1/ Thread on Framing Customer Loyalty and Valuation:

If we boil down the components of long-term cash flows, an investor is making an implicit bet on the customer loyalty of a business. Spotting inflections in investor perception of loyalty can be very profitable.

If we boil down the components of long-term cash flows, an investor is making an implicit bet on the customer loyalty of a business. Spotting inflections in investor perception of loyalty can be very profitable.

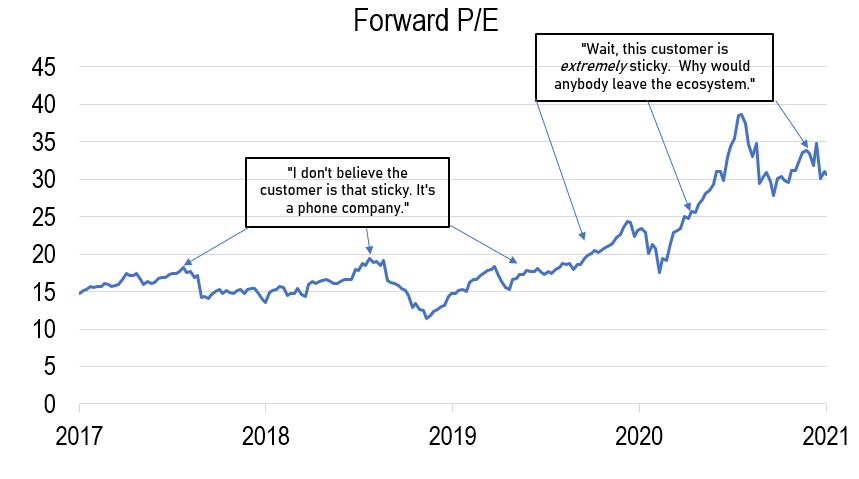

2/ Ex: 1 $AAPL

At the end of the day, $AAPL re-rate was largely driven by investor perception of the terminal value. Said differently, "how certain are we that projected cash flows 5-10 years from now will actually be there?"

At the end of the day, $AAPL re-rate was largely driven by investor perception of the terminal value. Said differently, "how certain are we that projected cash flows 5-10 years from now will actually be there?"

3/ Until ~2018, Apple's business was largely perceived as hardware. The body of historical evidence pointed to the fact that hardware businesses get disrupted. Despite incredible unit-economics, investors didn't really believe they could do it for a long-time (thus the low val.)

4/ With the growth of the Apple ecosystem, it became more clear to market participants that LT cash flows were likely to be there. This change in investor perception re: customer loyalty drove excess returns as the valuation grew. Buffett saw this gap in expectations.

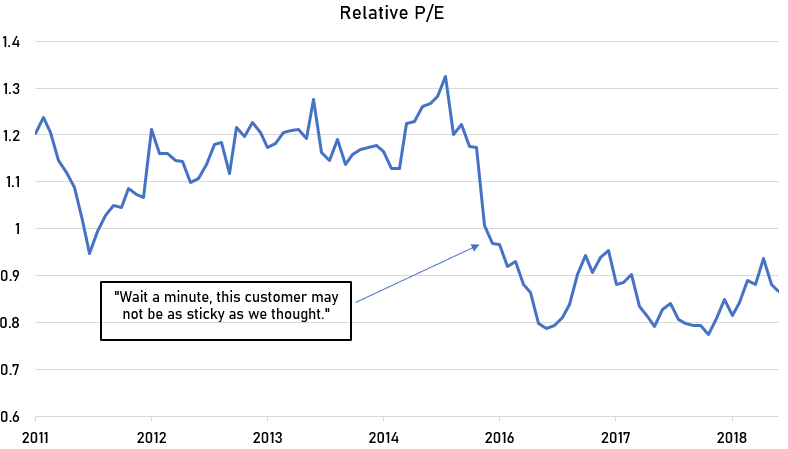

5/ Ex 2. $DIS

2015 - ESPN started losing subs and $NFLX is reaching critical mass. All of a sudden, investor perception of long-term customer loyalty changes negatively. The stock trades at a discount to the index.

"We're less certain of long-term cash flows."

2015 - ESPN started losing subs and $NFLX is reaching critical mass. All of a sudden, investor perception of long-term customer loyalty changes negatively. The stock trades at a discount to the index.

"We're less certain of long-term cash flows."

6/ This perception starts to change after the first analyst day. It **really** changes after the second. Now, the investment community seems to have confidence regarding Disney's underlying customer loyalty well into the future. Right or wrong, that's what the val. reflects.

7/ Of course, there are other variables in valuation like growth rates, interest rates etc. However, I find that the direction of customer loyalty can be a good starting point to frame valuation and investor expectations.

8/ Through this lens, customer loyalty was one of the fundamental qualitative insights into SaaS transitions. Yes, the cash flows were more stable yada yada. However, there's also an implicit statement on how loyal the sub base becomes when feedback loops tighten..

9/ ...and customers can manage their costs with greater visibility. See $ADBE re-rate etc.

The direction of customer loyalty frames ROIIC as well. Taking more share of wallet utilizes the fixed cost base to driven incremental returns on capital.

The direction of customer loyalty frames ROIIC as well. Taking more share of wallet utilizes the fixed cost base to driven incremental returns on capital.

12/ If I can get a handle on the direction of customer loyalty, I feel much more comfortable on the direction of incremental returns on capital or the sustainability of current ROIC.

Read on Twitter

Read on Twitter