Cryptocurrency- its role in Money Laundering and @cenbank war against Cryptocurrency in Nigeria  .

.

It’s a thread

.

.It’s a thread

The World as we know it becomes smaller and smaller each passing day. Borderless transactions facilitated by various payment systems encourages Globalization.

There are illicit industries that thrive which are the dark sides of globalization. These include Drug Trafficking estimated to be a $350 Billion annual industry. Illegal Arms Trafficking, Human Trafficking, Cyber Crime, Oil Theft & Corruption are some of the illicit industries.

Stakeholders in these sectors must conceal the origins of these monies by passing it through a complex web of banking transfers or commercial transactions which is known as MONEY LAUNDERING.

A problem of criminal activity is accounting for the proceeds of ill-gotten wealth without raising the suspicion of law enforcement agencies. It is estimated that about $800 Billion to $2 Trillion is laundered every year.

Since the advent of the internet in the early 2000s in Nigeria, Online Dating Scams and Identity Theft have been a major side hustle of the average unemployed millennial male. Popularly referred to as Yahoo Boys.

Like NAS rapped in the song NEW WORLD – ALEXANDER GRAHAM BELL MADE TELEPHONE YES, BUT NOW WE REQUEST FOR YOUR EMAIL ADDRESS. Nigerian Youth have been ingenious by exploiting vulnerable victims due to globalization mostly through email.

Most of them are very intelligent with good interpersonal skills and a passable command of English that can fool any foreigner on the internet.

The advent of Social Media in the late 2000s – Facebook, Instagram and other social media platforms further proliferated the prospect/shopping list for these delinquents to further fuel their trade.

Nigeria is the second largest receiver of diaspora remittances in Africa (behind Egypt) with close to $25 Billion remitted in 2018 according to a Price Water House Coopers (PWC) report.

International Money Transfer Operators like Western Union, Money Gram and Ria are the biggest in the country. The major beneficiaries are said to be this demographic – the Yahoo Boys.

It is common knowledge that there are levels to this trade and each level comes with more sophistication with respect to their operations and the risks involved.

This upper class of online fraudsters are practically known as G boys because they live a flashy and ostentatious lifestyle including buying and owning luxury designer wears and accessories, luxury cars amongst other things.

Lemme derail a bit. To open a corporate account in Nigeria, some sectors require a SCUML certificate. You may ask, what is a SCUML certificate? SCUML means Special Control Unit against Money Laundering.

Companies requiring SCUML are labelled Designated Non-Financial Institutions (DNFIs) and they include Jewelry, Cars and Luxury Goods, Precious Stones and Metals, Real Estate, Estate Developers, Hotels, Casinos, Supermarkets just to mention a few.

I guess you can see what the Law Enforcement Agencies are on the lookout for – Jewelry Sellers, Car and Luxury Good sellers, Real Estate etc. These are avenues to launder ill-gotten wealth. Hence these DNFIs are closely monitored.

As an internal stakeholder in the Nigerian Financial System, I get inundated with compliance enquiries on the nature of funds, the relationship of account owners with beneficiaries and senders of funds on accounts I manage. I have also visited EFCC several times on such matters.

All financial transactions that are over the regulatory threshold for individuals and corporate bodies are disclosed by the Deposit Money Banks to a government body. Who gathers all this information? It is the NFIU.

The Nigerian Financial Intelligence Unit (NFIU) is the central Nigerian agency responsible for the receipt of disclosures from reporting organisations (mostly banks), the analysis of these disclosures and the production of intelligence for dissemination to competent authorities.

The NFIU is an autonomous unit, domiciled within the Central Bank of Nigeria (CBN) and the central coordinating body for the country’s Anti-Money Laundering, Counter-Terrorist Financing and Counter-Proliferation Financing (AML/CFT/CPF) framework.

Now you can all understand why I was singing like a Canary Bird about the CBN’s threat of uncovering unscrupulous persons and FX dealers labelling them as economic saboteurs. This followed with the rapid devaluation of the Naira when the Coronavirus pandemic began in March 2020.

Apologies for derailing but let’s get back on track. These G Boys are mostly members of an international criminal syndicate which crisscrosses countries and continents. From Malaysia, South Africa to the Middle East, Europe, and the Americas.

Their operations include Fake Cheque Deposits and Business Email Compromise (BEC) where the online scammer sends an email message that appears to come from a known source making a legitimate request.

BEC scams have been a major concern for businesses and governments worldwide. In this type of attack, cybercriminals aim to trick & persuade employees to take a specific action, such as making a wire transfer, providing funds to pay for a project or providing confidential info.

Online Fraudsters carry out BEC scams by spoofing an email account, using malware or spearphising mails.

Business Email Compromise is one of the most financially damaging online crimes where thousands and even millions of dollars are stolen. It is estimated that BEC scams totaled $1.9 Billion in 2019 according to the FBI.

No wonder Cyber Security as an industry is on the rise and its objective is to checkmate the growing menace of Cyber Crime and minimize operational losses as a result of BEC.

Criminals recruit money mules to help launder proceeds derived from online scams & frauds or crimes like human and drug trafficking. Money mules add layers of distance between crime victims & criminals, which makes it harder for law enforcement to accurately trace money trails.

It is common in Nigeria to have a friend or acquaintance tell you that he or she has funds abroad especially in the USA. Most often at times, it is G Boy Money (proceeds of cybercrime) as the rate is usually lower than prevailing (black) market rates.

These Money Mules kill the paper trail by withdrawing cash in a complex web of intra bank transfers. This cash is reinserted into the banking system and these proceeds of crime have become completely laundered.

However, withdrawing huge cash sums in America raises a lot of suspicion on the part of the bank, it is difficult not to get noticed as a Money Mule. As Due Diligence is done on account onboarding. Discrepancies would show based on transaction trends

After a while, the Banks notice a suspicious trend of heavy cash withdrawals. The transactions get flagged and in line with AML/CFT laws, a request for the closure of the said account is made.

Why am I taking my time to explain all of this – one of the easiest ways to launder money is via digital currencies. Digital currencies include Cryptocurrencies.

What is cryptocurrency? A cryptocurrency is a medium of exchange that is digital, encrypted and decentralized. Unlike the U.S. Dollar or the Euro, there is no central authority that manages and maintains the value of a cryptocurrency.

Instead, these tasks are broadly distributed among a cryptocurrency’s users via the internet.

Bitcoin was the first cryptocurrency, first outlined in principle by Satoshi Nakamoto in a 2008 paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” Nakamoto described the project as “an electronic payment system based on cryptographic proof instead of trust.”

That cryptographic proof comes in the form of transactions that are verified and recorded in a form of program called a blockchain.

Enough with the technobabble already. The FBI has alerted the public of late that many traditional financial crimes and money laundering schemes are now orchestrated via cryptocurrencies.

Developments in cryptocurrency technology and an increasing number of businesses accepting it as payment have driven the growing popularity and accessibility of cryptocurrency.

There are not only numerous virtual asset service providers online but also thousands of cryptocurrency kiosks located throughout the world which are exploited by criminals to facilitate their schemes.

The FBI also warned that they expect a rise in Scams Involving cryptocurrency related to the COVID-19 Pandemic.

They are several cryptocurrency exchanges across the world, which are like Stock exchanges where people buy and sell cryptocurrencies. So, the proceeds of Cybercrime using Cryptocurrency exchanges (such as Cash App and Coin Base) are used to buy Cryptocurrency such as Bitcoin.

Now remember the song by Bella Shmurda, Zlatan and Lincoln with the title Cash App

Sho ni CC

Load am cash app

Cashout

O ni maga bill am

Small money ball out

Usain bolt run am

You get sure client lock am

If you no get money leave am

EFCC n bo japa

Load am cash app

Cashout

O ni maga bill am

Small money ball out

Usain bolt run am

You get sure client lock am

If you no get money leave am

EFCC n bo japa

Of course, the small timers scam folks by gaining access into their Cash App accounts, changing the email and security controls. Then Boom! Cash Out. Fleecing all the funds connected to their bank accounts and buying Bitcoin.

Luno is one of many cryptocurrency exchanges that buy and sell bitcoin for Naira - Nigeria's legal tender. Luno operates in about 40 countries and can pay naira for any holder of bitcoin.

The problem with Bitcoin. It moves swiftly, making it impossible for the FBI to find a paper trail to indict criminals when apprehended

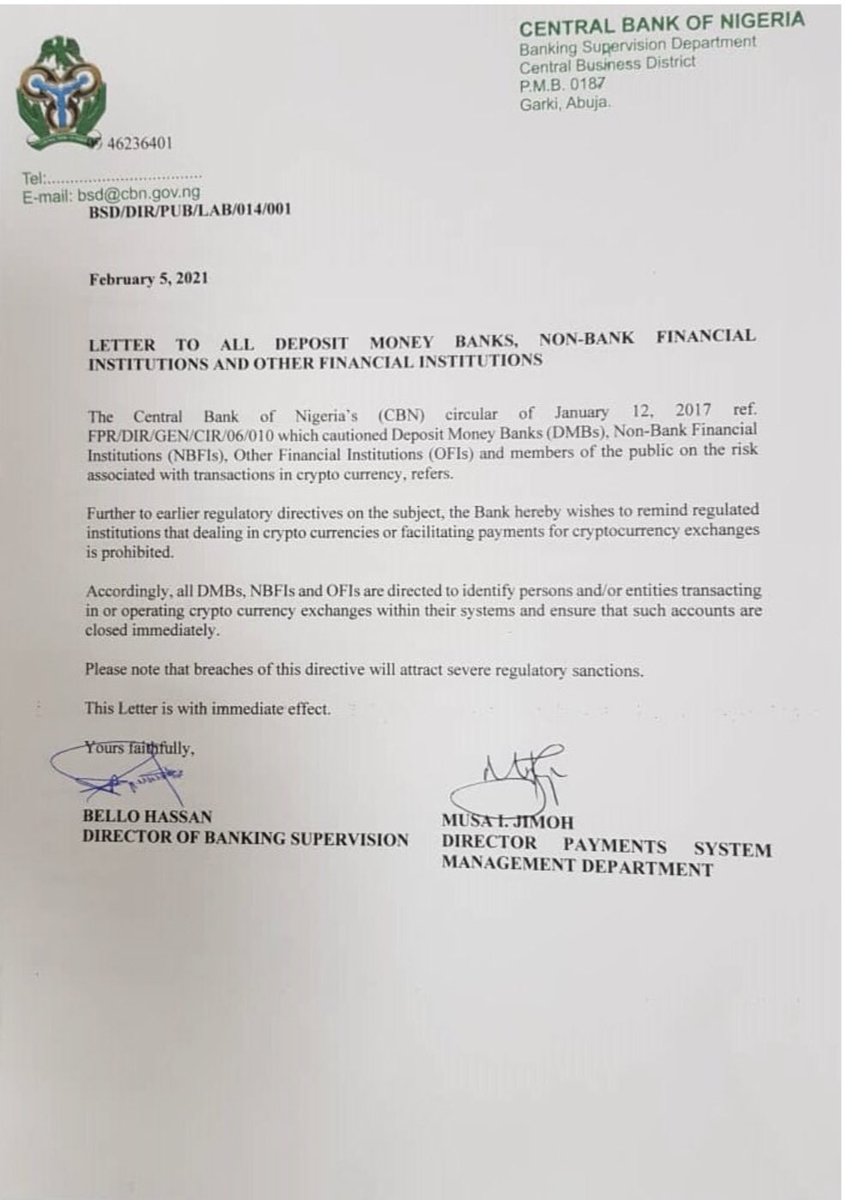

Following @cenbank policy announcement against cryptocurrency in the country, the apex bank will work with the NFIU to investigate cryptocurrency exchange corporate bank accounts within the country.

The same strategy it used to fish out perceived economic saboteurs and had their accounts frozen in banks will most likely be applied.

Paxful, a leading peer-to-peer bitcoin marketplace, reports that Nigeria now has the world’s second largest Bitcoin trading volume. Nigerians have traded 60,215 Bitcoins in the last five years, or more than $566 Million.

2020 happened and created a 30% trading spike, with over 20,500 coins traded, or $451 Million in 2020 alone further exacerbated by Dollar/Naira restrictions, CBN policy pronouncements on Diaspora Remittances amongst others as reported.

However, the truth is that G Boys found loopholes to exploit the West during the pandemic to launder Millions of Dollars which invariably affected local BDC operators, facilitated trade payments and saw dwindling dollar transactions for players such as Mastercard and Visa.

Although some of us see crypto as a store of wealth considering the volatility of the Naira against the greenback, a certain class of Nigerians have exploited the loopholes in cryptocurrency being a decentralized and unregulated commodity. This is the sad truth.

To the indigenous cryptocurrency investors, I come in peace

End of Thread.

End of Thread.

Read on Twitter

Read on Twitter