1/ A thread on http://OnX.finance ( @OnXFinance) a $20M mcap gem tht could easily be the next 10x on Uniswap. $ONX ticks all the right boxes, including an innovative DeFi use case, a fair launch, great token metrics & a busy roadmap with major launches in Feb.

So here we go:

So here we go:

2/ $OnX aims to be the first hub for collateralized tokens, such as LP tokens, yield-earning tokens (like yearn y tokens), or the newly-emerged Bond tokens. OnX will allow users to farm, borrow against, swap or even create new synthetic tokens using their collateralized tokens.

3/ The first focus of the platform will be on the aETH “bond token”, so it’s worth giving an overview of aETH here. aETH is a token representing ETH staked in the upcoming ETH 2.0 network + all future staking rewards relating to this ETH.

4/ The idea is that instead of locking you ETH in staking for ETH 2.0 and having no access to it, you can stake your eth through the ankr platform ( https://eth2.ankr.com/ ), and receive aETH tokens in return, which represent your ETH + future staking rewards.

5/ This allows you to have full access to your staked ETH + future rewards (in the form of aETH), and trade it, stake it, use it as collateral, and any other creative used you can think of. And this is where OnX finance comes in, because creative they are!

6/ The first major OnX product is Lending, where we will be able to borrow ETH at 75% using aETH as collateral. This will be based on the intrinsic value of the aETH (= ETH + future rewards) and not market price of aETH which can vary and affect the collateral coverage.

7/ And as posting collateral for borrowing will also generate $ONX rewards, it will be possible to “leverage” up by posting aETH as collateral to borrow ETH, use ETH to buy aETH, post the new aETH as collateral, and so on until the collateral value is too low.

8/ This would be a low risk way of taking a leveraged aETH / ETH position, to explore any market inefficiencies, while enjoying increased ONX rewards from staking collateral. Lending is expected to go live in February and the team announced the lending contract just passed audit.

9/ The other MAJOR product of the OnX platform is onSynthetics, which uses the know-how from the algorithmic stable coin space to create synthetic Ethereum using aETH as fractional reserve and seigniorage as a stabilization mechanism.

10/ There will be three main synthetic assets at first:

- onEthereum (onE), representing 1 synthetic ETH

- onShares (onS), representing the accrued staking rewards embedded in aETH

- onBonds (onB), to be used as a price stability mechanism

- onEthereum (onE), representing 1 synthetic ETH

- onShares (onS), representing the accrued staking rewards embedded in aETH

- onBonds (onB), to be used as a price stability mechanism

11/ In short, onSynthetics is stripping away ETH and ETH accrued staking rewards from aETH. And if onE price trades below ETH for a certain time, some onE is traded for onB (which receives onS rewards from the interest pool), decreasing onE supply and helping it reach fair value

12/ It’s hard to overstate how awesome this stuff is! Not only it creates more utility and demand for aETH but it also creates a new synthetic asset onS representing staking rewards, which could be viewed as a reference rate for the DeFi space like the FED rate for the US economy

13/ onE farming (with ONX, ETH, aETH and stable coins) has just started and onS farming + onE minting will begin tomorrow, Feb 9th ( https://app.onx.finance/synthetics )

14/ And it’s worth reminding that these products around aETH are just the beginning and similar use cases will be available for a range of other collateralized tokens in the future.

15/ Other products will include Collateralized Token Swaps (CTS), allowing direct swaps between different collaterals without going through all the steps of repaying loan, unstaking, withdrawing, trading on uniswap, staking collateral again, and getting a new loan.

16/ And it goes without saying that CTS will also be a source of fee revenues for the platform, which will be distributed to $ONX token holders, but more on that later.

17/ Other products a bit further on the roadmap will include insurance (much like Cover/yIsurance), Automated Asset Management, or AAM (allowing the automation of investment strategies like the aETH/ETH leveraging mentioned earlier), and Governance.

18/ What about the $ONX token utility:

- pay rewards to ETH, aETH, ETH/ONX LP, ONX and ANKR stakers

- pay interest for OnX Lending

- receive discount on the OnX platform

- earn a portion of trading fees from the CTS

- governance

- & more to come

- pay rewards to ETH, aETH, ETH/ONX LP, ONX and ANKR stakers

- pay interest for OnX Lending

- receive discount on the OnX platform

- earn a portion of trading fees from the CTS

- governance

- & more to come

19/ And let’s not forget the project had a fair launch and has awesome token metrics.

Only 1% of tokens have been time-locked for the team, 93.25% will be distributed thru yield farming, plus 4% distro as an airdrop (already done) and 1.75% for initial liquidity and marketing

Only 1% of tokens have been time-locked for the team, 93.25% will be distributed thru yield farming, plus 4% distro as an airdrop (already done) and 1.75% for initial liquidity and marketing

20/ Out of the 93.25% to be distributed through yield farming, 5% will go to treasury, and 2% will go to an insurance fund, leaving over 86% of rewards to be distributed to the user community. All tokens are expected to be farmed by Dec 2021.

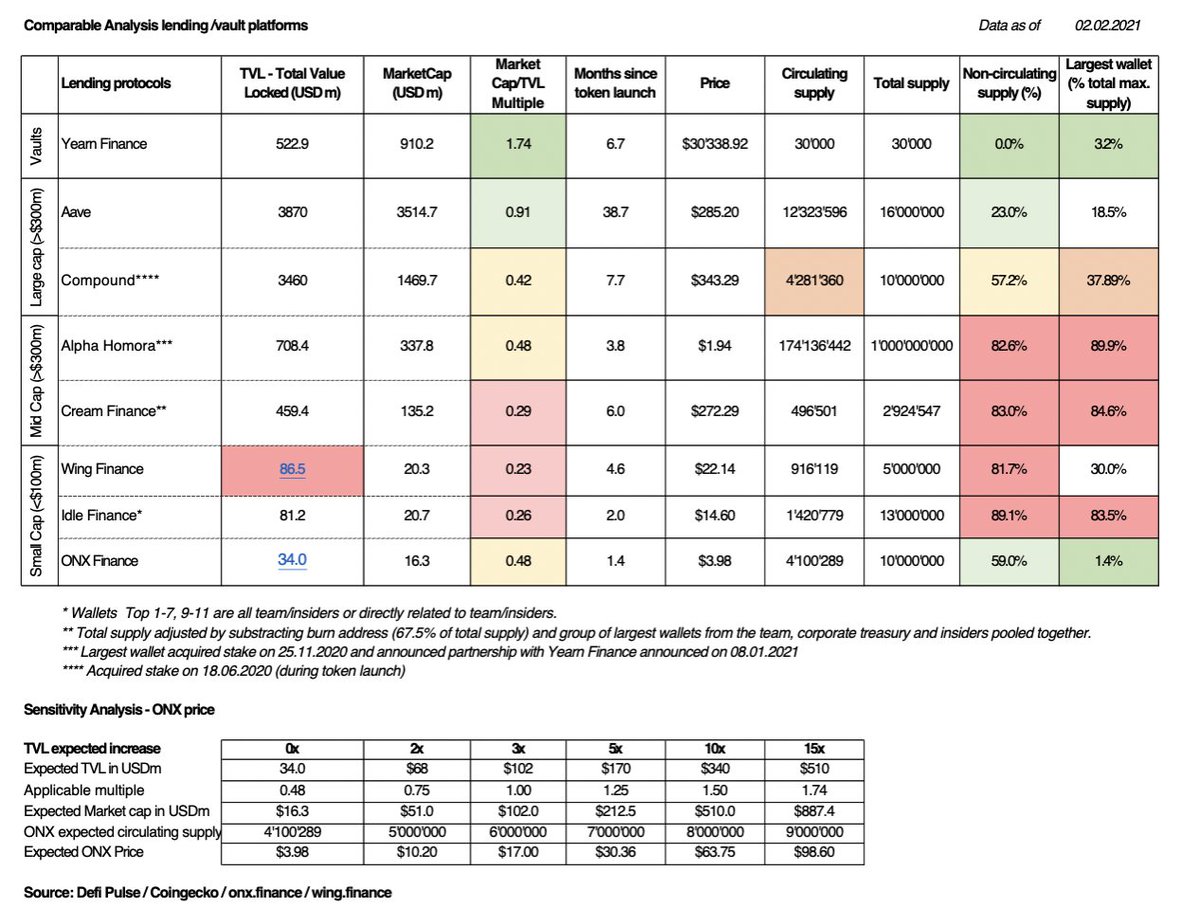

21/ To end with a splash, I copied here a great comparison table made by Filipe in the OnX trading group:

22/ So $OnX has the lowest market cap among the comparables, rising TVL (this 66M was 22M 2 weeks ago), it’s the youngest project (launched on Dec 21st), non circulating supply is decreasing very fast as rewards are distributed, and a very low concentration of large wallets.

23/ And on the synthetic assets side, I’ll just put it out there that the $SNX market cap is currently $3.2billion, versus $20M for ONX…

24/ The team is semi anon, so while they don’t reveal their ids publicly they are known to partners and they KYC on exchanges.

25/ More importantly, their smart contracts are audited and audit reports are available in the website. As usual, don’t trust, verify!

25/ More importantly, their smart contracts are audited and audit reports are available in the website. As usual, don’t trust, verify!

26/ That’s it folks, here are some useful links for you to continue to DYOR:

- Project WP https://onx-finance.gitbook.io/docs/

- ONX Medium: https://onxfinance.medium.com

-OnSynthetics simplified explanation: https://onx-finance.gitbook.io/docs/products/onsynthetics/onsynthetics-eli5

-OnSynthetics technical explanation: https://onxfinance.medium.com/%EF%B8%8Fintroducing-the-onx-synthetic-assets-platform-onsynthetics-8a4cc4d8c6f2

- Project WP https://onx-finance.gitbook.io/docs/

- ONX Medium: https://onxfinance.medium.com

-OnSynthetics simplified explanation: https://onx-finance.gitbook.io/docs/products/onsynthetics/onsynthetics-eli5

-OnSynthetics technical explanation: https://onxfinance.medium.com/%EF%B8%8Fintroducing-the-onx-synthetic-assets-platform-onsynthetics-8a4cc4d8c6f2

Read on Twitter

Read on Twitter