Weekly Fundamental Analysis: -> We focus on $CHGG

Huge disruptor in Education Technology with a massive Moat and high-potential.

Business Thread & Today's Earnings Analysis

(PS: Computer rebooted erased all my work but I tried to put something helpful)

Huge disruptor in Education Technology with a massive Moat and high-potential.

Business Thread & Today's Earnings Analysis

(PS: Computer rebooted erased all my work but I tried to put something helpful)

1/ At the core:

$CHGG is a direct-to-student learning platform aimed at improving educational outcomes from high-school to university for students by providing the right tools for them to pass exams or classes and save money on textbooks and supplementary materials.

$CHGG is a direct-to-student learning platform aimed at improving educational outcomes from high-school to university for students by providing the right tools for them to pass exams or classes and save money on textbooks and supplementary materials.

2/ $CHGG Products & Business Model:

i) Chegg Services:

$CHGG Study

$CHGG Writing,

$CHGG Math Solver,

$CHGG Study Subscriptions: Expert-Answers

Honor-shield for institutions

$CHGG Thinkful for skill-based

ii) $CHGG Required Materials: Textbook Solutions

i) Chegg Services:

$CHGG Study

$CHGG Writing,

$CHGG Math Solver,

$CHGG Study Subscriptions: Expert-Answers

Honor-shield for institutions

$CHGG Thinkful for skill-based

ii) $CHGG Required Materials: Textbook Solutions

3/ Some Competitive Advantages & Moat:

- Students All-In-One Product line that solves a host of problems for the student experience

- Data: $Chgg has a vast amount of data for/about students

- Superior Brand Recognition amongst students (More below)

- Students All-In-One Product line that solves a host of problems for the student experience

- Data: $Chgg has a vast amount of data for/about students

- Superior Brand Recognition amongst students (More below)

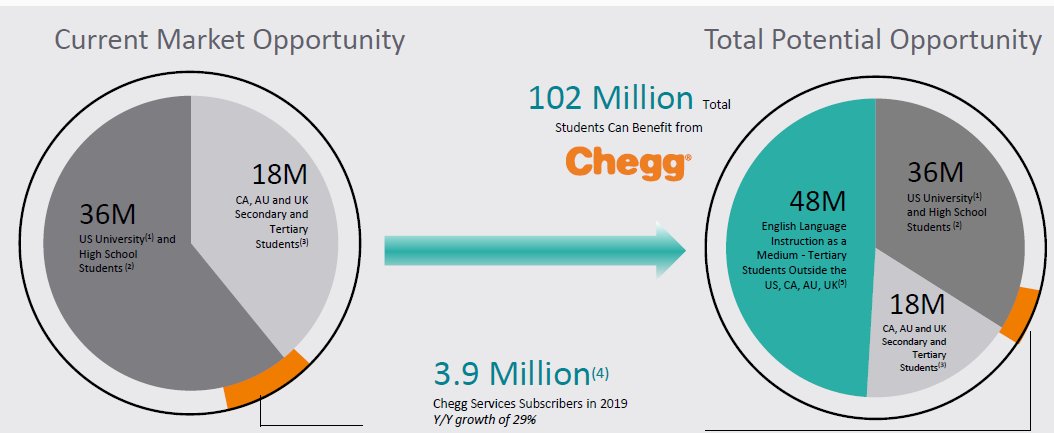

4/ $CHGG Market Industry: #1

The TAM is clear for TAM. There are so much more students that can be reached by $CHGG -- This has been accelerated as students spend more time on the computer.

Chart outlines everything below outlines

The TAM is clear for TAM. There are so much more students that can be reached by $CHGG -- This has been accelerated as students spend more time on the computer.

Chart outlines everything below outlines

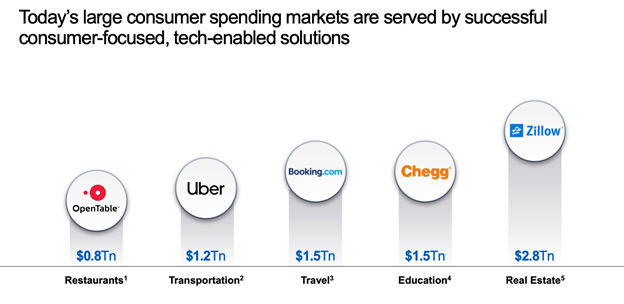

5/ $CHGG Solving problems within a Massive TAM - #2

Like $UBER in Transport

Like $BKNG in Travel

Like $ZG in Homes

So.. $CHGG is for students and Education with massive runways. There are currently over 300M+ have viewed some $CHGG contents

Like $UBER in Transport

Like $BKNG in Travel

Like $ZG in Homes

So.. $CHGG is for students and Education with massive runways. There are currently over 300M+ have viewed some $CHGG contents

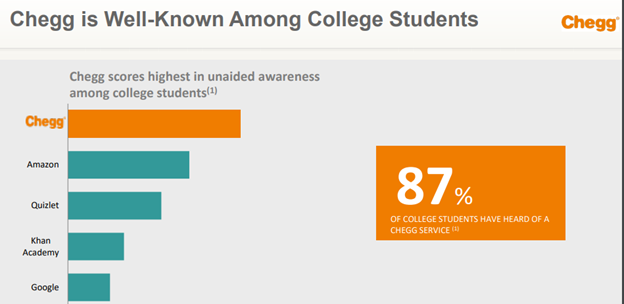

6/ $CHGG Competitive advantage in Brand Recognition TAM - #3:

Similar:

- $PTON for fitness

- $ZM for video communication

$CHGG is unrivalled in their brand recognition amongst university students.

I believe the power of brands is under-rated

Similar:

- $PTON for fitness

- $ZM for video communication

$CHGG is unrivalled in their brand recognition amongst university students.

I believe the power of brands is under-rated

7/ Let's explore $CHGG students

Students paid for products and services

• In 2017: 4.2M --> In 2019: 5.8M

Chegg Services Subscriptions:

- Q4-2019: 2.5M

FY - 2020:

- Q1: 2.9M;

- Q2/Q3: 3.7M (68%)

- Q4: 6.6M* (74% YoY)

Charts explains more:

Students paid for products and services

• In 2017: 4.2M --> In 2019: 5.8M

Chegg Services Subscriptions:

- Q4-2019: 2.5M

FY - 2020:

- Q1: 2.9M;

- Q2/Q3: 3.7M (68%)

- Q4: 6.6M* (74% YoY)

Charts explains more:

8/ $CHGG Financials - #1

Revenue Growth:

-2017: $255M

- 2018: $321M

- 2019: 411M

FY 2020

- Q1-2020: 131M on 35% YoY Revenue Growth.

- Q2-2020: 153M on 63% YoY

- Q3-2020: 154M on 64% YoY

-Q4-202: 205M on 64% YoY

While Avg. Gross margins across 4-Qtrs: 70%

Revenue Growth:

-2017: $255M

- 2018: $321M

- 2019: 411M

FY 2020

- Q1-2020: 131M on 35% YoY Revenue Growth.

- Q2-2020: 153M on 63% YoY

- Q3-2020: 154M on 64% YoY

-Q4-202: 205M on 64% YoY

While Avg. Gross margins across 4-Qtrs: 70%

9/ $CHGG Financials - #2:

- Profitable: From 2019 EPS $0.18 --> 2020 $0.57 (Growing 60%+)

- Gross margins has expanded

- EBITDA Margins from 5% in 2017 to over 32%

- Cash Position: Cash-flow growth ; Cash >$1.3B

Its rare to find a company growing both Top & Bottom-line

- Profitable: From 2019 EPS $0.18 --> 2020 $0.57 (Growing 60%+)

- Gross margins has expanded

- EBITDA Margins from 5% in 2017 to over 32%

- Cash Position: Cash-flow growth ; Cash >$1.3B

Its rare to find a company growing both Top & Bottom-line

10/ $CHGG Management Team:

The company was orignially founded by Iowa University students Josh Carlson, Mike Seager, and Mark Fiddleke.

Dan Rosenwig is the current CEO over 11years (Cool guy). The company appears to score high as a great place to work and solid mgmt team

The company was orignially founded by Iowa University students Josh Carlson, Mike Seager, and Mark Fiddleke.

Dan Rosenwig is the current CEO over 11years (Cool guy). The company appears to score high as a great place to work and solid mgmt team

11/ $CHGG Risks:

• Increase TAM or business model to get more value from existing subs

• Competitors offering similar services or products eg. Quizlet, Khan Academy

• Seasonality trends for school seasons

• Students stealing or sharing accounts (*Company has invested here)

• Increase TAM or business model to get more value from existing subs

• Competitors offering similar services or products eg. Quizlet, Khan Academy

• Seasonality trends for school seasons

• Students stealing or sharing accounts (*Company has invested here)

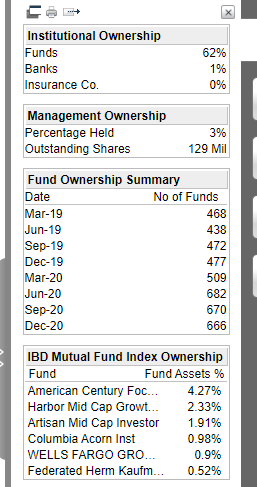

12/ $CHGG Institutional Funds Ownership

Currently, $CHGG is owned by 666 Funds. This is very high.

Also, there are 6- High quality and high-performing fund managers owning this stock. According to @MarketSmith, it is very rare to find up to 6 top funds owning a stock.

Currently, $CHGG is owned by 666 Funds. This is very high.

Also, there are 6- High quality and high-performing fund managers owning this stock. According to @MarketSmith, it is very rare to find up to 6 top funds owning a stock.

13/ $CHGG Earnings Takeaways/ Future Growth Drivers - #1:

1) Earnings financials has been highlighted(below)

2) International markets (now in 190 countries) outside US is going to be a core focus and expect growth here

3) Cont'd

My early earnings takes https://twitter.com/InvestiAnalyst/status/1358887515701219328

1) Earnings financials has been highlighted(below)

2) International markets (now in 190 countries) outside US is going to be a core focus and expect growth here

3) Cont'd

My early earnings takes https://twitter.com/InvestiAnalyst/status/1358887515701219328

14/ $CHGG Future Growth Drivers:

3) Skills based learning (Thinkful) and expansion is Mgmt goal for students after they finish University. This will expand TAM

4) New products for exam integrity since this is critical with online classes

5) Full Year Guidance shown below

3) Skills based learning (Thinkful) and expansion is Mgmt goal for students after they finish University. This will expand TAM

4) New products for exam integrity since this is critical with online classes

5) Full Year Guidance shown below

15/ $CHGG Bottom Line:

- The Brand Recognition is unrivalled

- Unrivalled data about students

- Large TAM w. more students to be reached combined with Covid Tailwinds and digital trends.

- The company has a high-growth and high-margin

- The Brand Recognition is unrivalled

- Unrivalled data about students

- Large TAM w. more students to be reached combined with Covid Tailwinds and digital trends.

- The company has a high-growth and high-margin

16/ Funfact - $CHGG is a combination of the words chicken and egg, and references the founders’ catch-22 feeling of being unable to obtain a job without experience.

Did you ever use or hear about $CHGG in High-school or College?

Did you ever use or hear about $CHGG in High-school or College?

17/

I believe Ed-Tech is ripe for Innovation and its under-rated. I will be sharing more information about $TWOU, $LRN and maybe $PACE later this week

I wrote about $PLTR $LMND in their early days in 2020

Check out my substack and subscribe if you want: https://investianalystnewsletter.substack.com/

I believe Ed-Tech is ripe for Innovation and its under-rated. I will be sharing more information about $TWOU, $LRN and maybe $PACE later this week

I wrote about $PLTR $LMND in their early days in 2020

Check out my substack and subscribe if you want: https://investianalystnewsletter.substack.com/

Sorry this thread was in a hurry as all the work I had conducted on $CHGG got erased from my computer reboot :(

Happy to hear your thoughts on Education Tech, $CHGG & trends!

@IshanPuri2

@parrfff

@GetBenchmarkCo

Any other folks interested in this sector? Anything missed?

Happy to hear your thoughts on Education Tech, $CHGG & trends!

@IshanPuri2

@parrfff

@GetBenchmarkCo

Any other folks interested in this sector? Anything missed?

Read on Twitter

Read on Twitter