QE DEBUNKED

I was having some trouble to fully understand QE and how it is impacting us, so I decided to investigate further

THREAD

I was having some trouble to fully understand QE and how it is impacting us, so I decided to investigate further

THREAD

1/

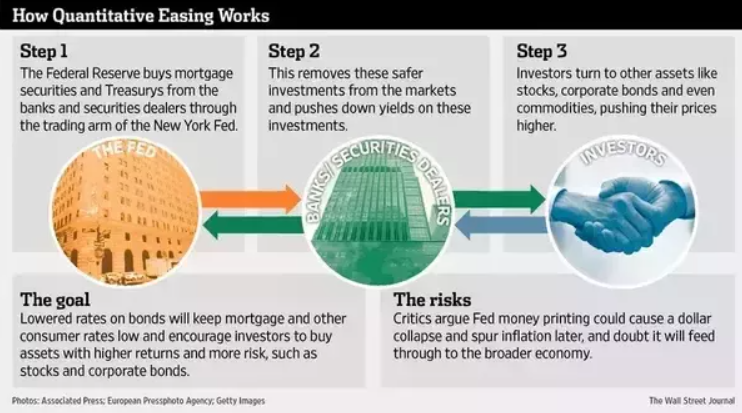

What is QE?

CBs buys long-term securities from its member banks

CBs buys long-term securities from its member banks

In return, it issues credit to the banks' reserves

In return, it issues credit to the banks' reserves

To do that, they create funds "out of thin air"

To do that, they create funds "out of thin air"

What is QE?

CBs buys long-term securities from its member banks

CBs buys long-term securities from its member banks In return, it issues credit to the banks' reserves

In return, it issues credit to the banks' reserves To do that, they create funds "out of thin air"

To do that, they create funds "out of thin air"

2/

It's a rather complicated process, but banks cannot use that money that they owe to the FED

I suggest that you listen to this podcast from

@MetreSteven

@SantiagoAuFund

To fully understand the concept

It's a rather complicated process, but banks cannot use that money that they owe to the FED

I suggest that you listen to this podcast from

@MetreSteven

@SantiagoAuFund

To fully understand the concept

3/

How does it work?

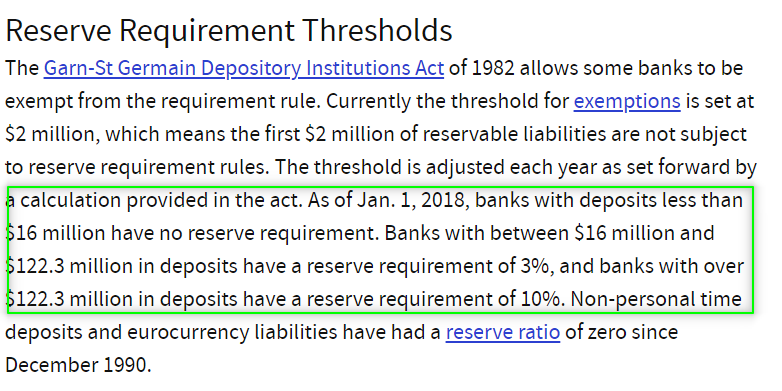

When the Fed adds credit to a bank's balance sheet, it gives it more than it needs to meet the reserve requirement

When the Fed adds credit to a bank's balance sheet, it gives it more than it needs to meet the reserve requirement

The reserve is the amount the Fed requires banks to have on hand each night when they close their books

The reserve is the amount the Fed requires banks to have on hand each night when they close their books

How does it work?

When the Fed adds credit to a bank's balance sheet, it gives it more than it needs to meet the reserve requirement

When the Fed adds credit to a bank's balance sheet, it gives it more than it needs to meet the reserve requirement The reserve is the amount the Fed requires banks to have on hand each night when they close their books

The reserve is the amount the Fed requires banks to have on hand each night when they close their books

4/

The official story

Banks are supposed to lend the extra cash

Banks are supposed to lend the extra cash

QE Keeps Bond Yields Low : by increasing demand, the FED keeps Treasury yields low

QE Keeps Bond Yields Low : by increasing demand, the FED keeps Treasury yields low

Attracts Foreign Investment and

Attracts Foreign Investment and  Exports by devaluing currency

Exports by devaluing currency

Remove toxic loans from the banks B/S

Remove toxic loans from the banks B/S

The official story

Banks are supposed to lend the extra cash

Banks are supposed to lend the extra cash QE Keeps Bond Yields Low : by increasing demand, the FED keeps Treasury yields low

QE Keeps Bond Yields Low : by increasing demand, the FED keeps Treasury yields low Attracts Foreign Investment and

Attracts Foreign Investment and  Exports by devaluing currency

Exports by devaluing currency Remove toxic loans from the banks B/S

Remove toxic loans from the banks B/S

5/

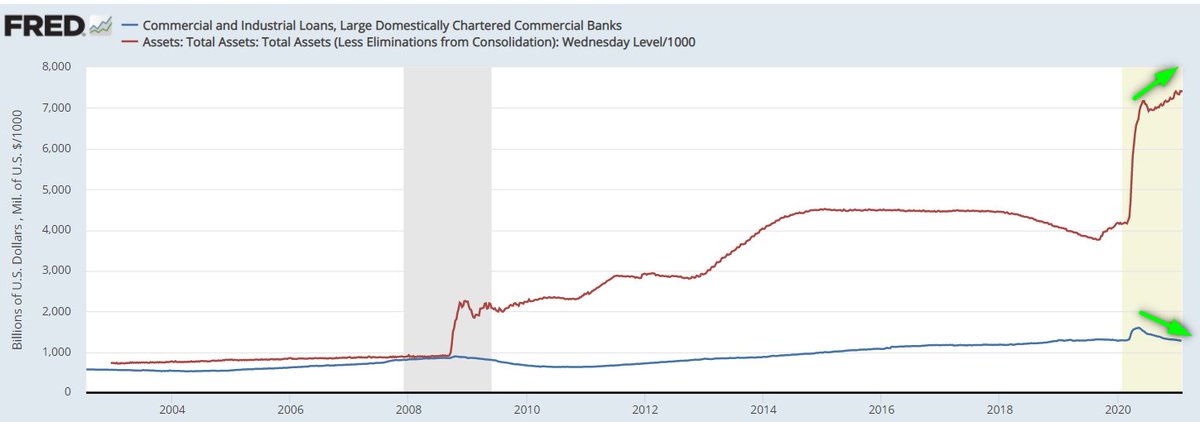

Are banks lending the extra -reserve - cash?

When looking at previous QEs & the long term, it's not easy to see if there's any impact at all

When looking at previous QEs & the long term, it's not easy to see if there's any impact at all

I assume the big bump is PEPP/Emergency lending

I assume the big bump is PEPP/Emergency lending

Are banks lending the extra -reserve - cash?

When looking at previous QEs & the long term, it's not easy to see if there's any impact at all

When looking at previous QEs & the long term, it's not easy to see if there's any impact at all I assume the big bump is PEPP/Emergency lending

I assume the big bump is PEPP/Emergency lending

6/

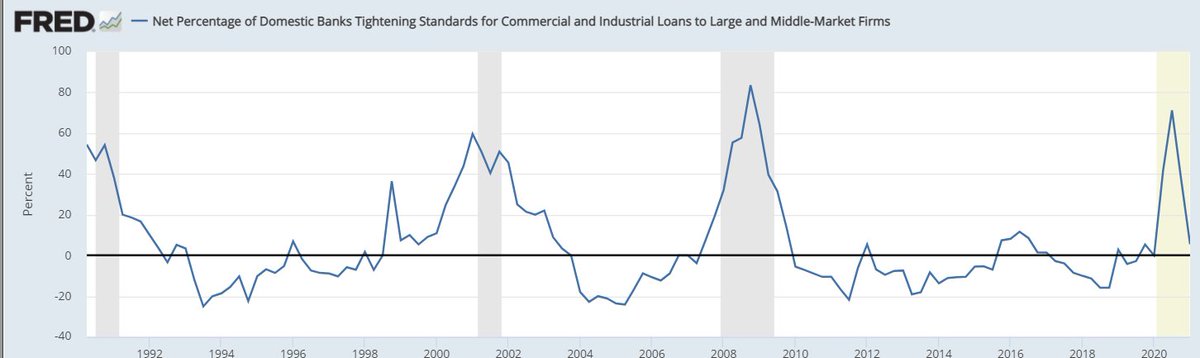

When looking at tightening standards, it seems to follow a totally normal cycle pattern

Banks likely don't want to take more risk on credits if rates are low

When looking at tightening standards, it seems to follow a totally normal cycle pattern

Banks likely don't want to take more risk on credits if rates are low

7/

OK if banks are not lending, what are they doing with it?

OK if banks are not lending, what are they doing with it?

Instead of keeping the money as reserve, they can spend on dividends & buybacks

Instead of keeping the money as reserve, they can spend on dividends & buybacks

They can also invest in risky assets

They can also invest in risky assets

It's like a favor of the FED in exchange of the pain of keeping rates low

It's like a favor of the FED in exchange of the pain of keeping rates low

OK if banks are not lending, what are they doing with it?

OK if banks are not lending, what are they doing with it?  Instead of keeping the money as reserve, they can spend on dividends & buybacks

Instead of keeping the money as reserve, they can spend on dividends & buybacks They can also invest in risky assets

They can also invest in risky assets It's like a favor of the FED in exchange of the pain of keeping rates low

It's like a favor of the FED in exchange of the pain of keeping rates low

8/

If banks are not lending, does it spur economic growth & inflation?

If banks are not lending, does it spur economic growth & inflation?

There isn't proof of this but it looks like it doesn't really have any impact on the GDP

There isn't proof of this but it looks like it doesn't really have any impact on the GDP

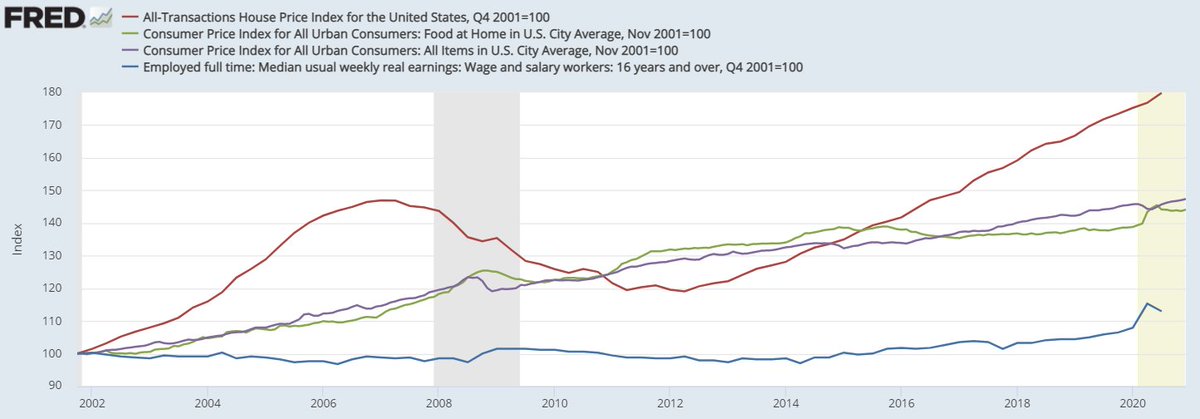

It is boosting housing & equities (skewing the chart so removed)

It is boosting housing & equities (skewing the chart so removed)

It is likely increasing wealth inequality

It is likely increasing wealth inequality

If banks are not lending, does it spur economic growth & inflation?

If banks are not lending, does it spur economic growth & inflation? There isn't proof of this but it looks like it doesn't really have any impact on the GDP

There isn't proof of this but it looks like it doesn't really have any impact on the GDP It is boosting housing & equities (skewing the chart so removed)

It is boosting housing & equities (skewing the chart so removed) It is likely increasing wealth inequality

It is likely increasing wealth inequality

9/

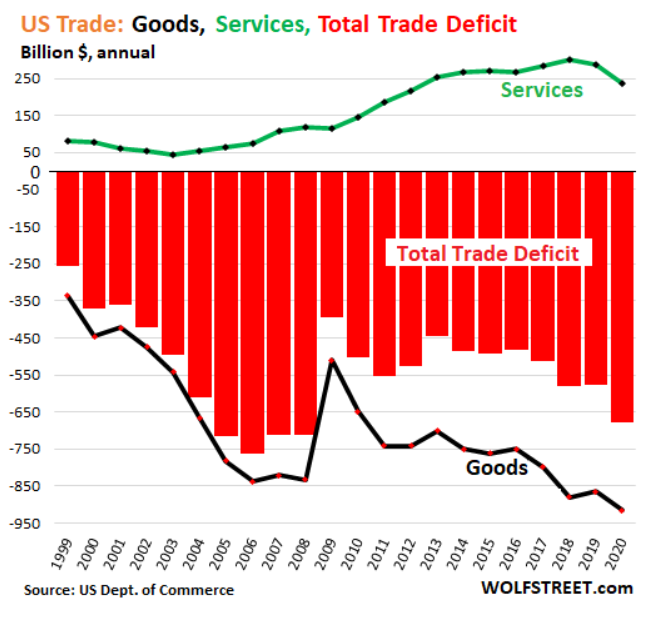

Does that improve the trade deficit by boosting exports?

Does that improve the trade deficit by boosting exports?

Data says no, at least it is unrelated

Data says no, at least it is unrelated

After the 1st QE the Dollar strengthened ... but remember they're all doing QE

After the 1st QE the Dollar strengthened ... but remember they're all doing QE

Does that improve the trade deficit by boosting exports?

Does that improve the trade deficit by boosting exports? Data says no, at least it is unrelated

Data says no, at least it is unrelated After the 1st QE the Dollar strengthened ... but remember they're all doing QE

After the 1st QE the Dollar strengthened ... but remember they're all doing QE

10/

Summarized

More Lending

More Lending

QE Keeps Bond Yields Low

QE Keeps Bond Yields Low

Exports by devaluing currency

Exports by devaluing currency

Remove toxic loans from the banks B/S

Remove toxic loans from the banks B/S

Summarized

More Lending

More Lending

QE Keeps Bond Yields Low

QE Keeps Bond Yields Low

Exports by devaluing currency

Exports by devaluing currency

Remove toxic loans from the banks B/S

Remove toxic loans from the banks B/S

11/

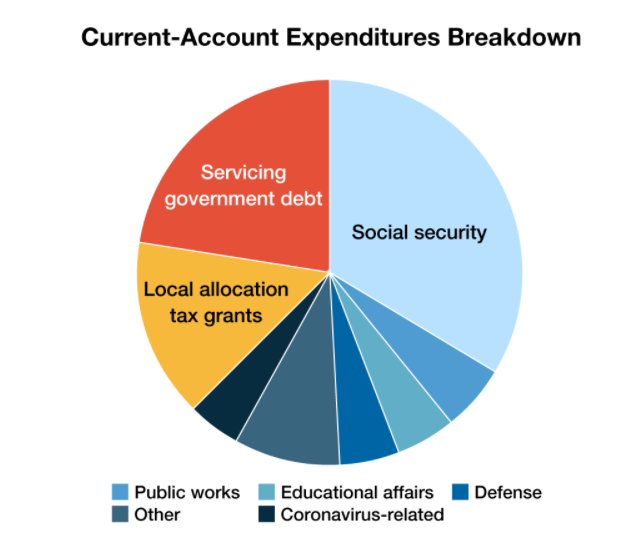

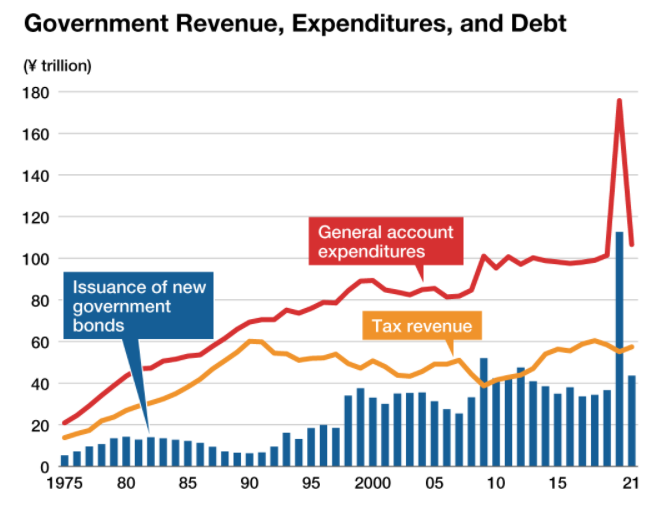

QE master: Japan

After 30 years of QE, 1/3 of their budget is servicing the debt

They've entered the "death loop" where their economy is declining because of inefficient capital allocation due to QE but at the same time they can't stop QE or they would bust

QE master: Japan

After 30 years of QE, 1/3 of their budget is servicing the debt

They've entered the "death loop" where their economy is declining because of inefficient capital allocation due to QE but at the same time they can't stop QE or they would bust

12/

Let's come back a little further down the road.

Why did the West start QEs in the first place?

"The Fed resorted to QE because its other expansionary monetary policy tools had reached their limits. The fed funds rate and the discount rate were zero."

Let's come back a little further down the road.

Why did the West start QEs in the first place?

"The Fed resorted to QE because its other expansionary monetary policy tools had reached their limits. The fed funds rate and the discount rate were zero."

13/

Well. Yes.

We're at the cross road. Our debt model, inherited from a millennial ago comes to the point were you get to get paid to receive money

CBs don't have any solution on this yet

Well. Yes.

We're at the cross road. Our debt model, inherited from a millennial ago comes to the point were you get to get paid to receive money

CBs don't have any solution on this yet

14/

I came to wonder what is the end game

Obvious states have an issue to finance themselves & as they didn't find any solution, CBs have engineered mechanisms which replace the market economy

This isn't sustainable as there are no incentive for governments to be efficient

I came to wonder what is the end game

Obvious states have an issue to finance themselves & as they didn't find any solution, CBs have engineered mechanisms which replace the market economy

This isn't sustainable as there are no incentive for governments to be efficient

15/

I hope this was helpful.

Don't hesitate to comment & retweet.

Cheers

Link to the top: https://twitter.com/TheMarketDog/status/1359376439833812994?s=20

I hope this was helpful.

Don't hesitate to comment & retweet.

Cheers

Link to the top: https://twitter.com/TheMarketDog/status/1359376439833812994?s=20

Read on Twitter

Read on Twitter