#FCBarcelona recent accounts revealed major debt challenges, but they also highlighted some issues around different definitions of debt, so this thread will take a look at these using 2019/20 accounts from selected clubs and explain why Barca might have more problems than others.

Note: the clubs covered in this review are just a few of those that have already published accounts for the 2019/20 season, so it is not a ranking table as such, but there is enough detail here to illustrate the points made.

At the narrowest extreme, we have just bank debt, but the broadest definition covers total liabilities, which includes all financial obligations, including transfer debt, staff payables, tax liabilities, trade creditors, provisions, accrued expenses and even deferred income.

The net debt reported in an English club’s financial statement is in line with IFRS (International Financial Reporting Standards) and essentially covers purely financial obligations, such as overdrafts, bank loans, bonds, shareholder loans and finance leases less cash.

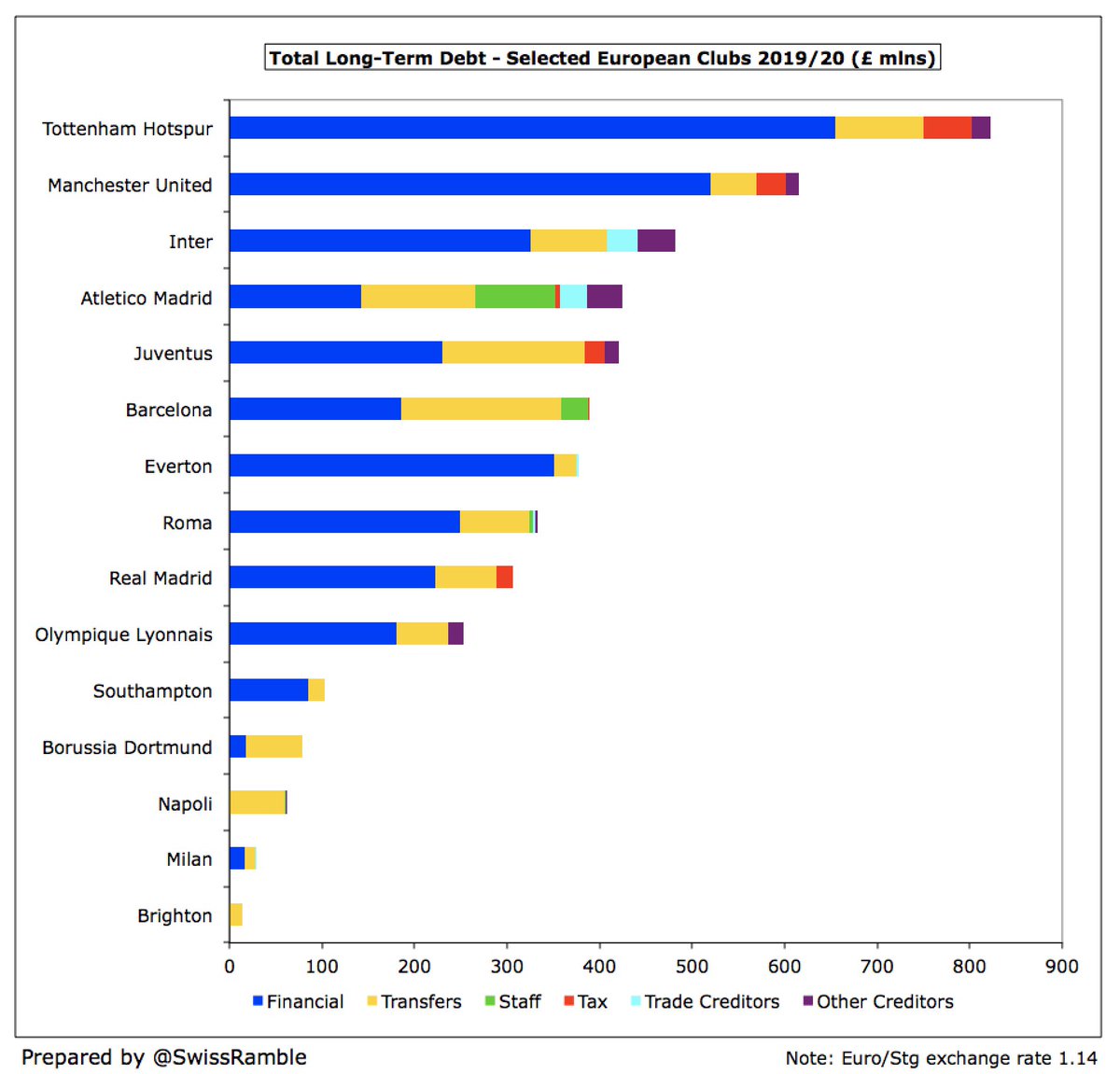

On that basis, #THFC has gross debt of £831m (primarily to fund the new stadium), followed by #MUFC £526m (Glazers’ leveraged buy-out), then #FCBarcelona £421m, #EFC £409m and #Inter £361m. #SSCNapoli have zero financial debt, while #BVB only have £28m.

Some clubs benefit from debt largely being provided by their owner, usually in the form of interest-free loans with no fixed repayment date. For example, Farhad Moshiri has provided #EFC with £350m of their £409m debt, while Tony Bloom has funded £304m of #BHAFC £306m debt.

Gross debt is offset by large cash balances in some cases: #THFC £226m, #FCBarcelona £142m, #RealMadrid £118m and #SSCNapoli £109m. On the other hand, #Milan, #Juventus, #BHAFC and #BVB all had less than £10m. Balances likely to be much lower now due to COVID impact on revenue.

However, many clubs still had significant net financial debt. Excluding those funded by owners, highest are #THFC £605m, #MUFC £474m, #Juventus £342m, #Inter £283m, #FCBarcelona £279m and #ASRoma £263m. Barca don’t look too bad here, but we shall later see why thy are in trouble.

An increasingly important element in a club’s business model is transfer debt. In most cases, these payables are not overdue, but in line with the payment schedule agreed between the respective clubs for transfer fees. Clubs have payables, receivables and net transfer debt.

European clubs have been financing transfers in this way for years, so no surprise to see #FCBarcelona £283m, #Atleti £277m, #Juventus £264m, #Inter £182m, #RealMadrid £172m and #ASRoma £168m at the top. Highest English clubs are a fair way behind: #MUFC £149m and #THFC £140m.

However, this approach to transfers works both ways, so highest receivables (amounts owed for player sales to other clubs) are also at #Juventus £260m, #FCBarcelona £147m, #Inter £107m, #SSCNapoli £96m and #RealMadrid £80m. Again, the highest English club here is #MUFC with £58m.

Consequently, there are only 4 clubs here with a net transfer debt above £100m. #Atleti had by far the highest with a hefty £230m, followed by #FCBarcelona £136m, #ASRoma £119m and #THFC £114m (which explains how they funded player purchases during the stadium development).

UEFA have introduced another definition of debt, effectively between the narrow calculation used in annual accounts and the widest possible measure of total liabilities. This includes net debt for borrowings (i.e. bank loans, overdrafts and owner loans) plus net transfer debt.

With this UEFA definition, 5 clubs have over half a billion of gross debt with the highest reported at #THFC £970m, followed by #FCBarcelona £704m, #MUFC £675m, #Juventus £611m and #Inter £543m. 4 clubs below £200m: #Milan £168m, #SaintsFC £146m, #BVB £134m and #SSCNapoli £126m.

The other side of the coin is cash and transfer receivables. The highest balances here are at #FCBarcelona £289m, #Juventus £265m, #THFC £252m, #SSCNapoli £205m, #RealMadrid £198m and #Inter £184m.

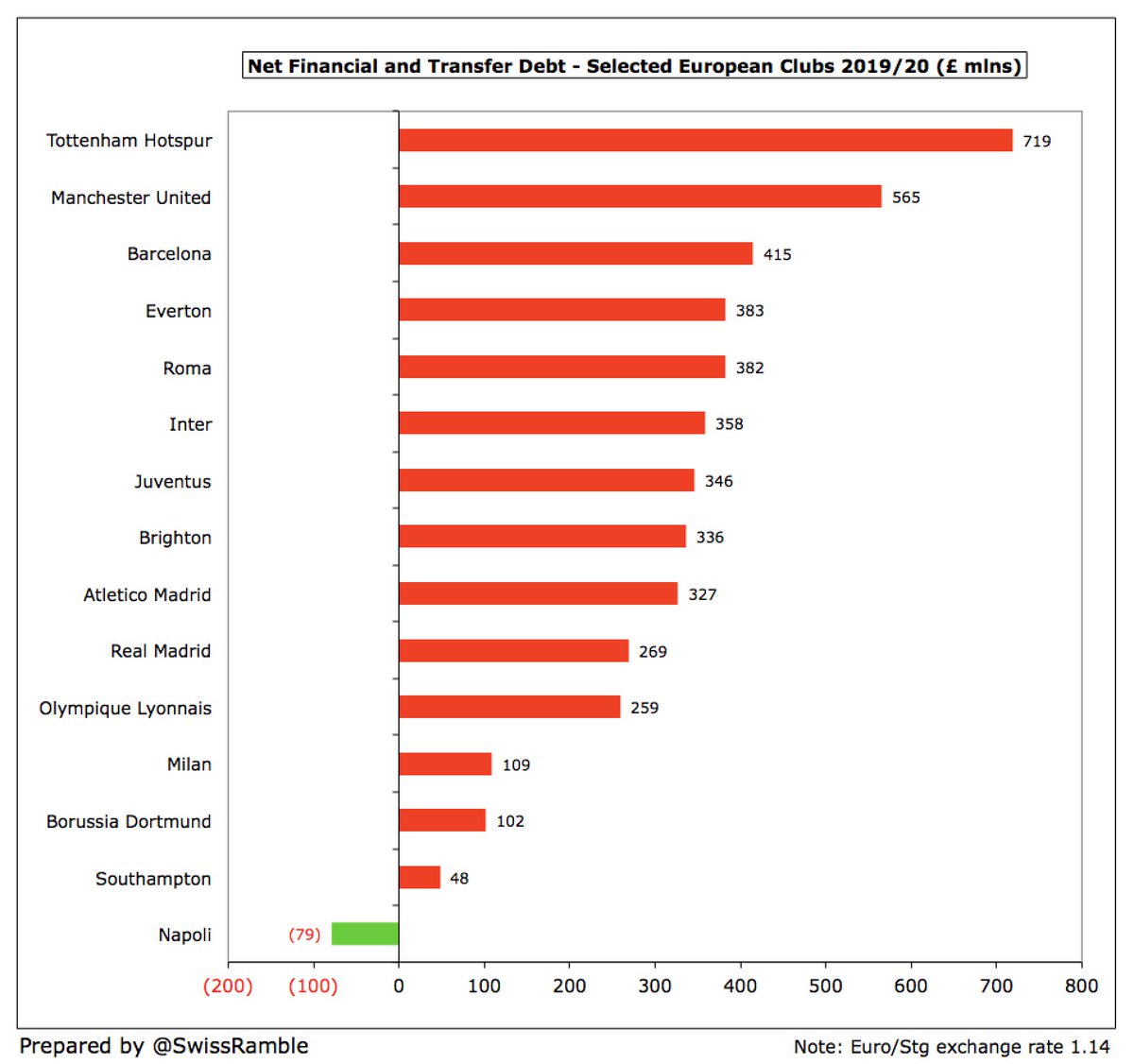

Using UEFA’s definition of net financial and transfer debt, the highest amounts owed are actually at two English clubs, namely #THFC £719m and #MUFC £565m, with #FCBarcelona in third place with “only” £415m. So, again, why is debt such an issue at Barca?

One reason why #FCBarcelona have more problems with debt than the English clubs is that so much of it is short-term, i.e. needs to be repaid within the next 12 months. £346m of Barca’s £704m is short-term, while for #THFC it is only £220m of £970m, and for #MUFC £105m of £675m.

#FCBarcelona £346m short-term debt is by far the highest, comprising £236m bank loans and £111m transfer fees. The next highest, #BHAFC, is a technicality, as the owner’s loans are repayable on demand. The closest equivalent is really #Juventus, £119m lower than Barca with £227m.

The reason that debt is not so immediately problematic for the leading English clubs is that so much of it is structured via long-term financing, e.g. #THFC have nearly a billion in financial/transfer debt, but £750m is long-term with average maturity in 23 years for bank loans.

Another problem for football clubs is that debt has steeply increased since the pandemic struck. This is particularly the case in Spain. Looking at bank loans and transfer debt combined, there has been staggering growth: #RealMadrid £314m, #FCBarcelona £237m and #Atleti £135m.

Largest year-on-year growth in financial debt was #RealMadrid £244m (including stadium development loan), #FCBarcelona £182m & #THFC £176m (low interest loan from government COVID facility). In contrast, #Juventus and #Inter reduced financial debt by £68m and £44m respectively.

Largest year-on-year growth in transfer debt was #Atleti £139m, #TeamOL £83m, #RealMadrid £70m and #Juventus £70m. On the other hand, there were decent reductions in transfer payables at #Milan £56m, #MUFC £38m and #SaintsFC £34m.

However, that’s not the end of the story. For total debt, we also need to include other operational debt: (a) wages owed to staff; (b) money owed to tax authorities; (c) trade creditors, i.e. amounts outstanding for things like rent & electricity; (d) other creditors.

This is where the figures get really concerning. Two clubs have more than a billion of total debt: #THFC £1,177m and #FCBarcelona £1,030m. They are followed by #Atleti £804m, #MUFC £771m, #Inter £757m and #Juventus £752m.

Finally, this highlights why #FCBarcelona have more of a debt problem than other clubs, as they have by far the highest short-term debt of £641m, far above #Atleti £379m, #THFC £355m and #RealMadrid £344m. Barca include £149m wages and £48m tax debt.

It also explains why the English clubs have less of a debt problems, even though their debt is among the highest around, as much of it is long-term in nature. Specifically, #THFC and #MUFC have the most long-term total debt with £823m and £615m respectively.

Spanish clubs often pay wages twice a year, so their high cash balances when accounts are published end-June can be misleading, as the money is largely needed to make payroll. Therefore, they have high staff debt: #FCBarcelona £180m, #RealMadrid £122m and #Atleti £86m.

“But there’s one more thing”, as Steve Jobs used to say. The broadest definition of debt is total liabilities, which also includes: (a) accruals, where no invoice has been received; and (b) provisions, which are estimate of probable future losses, e.g. legal claims.

Also includes deferred income for payments received for services not yet provided, e.g. season ticket revenue for matches to be played in future. Booked as a liability, as cash received has not yet being fully earned, but it is clearly not a debt that will have to be repaid.

Therefore, total liabilities is a somewhat academic definition of debt, but for the purposes of completeness, this metric shows that #THFC have the highest liabilities with £1.5 bln, followed by #FCBarcelona £1.3 bln and #MUFC £1.0 bln.

While it is important to be able to ultimately pay off debt, the ability to service the debt via interest expenses is absolutely crucial. The highest interest payments (in cash terms) in 2019/20 were #FCBarcelona £23m, #MUFC £20m, #ASRoma £16m, #Inter £15m and #THFC £14m.

That concludes “Everything you always wanted to know about debt, but were afraid to ask”. Debt is a four-letter word, but it has many different meanings. It’s not just that #FCBarcelona debt is so high, but much of it is short-term, hence the need to restructure repayment.

Read on Twitter

Read on Twitter