1) Tesla's announcement of $1.5bn Bitcoin Treasury allocation sent spot surging >20% from 39k-48k.

Short-term Option vol pumped in response.

Then as BTC broke 44k, large buyers x2.5k+ of Feb12-26 44k-52k Calls lifted offers, IV surging >150% at its peak before cooling overnight.

Short-term Option vol pumped in response.

Then as BTC broke 44k, large buyers x2.5k+ of Feb12-26 44k-52k Calls lifted offers, IV surging >150% at its peak before cooling overnight.

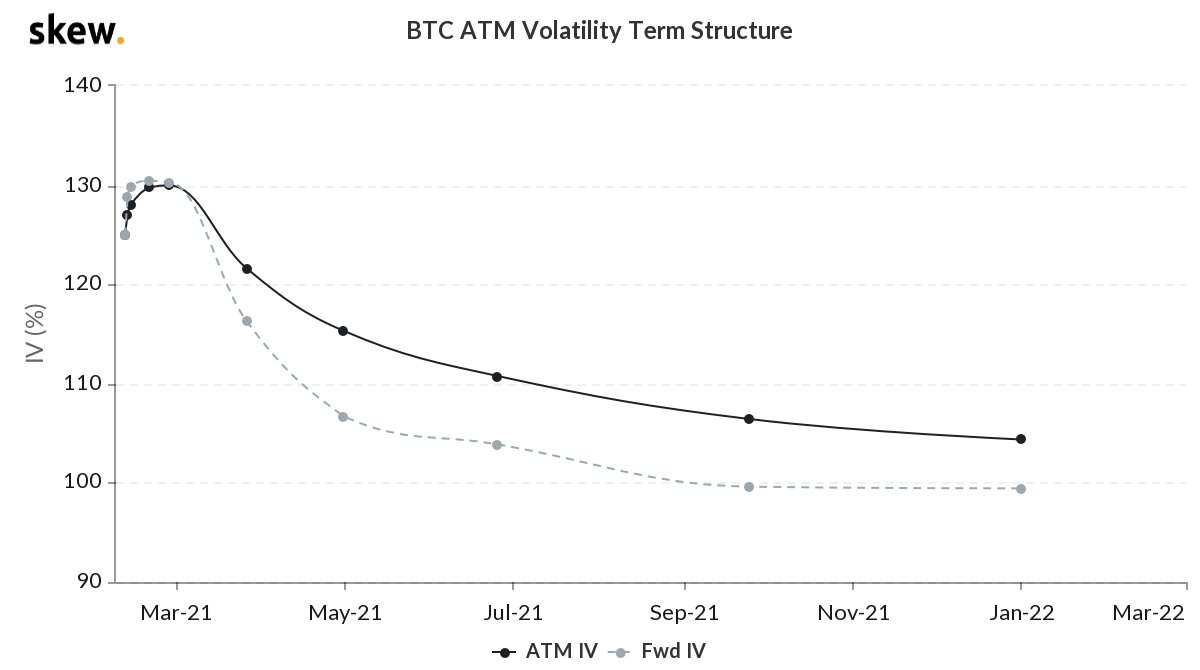

2) BTC 32-40k comfort zone was short-lived; so was <100% Implied Vol. The market needed an Elon-esque announcement to break ATHs and the Tesla news was it.

Risky Put selling rewarded, but there is now a dilemma for those short Calls: large ITM and approaching OTM Short Strikes.

Risky Put selling rewarded, but there is now a dilemma for those short Calls: large ITM and approaching OTM Short Strikes.

3) Straightforward opportunity for Long ITM Calls:

Prior 'Yield enhancing' sellers of OTM Calls >50k have created a surprisingly flat OTM Call skew given the ATH breach; MMs are saturated with upside Calls.

This presents an efficient way to take profits + roll-up Call exposure.

Prior 'Yield enhancing' sellers of OTM Calls >50k have created a surprisingly flat OTM Call skew given the ATH breach; MMs are saturated with upside Calls.

This presents an efficient way to take profits + roll-up Call exposure.

Read on Twitter

Read on Twitter