confirmed until the “black line” crosses the red one upward.(red circle) on that day you could’ve started building a tiny position. I start building positions this early only when I believe in the company.

*Jan 8th! Sorry for the confusion. So the 19th $APRE started to work its way back to the 20 but the 5,10 & 20 were “out of wack” (red circle) so the uptrend was not confirmed. This is when most people buy in because they see a steady gain. Not good.

Let’s say you bought the fake out. About a week later the price drops from $6.04 to 5.12 you start panicking and sell  . You see someone tweet “buy the dip” this is an example of it. Instead of selling because you’re down you buy more and bring your avg down. Why?

. You see someone tweet “buy the dip” this is an example of it. Instead of selling because you’re down you buy more and bring your avg down. Why?

. You see someone tweet “buy the dip” this is an example of it. Instead of selling because you’re down you buy more and bring your avg down. Why?

. You see someone tweet “buy the dip” this is an example of it. Instead of selling because you’re down you buy more and bring your avg down. Why?

There are plenty of reasons but a short one is the 5,10 & 20 began aligning which confirmed an uptrend which is #Bullish. You could of also researched the company and news. This is the importance of fundamentals and DD.

If you made it this far thank you. Feel free to like share if you enjoyed or learned anything. For all my experienced traders yes I know there’s plenty more things I could’ve said and used blah blah this was meant to be brief and sweet

Thanks

Thanks

Read on Twitter

Read on Twitter