Overconfidence Bias and Investing

How irrational optimism and overconfidence can destroy your investments

/THREAD/

How irrational optimism and overconfidence can destroy your investments

/THREAD/

1/ Overconfidence bias is one of the cognitive psychology biases.

It entails our tendency to have a misleading and incorrect assessment of our intellect, talent, and/or skills.

Our brain makes us hold this egotistical belief that we’re much better than we actually are.

It entails our tendency to have a misleading and incorrect assessment of our intellect, talent, and/or skills.

Our brain makes us hold this egotistical belief that we’re much better than we actually are.

2/ According to a 2018 AAA survey, approximately 73% of Americans consider themselves to be better-than-average drivers.

As you can imagine this is statistically highly unlikely to be true.

But how does this ego-driven tendency can affect your investments?

As you can imagine this is statistically highly unlikely to be true.

But how does this ego-driven tendency can affect your investments?

3/ Forecasting is one of the most critical traits in investing.

Creating your investing thesis involves a lot of assumptions about the company, the sector, and the economy.

Most analysts and investors consider themselves to be above average in their investing skills.

Creating your investing thesis involves a lot of assumptions about the company, the sector, and the economy.

Most analysts and investors consider themselves to be above average in their investing skills.

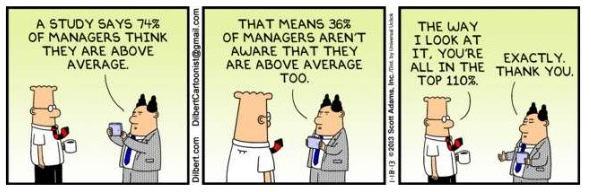

4/ However, it is obviously a statistical impossibility for most of them to be above average.

James Montier conducted a survey of 300 professional fund managers, asking if they believe themselves above average in their ability.

James Montier conducted a survey of 300 professional fund managers, asking if they believe themselves above average in their ability.

5/ 74% of them responded "Yes".

74% believed that they were above average at investing.

Of the remaining 26%, most thought they were average.

74% believed that they were above average at investing.

Of the remaining 26%, most thought they were average.

6/ In short, almost 0% thought they were below average.

However, these numbers are a statistical impossibility.

You can read the study here

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=890563

However, these numbers are a statistical impossibility.

You can read the study here

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=890563

7/ There are several ways overconfidence can manifest in our investing decisions.

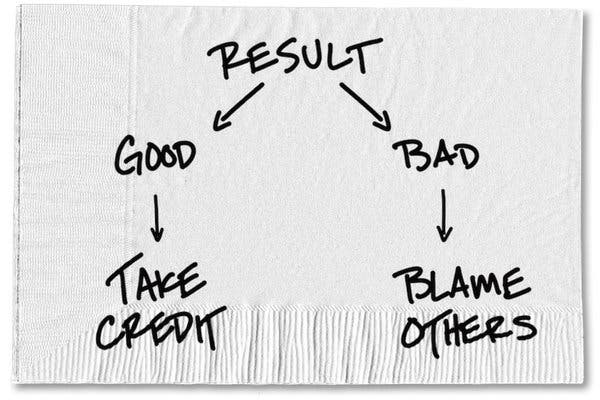

1. Over Ranking

It's when you rate your personal performance higher than it actually is.

1. Over Ranking

It's when you rate your personal performance higher than it actually is.

8/ When you think you are a much better investor, especially when you invest during bull markets when everything goes up, you end up risking too much.

9/ 2. Illusion of Control

It's when you think you have control over a situation when in fact you do not.

When you do not things out of your control into account, you fail to accurately assess risk.

It's when you think you have control over a situation when in fact you do not.

When you do not things out of your control into account, you fail to accurately assess risk.

10/ 3. Timing Optimism

It's when you overestimate how quickly you can complete a task.

Investors frequently underestimate how long it may take for an investment to pay off.

Not everything will work out as planned in a few months.

Sometimes, it may take years.

It's when you overestimate how quickly you can complete a task.

Investors frequently underestimate how long it may take for an investment to pay off.

Not everything will work out as planned in a few months.

Sometimes, it may take years.

11/ 4. Desirability Effect

Also known as “wishful thinking”, it's when you overestimate the odds of something happening simply because the outcome is desirable for you.

Also known as “wishful thinking”, it's when you overestimate the odds of something happening simply because the outcome is desirable for you.

12/ Just because you want a specific company to execute its plan perfectly, doesn't mean it will happen.

In fact, it rarely does.

However, you do not need to be disheartened. There solutions to combat your overconfidence bias

In fact, it rarely does.

However, you do not need to be disheartened. There solutions to combat your overconfidence bias

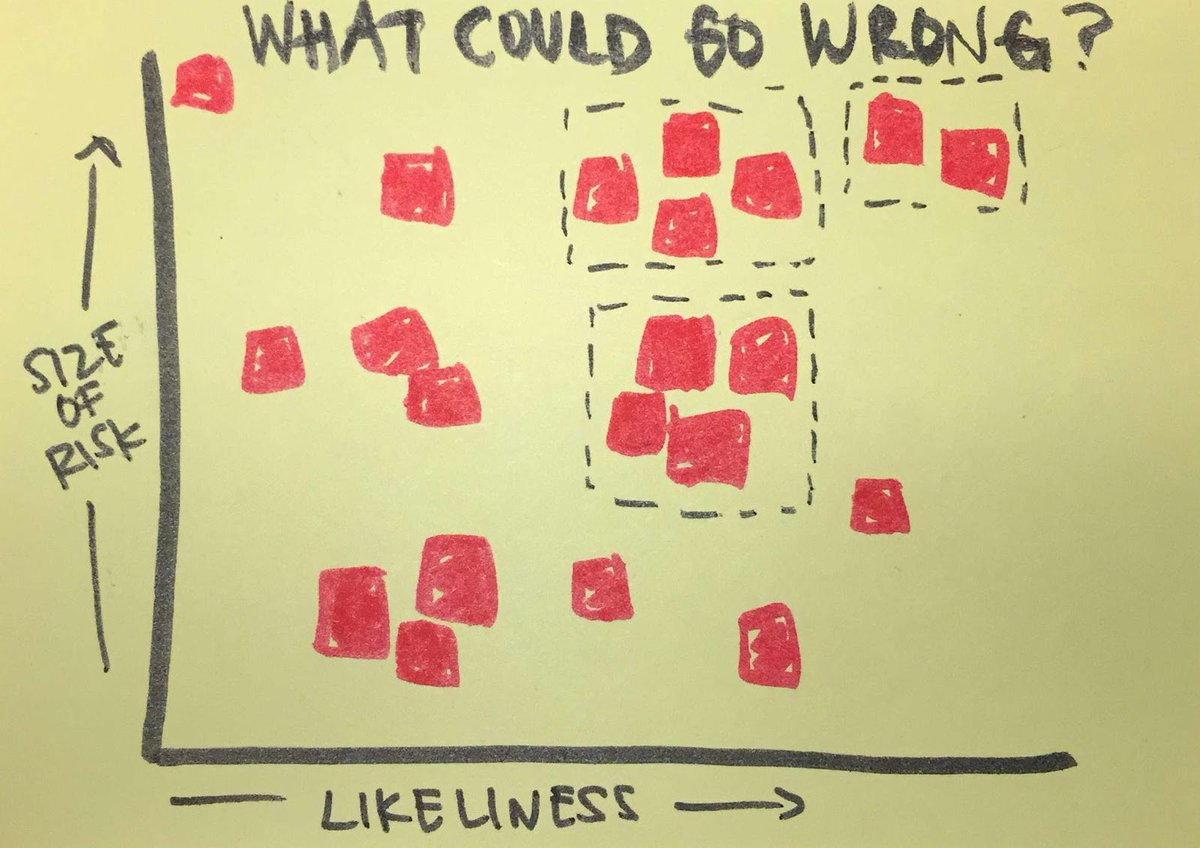

13/ Ray Dalio, founder of the world’s largest hedge fund, Bridgewater & Associates, has attributed a significant amount of his success to avoiding any overconfidence bias.

He makes it a point to stay aware of the possibility that his assessments may be wrong.

He makes it a point to stay aware of the possibility that his assessments may be wrong.

14/ “I knew that no matter how confident I was in making any single bet, that I could still be wrong.”

With that mindset, he always aims to consider the worst-case scenarios and take appropriate measures to minimize his risk.

With that mindset, he always aims to consider the worst-case scenarios and take appropriate measures to minimize his risk.

15/ If one of the most successful investors, by all accounts, can remain cautious and not overestimate his abilities, you have no reason to be overconfident.

Another solution is to perform a “premortem.”

Another solution is to perform a “premortem.”

16/ This process was popularized by Nobel Prize-winning economist and psychologist Daniel Kahneman.

It involves imagining potential outcomes from a future perspective, 5-10-20 years later.

You have to imagine two scenarios.

It involves imagining potential outcomes from a future perspective, 5-10-20 years later.

You have to imagine two scenarios.

17/ The first is that your investment strategy has succeeded and you think through all the reasons it has performed well.

The other is that the same strategy has underperformed, and think through all the reasons it didn't succeed as you expected.

The other is that the same strategy has underperformed, and think through all the reasons it didn't succeed as you expected.

18/ This mental exercise can help you see potential risks and missteps that you may have overlooked and not considered during your analysis due to your excessive optimism.

19/ As you can see being modest can be quite profitable when it comes to investing.

Stay humble and get rich.

/END/

Stay humble and get rich.

/END/

If you liked this thread click below and retweet the first tweet, and follow to stay updated. https://twitter.com/itsKostasOnFIRE/status/1359047455195754497?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

I hope you find my content on finance and investing for F.I.R.E. insightful and valuable

Feel free to support my efforts on financial education by buying me a slice of pizza here

here  https://www.buymeacoffee.com/ItsKostasOnFIRE

https://www.buymeacoffee.com/ItsKostasOnFIRE

Feel free to support my efforts on financial education by buying me a slice of pizza

here

here  https://www.buymeacoffee.com/ItsKostasOnFIRE

https://www.buymeacoffee.com/ItsKostasOnFIRE

Read on Twitter

Read on Twitter