1/ $APD Q1 Earnings

EPS of $2.12 (-1%) misses by $0.06 [17 est, $2.08-2.31]

Revenue of $2.38B (+5% Y/Y) beats by $30M [12 est, $2.31-2.46B]

Adj EBITDA $932.1M (+3% Y/Y) vs cons $955.5M [9 est, $918.0-986.7M]; Margin of 39.2% (-110 bps y/y)

Stock -7%

https://twitter.com/SLC_Fund/status/1326655836517781504

EPS of $2.12 (-1%) misses by $0.06 [17 est, $2.08-2.31]

Revenue of $2.38B (+5% Y/Y) beats by $30M [12 est, $2.31-2.46B]

Adj EBITDA $932.1M (+3% Y/Y) vs cons $955.5M [9 est, $918.0-986.7M]; Margin of 39.2% (-110 bps y/y)

Stock -7%

https://twitter.com/SLC_Fund/status/1326655836517781504

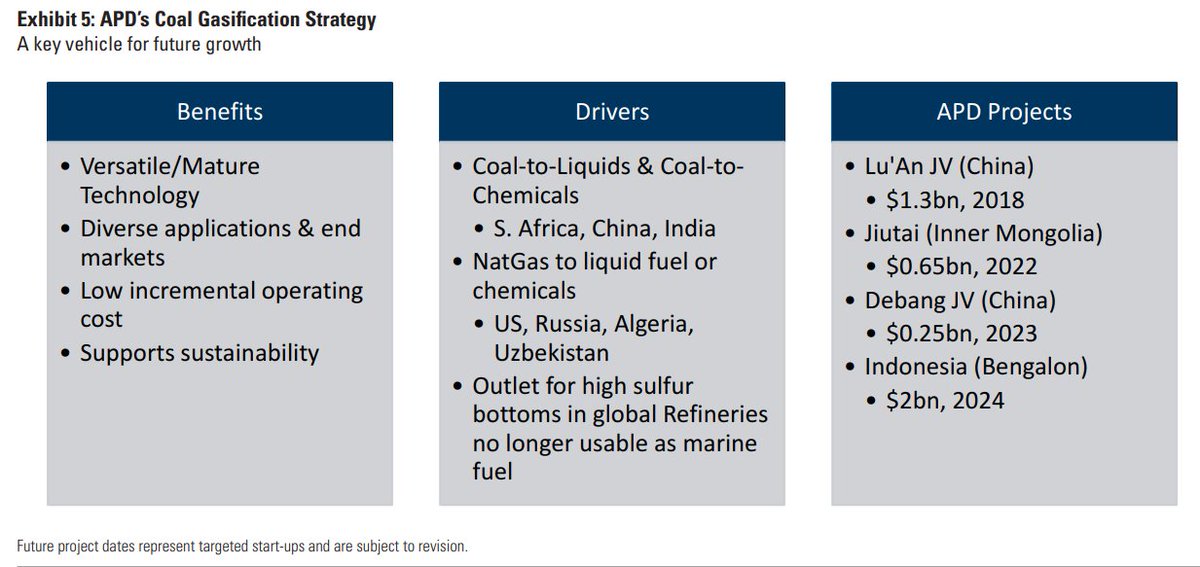

2/ Lu’An

APD temporarily reduced fixed monthly fee while plant was shut down (received pmt for Oct/Nov/Dec)

Lu'An extended contract with APD & overall return will actually be better than before

"Not as worried about Lu’An as investors seem to be”

APD temporarily reduced fixed monthly fee while plant was shut down (received pmt for Oct/Nov/Dec)

Lu'An extended contract with APD & overall return will actually be better than before

"Not as worried about Lu’An as investors seem to be”

3/ Jazan

"Much more optimistic than three months ago"

Two issues

1) Negotiation on allocating debt interest savings (due to lower rates)

2) Financing $7.2B of debt is not easy

Hopefully close May/June

Added to EPS when financials close (in-line w/ projection)

"Much more optimistic than three months ago"

Two issues

1) Negotiation on allocating debt interest savings (due to lower rates)

2) Financing $7.2B of debt is not easy

Hopefully close May/June

Added to EPS when financials close (in-line w/ projection)

4/ Summary

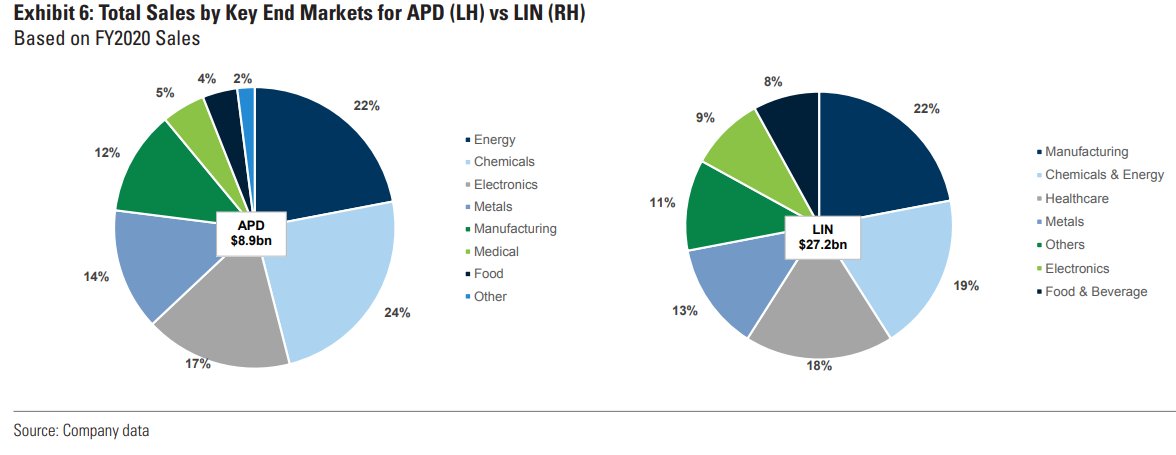

Long-term growth engine of 10%+ EPS growth is in tact

Opportunities - gasification, carbon capture, and hydrogen for mobility (first mover)

50% on-site business

Purchased a little $APD

Long-term growth engine of 10%+ EPS growth is in tact

Opportunities - gasification, carbon capture, and hydrogen for mobility (first mover)

50% on-site business

Purchased a little $APD

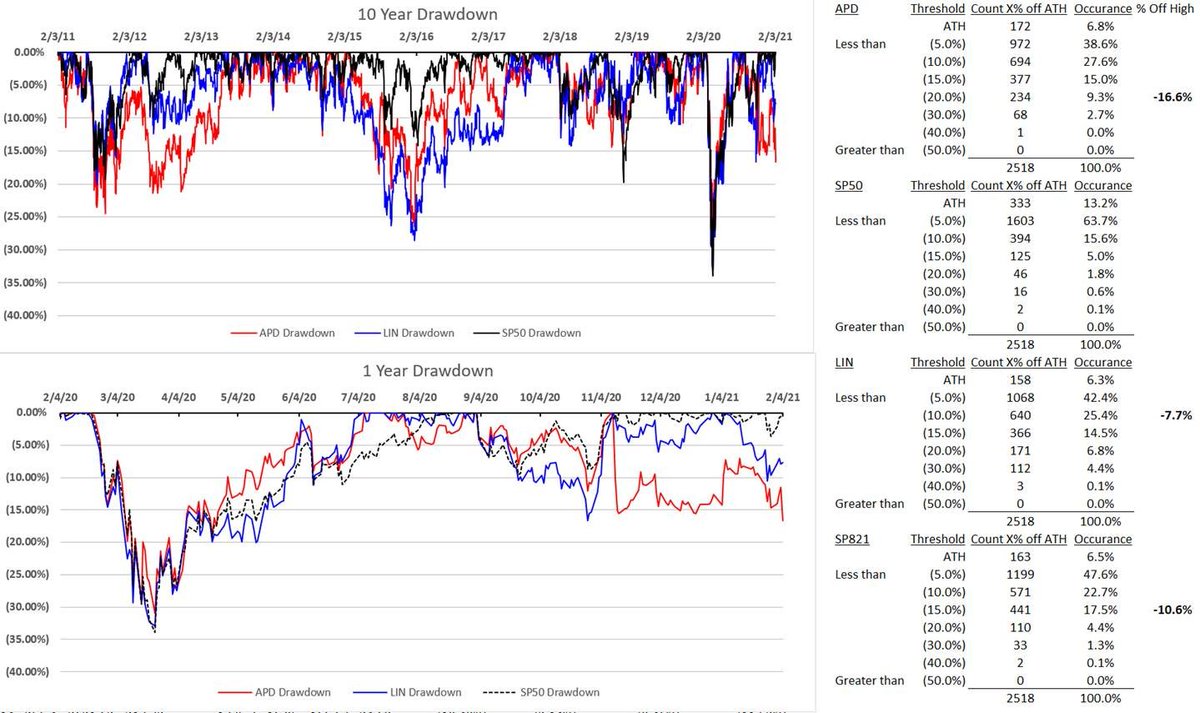

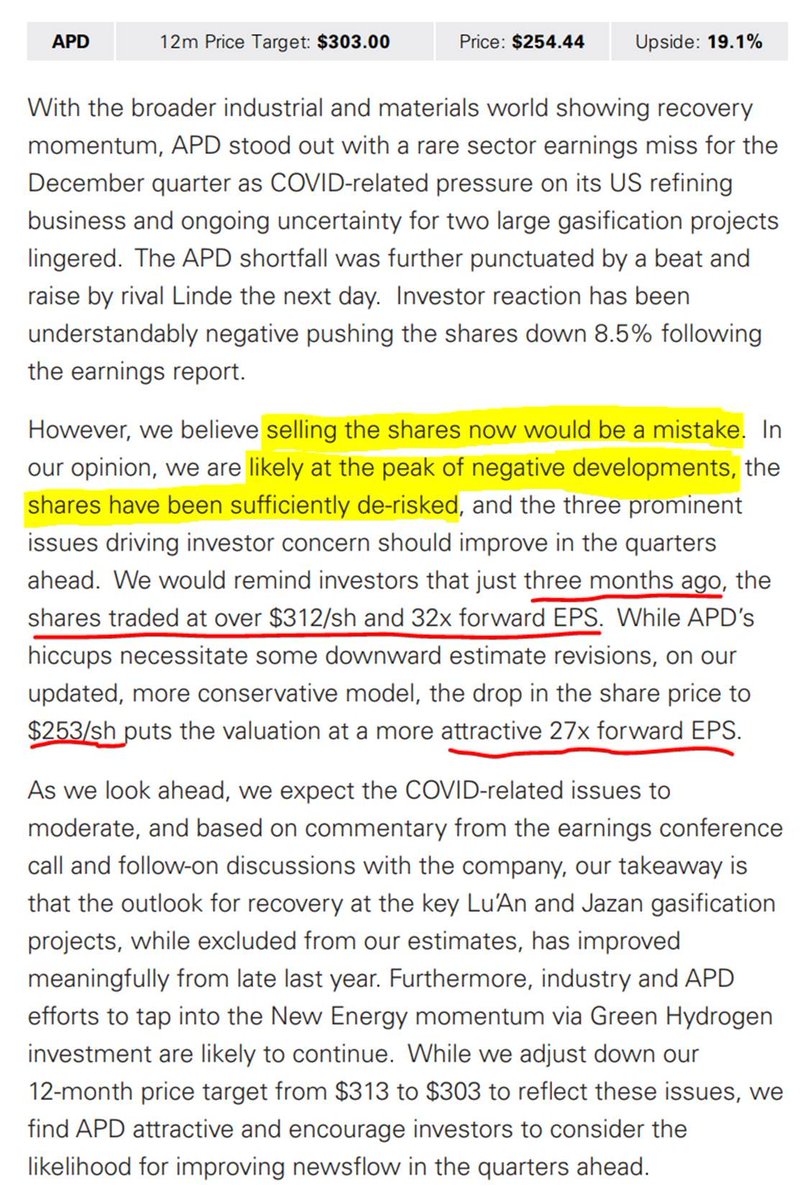

GS would own $APD

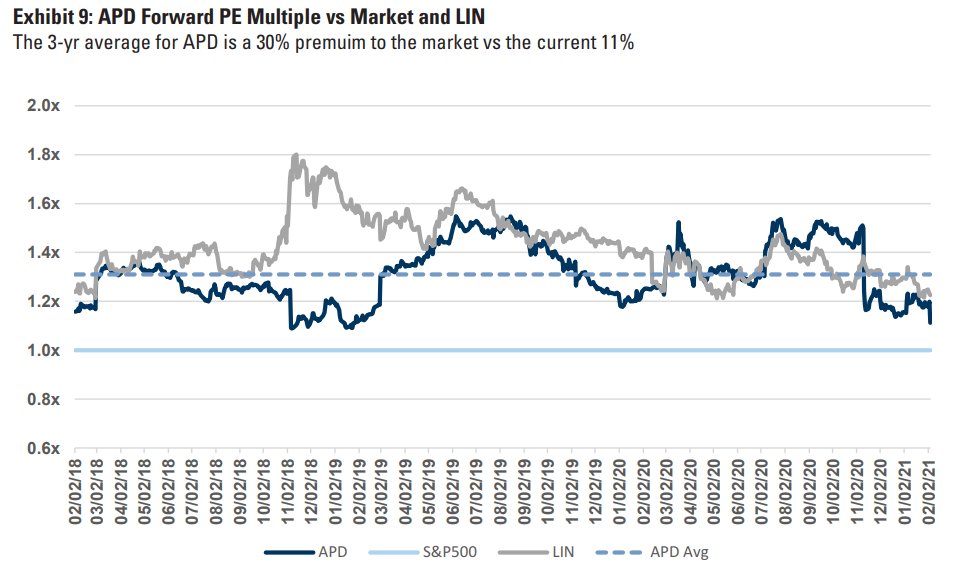

Shares have de-risked as multiple is down 5 turns and the company is hopefully past peak negative news

Unclear how much of Lu'An and Jazan are baked into consensus

Shares have de-risked as multiple is down 5 turns and the company is hopefully past peak negative news

Unclear how much of Lu'An and Jazan are baked into consensus

Read on Twitter

Read on Twitter![1/ $APD Q1 EarningsEPS of $2.12 (-1%) misses by $0.06 [17 est, $2.08-2.31]Revenue of $2.38B (+5% Y/Y) beats by $30M [12 est, $2.31-2.46B]Adj EBITDA $932.1M (+3% Y/Y) vs cons $955.5M [9 est, $918.0-986.7M]; Margin of 39.2% (-110 bps y/y)Stock -7% https://twitter.com/SLC_Fund/status/1326655836517781504 1/ $APD Q1 EarningsEPS of $2.12 (-1%) misses by $0.06 [17 est, $2.08-2.31]Revenue of $2.38B (+5% Y/Y) beats by $30M [12 est, $2.31-2.46B]Adj EBITDA $932.1M (+3% Y/Y) vs cons $955.5M [9 est, $918.0-986.7M]; Margin of 39.2% (-110 bps y/y)Stock -7% https://twitter.com/SLC_Fund/status/1326655836517781504](https://pbs.twimg.com/media/EtvsTdfXUAEn3u-.jpg)

![1/ $APD Q1 EarningsEPS of $2.12 (-1%) misses by $0.06 [17 est, $2.08-2.31]Revenue of $2.38B (+5% Y/Y) beats by $30M [12 est, $2.31-2.46B]Adj EBITDA $932.1M (+3% Y/Y) vs cons $955.5M [9 est, $918.0-986.7M]; Margin of 39.2% (-110 bps y/y)Stock -7% https://twitter.com/SLC_Fund/status/1326655836517781504 1/ $APD Q1 EarningsEPS of $2.12 (-1%) misses by $0.06 [17 est, $2.08-2.31]Revenue of $2.38B (+5% Y/Y) beats by $30M [12 est, $2.31-2.46B]Adj EBITDA $932.1M (+3% Y/Y) vs cons $955.5M [9 est, $918.0-986.7M]; Margin of 39.2% (-110 bps y/y)Stock -7% https://twitter.com/SLC_Fund/status/1326655836517781504](https://pbs.twimg.com/media/EtvsVQfXAAIIhTZ.jpg)

![1/ $APD Q1 EarningsEPS of $2.12 (-1%) misses by $0.06 [17 est, $2.08-2.31]Revenue of $2.38B (+5% Y/Y) beats by $30M [12 est, $2.31-2.46B]Adj EBITDA $932.1M (+3% Y/Y) vs cons $955.5M [9 est, $918.0-986.7M]; Margin of 39.2% (-110 bps y/y)Stock -7% https://twitter.com/SLC_Fund/status/1326655836517781504 1/ $APD Q1 EarningsEPS of $2.12 (-1%) misses by $0.06 [17 est, $2.08-2.31]Revenue of $2.38B (+5% Y/Y) beats by $30M [12 est, $2.31-2.46B]Adj EBITDA $932.1M (+3% Y/Y) vs cons $955.5M [9 est, $918.0-986.7M]; Margin of 39.2% (-110 bps y/y)Stock -7% https://twitter.com/SLC_Fund/status/1326655836517781504](https://pbs.twimg.com/media/EtvsWkqWgAMeHGJ.jpg)

![1/ $APD Q1 EarningsEPS of $2.12 (-1%) misses by $0.06 [17 est, $2.08-2.31]Revenue of $2.38B (+5% Y/Y) beats by $30M [12 est, $2.31-2.46B]Adj EBITDA $932.1M (+3% Y/Y) vs cons $955.5M [9 est, $918.0-986.7M]; Margin of 39.2% (-110 bps y/y)Stock -7% https://twitter.com/SLC_Fund/status/1326655836517781504 1/ $APD Q1 EarningsEPS of $2.12 (-1%) misses by $0.06 [17 est, $2.08-2.31]Revenue of $2.38B (+5% Y/Y) beats by $30M [12 est, $2.31-2.46B]Adj EBITDA $932.1M (+3% Y/Y) vs cons $955.5M [9 est, $918.0-986.7M]; Margin of 39.2% (-110 bps y/y)Stock -7% https://twitter.com/SLC_Fund/status/1326655836517781504](https://pbs.twimg.com/media/EtvwZ39WYAE8Zhs.png)