New @resfoundation report out today assesses the impact of Covid-19 on business, focusing on whether the sector is able to support a rapid recovery in living standards, see:

https://www.resolutionfoundation.org/publications/on-firm-ground/

Here's a short thread summarising the findings….

https://www.resolutionfoundation.org/publications/on-firm-ground/

Here's a short thread summarising the findings….

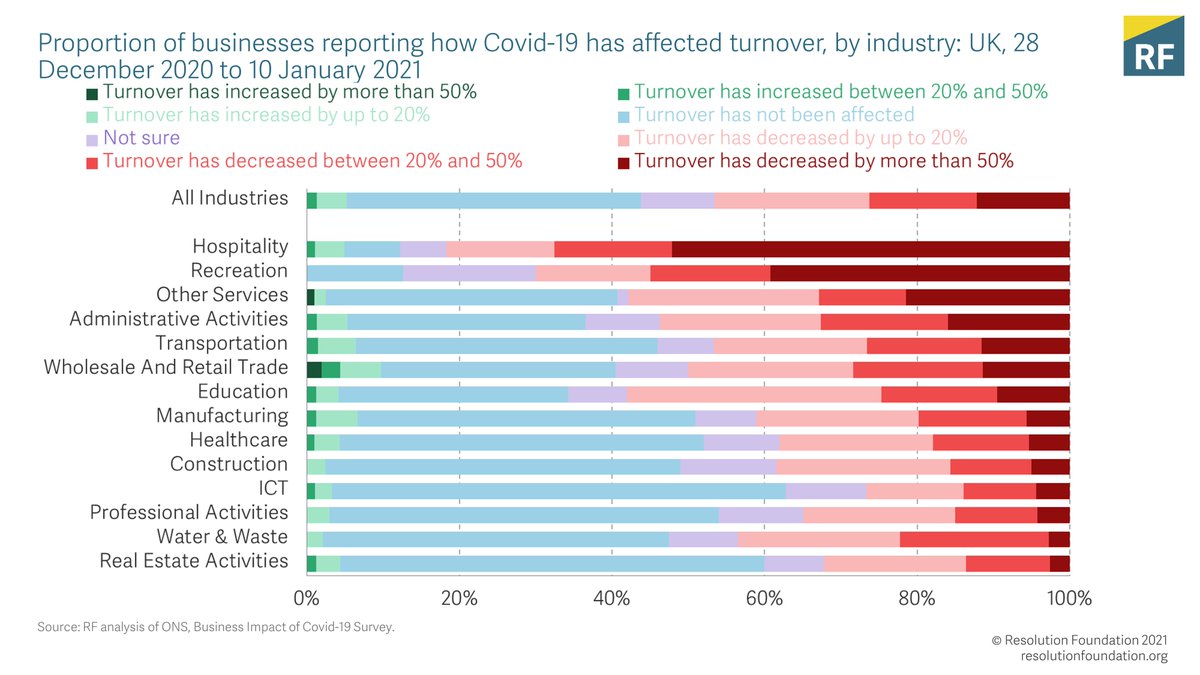

The huge hit to the economy has led to large huge falls in turnover, particularly in sectors reliant on social interaction.

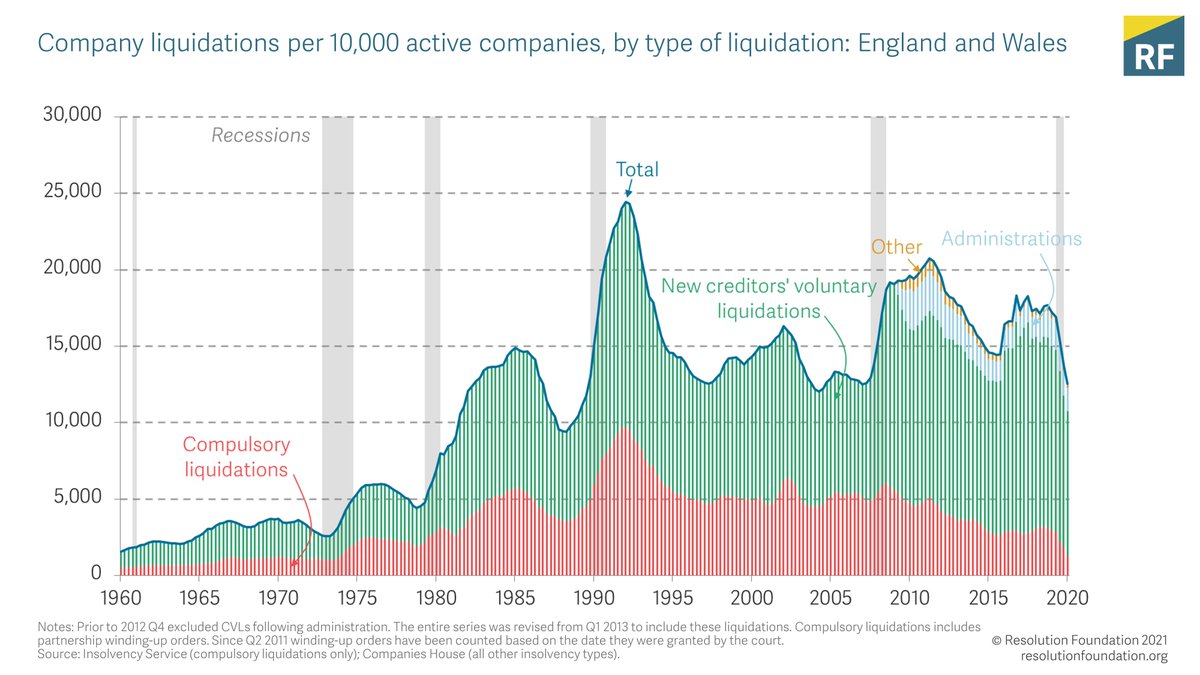

The big question is whether this will lead to more firms going bust.

The big question is whether this will lead to more firms going bust.

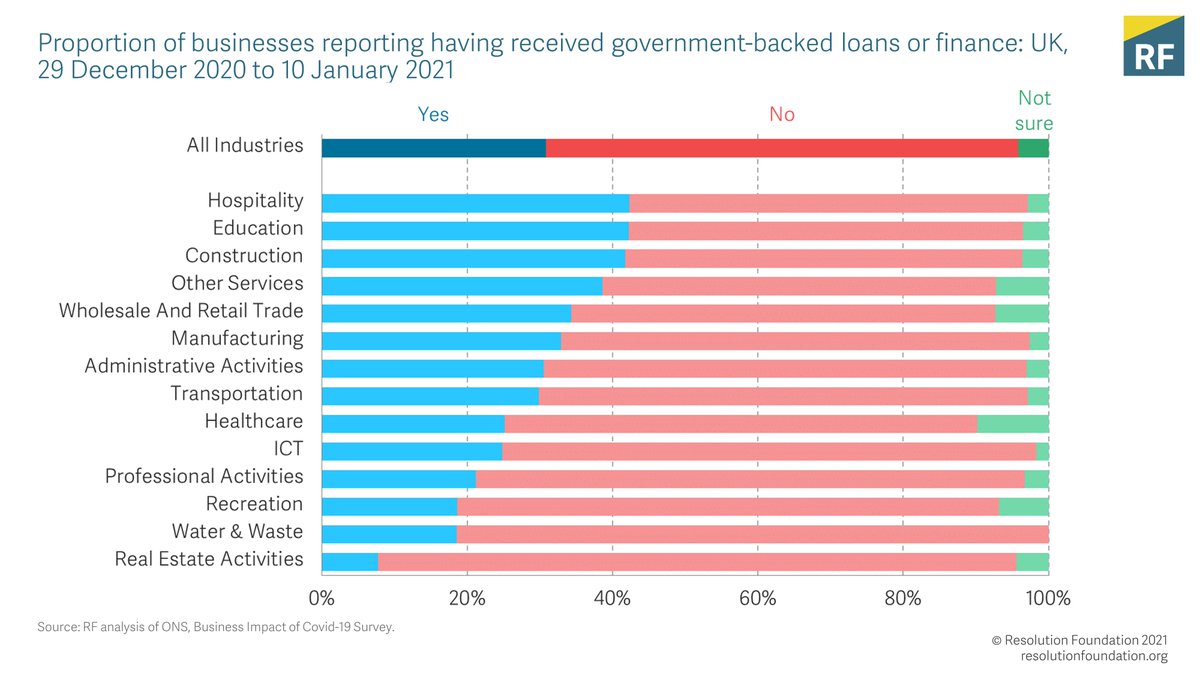

That huge hit to firms' revenues has been met by huge government support that has (largely) covered firms' costs and provided easy access to raise finance…

This has meant firms cash positions has actually improved by £118 billion in aggregate, rather than falling by around the equivalent of £40 billionn in previous recessions.

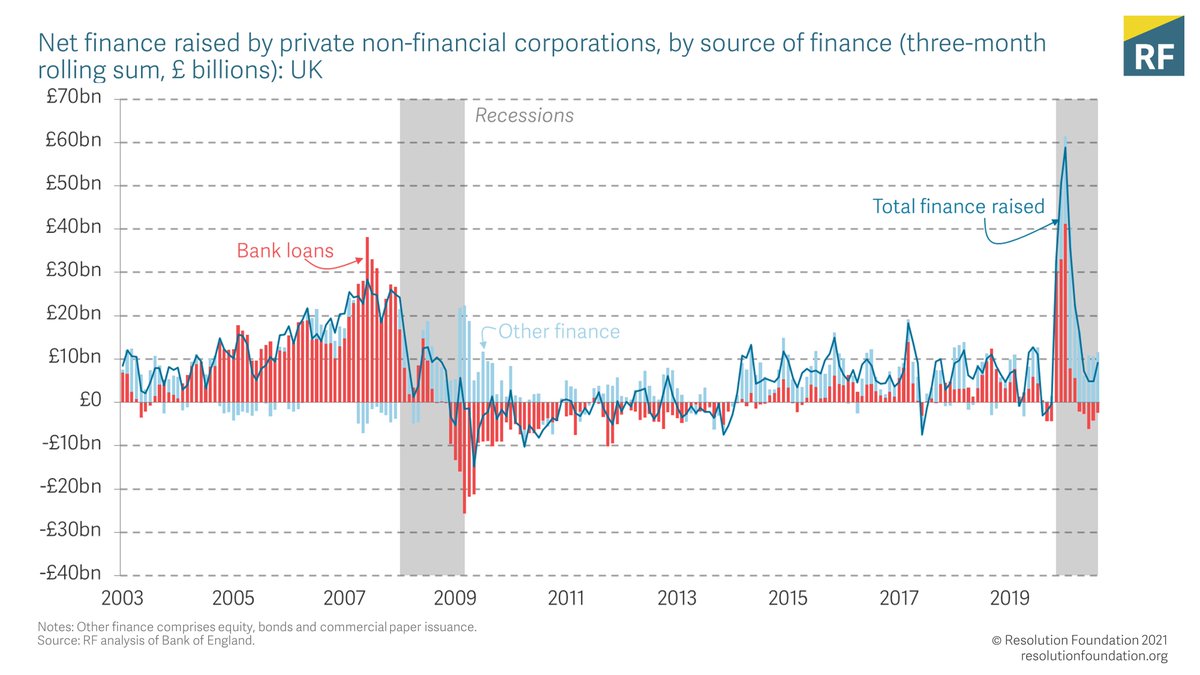

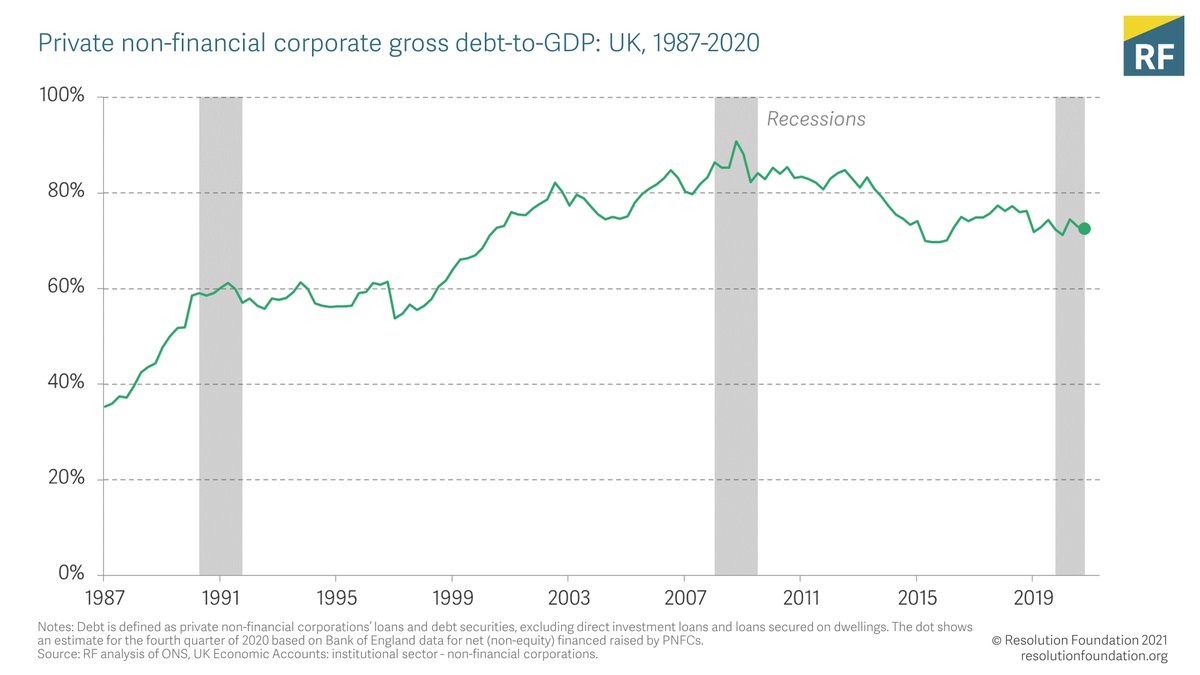

Firms have increased their borrowing to get through the crisis, but total borrowing is still lower than it was prior to the financial crisis relative to the size of the economy.

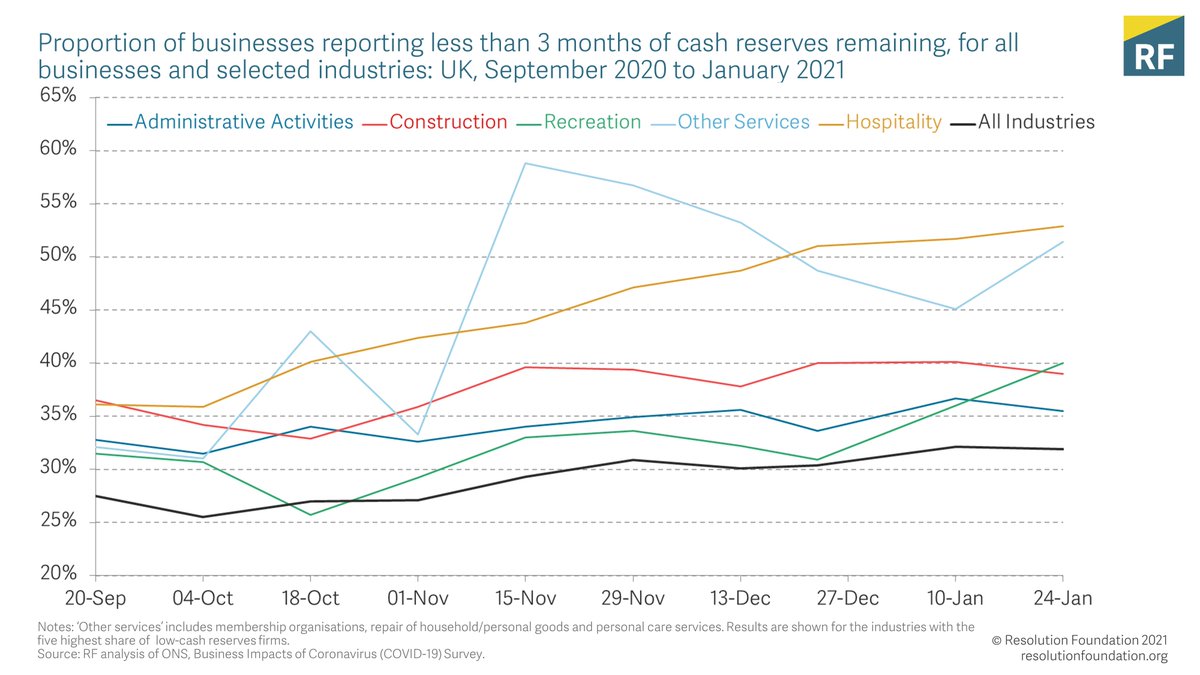

But aggregate picture hides some worrying developments: cash levels have been deteriorating, particularly in the hardest hit sectors like hospitality.

53% of hospitality firms say less than 3 months cash, up from 36% in September.

53% of hospitality firms say less than 3 months cash, up from 36% in September.

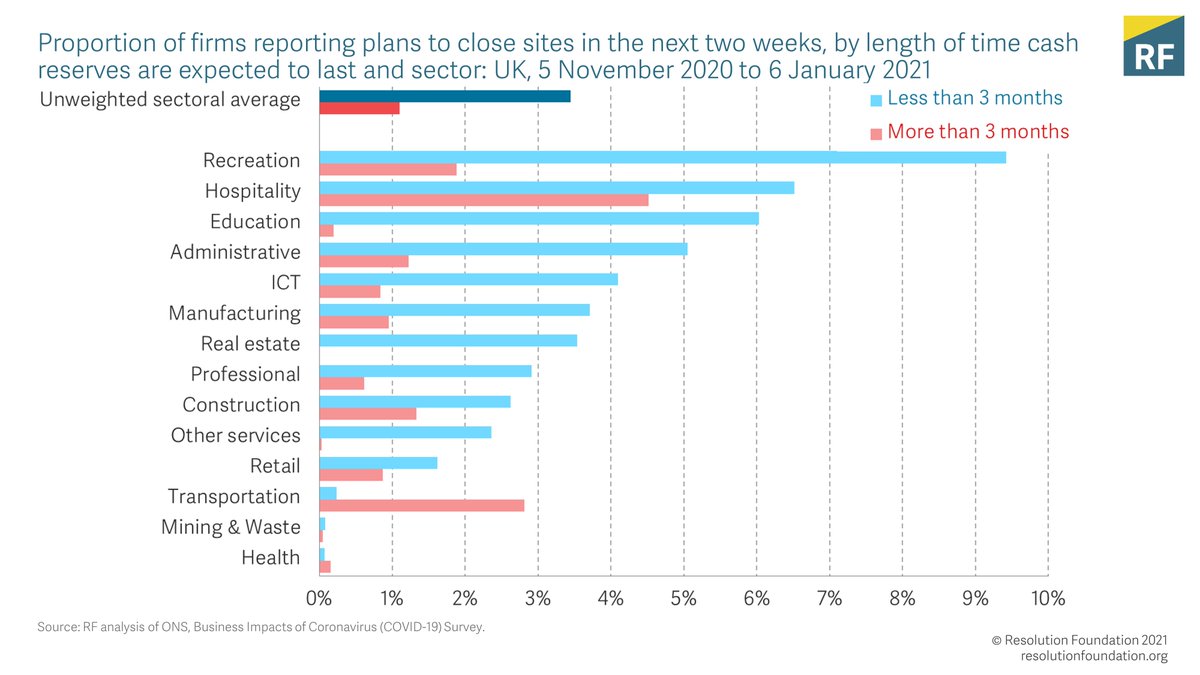

Importantly, those parts of the corporate sector which say their cash holdings are low also say that they plan to close sites and make layoffs.

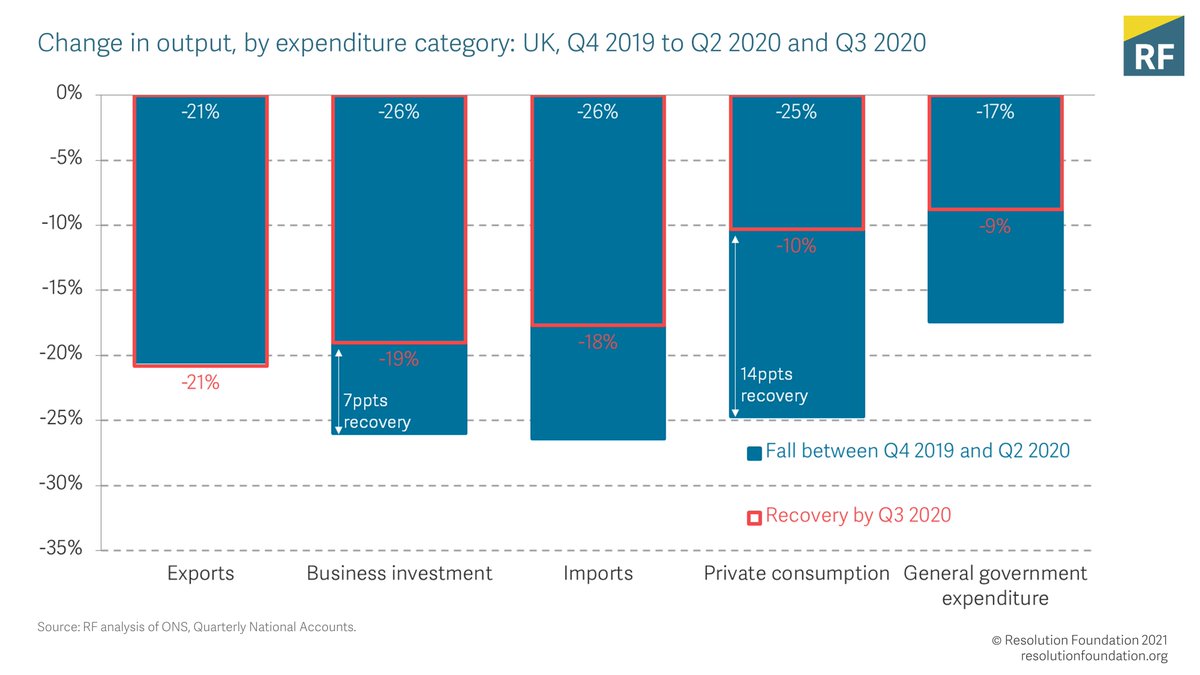

On top of that, is striking that investment has remained very subdued even as the economy recovered over the summer.

Firms’ hiring intentions have remained weak too.

All this should policy makers on alert about the risk of a slow recovery.

Firms’ hiring intentions have remained weak too.

All this should policy makers on alert about the risk of a slow recovery.

So what can policy makers do?

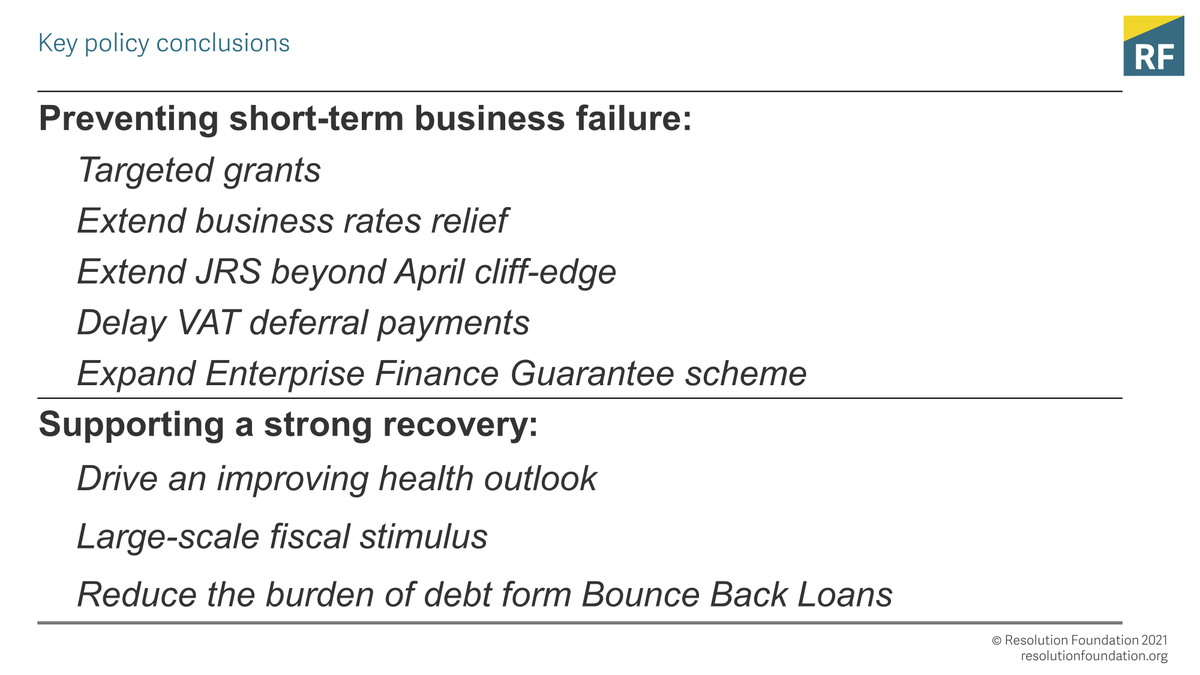

To prevent business failure: extend support targeted at hardest hit sectors.

To support a strong recovery: health measures and fiscal stimulus are key but also need to ensure banks properly manage small-business debt.

To prevent business failure: extend support targeted at hardest hit sectors.

To support a strong recovery: health measures and fiscal stimulus are key but also need to ensure banks properly manage small-business debt.

You can read the full report by @JamesSmithRF @nyecominetti & @jackhleslie here: https://www.resolutionfoundation.org/publications/on-firm-ground/

And you can watch our interactive webinar at 3.30pm today when we'll be discussing how we can build back business after the pandemic with @tonydanker @CBItweets Dame Vivian Hunt @McKinsey @TorstenBell & @jackhleslie https://www.resolutionfoundation.org/events/building-back-business/

Read on Twitter

Read on Twitter