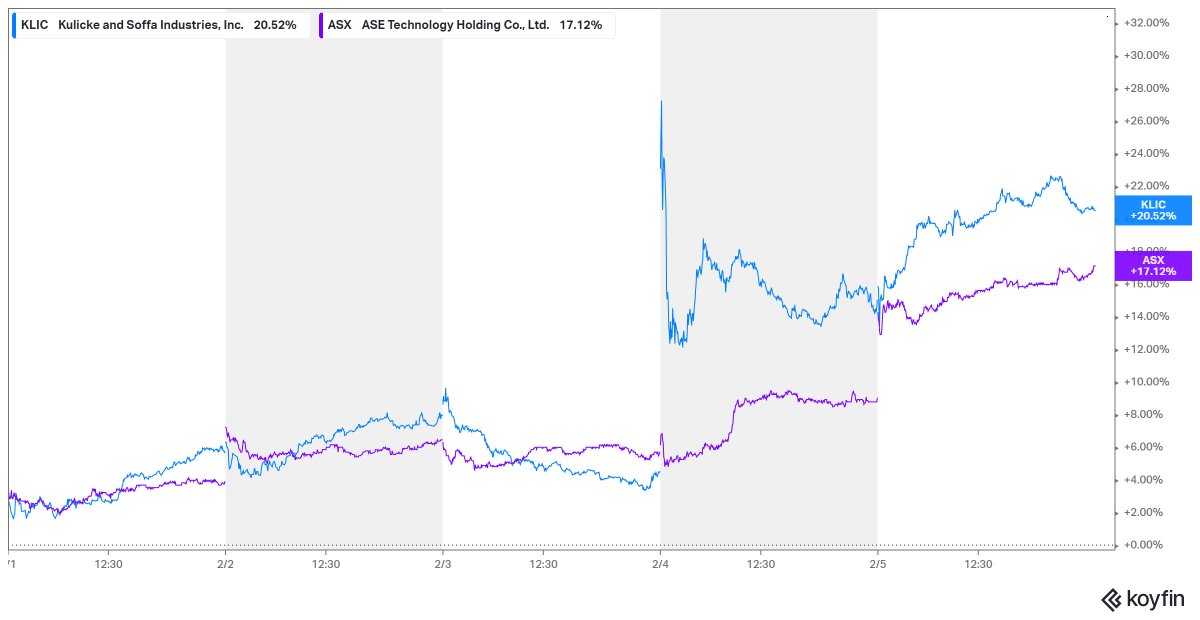

In light of strong reports from $KLIC and $ASX last week, it might be an idea to look at Amkor $AMKR before it reports earnings tonight on Monday

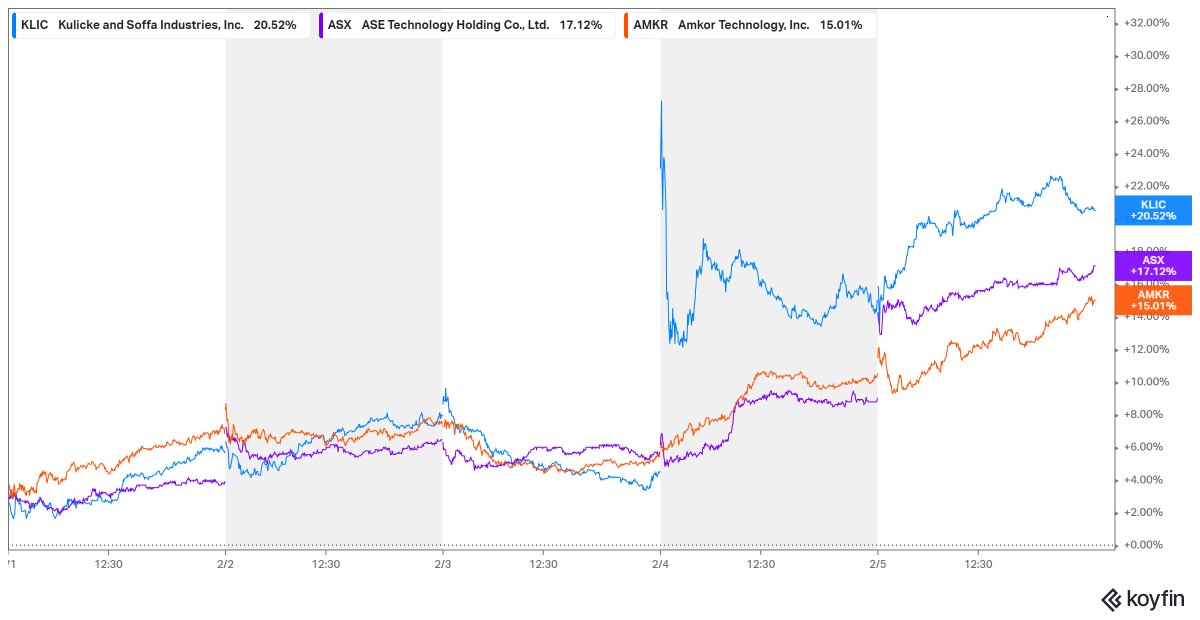

Both reported strong earnings, raised guidance and gapped up the next day

Both reported strong earnings, raised guidance and gapped up the next day

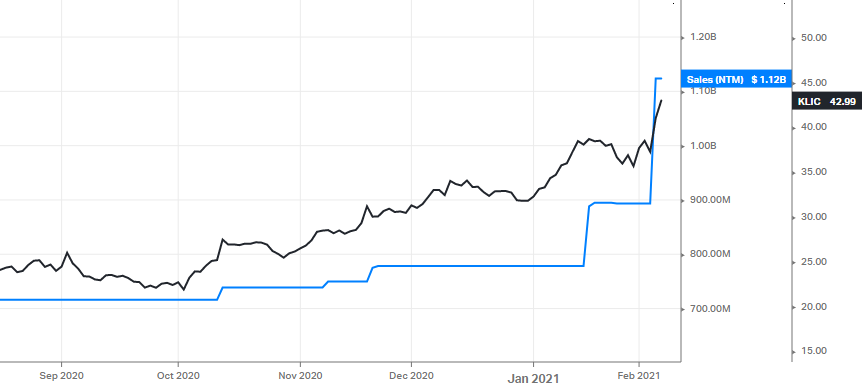

Last week Kulicke and Soffa $KLIC reported extremely strong earnings and guidance

FY estimates were raised 25% to $1.1B

FY estimates were raised 25% to $1.1B

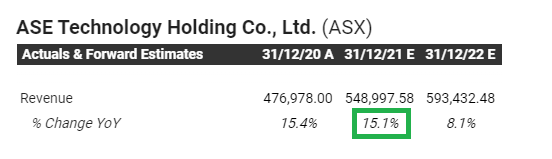

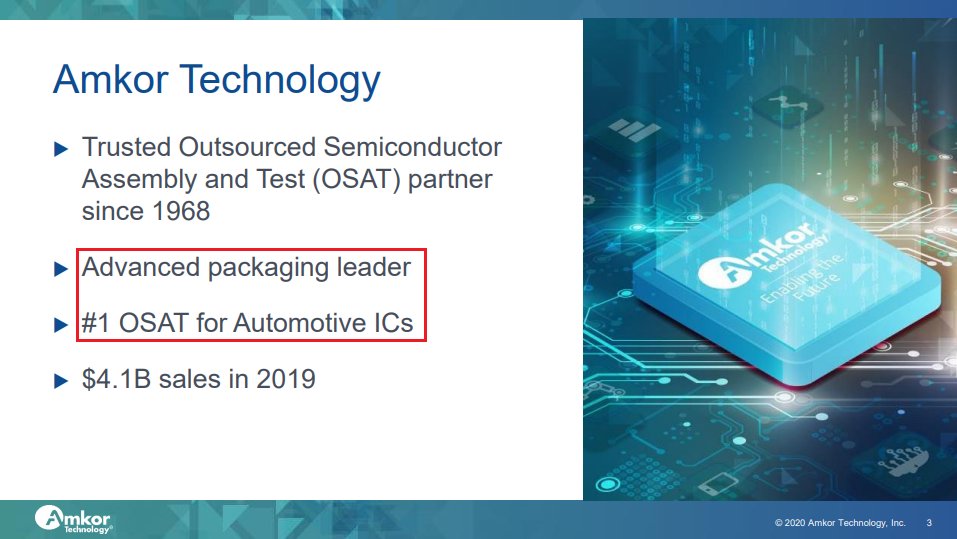

A day later, on Thursday, ASE Tcchnologies $ASX reported good earnings and guidance. Estimates were raised 7%

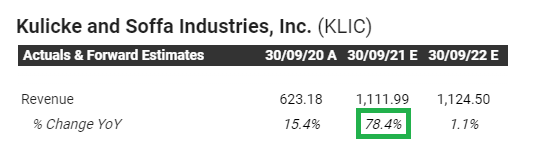

Amkor's estimates for the coming FY are currently unchanged

Unlike the other two, theirs have not been raised in the lead up to earnings and are far more stale, so an good upgrade may be proportionally much greater for $AMKR - which may impress the algos

Unlike the other two, theirs have not been raised in the lead up to earnings and are far more stale, so an good upgrade may be proportionally much greater for $AMKR - which may impress the algos

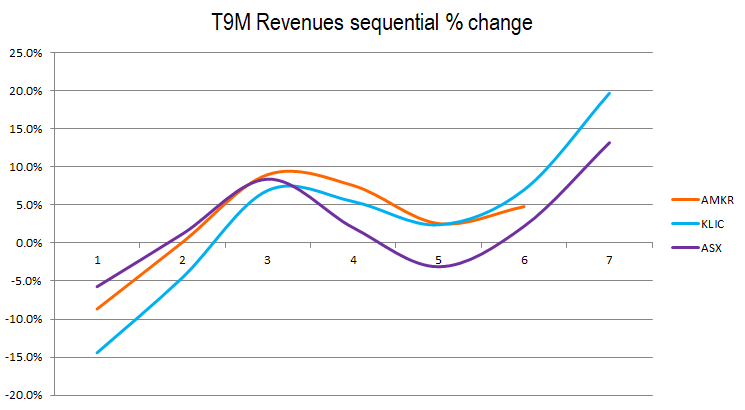

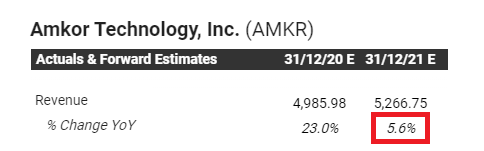

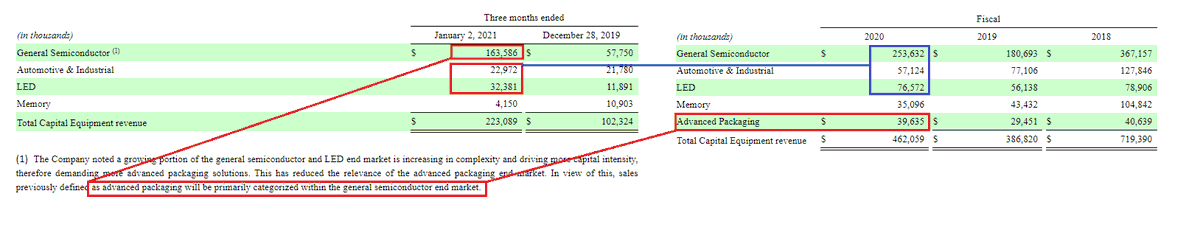

A good part of $KLIC's strength is due to packaging, some automotive and general semiconductor.

$KLIC & $AMKR isn't apples to apples; these things are much more fine grained - but for a rough idea, it's not totally outrageous to put them side by side

$KLIC & $AMKR isn't apples to apples; these things are much more fine grained - but for a rough idea, it's not totally outrageous to put them side by side

Again, there's a lot of detail, differentiation and end markets hidden within segment titles but it's close enough to call $AMKR a direct beneficiary of heightened volume in semi, with convenient overlap in exposure to the markets that have driven $KLIC

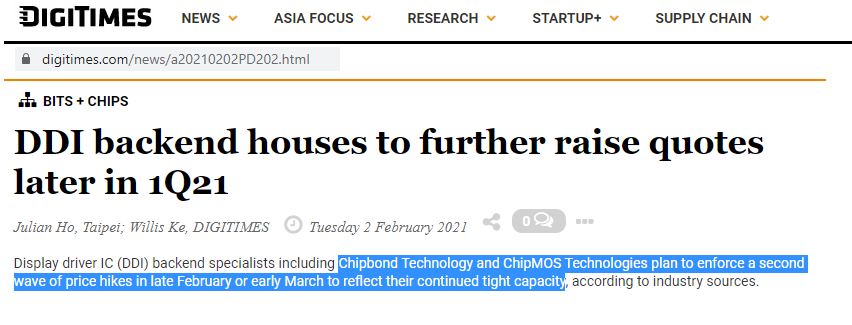

OSATs are reporting capacity fully booked until the end of the year with customers committing to two year contracts

However - I've noticed it, it's widely reported in the trade news and people can look past clearly wrong estimates and make up their own minds.

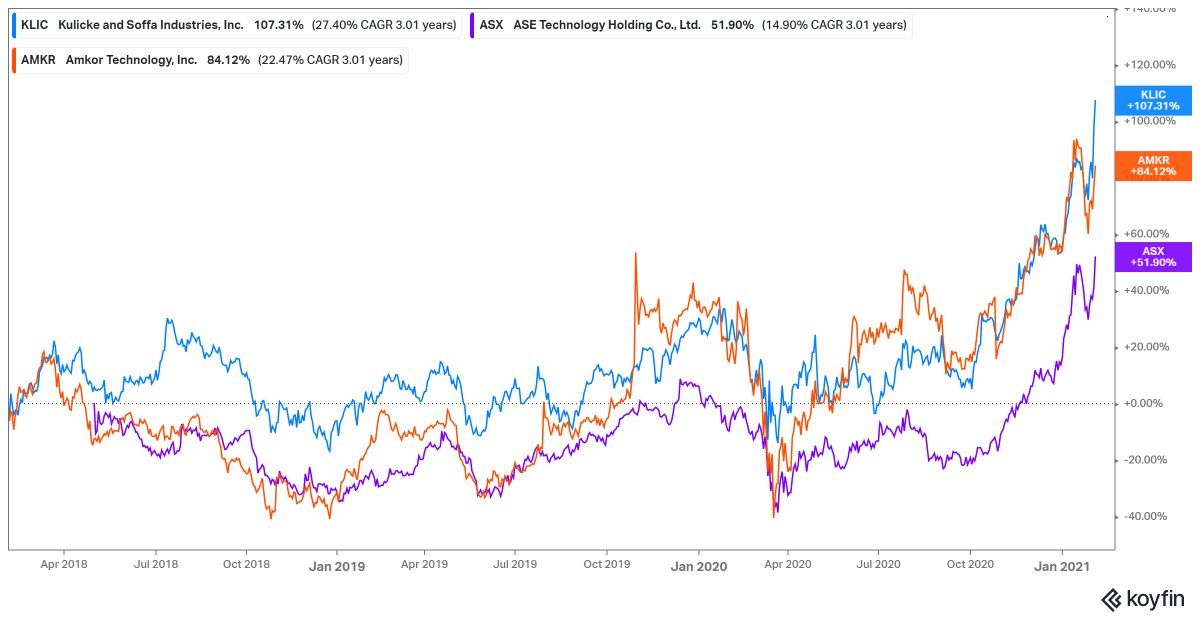

So the question is, is all this in the price already?

In the very immediate short-term the answer seems to be: to a degree, it is

So the question is, is all this in the price already?

In the very immediate short-term the answer seems to be: to a degree, it is

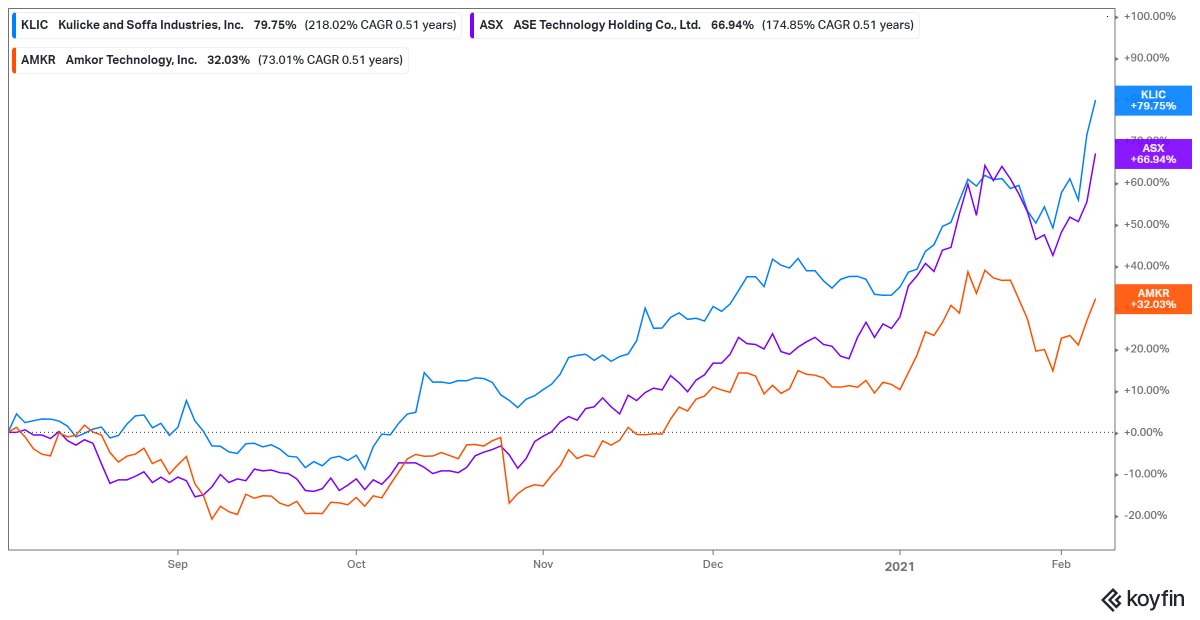

..and a six month period, $AMKR still has a lot catching up to do.

Read on Twitter

Read on Twitter