Out today: Risky Bet - National Oil Companies in the Energy Transition. We dug into how NOC plans for new spending could impact global climate goals, and their economies. https://resourcegovernance.org/analysis-tools/publications/risky-bet-national-oil-companies-energy-transition. THREAD 1/

As BP, Shell & others write off assets in the face of energy transition, most NOCs have been quiet. But these companies are responsible for 40% of global O&G spending (using public money), and are planning more over next decade. 2/

Headline #: of $1.9 trillion in upcoming spending by NOCs, $400+ billion could fail to break even if we meet global climate targets. That matters a lot for the global picture, as @fionaharvey discusses here: https://www.theguardian.com/environment/2021/feb/09/state-owned-fossil-fuel-firms-planning-19tn-investments?CMP=Share_iOSApp_Other. 3/

It will also have a HUGE impact on the economic well-being of people in countries that depend today on oil, and govts. & NOCs in these countries face big challenges going forward. Digging into examples helps show the scope. 4/

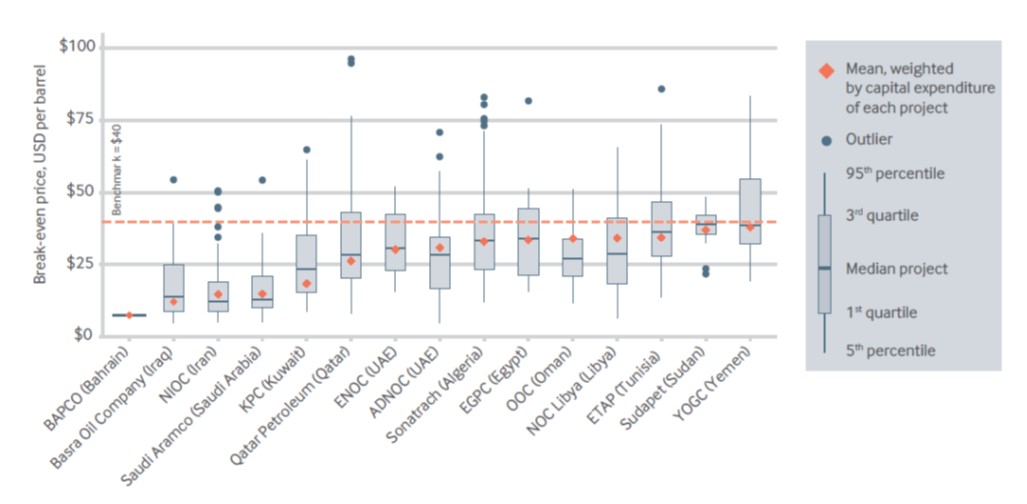

Middle East/N. Afr. NOCs are, in the aggregate, the least at risk, with large reserves left to be exploited at relatively low cost. But some co's in the region face tough choices about whether/how much to spend to replace production as fields age. 5/

And many MENA countries rely on high oil prices to balance their budgets, so reexamining NOC role in the social contract and fiscal rels b/t NOC and the state will be crucial. See our region-specific briefer here: https://resourcegovernance.org/analysis-tools/publications/national-oil-companies-energy-transition-middle-east-north-africa 6/

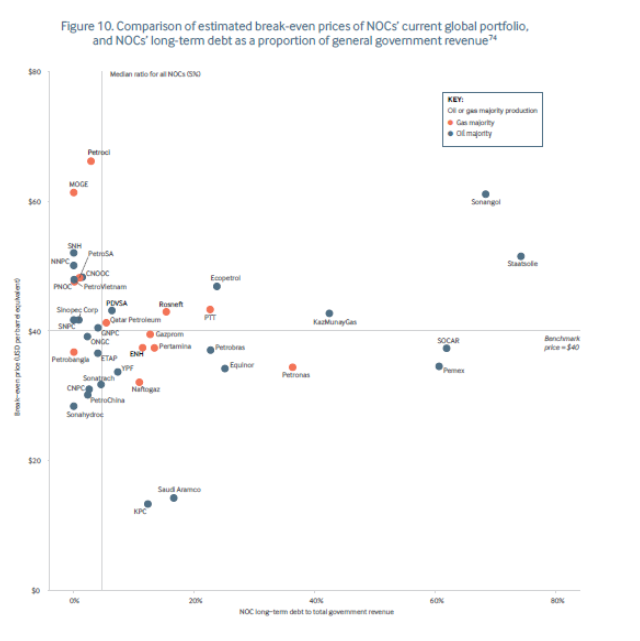

Debt is a big compounding risk in some places: if the company is "too big to fail," govt may need to step in to bail out NOCs if new projects don't break even. Heavy debt + a high share of costly projects in upcoming portfolio = big national risk. 7/

Pemex stands out here, already bailed out and facing heavy new costs if it wants to revitalize production. @jude_webber reports that company could impose a burden of 2.3% of GDP if it gets capex boost it seeks: https://www.ft.com/content/22e8802b-3c6f-4005-9aeb-4a85108cf2bf 8/

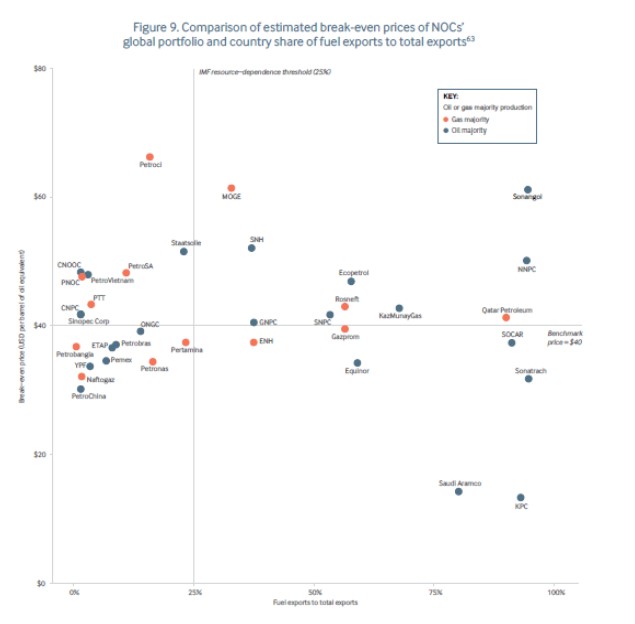

Oil dependence is another risk factor. Countries like Nigeria, Colombia, Kazakhstan face high-risk NOC investment decisions AND economies dominated by oil. Reverberations of project failure can be wide, and NOC $$ may divert resources for necessary diversification. 9/

Some countries/NOCs come close to a perfect storm of risk. Angola and Azerbaijan stand out: big upcoming spending on projects that will fail if prices drop, large debts, oil-dominated economies. 10/

So what do governments do? Paper offers various ideas, but at the core is a choice: do we want to cash out or stay at the table? Some NOCs may be better-positioned than others to be last one standing, with lower-cost assets. But q should be scrutinized everywhere. 11/

Cashing out doesn’t mean abandoning O&G altogether, but means reducing country’s risk exposure via the NOC and prioritizing near-term monetization. Measures may include increasing NOC taxes, selling assets/shares, mandating carried interest or setting tougher inv. thresholds. 12/

Most importantly, it's time for govts. and NOCs to start looking to the future in a more rigorous, transparent way, stress-testing their plans for their impact on the well-being of their economies and the climate. Not easy, but necessary. end/

Read on Twitter

Read on Twitter