A thread about $GME and Robinhood (how original!), but let’s focus on the fundamental issues with the plumbing of traditional finance.

Credit to @compound248 for articulating this better than most.

https://twitter.com/compound248/status/1355274739351248898

1/14

Credit to @compound248 for articulating this better than most.

https://twitter.com/compound248/status/1355274739351248898

1/14

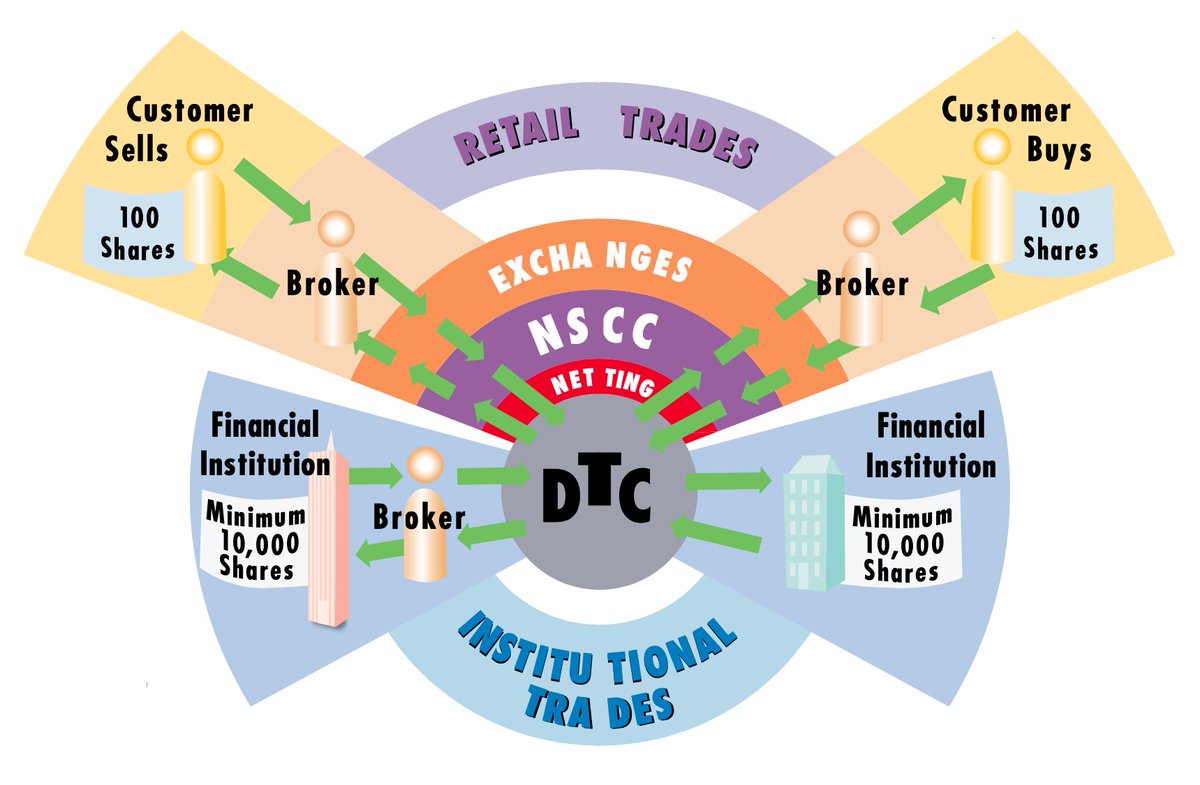

Short version: When you use a broker, who uses a clearing house, who is dealing with another broker, who has its own client (see image), the chain of intermediaries exacerbates two main types of risk; (1) settlement risk (2) breakdown of risk models

2/14

2/14

Re (1) much has already been said about T+2 settlement. When prices go mental, the risk of someone not settling goes up drastically, and CHs place large collateral requirements on brokers as a result. RH gets forced to cough up cash or stop adding risk.

3/14

3/14

Can blockchain and DeFi be a solution? Instant settlement removes credit risk for cash trades. So, yes, the rails have been built now for reliable, fast settlement of funds with finality. Do we want this for all trades? Not necessarily:

https://twitter.com/jtdaugh/status/1356963105574682624

4/14

https://twitter.com/jtdaugh/status/1356963105574682624

4/14

In summary, market makers are providing liquidity across multiple venues, and T+n gives them the ability to trade long and short and net out before it's time to settle. MM needing to settle instantly would DRAIN liquidity massively. So optimal n is probably > 0 and < 2 days! 5/14

What are MM REALLY doing by not settling instantly? They're trading short-dated forwards. Instant settlement doesn't remove credit risk for anyone that trades derivatives. If you trade spot, as soon as you settle, you're free to walk away. 6/14

Derivatives don't work that way - exposure inherently persists - and the amount of risk in a portfolio (and margin required) is constantly changing based on NET risk across spot, forwards, futures, options etc.

This brings us to risk (2), breakdown of risk models. 7/14

This brings us to risk (2), breakdown of risk models. 7/14

As @samchepal studies here, in the case of $GME and other affected stocks, vol went bananas (perhaps rightly so)

https://twitter.com/samchepal/status/1356516363750178816

Crazy stat from @compound248: a $70 strike put traded at $20 when $GME was trading $77. 8/14

https://twitter.com/samchepal/status/1356516363750178816

Crazy stat from @compound248: a $70 strike put traded at $20 when $GME was trading $77. 8/14

When $GME traded $348, the $70 put was almost unchanged in price (it would usually trade for a few cents).

It's almost impossible for a standard risk model to capture this correlation breakdown 9/14

It's almost impossible for a standard risk model to capture this correlation breakdown 9/14

Normally, if you were short the stock and short the puts, and the price tripled, it'd be fair to say you'd have expected one trade to lose, one trade to win 10/14

These assumptions are embedded in margin calculations - given scenario A, XYZ net position should make/lose X. And then by cycling through enough scenarios, you get maximum expected loss.

Well, all those assumed correlations broke down 11/14

Well, all those assumed correlations broke down 11/14

CHs asked RH for a bunch more margin as a result. Clients of RH were affected even though they were on the right side of the trade

Why do we care? The many intermediaries (designed to make trading easier) inadvertently created a load more friction. 12/14

Why do we care? The many intermediaries (designed to make trading easier) inadvertently created a load more friction. 12/14

When the CH is the only main source of credit, and it changed its risk model, the number of intermediaries means that the end-user gets stopped out when they shouldn't

Your access to the market is only as good as your broker's credit. 13/14

Your access to the market is only as good as your broker's credit. 13/14

Is that foundation something that can be improved? We definitely think so. See our next thread to learn more about that.. 14/14

Read on Twitter

Read on Twitter