//Thread

As a trader one of the biggest problems you will face are black swan events.

Black swan events are events that aren't predictable but seem obvious after-the-fact

Today was a perfect example

As a trader one of the biggest problems you will face are black swan events.

Black swan events are events that aren't predictable but seem obvious after-the-fact

Today was a perfect example

So what is a black swan more specifically?

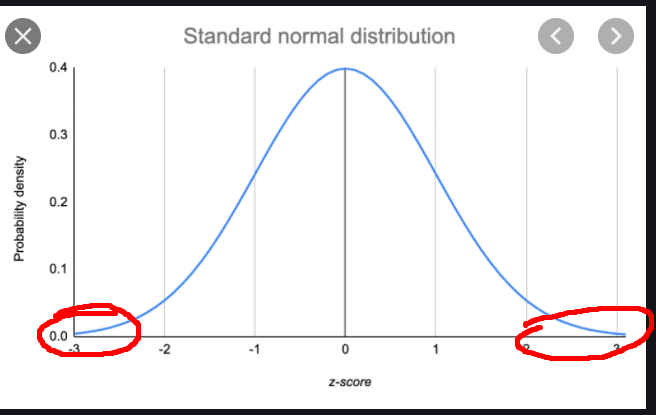

A black swan is what we call a "tail risk". The reason it's called this is because if we have a normal (perfect) probability distribution it is more likely that something like say: a 0.1% bitcoin move happens rather than a 10% move

A black swan is what we call a "tail risk". The reason it's called this is because if we have a normal (perfect) probability distribution it is more likely that something like say: a 0.1% bitcoin move happens rather than a 10% move

the 10% move in this case is an unlikely event, hence it is part of the "tail" of the probability distribution.

You can't predict black swans (you can ofcourse but 99% of cases you won't) this is why they pose such a large risk to your trading.

Another problem is that they're almost never the same though they might have similar elements.

Another problem is that they're almost never the same though they might have similar elements.

Example: When the BTC ETF got denied first time back in 2018 price dropped 14% in a matter of hours, while the second ETF to get denied didn't move the market at all

Usually black swans are caused by news events i.e Tesla buying bitcoin, ETF being denied etc.

But there is also a risk that the market goes haywire such as with the flash crash in the SP500 back in 2010

But there is also a risk that the market goes haywire such as with the flash crash in the SP500 back in 2010

So how do you navigate black swans as a trader? First off - if possible - try to not have active positions that are extremely price sensitive if you can't monitor them.

Secondly, every time you spot an edge case while trading your system make sure to study it

Secondly, every time you spot an edge case while trading your system make sure to study it

This way if the black swan repeats you have a higher chance of surviving it and possibly turning a devastating loss into a great win

Personally, my biggest weakness is I don't follow the news that much so by the time price starts to move based on a headline I'm already behind since I have to check twitter to see what's going on.

That's an area I've fixed now though

That's an area I've fixed now though

So take today or tomorrow and reflect on all the black swans you've experienced trading. Whether it be news headlines, new market mechanics or an array of other things.

Start actively studying these moments and figure out where your system is lacking

Start actively studying these moments and figure out where your system is lacking

Read on Twitter

Read on Twitter