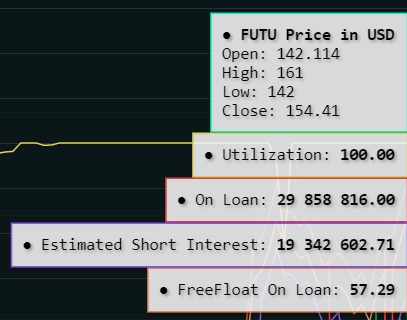

$FUTU stats at close yesterday (on 51.86M shares free float, 135.33M shares outstanding). Long thread follows...

This is an exceptionally interesting short squeeze. "Market manipulation" tends to imply something illegal. I think there is technically nothing illegal happening here, at least in relation to why the share price is doing what it's doing, but I can't think of a more fitting term.

The borrow inventory has been 100% utilized dating back to Nov 24. On that date, the size of the borrow inventory was 9.8M shares. That represents just 18.9% of the free float today.

On Jan 14, the size of the borrow inventory peaked at 28.6M shares, representing 55.1% of the free float. The size of the borrow inventory was increasing at a very steady rate over that entire period of Nov 24 through Jan 14.

During that time, the share price also rose from about 46 to 73. So think about that for a moment...

Shares were being added to the borrow inventory at a very slow and steady rate. Over 35 sessions, the borrow inventory increased by 18.8M shares, or about 537K shares per session. Daily average volume during that time was around 4 or 5 million shares a day.

A small amount of shares were added to borrow inventory daily, and were immediately used to sell short as the borrow inventory utilization remained 100% every day.

This builds a sizeable short position in a controlled manner where the shorts have no power to stop the price increase. Instead, they are continuously being squeezed.

From January 14th to Feb 1st, the size of the borrow inventory declined from 28.6M to 25.1M as utilization stayed at 100% and share price moved from 73 to 105.

In other words, in11 sessions, 3.5M shares were gradually removed from borrow inventory, and hence whomever had sold those shares short were forced to buy those shares back on the open market to return them to the lender. This pushes the price higher as the shares are recalled.

From Feb 1st to close yesterday, 6 sessions, borrow inventory increased from 25.1M to 29.9M as utilization stayed at 100% and share price moved from 105 to 154. Once again, shares being slowly released to the borrow inventory and immediately used to short as the price was rising.

There has been 3 distinct stages to this move so far. First, a long steady rise in borrow inventory and shares sold short. Second, a recall of a portion of the borrow inventory over a shorter period of time.

Third, the addition back of all the recalled borrow inventory and then some more over a shorter period of time. This, the size of the borrow inventory is being cleverly manipulated to trap short sellers and force their covering to artificially increase the share price.

There has been little to no natural price support for this stock in months.

As of yesterday, I'm also seeing distinct signs of a building gamma squeeze. Yesterday there were 2K Feb 19th 190 puts sold around $48, taking in about $9.6M in premium.

There were 1K of the Feb 19th 175 strike calls sold for $31, taking in $3.1M in premium. Even more interesting, there were 6.5K of the March 180 strike calls sold for $50, taking in $32.5M in premium. Yesterdays high of the day was around $160/sh.

The ONLY reason you'd sell in the money puts (180 and 190 strikes) is if you think/know the share price is headed higher and hence the value of those puts will decrease.

From what I can see, similar sized bets (based on total premium) were placed in $FUTU calls at various strikes, presumably using the proceeds from the put selling.

There were also over 7K call contracts (700K share equivalent) bought yesterday over the 4 highest strikes, the lowest of which, the 175 strike, was still 10% higher than the stock actually traded yesterday.

The seller of these 700K calls is going to absolutely need to be buying shares today to hedge themselves against the calls they sold yesterday.

I said, I don't think there is anything illegal going on here, no one is forcing short sellers to short this stock. A lender is entirely within their rights to request their shares back and hence force short covering. No one is forcing market makers to write calls or buy puts.

This is how short and gamma squeezes work. But I've never seen one that was this well orchestrated.

I have no idea when this ends or at what share price. As far as fuel goes, there is huge short interest, utilization of borrow inventory remained at 100% at close yesterday. The gamma squeeze is just starting.

There is still plenty of free float that can be slowly released into borrow inventory and continue to fuel the fire. There are still likely to be plenty of eager beaver shorts that will short sell it too early and continue the squeeze.

Once gamma squeezes start, it tends to destabilize price movement and more readily leads to blow offs. Remember, outrage at price/market cap alone does not make a good short. If you want to go short/puts on $FUTU you need to wait to see numerous signs of a blow off top FIRST.

Read on Twitter

Read on Twitter