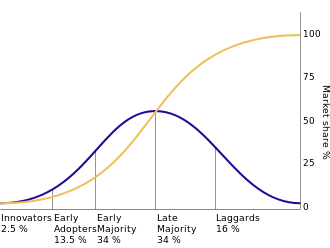

eCommerce was in its spring training in 2000,

1st innings was until Covid,

2nd innings was 2020-2021.

The 3rd innings will benefit enablers - payments $FSRV, $AFRM, $BFT, $FTOC, etc.

This is the right time for them. Unlike Orbital space which is in Spring training now.

1st innings was until Covid,

2nd innings was 2020-2021.

The 3rd innings will benefit enablers - payments $FSRV, $AFRM, $BFT, $FTOC, etc.

This is the right time for them. Unlike Orbital space which is in Spring training now.

The data to support:

1. 1996 - 2005: eCommerce = < 3% of Retail

2. 2005 - 2019: eComm = < 8% of Retail

3. 2020 - 13% of Retail

Payments

$AFRM, $PYPL, etc. until 2020 < 3% of Online payments

2021 - these payments will move to 1st innings.

Long #FinTech Long $FSRV $PYPL $ARFM

1. 1996 - 2005: eCommerce = < 3% of Retail

2. 2005 - 2019: eComm = < 8% of Retail

3. 2020 - 13% of Retail

Payments

$AFRM, $PYPL, etc. until 2020 < 3% of Online payments

2021 - these payments will move to 1st innings.

Long #FinTech Long $FSRV $PYPL $ARFM

This data is from the US Census Bureau, so not something to take lightly.

https://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf

https://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf

There are 5 categories of enablers:

1. Payments - $FSRV, $PYPL, $AFRM, $BFT, $FTOC etc.

2. Shipping - multiple SaaS shipping cos will be SPACed

3. Marketplace sellers - $MWK etc.

4. Software providers: $BIGC, $SHOP etc.

5. Advertising: $PINS, TikTok, etc.

1. Payments - $FSRV, $PYPL, $AFRM, $BFT, $FTOC etc.

2. Shipping - multiple SaaS shipping cos will be SPACed

3. Marketplace sellers - $MWK etc.

4. Software providers: $BIGC, $SHOP etc.

5. Advertising: $PINS, TikTok, etc.

By now you know I care about: Markets, Markets, Markets. Size, Dynamics, Structure, Momentum and Growth

1. Payments: $1.3T WW - Ginormous

2. Shipping - $156B - US only dont have WW

3. Sellers - $90B WW

4. Software $11B WW (just S/W in eCom)

5. Ads: $80B WW (just ads in eCom)

1. Payments: $1.3T WW - Ginormous

2. Shipping - $156B - US only dont have WW

3. Sellers - $90B WW

4. Software $11B WW (just S/W in eCom)

5. Ads: $80B WW (just ads in eCom)

If you had to put 10-25% of your portfolio in a sector I would put it in eCommerce and enablers.

Thanks to @skaushi for the discussion this morning that sparked this thread.

Thanks to @skaushi for the discussion this morning that sparked this thread.

Read on Twitter

Read on Twitter