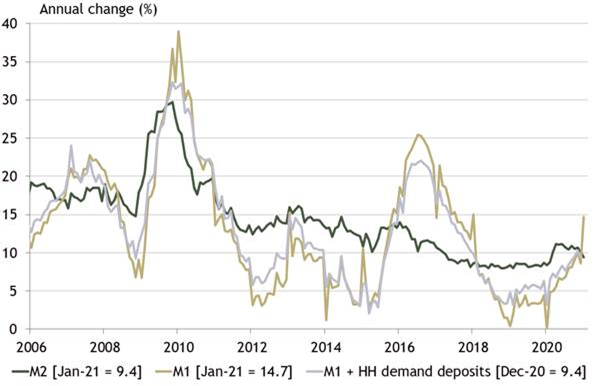

3 takeaways from China’s money & credit data: 1 the jump in M1 was entirely due to the timing of Chinese New Year. 2 the credit cycle peaked months ago. 3 the excess issuance of government bonds in H2 has a lot to do with the credit slowdown and may soon result in weak M1 1/x

While M1 growth spiked to 14.7% in January, M2 growth slumped to 9.4%, its weakest growth rate since the Covid-crisis started in February last year. M2 is less distorted by the red envelope problem and is a better reflection of what’s going on in the January/February period. 2/x

M1 is just corporate demand deposits in China, and corporates hand out cash for Chinese New Year. The holiday started on Jan 25 last year and will begin this Friday this year. So, corporates had withdrawn cash for the holiday last Jan but had not yet this year 3/x

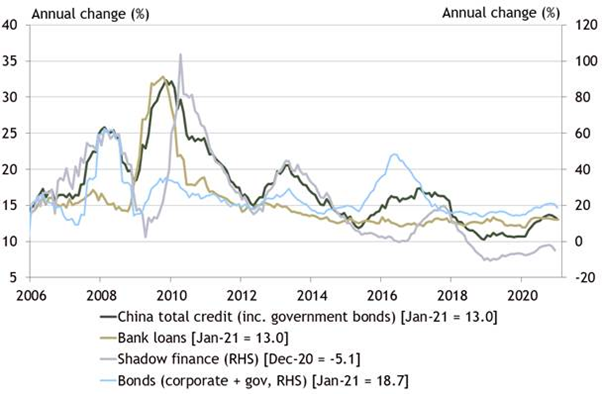

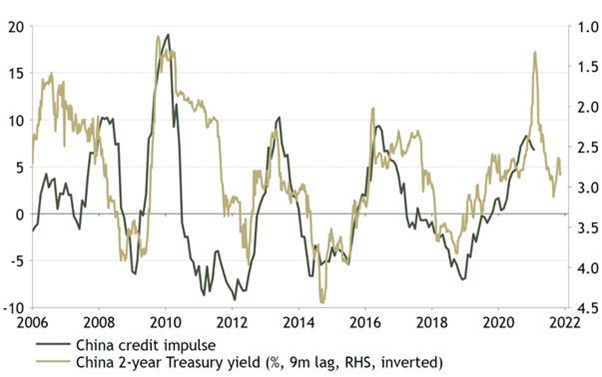

But whether you look at annual growth for credit or the credit impulse, it’s pretty clear that we are past peak for this cycle. That’s partly a function of tighter interbank liquidity conditions and partly because government bond issuance is included in the credit data. 4/x

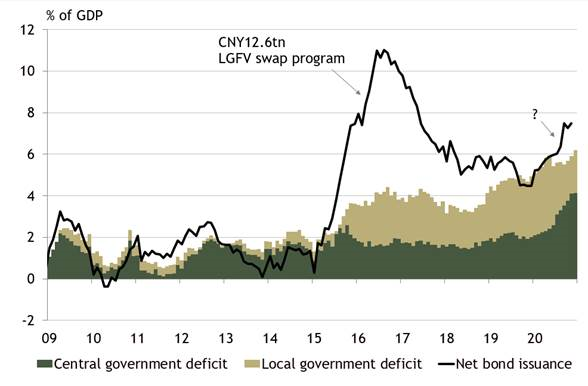

Typically, government bond issuance does not start in earnest until March, after the National People’s Congress. But for the previous two years, the central government allowed local governments to issue bonds before their budgets were approved. This year they did not. 5/x

Net government bond issuance was CNY244bn in January compared to CNY761bn in the same month last year. If you exclude government bonds, there was less of a slowdown in credit growth in January, but it wouldn’t change the trend that saw peak growth happen a few months ago. 6/x

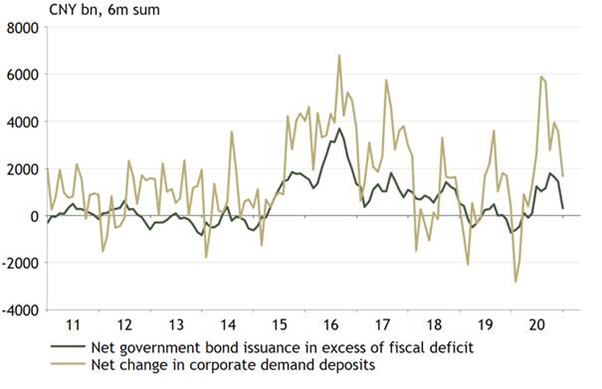

The slowdown in government bond issuance is a big deal. Bond issuance exceeded the fiscal deficit last year. That means that local government cash balances are healthy, and it’s why they did not get the early bond issuance quota they have received the previous 2 years. 7/x

But because it looks like the excess funds raised by local governments have been stored in banks and classed as “corporate” deposits, those funds have been inflating M1 and possibly M2 growth since around June last year. 8/x

The plan this year seems to be that governments will fund part of their deficit out of those cash balances. Those deposits won’t be destroyed, they’ll just be transferred to actual corporates. But the government will be injecting less cash into the system. 9/x

That might be one reason that the liquidity situation in the interbank system has been precarious lately, and I expect to see the PBoC continue to struggle to get the balance right. It may have to inject liquidity but won’t want to be seen loosening monetary conditions. 10/x

The upside may be continued volatility in Chinese rates over the next few months. -End

Read on Twitter

Read on Twitter