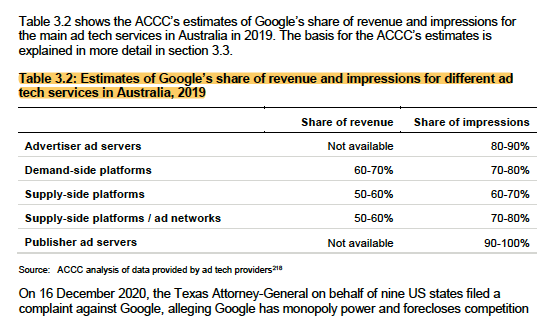

woah. just had time today to review Australia's report on adtech (222 pages!) - hands-down the best report I've ever seen on adtech complex - creates an overwhelmingly clear picture of the problem. Hint in this image of a monopoly participating in all sides of the market. /1

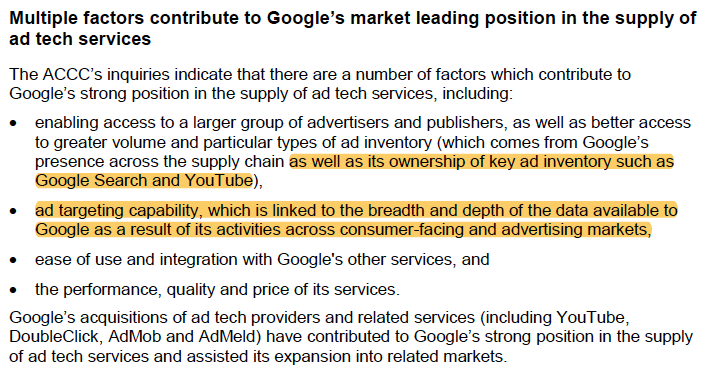

it's only the interim report but I would expect much of these facts and the report will hold up for the final report later this year. Look how they then connect Google's supply chain dominance to its marketshare throughout the supply chain. /2

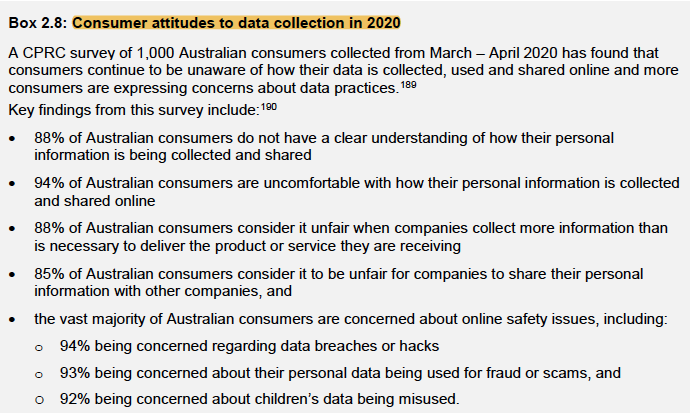

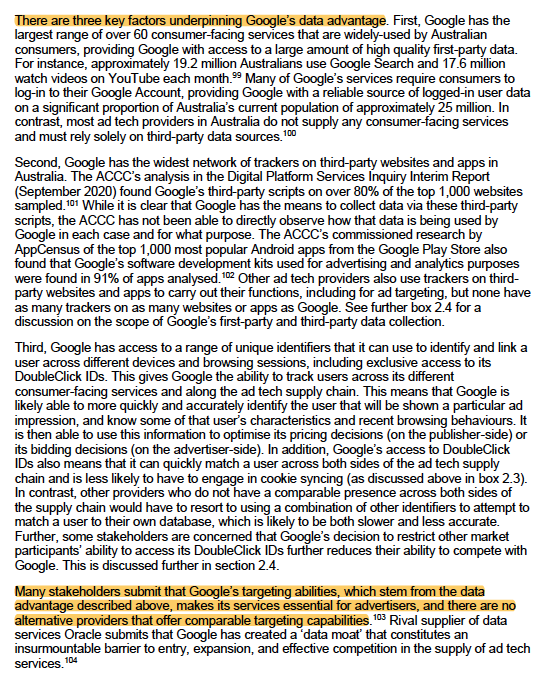

and great news is (like UK and US regulators) they very clearly tie Google's dominance to its unparalleled access to user data across all sides of the market. and how significantly this current market violates user expectations - something we previously researched, too. /3

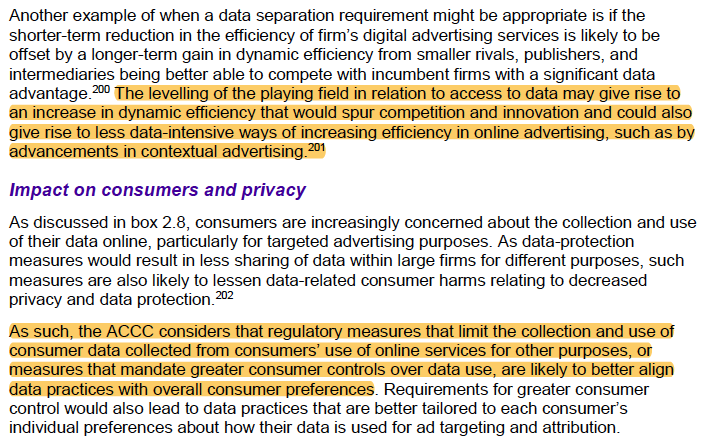

there are entire sections focused on the unique power of data and solutions focused on this intersection of data and competition policy. Super timely, really good to see proposed solutions around purpose limitations focused on companies who see much of our activity. /4

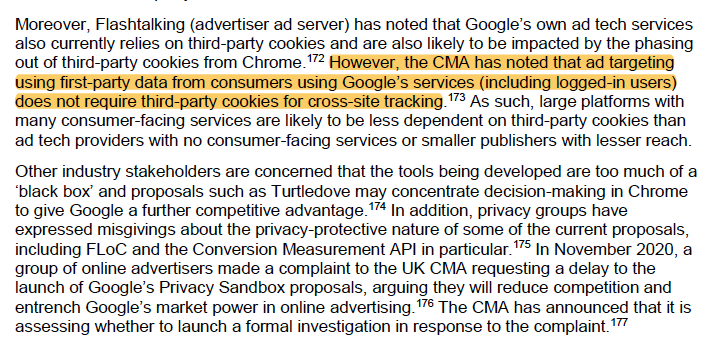

adtech complex is wrongly trying to impede tracking preventions and 3rd party cookie limitations. it would be much better if regulators would instead recognize Chrome's view of our activity (or any user agent) shouldn't be considered 1st party data and/or need special rules. /5

This.

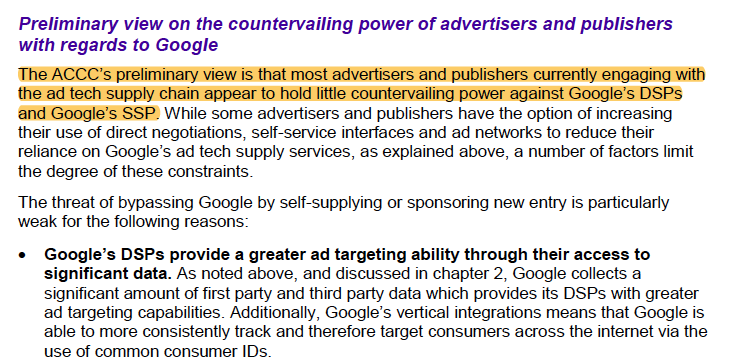

Yes the report here pretty much summarizes that both sides of the market are screwed due to Google's adtech monopoly power, tying and conduct - the basis of the state AGs case here in the U.S. See tweets 1 and 2. Need to break for a bit, will dive deeper later tonight. /6

Yes the report here pretty much summarizes that both sides of the market are screwed due to Google's adtech monopoly power, tying and conduct - the basis of the state AGs case here in the U.S. See tweets 1 and 2. Need to break for a bit, will dive deeper later tonight. /6

Sorry had to break for family and forgot to add link. I have about 40 notes I’ll summarize into thread when back at it tonight. /7 https://www.accc.gov.au/media-release/lack-of-competition-in-ad-tech-affecting-publishers-advertisers-and-consumers

back at it, few more points here. Simple word counts show how much western allies' regulators build on each others' work - all super smart.

11x Texas (state AGs adtech antitrust case)

12x subcommittee (Congress antitrust investigation)

91x CMA (UK competition investigation)

/8

11x Texas (state AGs adtech antitrust case)

12x subcommittee (Congress antitrust investigation)

91x CMA (UK competition investigation)

/8

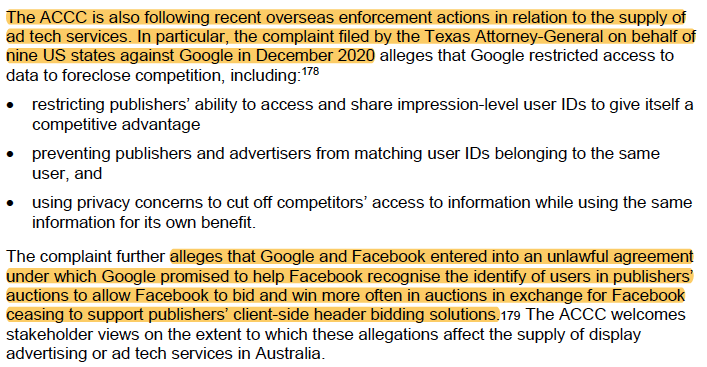

the Texas-led case against Google for adtech is most recent having been filed in Dec. I did a previous thread on it (now over 2mil impressions - https://twitter.com/jason_kint/status/1339349312694837250?s=20). pg 77 references the extremely concerning allegation of bid rigging between Google and Facebook. /9

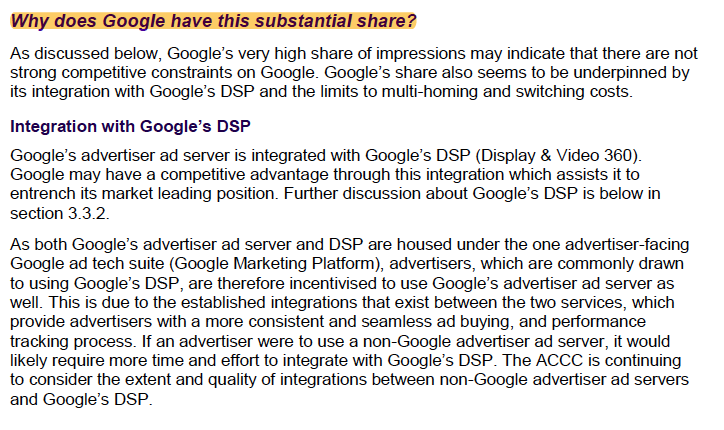

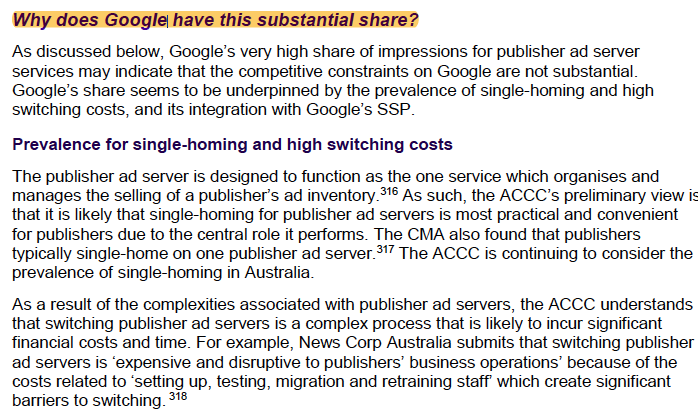

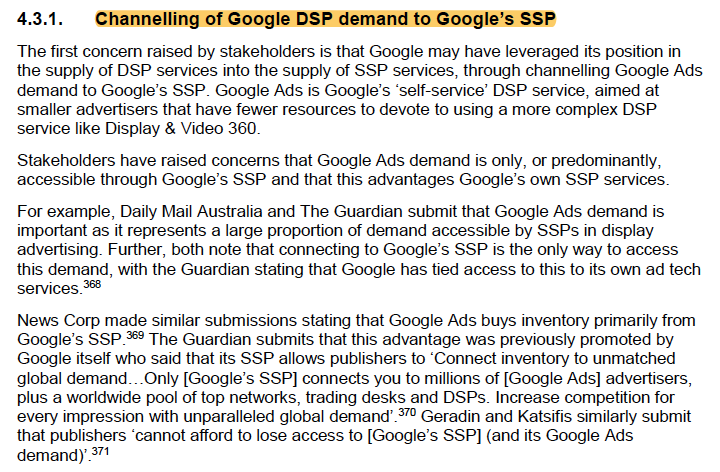

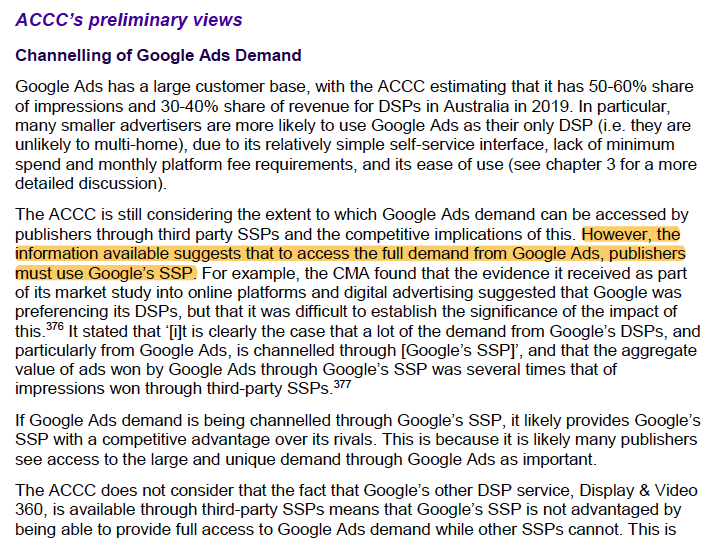

Australia report goes through countless samples of "Why does Google have this share?" explaining conduct issues like tying and market failures providing for Google's dominance in various areas of adtech and data surveillance. /10

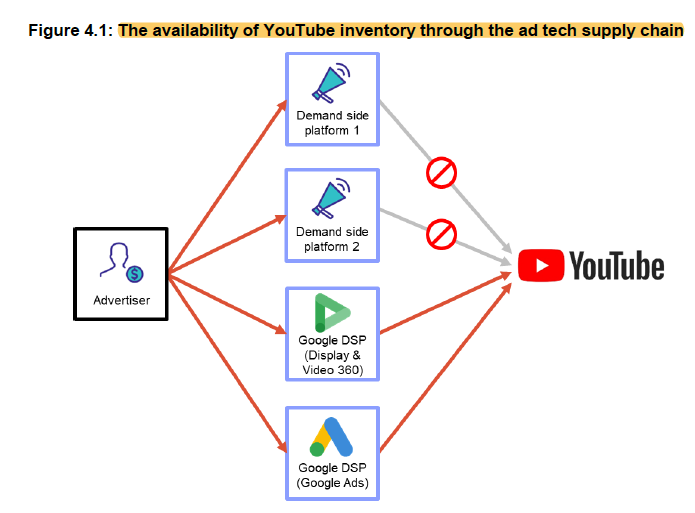

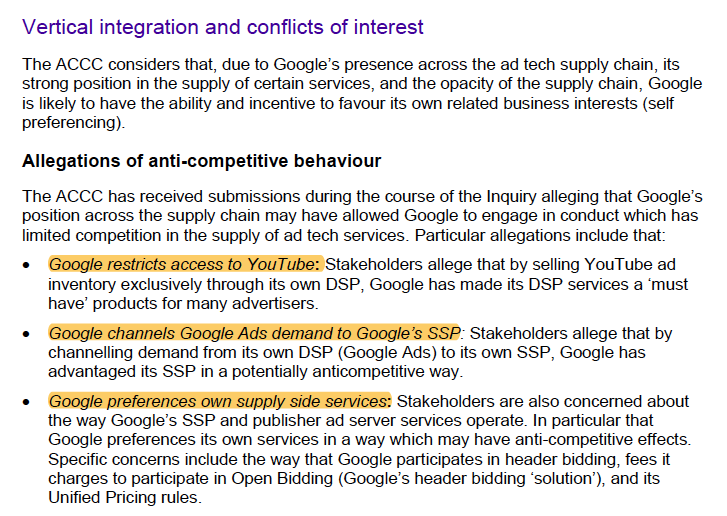

pg 125 includes the now well-documented allegations of Google's leveraging of YouTube inventory for exclusive access to push adtech business towards Google. It came up in testimony from witnesses during Senate Judiciary hearings twice in the past 18 months. /11

it's not that different than channeling of ad demand towards clients of Google's supply-side adtech. It's in TX-lawsuit and covered in the Australian (ACCC) report on pp130-131. I've heard Google has threatened to cut demand for pubs who don't preserve Goog's data access. /12

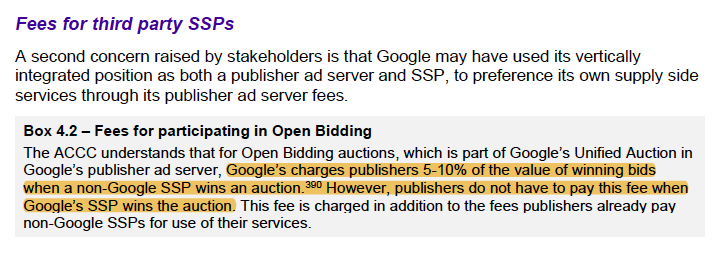

Also making appearances (40x+ mentions) in the Australia report is the brilliant investigation and report done by UK advertisers ( @ISBAsays). When you get to concerns like Google's additional fees for publishers using a competitive SSP, that report matters. It matters a lot. /13

But at the end of the day, the report rightly most focuses on Google's leveraging of unique assets combined with its unparalleled (Facebook in 2nd place) access to the data from our web browsing, app usage and location history. /14

and ACCC makes it clear these are allegations of anti-competitive behavior (of course, in a preliminary report). That this mirrors the findings of Texas-led state AGs and UK concerns plus EU coming means it's landing in a big, big way. Google should be in huge trouble. /15

the advertising case will have the most impact on digital media including finally holding Google's feet to the fire on its abuses of data which not only impact consumers lack of reasonable choice but harms the entire ecosystem including publishers. /16

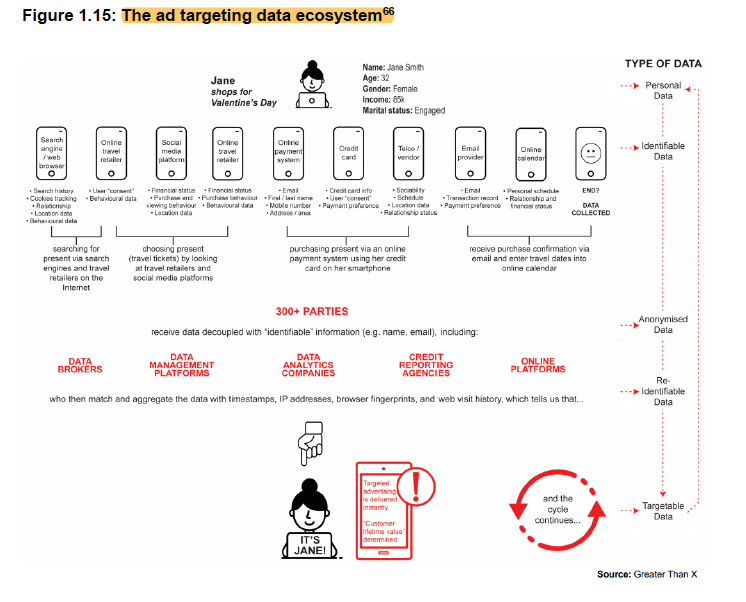

I've written previously about how Google more than any company built the tracking ecosystem. AG case called this "privacy fixing." There is an interesting model in the ACCC report (p49) demonstrating how the ad targeting ecosystem works. /17

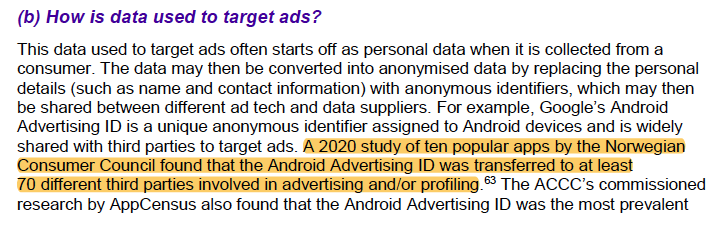

For those following Apple's shift to restrict use of its identifier as a vehicle for tracking (Facebook is leading the war to fight this privacy improvement), ACCC includes this interesting stat that Android's ID version is shared w/ 70+ companies across 10 popular apps. /18

Count me in as a strong fan of proposal 2 as solution. Make Google silo its data and act as a service provider when it's acting as a 3rd party (a majority of its data!). Google anticompetitively rolled over industry in abusing GDPR's purpose limitations - enforce them. /19

this is a super importance concept. the UK CMA report and German Federal Cartel Office got this right. If Facebook and Google are able to leverage dominance to collect data when users aren't even intending to interact with them, it harms publishers and advertisers. /20

p64 lists 3 factors for Google's data advantage underpinning its moats/monopolies. 1) 60 consumer-facing services, 2) tracking across 75% of web, 3) IDs to connect the two together (which they once promised not to do - see @JuliaAngwin Propublica report in 2016). /21

intersection of data and competition policy is central antitrust issue of our time. Until we use antitrust combined with privacy law to constrain the powerful, we'll have an unhealthy digital media marketplace with downstream harms (eg disinfo, data abuse, fraud, et al). /22

This is what @tim_cook was talking about in his speech 2 wks ago. Australians do not use Google's ad tech services. They don't choose to interact with them. Yet Google more than any company takes their online and offline activities and turns this "data exhaust" into profits. /23

ok, I'm stopping. I've covered all my notes, look forward to reading responses and following up with @acccgovau on a few clarifications. Bottom-line, it's a super smart report, should be read by any global regulator/lawmaker office touching digital. /end https://www.accc.gov.au/media-release/lack-of-competition-in-ad-tech-affecting-publishers-advertisers-and-consumers

Read on Twitter

Read on Twitter