Little changed in today's BLS release of Job Openings and Labor Turnover for December. In fact, "little changed" was mentioned 17 times in the report, including little changed in job openings and separations while hiring decreased in December.

https://www.bls.gov/news.release/pdf/jolts.pdf

https://www.bls.gov/news.release/pdf/jolts.pdf

The latest #JOLTS data shows that there was a significant and troubling drop in hiring in December.

On Friday, the BLS reported that in January, the economy was still 9.9 million jobs below where it was last February. This translates into a 12.1 million job shortfall when using a reasonable counterfactual of job growth if the recession hadn’t occurred. https://www.epi.org/press/the-u-s-labor-market-remains-9-9-million-jobs-below-pre-pandemic-levels/

Today’s JOLTS report is a clear sign that the recovery is not charging ahead. Hiring and job openings are below where they were before the recession hit => it's impossible to recover anytime soon when we have such a massive hole to fill in the labor market. https://www.epi.org/blog/a-stalled-recovery-hires-fall-in-the-job-openings-and-labor-turnover-survey/

In December hires softened considerably falling from 5.9 million to 5.5 million. In particular hiring decreased in leisure and hospitality—in both accommodation & food services and in arts, entertainment, & recreation. Hiring also fell in transportation, warehousing, & utilities.

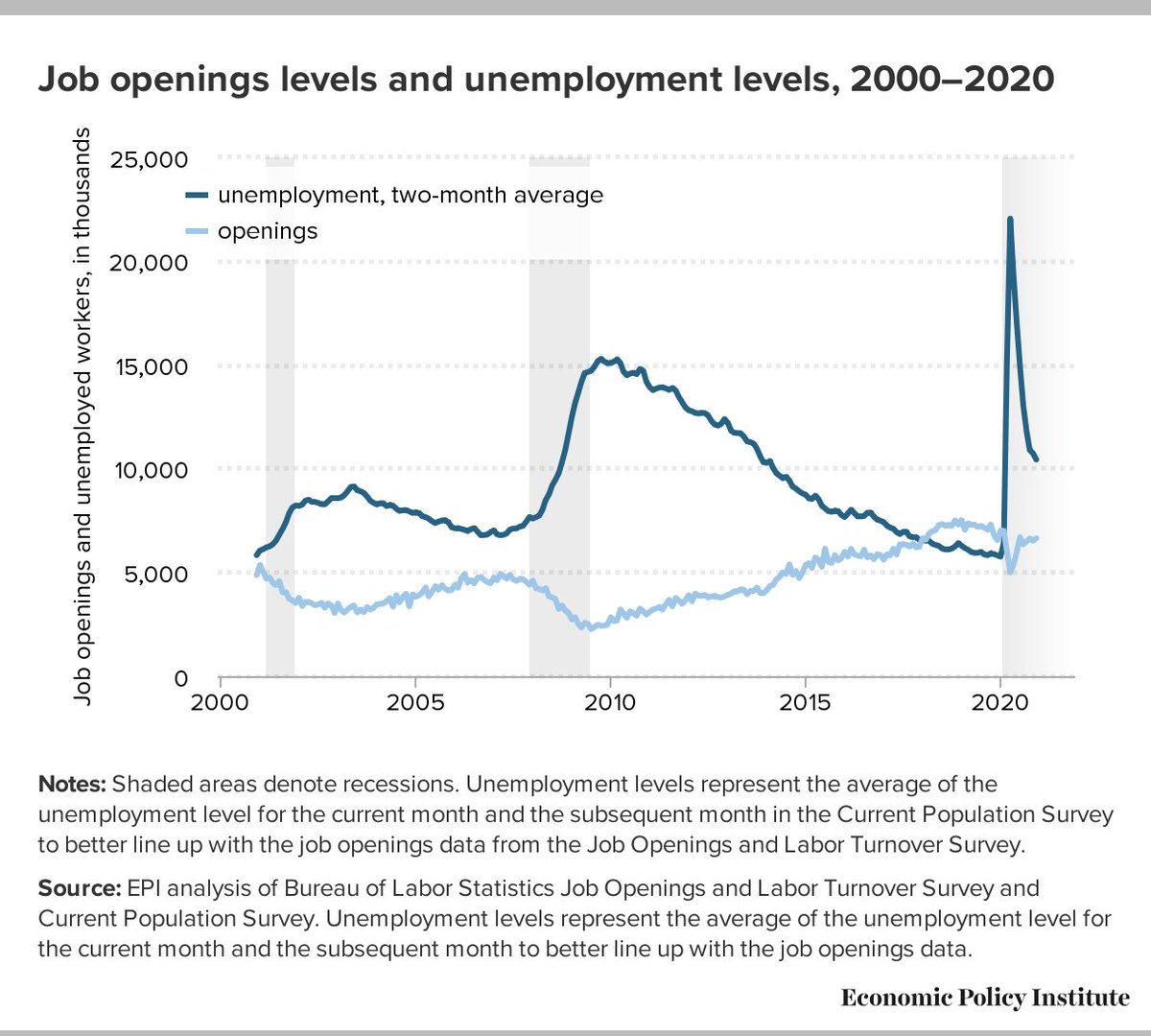

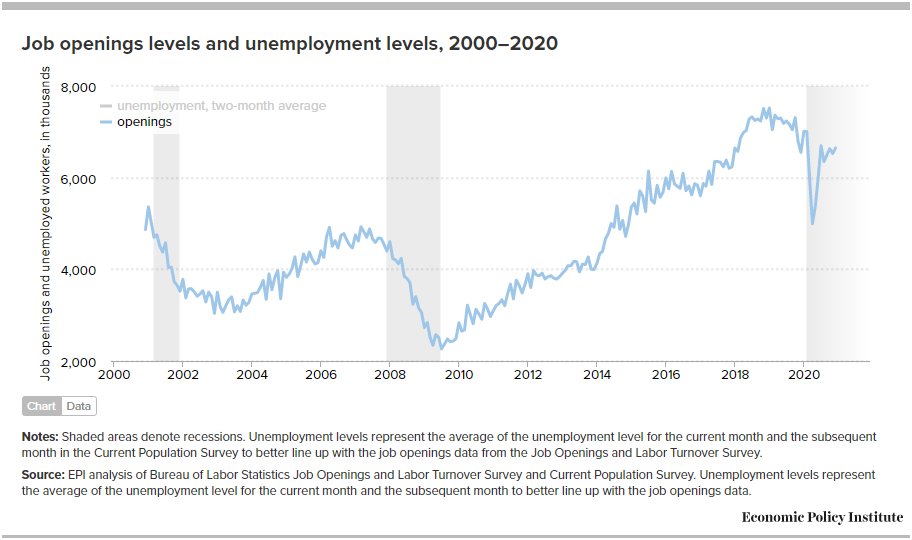

One of the most striking indicators is the job seekers ratio—the ratio of unemployed workers (averaged for mid-December and mid-January) to job openings (at the end of December). On average, there were 10.4 million unemployed workers compared with only 6.6 million job openings.

This translates into a job seekers ratio of 1.6 unemployed workers to every job opening. For every 16 workers who were officially counted as unemployed, there were only available jobs for 10 of them. No matter what they did, there were no jobs for 3.8 million unemployed workers.

And this misses the fact that many more weren’t counted among the unemployed: The economic pain remains widespread with 25.5 million workers hurt by the coronavirus downturn. https://www.epi.org/blog/the-economy-trump-handed-off-to-president-biden-25-5-million-workers-15-0-of-the-workforce-hit-by-the-coronavirus-crisis-in-january/

On the whole, the U.S. economy is seeing a significantly slower hiring pace than we experienced in May or June. In December, hiring was below where it was before the recession, a big problem given that we have only recovered just over half of the job losses from this spring.

And job openings are now substantially below where they were before the recession began (6.6 million at the end of December, compared to 7.1 million on average in the year prior to the recession).

With hiring and job openings at these levels, the economy is facing a long, slow recovery without additional action from Congress. Policymakers need to act now at the scale of the problem to address the continuing economic crisis.

For more charts and up-to-date analysis on job openings, please visit @EconomicPolicy's landing page devoted to JOLTS data.

https://www.epi.org/indicators/jolts/

Thank you to @joriskywalker @hshierholz and @NKauzlarich for their assistance with this release. Errors are mine.

https://www.epi.org/indicators/jolts/

Thank you to @joriskywalker @hshierholz and @NKauzlarich for their assistance with this release. Errors are mine.

Read on Twitter

Read on Twitter