Okay first thread, very short. What do we mean by "climate models" in this paper?

Not:

Energy transition models

Energy transition models

Economic climate damage models

Economic climate damage models

Catastrophe models

Catastrophe models

Yes:

Models that "represent the processes and interactions that drive the Earth’s climate" https://twitter.com/kmac/status/1358887678293417985

Models that "represent the processes and interactions that drive the Earth’s climate" https://twitter.com/kmac/status/1358887678293417985

Not:

Energy transition models

Energy transition models Economic climate damage models

Economic climate damage models  Catastrophe models

Catastrophe modelsYes:

Models that "represent the processes and interactions that drive the Earth’s climate" https://twitter.com/kmac/status/1358887678293417985

Models that "represent the processes and interactions that drive the Earth’s climate" https://twitter.com/kmac/status/1358887678293417985

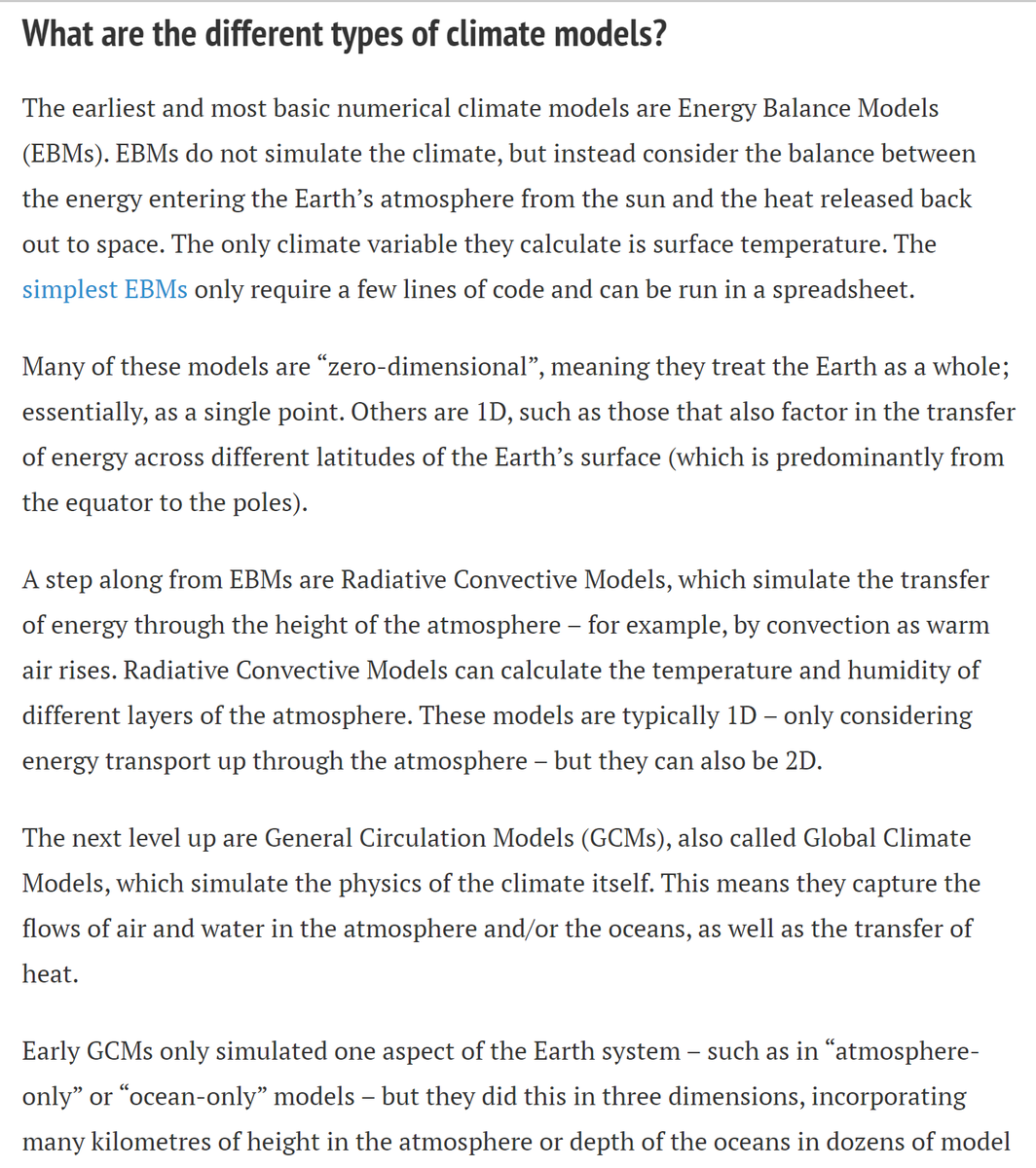

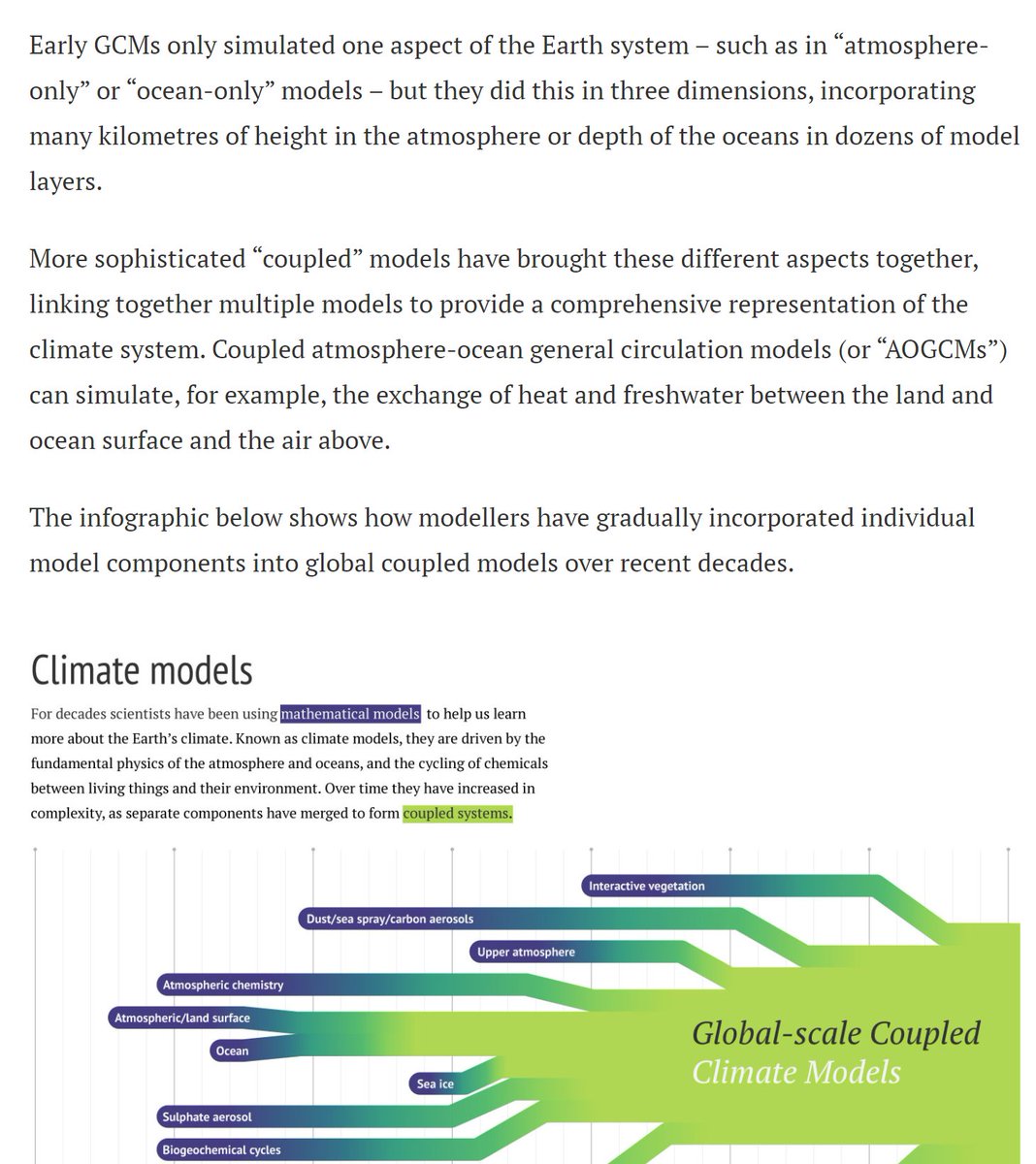

These are often called GCMs, although confusingly there are 2 ways you can unpack that acronym, and not all of them are GCMs anyway! Many require supercomputers; but some can run on your phone. This explainer in CarbonBrief is a good dive into the models: https://www.carbonbrief.org/qa-how-do-climate-models-work

So, the paper refers to the use of *those* models in finance and business, ie to anticipate how climate risk is changing and thus how your business assets or investment portfolio should be relocated or hardened up. Or, if you're a regulator, how to ensure risks are being managed.

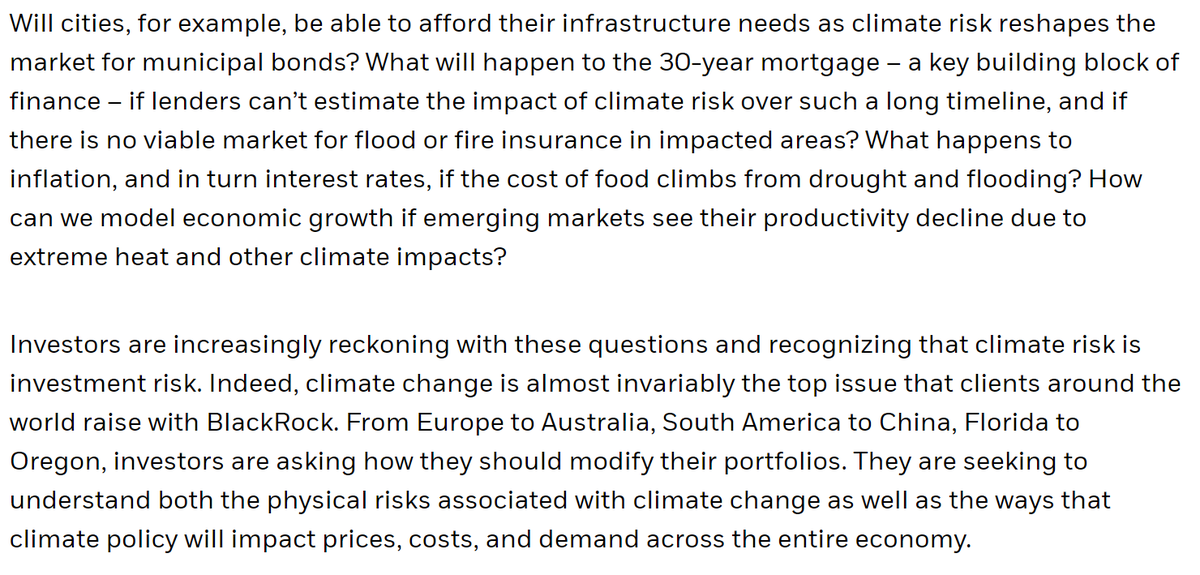

Many firms now offer this, either as a feature or dedicated service. Often called "physical risk" in sustainability/ESG/TCFD world. A concept that hardly existed 5 years ago is now enthusiastically referenced by Larry Fink of Blackrock; this is from his 2020 letter to clients:

Where does the intelligence come from? In practice it usually is (& should be) drawing on many sources, not just climate models! For a start, you have to understand the location and characteristics of the places you are looking at; & vulnerability to recent hazards.

Eg what if that hurricane that was a near miss actually makes landfall next time? What if a big hailstorm, fire etc interrupts supply chains? You'd think this would be basic risk management, but it's far from universal.

So, there are MANY layers. If you want to understand climate risk as well, it makes sense to seek intelligence from climate models, which are robust at anticipating global and continental-scale climate change due to increasing GHGs from fossil fuels, agriculture etc.

It gets trickier when you start looking for very precise, granular insights. The reasons it gets tricky are complex, but they involve the complexity of the climate system itself, and the limitations of the models - at least, in their current iterations.

Those limitations also have multiple causes that co-authors, modelling experts @sarahinscience & Andy Pitman, and model developer Christian Jakob can explain. But it includes computing power demands & fact that models weren't *designed* to inform precision analytics. Plus...

Understanding what these models are good & not good at doing is not easy knowledge to acquire. There are multiple models, scenarios, simulation methods, etc. Prof Pitman estimates perhaps 6,000 combinations in total. Which do you use?

And no, "just average out the models!" or "use CMIP6!" is not a good answer! Eg., CMIPs are "ensembles of opportunity". They do not fully account for model independence, for example. And they address different questions to what finance wants answered.

However to understand this better, I would defer to my scientist co-authors (Sarah, Andy, Christian) who can explain it all with clarity that is rather intimidating, considering they are also clearly maths geniuses. Back to the finance:

Firstly, financial regulators are very interested and are indeed already beginning to seek these insights about the financial institutions they supervise. For example, bank and insurer stress tests or vulnerability assessments are planned in UK, Australia, others to follow.

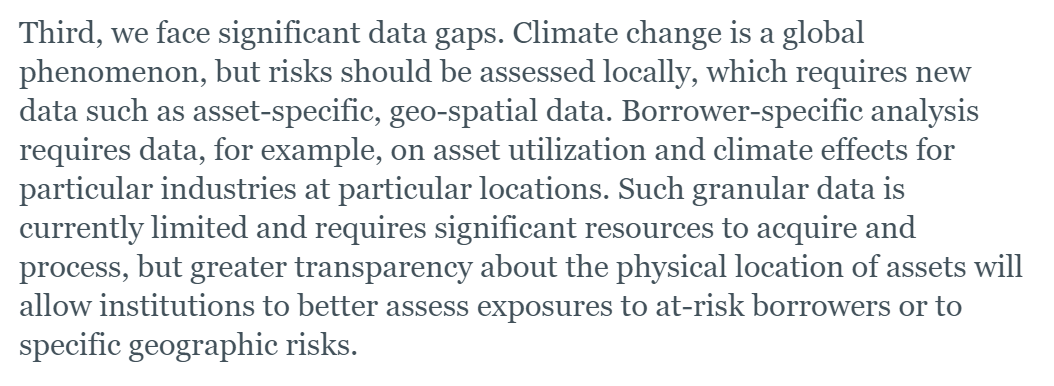

In the US here's a speech by Kevin Stiroh, who is now leading the Fed's climate change team. It's a thoughtful speech, as you'd imagine, and like most of these speeches from central bankers/supervisors on climate change, it includes a lot about data gaps: https://www.newyorkfed.org/newsevents/speeches/2019/sti191107

It's true there are data gaps in all the areas he describes: geo spatial, asset level data etc. But in these speeches and in similar publications eg from the NGFS, we see little mention of climate models, let alone climate modelling experts & developers.

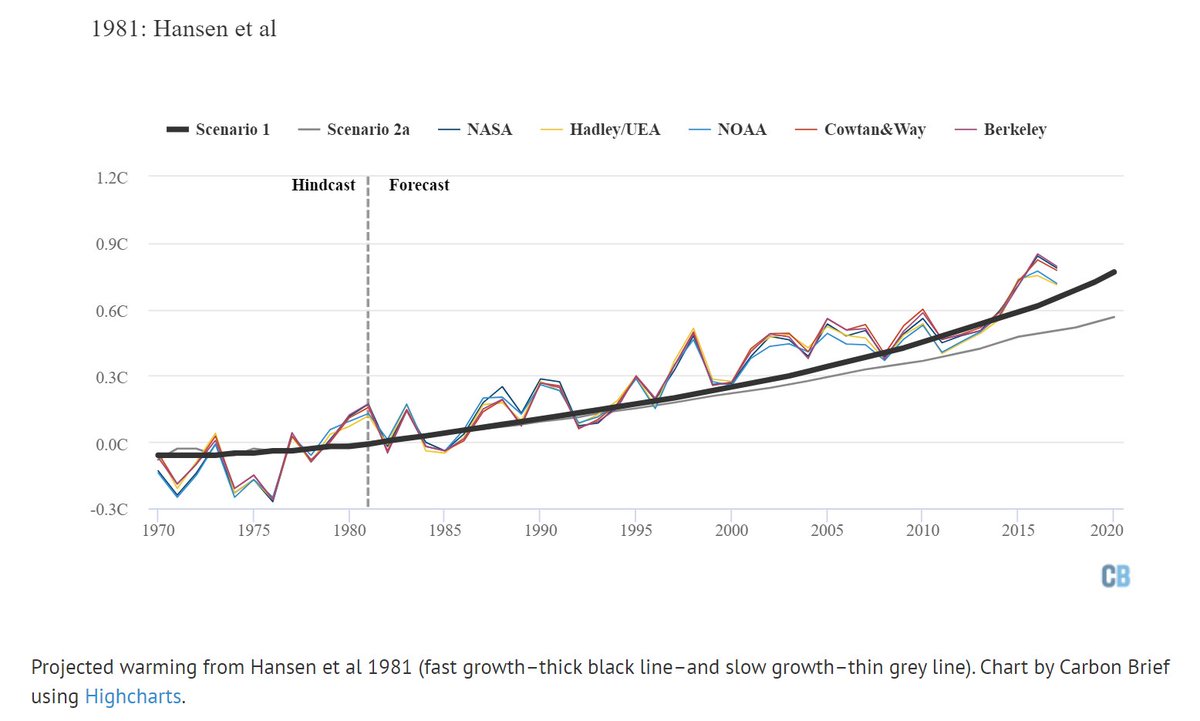

Now it bears repeating that these climate models have a track record of being pretty damn excellent at anticipating how the climate changes with increased forcing from fossil fuels (+ag, deforestation). Eg., from a simple model in 1981: https://www.carbonbrief.org/analysis-how-well-have-climate-models-projected-global-warming

It also bears repeating that most people knows climate models aren't the only source of insight. But they do underpin a lot of the knowledge of climate change, for good reasons.

Knowing what you can & can't do with which models matters. One reason this paper came about is that @TanyaFiedler and I noticed climate model experts are often not consulted when financial folks are establishing expectations for disclosure etc.

There's often an assumption from financial folk that it couldn't possibly be worthwhile to liaise with the climate scientists who mess about with these models. I've heard this from regulators* & industry. It's an odd assumption and I hope this paper helps address it.

The paper suggests that to better understand climate change impacts, we need to "operationalise" climate modelling, more like we have now with meteorology and weather. That requires public** investment. The paper also suggests a profession of "climate translators" could help.

*I have also worked with regulators who are genuinely curious about and appreciative of the insights of the climate modelling community. A bit of interpretation is sometimes required, but surprisingly little!

**I say public investment, because this info is in public interest. The social implications of climate analytics are profound, eg see my @climate column below. And these models are mostly publicly funded & open source already. https://www.bloomberg.com/news/articles/2020-06-26/lenders-with-the-best-climate-data-will-be-in-a-position-to-discriminate?sref=63ZrW3mM

Anyway, if you're interested in this, here again is the paper link! We will soon have some summaries & perhaps guest posts explainering it for different audiences. And follow @sarainscience & @TanyaFiedler (none of the paper's other authors tweet!) https://www.nature.com/articles/s41558-020-00984-6

Read on Twitter

Read on Twitter