Getting a few questions from friends on the following headline:

U.S. Junk-Bond Yields Drop Below 4% for the First Time Ever

It's quite eye catching, I admit. What are the reasons and implications? Some thoughts on the fly...

U.S. Junk-Bond Yields Drop Below 4% for the First Time Ever

It's quite eye catching, I admit. What are the reasons and implications? Some thoughts on the fly...

Yes, that's low and ppl are hunting for yield. First recognize a few things about US HY and the broad complex:

1. Spreads are b/e from pre-pandemic levels

2. Rates conversely, at lows

3. US HY is largely callable with large representation of oil

4. Crude is climbing but low

1. Spreads are b/e from pre-pandemic levels

2. Rates conversely, at lows

3. US HY is largely callable with large representation of oil

4. Crude is climbing but low

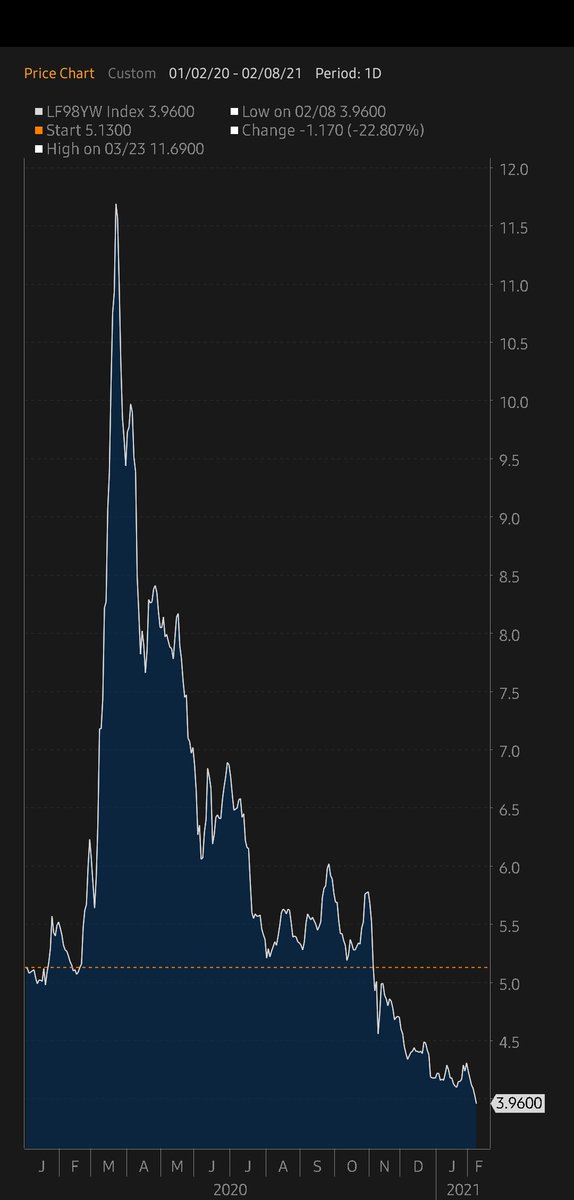

Here it is in chart form.

Since Jan '20, HY Spreads are about even now (wow!)

Total Return has picked up 8%

How? Lower benchmark rates (yellow line for 5y tsy)

Note a proxy for implied vol on risky assets (vix in Blue) still wide.

Crude is recovering but still lower.

Since Jan '20, HY Spreads are about even now (wow!)

Total Return has picked up 8%

How? Lower benchmark rates (yellow line for 5y tsy)

Note a proxy for implied vol on risky assets (vix in Blue) still wide.

Crude is recovering but still lower.

The callable nature of most of US HY means two things. One, the more positive outlook w lower rates increases pricing to call, lowering yields.

A compression in implied vol premiums would further tighten spreads.

So a positive growth outlook means further upside for HY

A compression in implied vol premiums would further tighten spreads.

So a positive growth outlook means further upside for HY

But, if rates move too high too fast that affects the pricing to call and associated spread. You'll always hear me talk about rate vol for this very reason.

For now, it's not an issue. For now.

For now, it's not an issue. For now.

Should a negative economic shock occur and spreads blow out, from the previous chart we can see that risk premia is still relatively high while benchmark rates are at lows.

To me it means any short on HY must be tactical and you gotta take your money and run when you get it.

To me it means any short on HY must be tactical and you gotta take your money and run when you get it.

Sounds odd but the reason is because Fed knows there's no more rates buffer right now. The SMCCF, which btw was hardly used, will get turned on tout de suite. Fight the fed at your will, I wouldn't.

This in a nutshell is to me why HY broke 4%, why it could keep going and if it doesn't what to think about.

Comments, questions, queries?

Comments, questions, queries?

Read on Twitter

Read on Twitter