COVID LESSONS FROM THE FREE MARKET: Among other places, much of my career has been in the capital markets. Such markets are not perfect, but they are an astonishing force to behold with much wisdom to bestow upon those willing to listen. So what lessons should we learn from

1/28

1/28

the markets as it relates to the COVID fiasco? 5 topics:

1. Markets Impose Humility Upon Models

The free markets have a way of imposing humility on those who think they have conquered them. The mad modelers and gov’t leaders will swear they saved millions of lives. Did

2/28

1. Markets Impose Humility Upon Models

The free markets have a way of imposing humility on those who think they have conquered them. The mad modelers and gov’t leaders will swear they saved millions of lives. Did

2/28

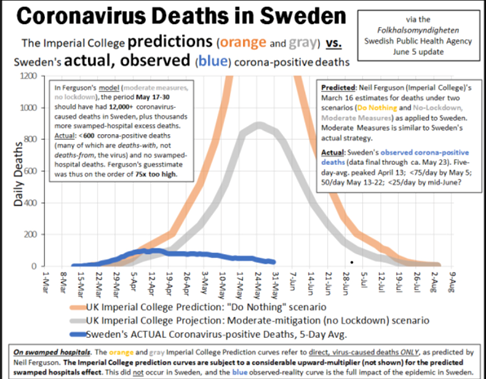

they? Let's look at Sweden-In April the lockdown modelers said that, if Sweden did nothing, almost 100,000 people would die by July 1. So Sweden did nothing and–what happened–the total was instead 5,490 with a curve similar to every lockdown country. Its hard to overstate

3/28

3/28

just how wrong this projection was-a chart is always helpful. In the free market, there would be consequences for such abject failure. This result would cause anyone gainfully employed in financial modeling to lose their job, or at a minimum, rethink their priors. Looking

4/28

4/28

at the chart above or any of those displayed by @ianmSC @Humble_Analysis @Hold2LLC should cause all to ponder whether maybe there are dynamics of viral transmission that are not controllable by “masking harder” or “if you just didn’t eat the cheesecake.”

The LTCM debacle of

5/28

The LTCM debacle of

5/28

1998 is a good analogy. The fund, started by academics + investing based on models, controlled over $100 billion at its peak and had positions worth over a $1 trillion. Unforeseen externalities (Russian default) caused the fund to suffer massive losses of hundreds of

6/28

6/28

millions per day. However, LTCM's computer models recommended that it continue holding its positions, and so it did right up until the Federal Reserve had to absorb it. The modelers thought they were smarter than everyone else and couldn’t accept that the collective actions

7/28

7/28

of 7 billion people perhaps can’t be summarized in Excel.

2. Stick to Well-Devised Plans

Long term investing is often more about the moves you DON’T make than the ones you do. For example, don't panic and sell stocks during a big market drawdown; instead that is when

8/28

2. Stick to Well-Devised Plans

Long term investing is often more about the moves you DON’T make than the ones you do. For example, don't panic and sell stocks during a big market drawdown; instead that is when

8/28

sticking to the plan becomes most important. All pre-2020 epidemiological preparedness either made no mention of lockdown (because it is so absurd) or dismissed it outright (because it is so absurd). Example: a 2006 study on Biosecurity & Bioterrorism concluded that

9/28

9/28

"experience has shown that communities faced with epidemics or other adverse events respond best and with the least anxiety when the normal social functioning of the community is least disrupted.” Oh…whoops.

Most studies (see pinned tweet) suggest the virus was already in

10/28

Most studies (see pinned tweet) suggest the virus was already in

10/28

decline before the lockdown. Thus, locking down society was the epidemiological equivalent of liquidating your portfolio in March of 2009 or 2020 because you panicked. We threw out decades of well-laid pandemic preparedness plans (think dollar cost averaging into a defined

11/28

11/28

asset allocation) and instead copied unprecedented CCP tyrannical lockdowns that were previously unthinkable. And then, just like going to cash might stop your portfolio from falling, gov’t attributed success to its actions – in reality, the market just bottomed like the

12/28

12/28

virus stopped spreading. And your actions were actually harmful because you missed out on market gains just like we missed out on the functioning of a normal society by staying locked down through spring/summer.

3. The Market Has a View on Lockdowns

The free market can also

13/

3. The Market Has a View on Lockdowns

The free market can also

13/

inform our view of lockdowns. If COVID was the indiscriminate killer it was made out to be, people would be voluntarily working from home, taking their kids out of school, and avoiding having visitors. Indeed we saw a lot of this behavior in March. However, the collective

14/28

14/28

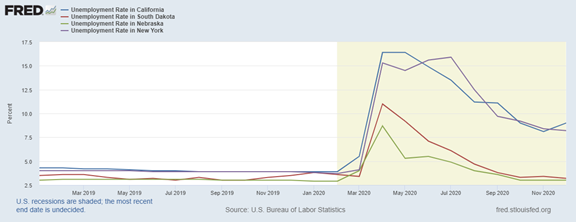

market of humans soon realized the threat had been exaggerated and moved on. Government bureaucrats, always a step behind, failed to pivot and instead doubled down. The US federal system allows for observing market dynamics; the chart below shows the unemployment rates in

15/28

15/28

South Dakota and Nebraska (no lockdown) vs. California and New York (hard lockdown). The former are below pre-pandemic levels. This debunks any notion “the virus closed the economy”–no, if you give people a choice to live their lives as normal they will do so. Or the viral

16/28

16/28

"terrifying" videos posted by MSM bluechecks of people living a normal life in Florida, which have instead caused more people to move to Florida. People vote with their feet-check out UHaul’s ranking of states by net migration; not shockingly you find TX and FL near the top

17/

17/

while NJ, IL, and CA are at the bottom. Turns out tyranny is not popular with customers (citizens). https://www.uhaul.com/Articles/About/22746/2020-Migration-Trends-U-Haul-Ranks-50-States-By-Migration-Growth

4. Private Schools are Accountable to Customers

In much of US, public schools remain closed while private schools have been open (without issue)

18/28

4. Private Schools are Accountable to Customers

In much of US, public schools remain closed while private schools have been open (without issue)

18/28

for months. Why? Because without actually providing the product for which $ have been exchanged, a private enterprise will not have any customers. Govt funded schools have no such constraints—in fact they are demanding more money and access to vaccinations without any

19/28

19/28

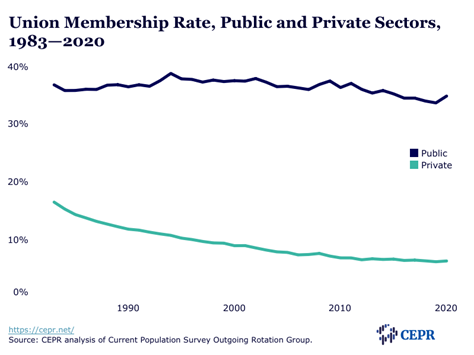

plans to provide anything in return. With private sector unionization, there is a countervailing force (management/shareholders) against whom to negotiate; public sector unions face nothing but corrupt politicians willing to trade away our children’s futures for votes/$.

20/28

20/28

Indeed this is why private sector unionization has declined precipitously whereas public sector unionization holds steady (priv unions put employers out of business).

5. Asset Markets are Discounting Mechanisms

One free market phenomenon you must understand is that,

21/28

5. Asset Markets are Discounting Mechanisms

One free market phenomenon you must understand is that,

21/28

because of the $$ available, many of the most gifted people are attracted to careers in Finance. These are not just valedictorians from top business schools, but also people at the top of other professions (like doctors or scientists) that realize-if so motivated-they can

22/28

22/28

make infinitely more $$ applying their expertise on Wall Street (e.g., analyzing/investing in fledgling biotechs).

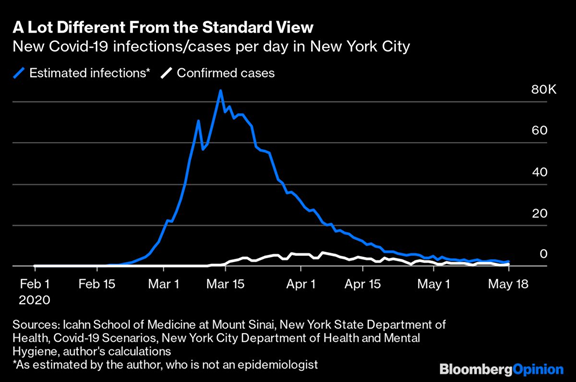

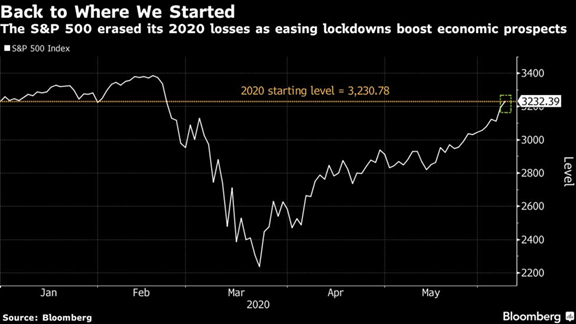

Look at these two charts; the US stock market bottomed on March 23, 2020 about a week after (in hindsight) NYC COVID infections peaked. That these charts are

23/28

Look at these two charts; the US stock market bottomed on March 23, 2020 about a week after (in hindsight) NYC COVID infections peaked. That these charts are

23/28

effectively a mirror image of one another is NOT a coincidence. While the public/media hysteria was just kicking into high gear, the market already knew COVID wasn’t the bubonic plague and investors were busy buying up airline, hotel, and cruiseline stocks, oil drillers, 24/28

& casino operators. Take this bit from JPM on April 6 (this is information made available to retail investors; imagine the intel multibillion-dollar funds had): “We believe we’ve seen a peak in new case growth in the US 3-4 days ago,.. deaths will peak in about a week so

25/28

25/28

we look for a limited reopening of the economy..and we think we will be able to recover the losses in equities sometime next year.” They were ridiculed and, guess what, they were right. So while everyone was busy saying, “the stock market makes no sense given the virus!” 26/28

the reality is that there was more demand for stocks than supply. The market was not wrong; CNN and the “experts” were wrong. Note JPM also suggested lockdowns don’t work and the virus has its own dynamics (see pinned tweet).

I do wish to conclude by saying I am not a

27/28

I do wish to conclude by saying I am not a

27/28

free-market “purist” and there is certainly a role for government in a crisis like this. No doubt many of us have lost loved ones (both to the virus and lockdowns) and I have deep empathy for all affected; however we MUST learn from our mistakes. Thanks for reading+sharing.

28/28

28/28

Read on Twitter

Read on Twitter