1/9

Given this morning's update from #ACP, its worthwhile revisiting the enclosed set of posts from 26th Jan 2021.

"The finalisation of this programme and the results of these studies are due imminently..."

https://twitter.com/aimrns/status/1359457135403352070?s=20 https://twitter.com/BigBiteNow/status/1354032699229564936?s=20

Given this morning's update from #ACP, its worthwhile revisiting the enclosed set of posts from 26th Jan 2021.

"The finalisation of this programme and the results of these studies are due imminently..."

https://twitter.com/aimrns/status/1359457135403352070?s=20 https://twitter.com/BigBiteNow/status/1354032699229564936?s=20

2/

but worth noting that it took Blackrock 5 months to reach the same point, post their deal with Yantai Jinyaun Mining Machinery in Sept 2018.

ACP and Xinhai Mineral EPC are at 2.5 months and counting.

There's much to like about that fact.

but worth noting that it took Blackrock 5 months to reach the same point, post their deal with Yantai Jinyaun Mining Machinery in Sept 2018.

ACP and Xinhai Mineral EPC are at 2.5 months and counting.

There's much to like about that fact.

3/

Today's RNS ;

"we now also have industry-leading independent confirmation of our mine processing plant design and build as selected within our Definitive Feasibility Study."

"this testing work through replicating choice and design of plant as determined in our low-capex,"

Today's RNS ;

"we now also have industry-leading independent confirmation of our mine processing plant design and build as selected within our Definitive Feasibility Study."

"this testing work through replicating choice and design of plant as determined in our low-capex,"

4/

"high-margin Feasibility Study both ratifies and de-risks the Mahenge considerably."

There's a lot to like about that statement too because it means the c. $39.7m or thereabouts CAPEX, is looking far more realistic and is significantly de-risked by this "industry leading...

"high-margin Feasibility Study both ratifies and de-risks the Mahenge considerably."

There's a lot to like about that statement too because it means the c. $39.7m or thereabouts CAPEX, is looking far more realistic and is significantly de-risked by this "industry leading...

5/

independent confirmation."

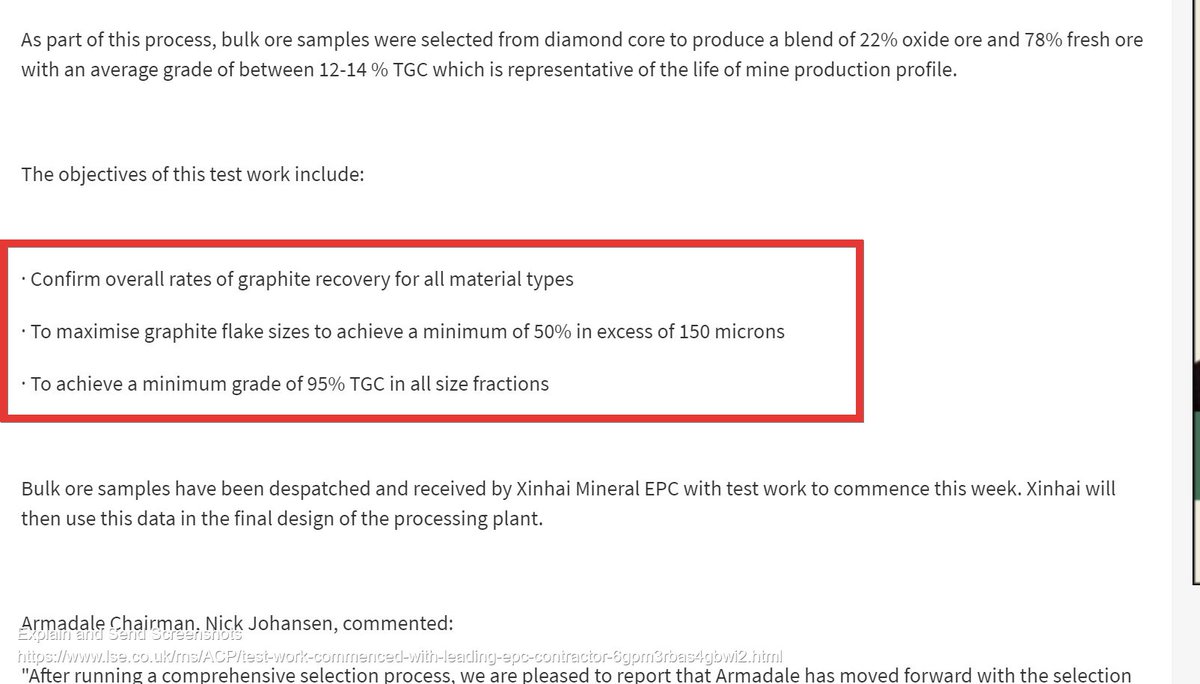

Here's what was being asked of Xinhai Mineral EPC...

and for reference, here's what Blackrock's full bulk test results delivered.

So essentially what we are looking out for in that "imminent" report.

https://blackrockmining.com.au/wp-content/uploads/BKTReplicatesNinetyNinePerentPlusTGCConcentrateChineseEPCPartner01Mar19.pdf

independent confirmation."

Here's what was being asked of Xinhai Mineral EPC...

and for reference, here's what Blackrock's full bulk test results delivered.

So essentially what we are looking out for in that "imminent" report.

https://blackrockmining.com.au/wp-content/uploads/BKTReplicatesNinetyNinePerentPlusTGCConcentrateChineseEPCPartner01Mar19.pdf

6/

Given we have had no official strategic deal or tie up, announced with Xinhai Mineral EPC, it looks to me like these test results are a means to establish that deal, with some sort of deferred capex funding or equity take up, tied into it.

No 2 paths are the same but worth...

Given we have had no official strategic deal or tie up, announced with Xinhai Mineral EPC, it looks to me like these test results are a means to establish that deal, with some sort of deferred capex funding or equity take up, tied into it.

No 2 paths are the same but worth...

7/

noting that Yantai Jinyaun undertook a further 2 months of pilot plant testing, prior to then agreeing 2 binding agreements with an off-take pricing agreement included.

See here.

https://blackrockmining.com.au/wp-content/uploads/190507-BKT-Graphite-Price-Discovery-release-8-May-FINAL.pdf

noting that Yantai Jinyaun undertook a further 2 months of pilot plant testing, prior to then agreeing 2 binding agreements with an off-take pricing agreement included.

See here.

https://blackrockmining.com.au/wp-content/uploads/190507-BKT-Graphite-Price-Discovery-release-8-May-FINAL.pdf

8/

As i talked about here, there are 2 big differences with ACP.

1. ACP Capex phase 1 $39.7m vs BKT $116m

2. Graphite market is strengthening in 2021...

and today's very solid progress (because independent analysis is now backing up what has been... https://twitter.com/BigBiteNow/status/1354032704241754115?s=20

As i talked about here, there are 2 big differences with ACP.

1. ACP Capex phase 1 $39.7m vs BKT $116m

2. Graphite market is strengthening in 2021...

and today's very solid progress (because independent analysis is now backing up what has been... https://twitter.com/BigBiteNow/status/1354032704241754115?s=20

9/

solely an ACP management and therefore trust exercise to date), goes a long way to confirming that c. $39.7m CAPEX is real.

More to come from the detailed report but this is the first signs of real progress for ACP.

solely an ACP management and therefore trust exercise to date), goes a long way to confirming that c. $39.7m CAPEX is real.

More to come from the detailed report but this is the first signs of real progress for ACP.

Read on Twitter

Read on Twitter