Exchanges to trade stocks, bonds, currencies, commodities, etc., that are set up at GIFT City benefit from incentives. But these have managed to convince only a couple firms to shift trades to GIFT. Here's where things stand today:

@jaysh88 https://themorningcontext.com/business/gift-city-might-stand-a-chance-after-all/?utm_source=twitter&utm_medium=social&utm_campaign=TMC

@jaysh88 https://themorningcontext.com/business/gift-city-might-stand-a-chance-after-all/?utm_source=twitter&utm_medium=social&utm_campaign=TMC

@jaysh88 https://themorningcontext.com/business/gift-city-might-stand-a-chance-after-all/?utm_source=twitter&utm_medium=social&utm_campaign=TMC

@jaysh88 https://themorningcontext.com/business/gift-city-might-stand-a-chance-after-all/?utm_source=twitter&utm_medium=social&utm_campaign=TMC

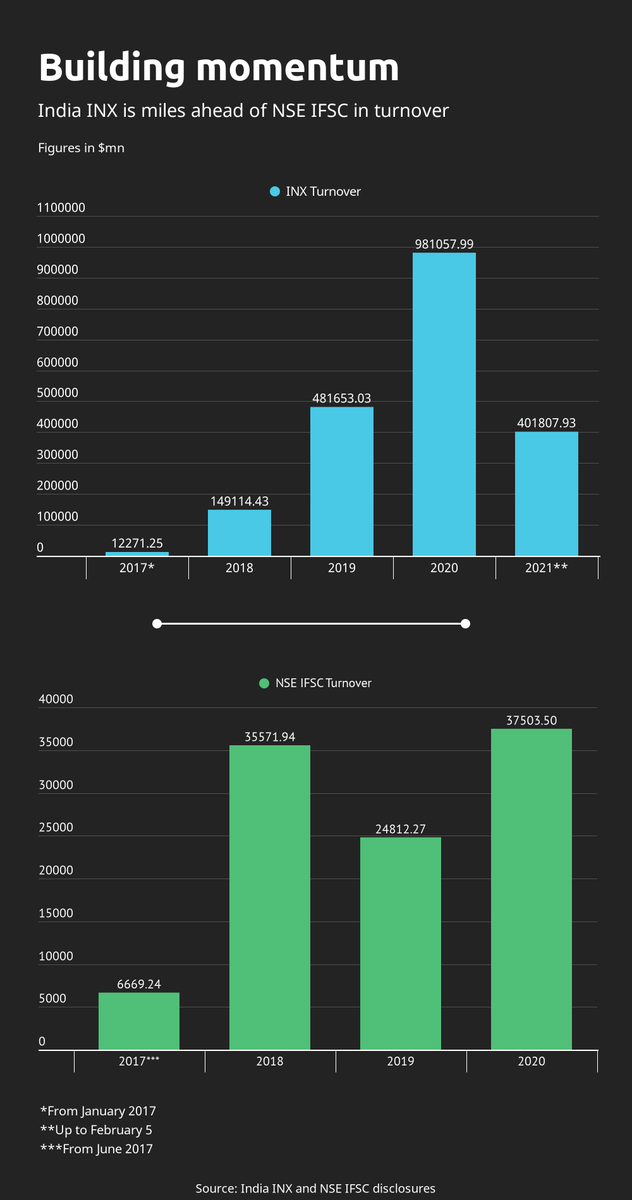

There are two major exchanges that have been established in GIFT City: India INX and NSE IFSC. Cumulative trades have crossed $1 trillion in turnover at India INX, from when it was set up in 2017 to November 2020. That sounds huge in isolation but is actually quite weak.

At least 85-90% of trades at GIFT exchanges are prop trades, according to exchange officials who did not wish to be quoted. Only two foreign brokerages have so far set up shop at GIFT—Phillip Capital and Dubai-based Evermore Global.

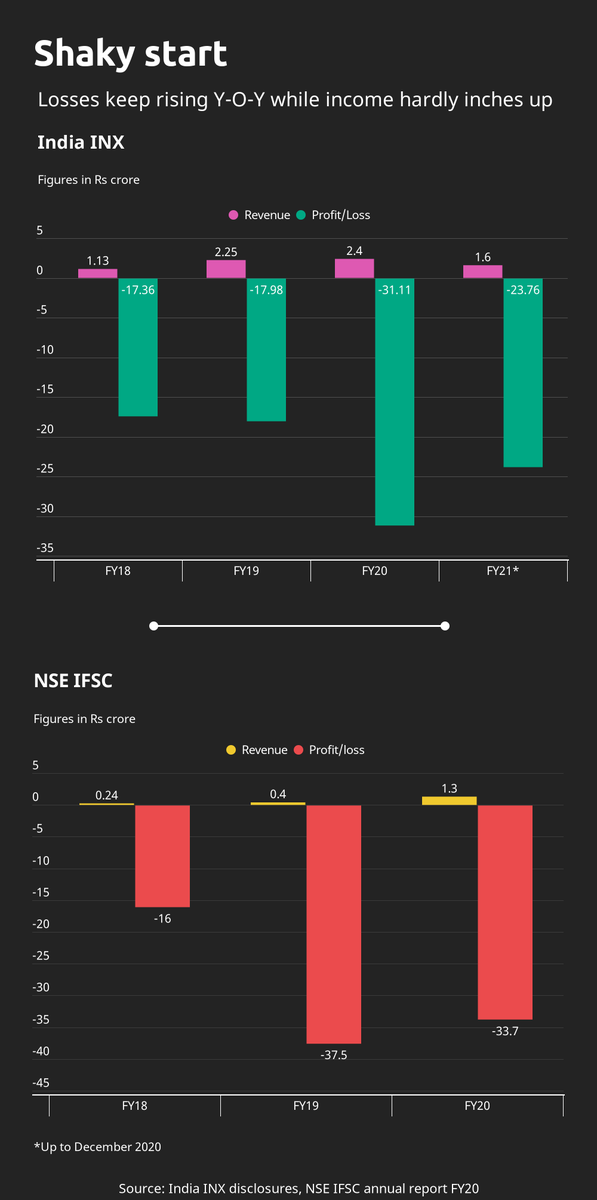

NSE IFSC due to its massively wealthy parent in Mumbai has the cash to burn but the same is not the case for India INX. NSE is by far India’s dominant stock exchange, with BSE a distant No. 2, even though the latter’s India INX subsidiary is the clear market leader in GIFT City.

The pressure to get foreign participants is coming directly from the government, and foreign players typically venture only into extremely liquid markets. It’s a chicken-and-egg situation. You need liquidity to attract foreign investors and need foreign investors for liquidity.

Successful financial centres have taken in the vicinity of 20 years to show evident progress. For India to arrive anywhere close to global counterparts it needs at least a decade of liberal approach. https://themorningcontext.com/business/gift-city-might-stand-a-chance-after-all/?utm_source=twitter&utm_medium=social&utm_campaign=TMC

Read on Twitter

Read on Twitter