The world’s first Central Bank Digital Currency was issued on a smart card by the Central Bank of Finland in 1991.

The Avant Card functioned as a bearer instrument: it stored a balance on the card, worked offline and enabled anonymous payments. 1/6

https://helda.helsinki.fi/bof/bitstream/handle/123456789/17590/BoFER_8_2020.pdf

The Avant Card functioned as a bearer instrument: it stored a balance on the card, worked offline and enabled anonymous payments. 1/6

https://helda.helsinki.fi/bof/bitstream/handle/123456789/17590/BoFER_8_2020.pdf

A true token system, funds were stored on physical devices.

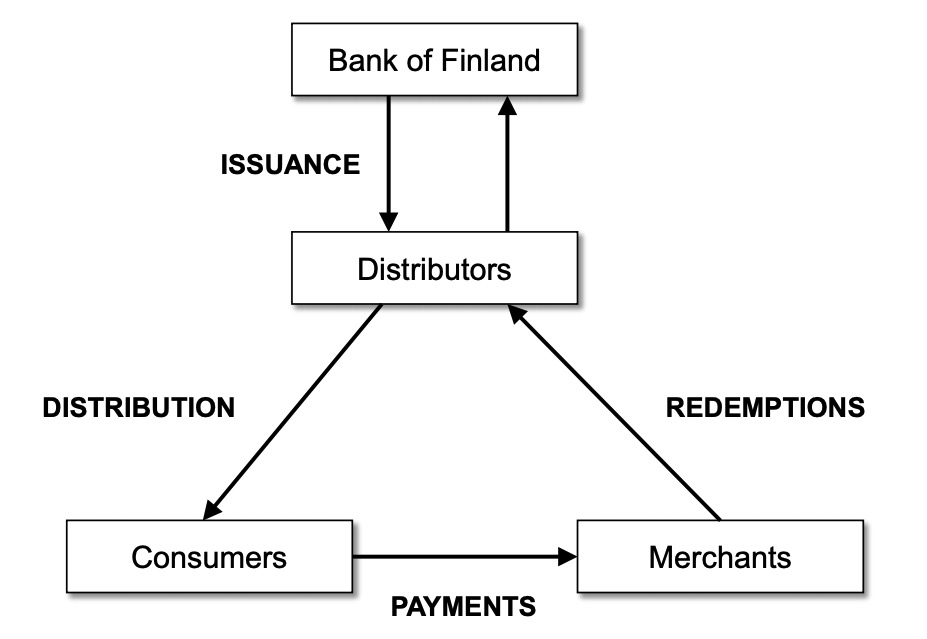

In a typical retail payment, the cardholder balance would decrease (on the card) & the merchant balance would increase (on the terminal). Merchants would then redeem accrued balances from the card issuer. 2/6

In a typical retail payment, the cardholder balance would decrease (on the card) & the merchant balance would increase (on the terminal). Merchants would then redeem accrued balances from the card issuer. 2/6

Since there was no precedent or relevant legislation at the time for electronic money issuance, it was presented as a parallel to cash issuance and thus fell within the mandate of the central bank! 3/6

It was pretty successful: 125k cards sold in 1st year; 500k when reloadable cards were developed. Avant used encrypted smart cards, significantly superior to mag-stripe debit/credit cards at the time (EMV standard was developed in ’94 but took at decade to become widely adopted)

Reloading balances required ATMs, retailers, banks to connect to a proprietary network and was rather costly, diminishing demand for the product.

Eventually Avant merged with a bank consortium (which ran ATMs) and the eMoney was moved to commercial banks (no longer CBDC). 5/6

Eventually Avant merged with a bank consortium (which ran ATMs) and the eMoney was moved to commercial banks (no longer CBDC). 5/6

Takeaways for a modern CBDC are not clear but the current toolkit is much deeper than in the Avant days. Will it be a BTC backed digital Rupee (per @balajis) or fiat-backed CBDC (China eCNY) or will commercial bank stablecoins ($30B+ minted) win this race? 6/6

Read on Twitter

Read on Twitter