$FUSE: A thread on Money Lion a new financial technology company (Neo Bank, Fintech) -

Rumor from Bloomberg that $FUSE will merge with Money Lion

https://www.bloomberg.com/news/articles/2021-01-29/mobile-bank-moneylion-said-in-talks-to-go-public-via-fusion-spac

cc: @skaushi @ripster47

Rumor from Bloomberg that $FUSE will merge with Money Lion

https://www.bloomberg.com/news/articles/2021-01-29/mobile-bank-moneylion-said-in-talks-to-go-public-via-fusion-spac

cc: @skaushi @ripster47

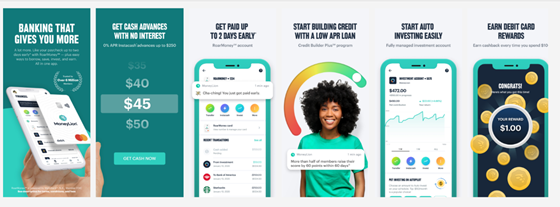

Money Lion is a FinTech (Financial + Technology) company that offers banking, loans, investing, rewards & other banking products.

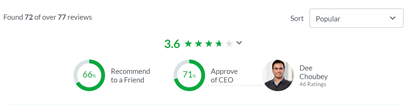

$FUSE: Money Lion was founded by Diwakar (Dee) Choubey, Pratyush Tiwari, Adam Green and Chee Mun Foong in 2013. They have background in Wall Street - JPM, etc. Good pedigree

https://www.linkedin.com/in/deechoubey

https://www.linkedin.com/in/deechoubey

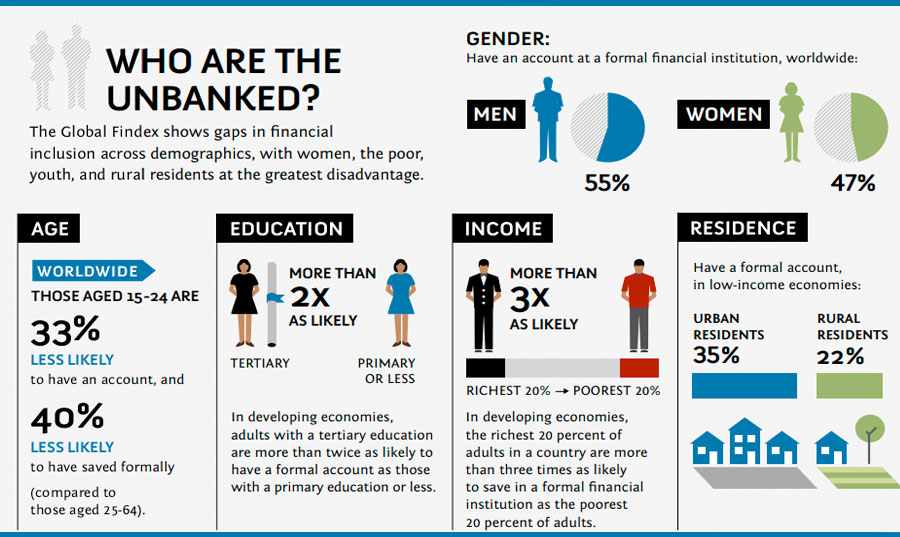

Problem: Help 50+ million Americans for whom saving money and investing is hard because they live paycheck to paycheck.

They use Payday loans or paycheck loans which charge high interest rates.

They do not know how to invest (financially illiterate).

They use Payday loans or paycheck loans which charge high interest rates.

They do not know how to invest (financially illiterate).

Wealthy have access to “private banking services” to:

a)save money,

b)invest money in stocks, etc.

c)get loans at less expensive rates,

d)get an advisor to help you plan your future savings and

e)improve your credit score by monitoring it and helping you make decisions.

a)save money,

b)invest money in stocks, etc.

c)get loans at less expensive rates,

d)get an advisor to help you plan your future savings and

e)improve your credit score by monitoring it and helping you make decisions.

The founders thought – “What if we used data and algorithms” to “democratize” private banking?

That was the insight that led to Money Lion

That was the insight that led to Money Lion

Obviously, you cannot provide an advisor for every person who can’t afford it, but you can provide “virtual agents” and “chat bots” and use data to help those who cannot afford private banking

This leads to:

a)Educating them about money – financial literacy

b)Helping them “automatically” save money,

c)Get less expensive loans and

d)Investing in low-cost funds and ETFs

a)Educating them about money – financial literacy

b)Helping them “automatically” save money,

c)Get less expensive loans and

d)Investing in low-cost funds and ETFs

The "underbanked" have $2.2 Trillion (yes Trillion with a T) in money but no assets, because they spend it all or don't have the financial literacy to save and invest.

The Federal Reserve estimated there are 55 million unbanked or underbanked adult Americans in 2018, which account for 22 percent of U.S. households. https://www.valuepenguin.com/banking/statistics-and-trends

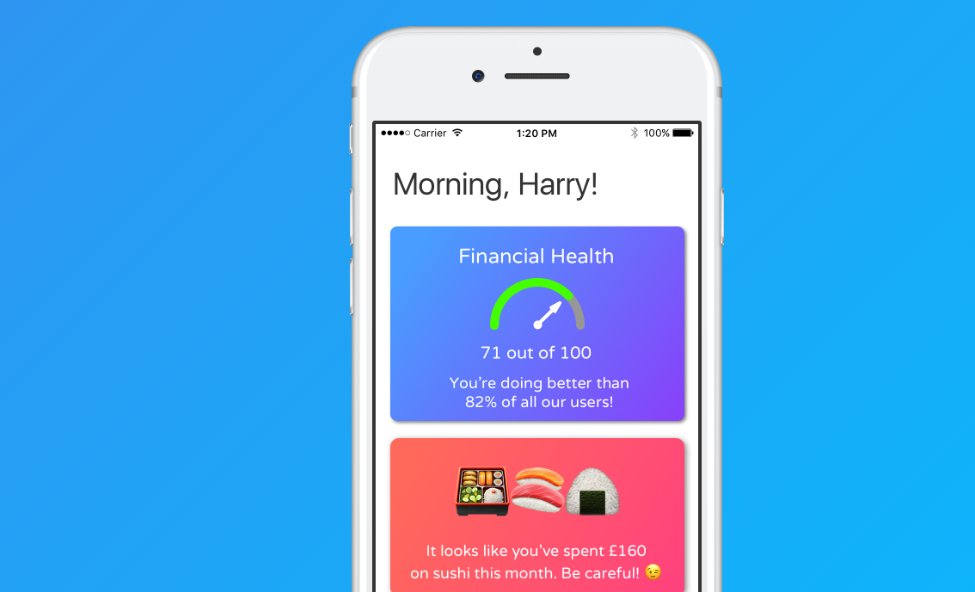

Money Lion provided a simple "Financial Fitness" app - Free that connects to your checking account to "analyze" your spending, earning etc.

Over 6 Million people have become member of this free app in the last 7 years!

Over 6 Million people have become member of this free app in the last 7 years!

$FUSE The app can give you "insights" such as how much you spend, where, etc.

It also now has the DATA about you. (Yes I know this is a privacy concern, but we'll get to that).

It also now has the DATA about you. (Yes I know this is a privacy concern, but we'll get to that).

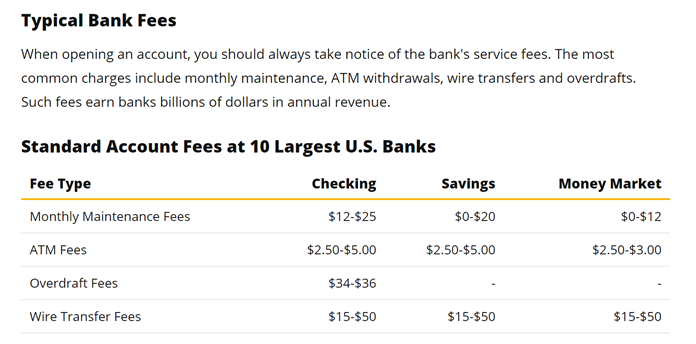

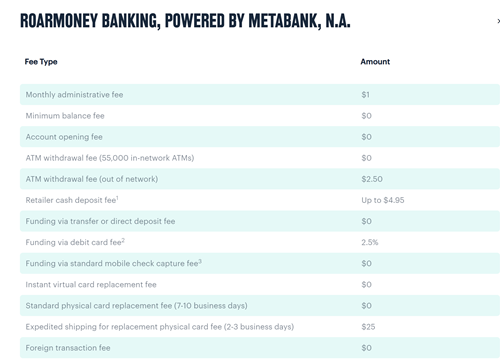

Realizing that most banks are "expensive" and charge a lot of fees that a person with a balance of $500 or less cannot afford, they expanded to provide free checking as well into their app

Traditional banks are expensive for the underbanked. That's why they underbank.

Traditional banks are expensive for the underbanked. That's why they underbank.

$FUSE, Money Lion then branched into providing loans - small personal loans $500 or less (even up to $1000) because:

1. They know how much you earn

2. They know how much you spend

3. They know when you get paid etc.

Money Lion = Financial Fitness + Free Checking + Loans

1. They know how much you earn

2. They know how much you spend

3. They know when you get paid etc.

Money Lion = Financial Fitness + Free Checking + Loans

They make money in 3 ways:

1. Charge "Subscription" fee or $19.99 or $29.99 flat per account

2. Make money lending (loans have interest rates)

3. Selling leads (your info) to partners in financial services (e.g. Funds, etc.)

1. Charge "Subscription" fee or $19.99 or $29.99 flat per account

2. Make money lending (loans have interest rates)

3. Selling leads (your info) to partners in financial services (e.g. Funds, etc.)

Customers can get fee waived IF they log into the app daily. - This is to promote "financial literacy.

BUT

I dont think some of their customers know this.

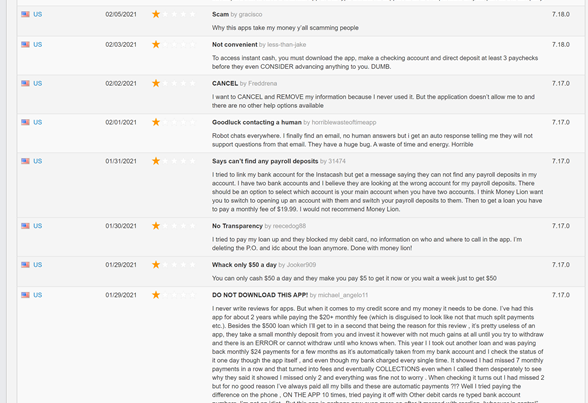

They have 67K app reviews and 4.7 rating, but the 1 Star ratings are BURUTAL

BUT

I dont think some of their customers know this.

They have 67K app reviews and 4.7 rating, but the 1 Star ratings are BURUTAL

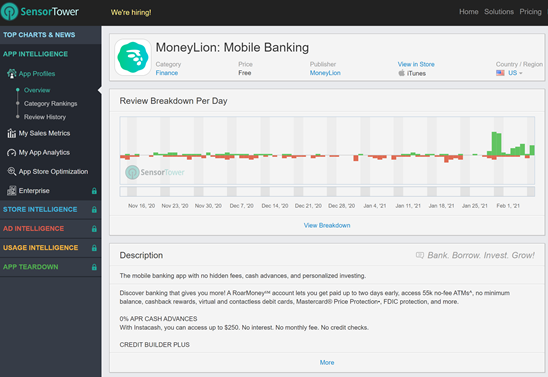

You can see that the app has "somewhat" of a love / hate relationship with its customers. Most love it, but *many* hate Money Lion and think it is a scam

Green below = positive reviews

Orange = negative

Green below = positive reviews

Orange = negative

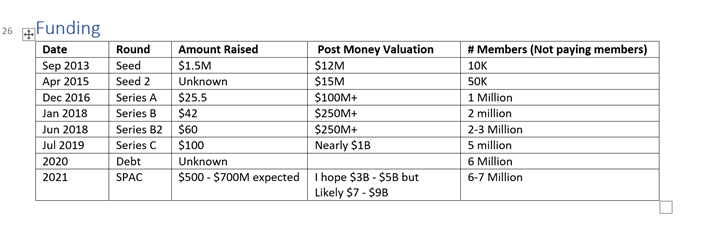

$FUSE - Money Lion, however has been growing like crazy and the funding has been pouring in. See the milestones I put together next to the funding rounds.

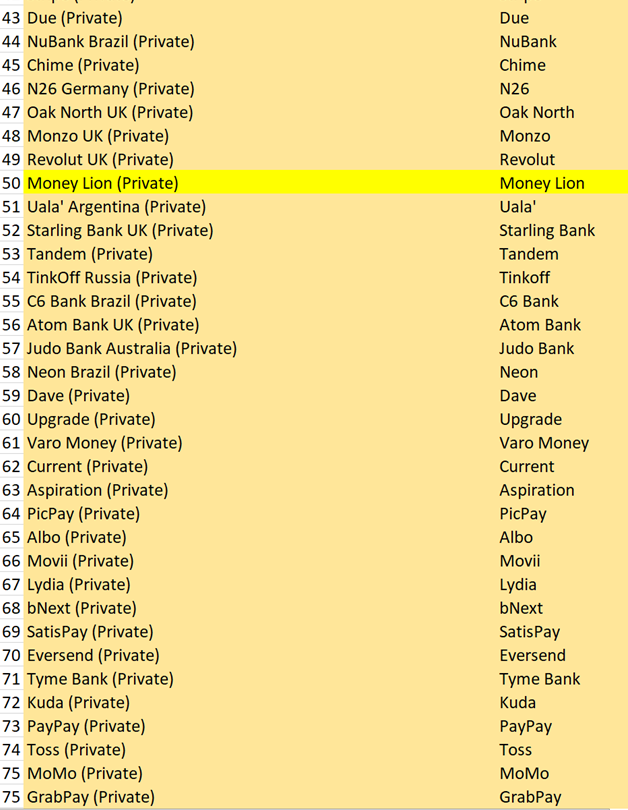

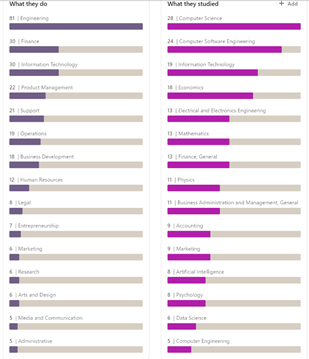

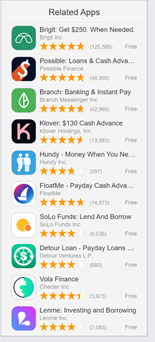

This "private banking" services for underbanked segment is incredibly competitive. I have a list of 49 competitors and I gave up.

Add to that existing large banks who dont want to cede an inch to the neo banks.

But some (Capital One for e.g.) have invested in Money Lion - $FUSE

Add to that existing large banks who dont want to cede an inch to the neo banks.

But some (Capital One for e.g.) have invested in Money Lion - $FUSE

Let me quickly summarize:

1. Large market - "private banking" for underbanked

2. Segment of market that is mostly mobile and has low financial literacy

3. Hugely competitive industry

4. An app that's either loved (many) or hated (few)

5. What can go wrong?

1. Large market - "private banking" for underbanked

2. Segment of market that is mostly mobile and has low financial literacy

3. Hugely competitive industry

4. An app that's either loved (many) or hated (few)

5. What can go wrong?

$FUSE class action lawsuits for one.

I dont remember how many were filed against Money Lion (3-5 or more) and they settled or are litigating some of them

https://www.oag.state.va.us/consumer-protection/files/Lawsuits/2018-2-5-MoneyLion-Compl-Filed.pdf

I dont remember how many were filed against Money Lion (3-5 or more) and they settled or are litigating some of them

https://www.oag.state.va.us/consumer-protection/files/Lawsuits/2018-2-5-MoneyLion-Compl-Filed.pdf

$FUSE Money lion however does not compete with $SOFI / $IPOE or others.

For comparison:

A) $AFRM in BNPL & $SOFI (Ivy league stuff)

B) $FUSE (Money Lion) & $FSRV (Katapult) (Under credited)

Just for context A) = 6X money of B

But B is still Trillions of $$

For comparison:

A) $AFRM in BNPL & $SOFI (Ivy league stuff)

B) $FUSE (Money Lion) & $FSRV (Katapult) (Under credited)

Just for context A) = 6X money of B

But B is still Trillions of $$

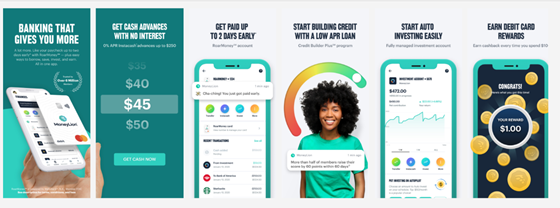

Money Lion product summary:

There’s banking, investing, credit monitoring, cash advances, cashback rewards, and loyalty programs.

The plus membership ($19, $29) comes with a monthly fee which consumers reduce by logging into the app daily.

There’s banking, investing, credit monitoring, cash advances, cashback rewards, and loyalty programs.

The plus membership ($19, $29) comes with a monthly fee which consumers reduce by logging into the app daily.

If you have bad credit and need access to a small amount of cash in case of emergencies or to build your credit, MoneyLion Plus could be a great option. Instead of a Pay day loan

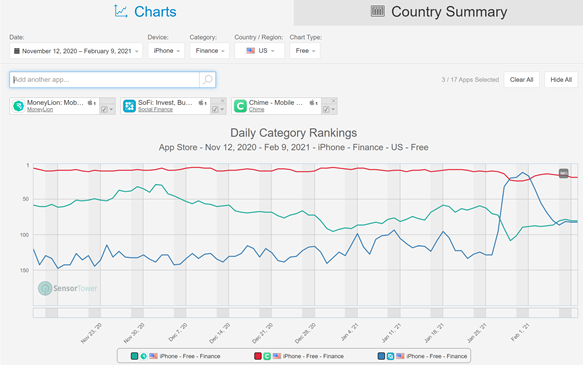

Money Lion is ranked 81 in the Financial services app category and ranks lower than SoFi and Chime (another neo bank)

But remember, their target markets are DIFFERENT.

But remember, their target markets are DIFFERENT.

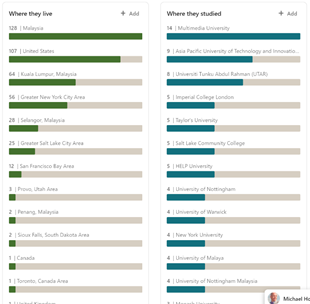

Money Lion $FUSE has over 200 employees and most are in Malaysia (chat support, etc.) with tech in NYC and other locations. They have fewer than 13 people in data / ML so if they say we are AI powered - they are not lying but stretching

The employee reviews are good, but not $AFRM level. In the 65 percentile

Money Lion $FUSE has partnered with NASCAR for advertising and getting the word out.

They are acquiring customer quickly.

Much faster than $SOFI and Chime for sure.

They are acquiring customer quickly.

Much faster than $SOFI and Chime for sure.

Financials:

Until they disclose numbers we dont know anything.

Expect them during DA to say

"Growing customer base"

"Large TAM - Trillion$"

"High engagement"

"Financial Literacy"

"AI and ML for the masses"

"Democratizing Private Banking"

But the numbers wont look great

Until they disclose numbers we dont know anything.

Expect them during DA to say

"Growing customer base"

"Large TAM - Trillion$"

"High engagement"

"Financial Literacy"

"AI and ML for the masses"

"Democratizing Private Banking"

But the numbers wont look great

They "may" look great, but I expect they will be projecting SUPERIOR number for 2024 - 2025 and keep talking about "engagement", customer literacy and market size.

Which is fine, but this is a NARRATIVE based investment thesis NOT a financial sharp pencils based one

Which is fine, but this is a NARRATIVE based investment thesis NOT a financial sharp pencils based one

Summarizing again:

1. Large & Underserved market

2. They are taking on more of a social problem than financial one alone

3. Good product, with some caveats

4. Some yellow flags (lawsuits)

5. Narrative based investment

1. Large & Underserved market

2. They are taking on more of a social problem than financial one alone

3. Good product, with some caveats

4. Some yellow flags (lawsuits)

5. Narrative based investment

<My opinion>

This will go well depending on the valuation, but expect some time for folks to digest this after the initial DA bump.

Meaning this will behave more like $FSRV, $FTOC, and less like $IPOE / $SOFI

This will go well depending on the valuation, but expect some time for folks to digest this after the initial DA bump.

Meaning this will behave more like $FSRV, $FTOC, and less like $IPOE / $SOFI

If you are buying, buy $FUSE close to the NAV, it is already $12.37, expect it to head to $14 - $16.

What would make it fly like $144 $LMND

1. investors buy the narrative

2. investors ignore the "issues"

3. investors love the "underbanked" story

4. investors buy into AI/ML story

What would make it fly like $144 $LMND

1. investors buy the narrative

2. investors ignore the "issues"

3. investors love the "underbanked" story

4. investors buy into AI/ML story

$FUSE storyline:

"Lets wish for a better future" play.

"use your investment to do good"

"Lets improve financial literacy"

"Lets reduce financial disparity"

If enough people buy into it, this flies, depending on enterprise value (EV) at merger

"Lets wish for a better future" play.

"use your investment to do good"

"Lets improve financial literacy"

"Lets reduce financial disparity"

If enough people buy into it, this flies, depending on enterprise value (EV) at merger

Read on Twitter

Read on Twitter