A thread on $RTP - @hippo_insurance <SPAC Rumor> from Bloomberg. There are multiple threads on the company, and I wanted to give you my own experience in the space and why I am excited.

$RTP: Background @reidhoffman (founder, LinkedIn) @markpinc (founder, Zynga) and Michael Thompson (Hedge Fund manager) raised $600M in Sep 2020

https://www.nytimes.com/2020/09/18/business/dealbook/hoffman-pincus-spac.html

The stock is at $13.45 AH on rumors that it is looking to merge with @hippo_insurance a home insurance company

https://www.nytimes.com/2020/09/18/business/dealbook/hoffman-pincus-spac.html

The stock is at $13.45 AH on rumors that it is looking to merge with @hippo_insurance a home insurance company

In 2014-2015 I was running the $MSFT Ventures accelerator program in Seattle, with a focus on Home Automation IoT

We partnered with @amfam one of the top 10 companies in home insurance to find home automation companies.

https://startups.microsoft.com/zh-cn/blog/10-startups-take-the-stage-at-seattle-accelerator-home-automation-demo-day/

We partnered with @amfam one of the top 10 companies in home insurance to find home automation companies.

https://startups.microsoft.com/zh-cn/blog/10-startups-take-the-stage-at-seattle-accelerator-home-automation-demo-day/

The idea behind the accelerator was to find new ways and means to revolutionize the home insurance business.

I worked alongside @DanielKReed , @kylenakatsuji (founder Clear Cover) and @patrickklas - all from AmFam https://news.microsoft.com/2014/06/17/microsoft-and-american-family-insurance-launch-startup-accelerator-focused-on-home-automation/

I worked alongside @DanielKReed , @kylenakatsuji (founder Clear Cover) and @patrickklas - all from AmFam https://news.microsoft.com/2014/06/17/microsoft-and-american-family-insurance-launch-startup-accelerator-focused-on-home-automation/

We evaluated about 200 companies and chose 10 for an intense 3 month program. Companies that monitor the home, detect leaks, manage home energy appliances - anything that allowed AmFam to price risk better and lower it so premiums lower.

The home insurance market falls into P&C Property and Casualty insurance segment. There are SFH (single family homes) and rentals (apartments) @hippo_insurance has "chosen" to start at SFH

There are 82.6M single detached homes in the US

https://www.statista.com/statistics/1072414/number-of-detached-single-family-homes-north-america-timeline/

There are 82.6M single detached homes in the US

https://www.statista.com/statistics/1072414/number-of-detached-single-family-homes-north-america-timeline/

Of these 82M+ homes, there are 70+M insured homes. The rest either have not purchased it or do not qualify

https://www.iii.org/insuranceindustryblog/how-many-homes-are-insured-how-many-are-uninsured/

https://www.iii.org/insuranceindustryblog/how-many-homes-are-insured-how-many-are-uninsured/

The average US home insurance premium is about $1083 per year per home, and the overall market is over $106Billion. This is a gigantic market. https://www.valuepenguin.com/home-insurance-statistics

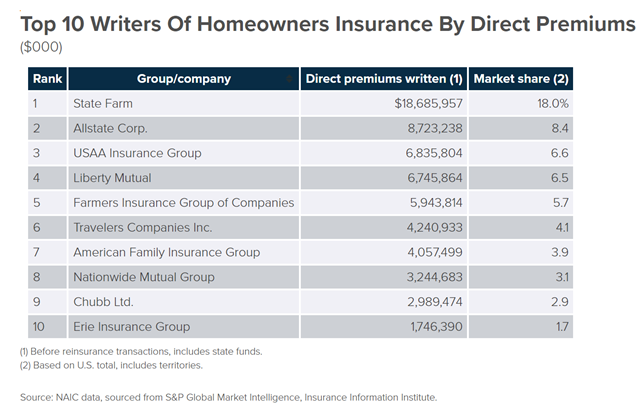

The market has over 100 companies. The 20 largest homeowners insurance companies in North America account for more than 70% of the market.

Statefarm, Allstate, USAA, Liberty Mutual and Farmers are the top 5

Statefarm, Allstate, USAA, Liberty Mutual and Farmers are the top 5

Notice that the #20 player had $850M in premiums and 0.8% market share. That means if someone gets 1% market share, they are a $1B revenue company. Again, this is a large market.

The market dynamics:

1. Consumers rarely change home insurance, unlike $LMND and apartment homes, where churn is higher, the average homeowner sticks with their insurance for 7 years.

2. Consumers worry about price, coverage and claims

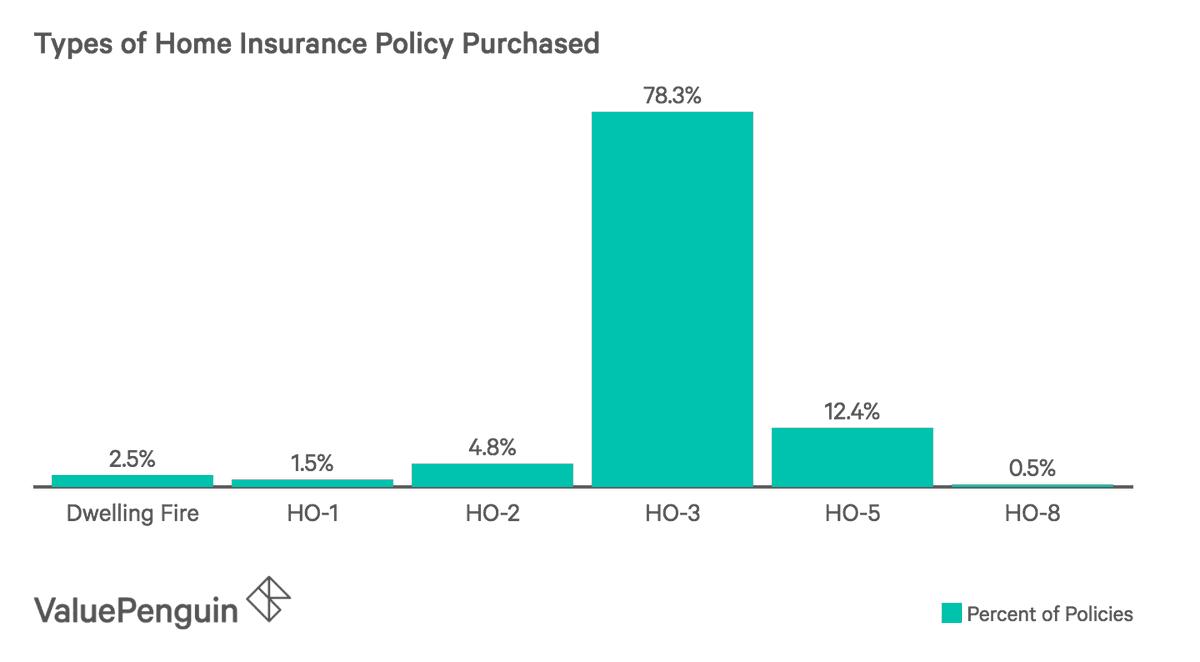

3. Most consumers buy HO-3 coverage

1. Consumers rarely change home insurance, unlike $LMND and apartment homes, where churn is higher, the average homeowner sticks with their insurance for 7 years.

2. Consumers worry about price, coverage and claims

3. Most consumers buy HO-3 coverage

HO-3 is for not just a house, but its contents and the owner's liability.

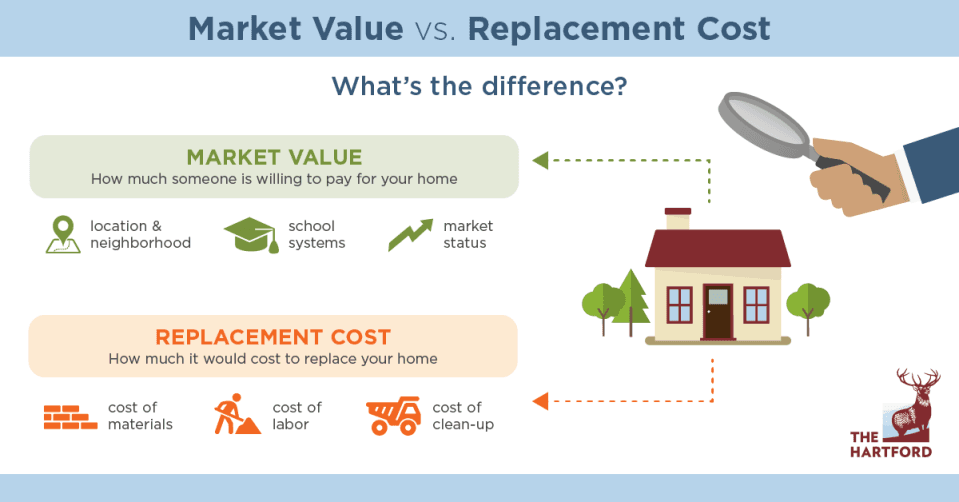

Many policyholders believe the amount of dwelling coverage they have is correlated to their home's real estate market value, when instead it's tied to the home's cost to rebuild.

https://www.valuepenguin.com/home-insurance-statistics

Many policyholders believe the amount of dwelling coverage they have is correlated to their home's real estate market value, when instead it's tied to the home's cost to rebuild.

https://www.valuepenguin.com/home-insurance-statistics

Consumers find insurance a) Complicated to understand - too few of them understand what they are buying, b) Cumbersome - you have to answer 120+ questions and c) painful to get claims completed

So the insights gathered about a) convenience, b) simplicity and c) Speed matter

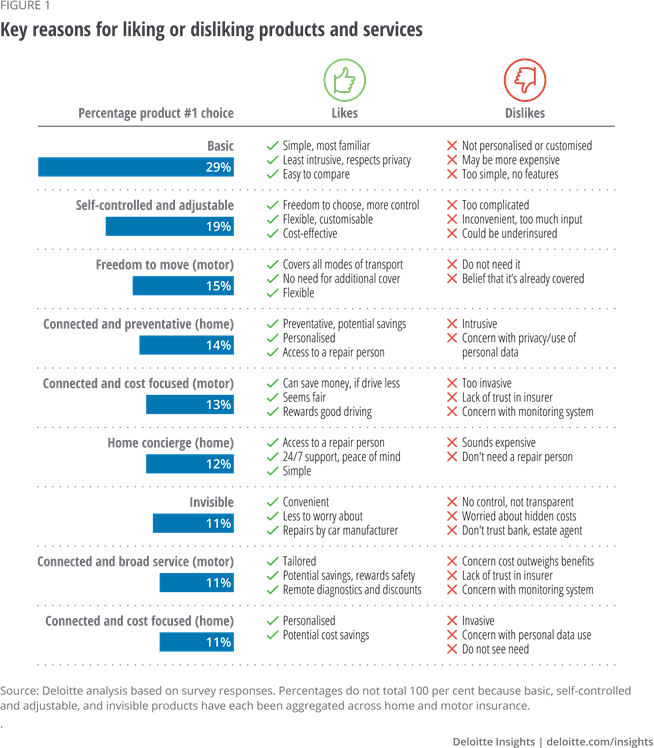

For home insurance consumers want: Easy to understand policies, Price, convenience of purchase (internet), quick claims response https://www2.deloitte.com/us/en/insights/industry/financial-services/future-of-insurance-survey.html

For home insurance consumers want: Easy to understand policies, Price, convenience of purchase (internet), quick claims response https://www2.deloitte.com/us/en/insights/industry/financial-services/future-of-insurance-survey.html

Consumers still buy most of their insurance "offline" - phone or in person, but that's changing.

Consumer preferences on where to buy insurance:

Phone 24%,

In person 26%,

Computer 38% and

Mobile 11% https://www2.deloitte.com/us/en/insights/industry/financial-services/future-of-insurance-survey.html

Consumer preferences on where to buy insurance:

Phone 24%,

In person 26%,

Computer 38% and

Mobile 11% https://www2.deloitte.com/us/en/insights/industry/financial-services/future-of-insurance-survey.html

So if you want to create a "great" home owners insurance product you focus on

a) Speed to quote,

b) Convenience - few questions, etc. and

c) superior customer experience

All at a compelling price.

a) Speed to quote,

b) Convenience - few questions, etc. and

c) superior customer experience

All at a compelling price.

The end of this equation is "claims".

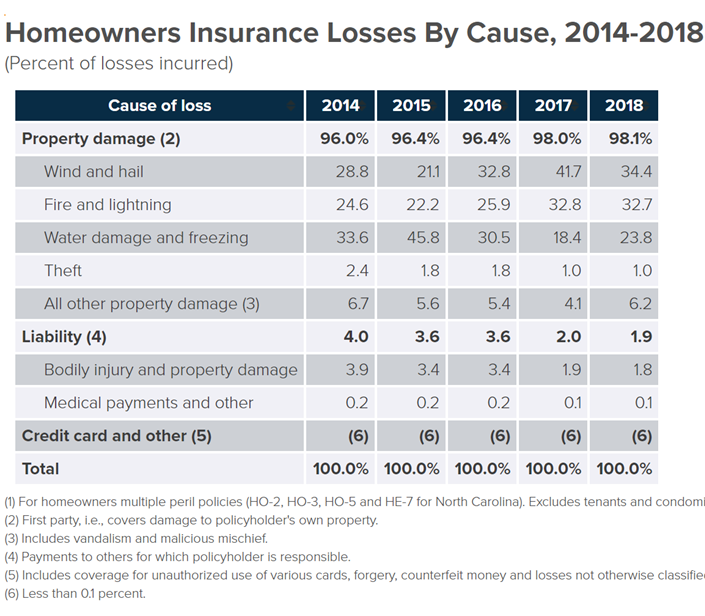

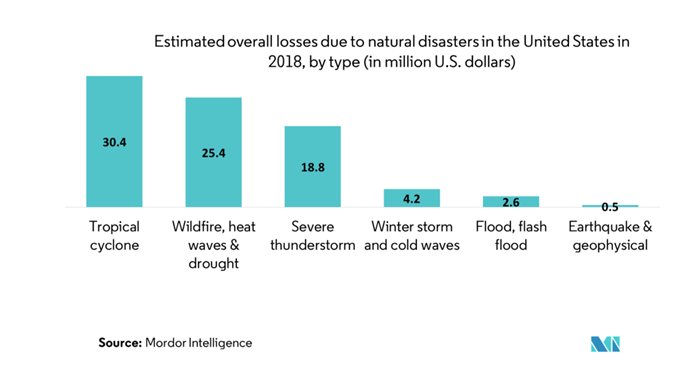

Most claims that can be "managed well" - meaning, not caused by forces of nature are Fire and Water damage.

Most claims that can be "managed well" - meaning, not caused by forces of nature are Fire and Water damage.

About 1 in 20 home policy owners file for claims each year and 27% at the low end are "avoidable" with early alerts, alarms and IoT (Internet of things) in the home.

Home insurance companies have realized the value of IoT for preventing claims, and customers can take advantage of partnerships between insurers and device makers to get a cheaper policy.

E.g. Farmers working with $AMZN Alexa for property monitoring etc.

https://www.nsinsurance.com/news/internet-of-things-insurance/

E.g. Farmers working with $AMZN Alexa for property monitoring etc.

https://www.nsinsurance.com/news/internet-of-things-insurance/

E.g. 2:

In the US alone, homeowners file more than 14,000 water damage claims per day, averaging between $6,000 and $15,000 each and totaling up to $123 million in preventable damages daily across the country. https://www.insurancebusinessmag.com/us/news/technology/is-this-the-future-of-home-insurance-claims-prevention-88826.aspx

In the US alone, homeowners file more than 14,000 water damage claims per day, averaging between $6,000 and $15,000 each and totaling up to $123 million in preventable damages daily across the country. https://www.insurancebusinessmag.com/us/news/technology/is-this-the-future-of-home-insurance-claims-prevention-88826.aspx

4reasons why people change:

•Affordable Prices: lower premium at similar coverage

•Better Service: experience a higher level of support.

• Special Discounts/Smarter Service: applying all the discounts

• Better Coverage: add-on or endorsement https://www.youngalfred.com/homeowners-insurance/can-i-change-my-home-insurance-policy-in-the-middle-of-the-year

•Affordable Prices: lower premium at similar coverage

•Better Service: experience a higher level of support.

• Special Discounts/Smarter Service: applying all the discounts

• Better Coverage: add-on or endorsement https://www.youngalfred.com/homeowners-insurance/can-i-change-my-home-insurance-policy-in-the-middle-of-the-year

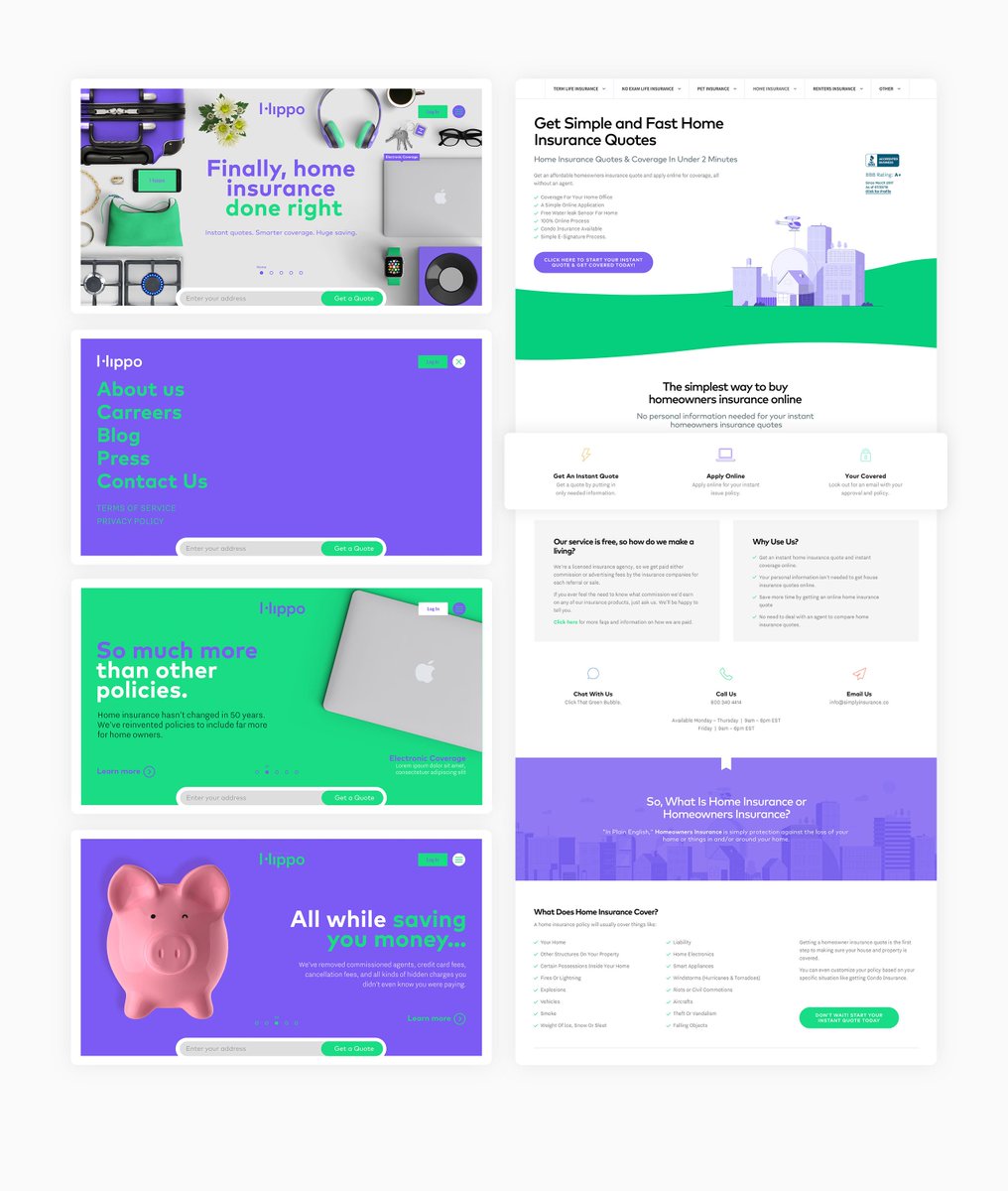

Given these insights, Assaf Wand worked with Eyal Navon to start Hippo in 2015. They worked to make home insurance a) less expensive, b) more service oriented and c) use technology to improve the customer experience

This is not just pretty UX, like $LMND https://www.fastcompany.com/90124021/what-does-it-take-to-remake-the-ux-of-a-90-billion-industry

This is not just pretty UX, like $LMND https://www.fastcompany.com/90124021/what-does-it-take-to-remake-the-ux-of-a-90-billion-industry

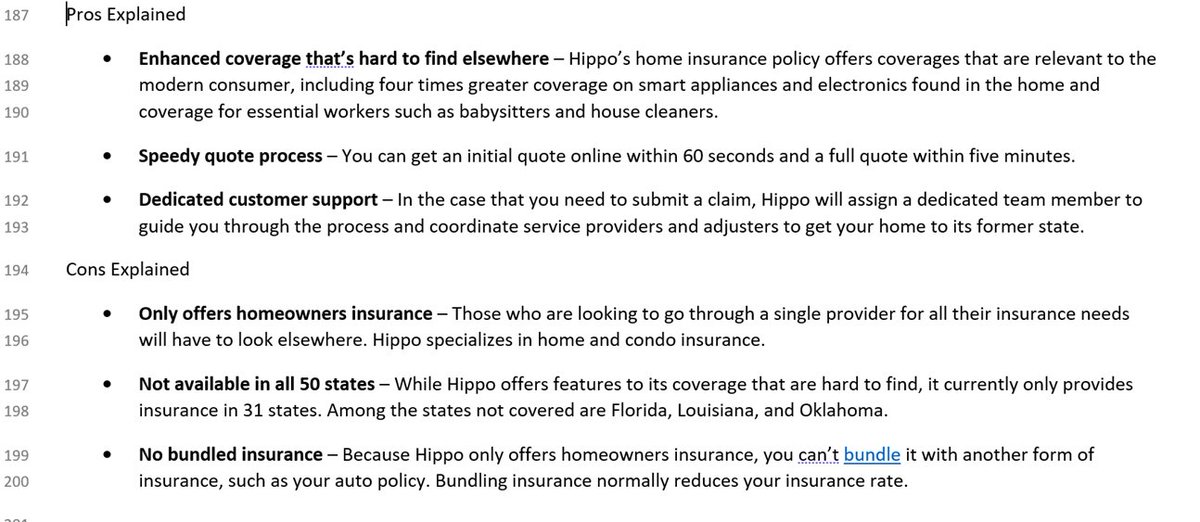

Hippo offers homeowners (H03) and condo insurance (H060), managing product design, pricing, underwriting, marketing and support, as well as the technology and data platforms that power its service.

It partners with TOPA Insurance and Swiss RE in CA and others

It partners with TOPA Insurance and Swiss RE in CA and others

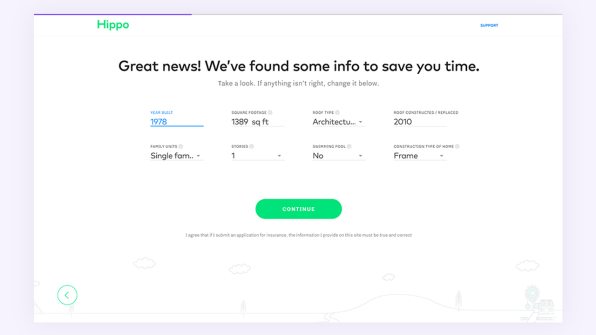

By leveraging data, Hippo saves customers time, while also garnering more accurate information that cannot be provided from subjective human answers alone.

It collects satellite images, home details, and 100's of other data points to give you a personalized quote in <60 secs

It collects satellite images, home details, and 100's of other data points to give you a personalized quote in <60 secs

Hippo also developed a strategy that relies on connected, smart home sensors and IOT data to identify and prevent damage before it occurs. Policyholders will receive a free, advanced water leak detector that sends digital alerts at the first sign of water damage

Lets summarize:

1. Faster quotes (<60 seconds)

2. Personalized quotes (based on few questions with lots of backend data collected and learning applied)

3. Convenient (Mobile app / Web)

1. Faster quotes (<60 seconds)

2. Personalized quotes (based on few questions with lots of backend data collected and learning applied)

3. Convenient (Mobile app / Web)

That's usually not enough. That's now become table stakes and the large companies such as StateFarm and Allstate can get there soon enough.

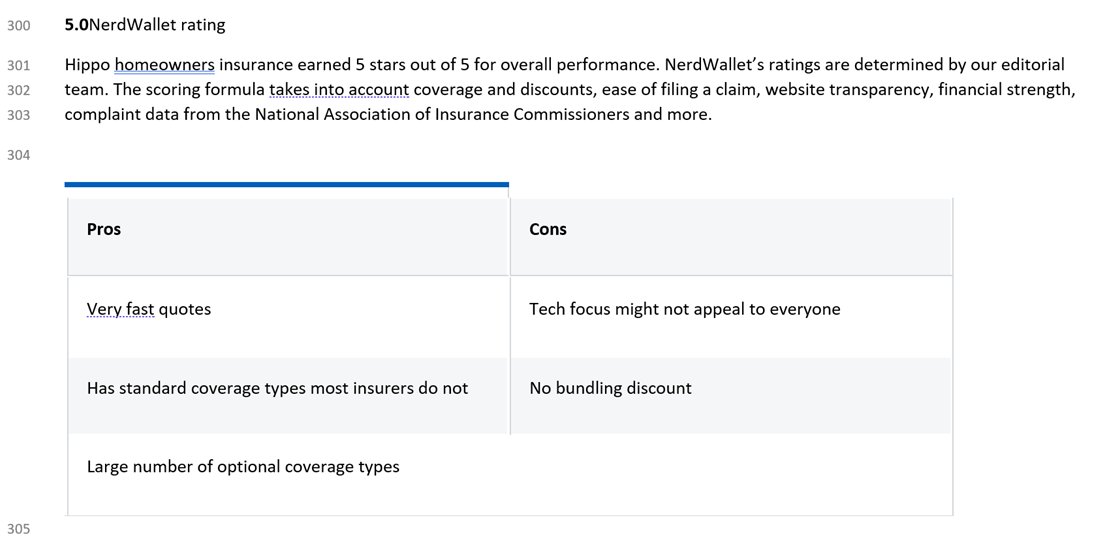

Here is the list of their Pros and Cons that I got from 2 customers

Here is the list of their Pros and Cons that I got from 2 customers

This has resulted in $700M of funding raised over the last 5 years. Most recently $350M at over $1.5B in valuation on Nov 2020

Even in the midst of a pandemic, Hippo has seen significant growth.

In July 2020, the company’s total written premiums reached $270 million, a 140 percent increase year over year. In the second quarter, Hippo’s sales increased by 60 percent year over year.

In July 2020, the company’s total written premiums reached $270 million, a 140 percent increase year over year. In the second quarter, Hippo’s sales increased by 60 percent year over year.

The company actively reviews changes to a customer’s property over time, using thermal and satellite imagery and layers in AI, machine learning and public records.

This is ongoing tracking, managing and monitoring. Not set it and forget it like older insurance carriers.

This is ongoing tracking, managing and monitoring. Not set it and forget it like older insurance carriers.

Enter your address, and you see a prefilled form detailing exactly how your home was built: how many square feet, when your roof was made, what’s its made of, what type of frame your house has.

For example, it might use its data sets to discern all the ways that different types of home damage are correlated, and how your home is likely to age. Shockingly, this isn’t how home insurance is done today.

http://thuifr.pbcsf.tsinghua.edu.cn/629.html

http://thuifr.pbcsf.tsinghua.edu.cn/629.html

This has resulted in customers giving Hippo top ratings 5/5 with high NPS scores on sites such as NerdWallet, other review sites online

Summarizing:

1. Insight: Speed, Convenience, Great customer experience AT A LOWER COST with higher coverage

2. Team that built technology based on data to scale the customer onboarding

3. Technology to price and monitor the home better

=

Rapid Growth, Setup for success

1. Insight: Speed, Convenience, Great customer experience AT A LOWER COST with higher coverage

2. Team that built technology based on data to scale the customer onboarding

3. Technology to price and monitor the home better

=

Rapid Growth, Setup for success

Summarizing

2. Team that understand the customer view of insurance, has used data and tech to envision the experience, rather that just a better front-end user experience

2. Team that understand the customer view of insurance, has used data and tech to envision the experience, rather that just a better front-end user experience

Summarizing

3. Product is compelling, differentiated (it takes 10X less time and costs about 20-25% less)

Technology platform has been built to scale and acquire customers rapidly

3. Product is compelling, differentiated (it takes 10X less time and costs about 20-25% less)

Technology platform has been built to scale and acquire customers rapidly

I think @reidhoffman chose this among other plays so he can coach the entrepreneur and CEO on how to now blitzscale customer acquisition since the "Back end" is ready to scale to millions of customers.

blitzscaling is prioritizing speed over efficiency in the face of uncertainty.

blitzscaling is prioritizing speed over efficiency in the face of uncertainty.

Financials: <until we get data these are sourced from 3rd parties so keep that in mind>

1. $270M in premiums Jul 2020 reported

2. Growing at over 100% in July 2020

3. Valued at over $3.5 B in its last round (caveats - not sure about liquidation preferences, warrants, etc.)

1. $270M in premiums Jul 2020 reported

2. Growing at over 100% in July 2020

3. Valued at over $3.5 B in its last round (caveats - not sure about liquidation preferences, warrants, etc.)

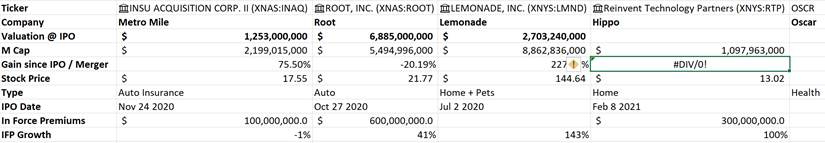

Comparables:

1. $INAQ (Metromile) $2.9B, $100M direct premium Q3, growing at -2% for 2020 (miles driven is down)

2. $LMND $8.7B, $188M IFP, growing 140%

3. $ROOT $5.4B, $600M IFP growing 41%

Older P&C insurers (e.g. Statefarm "growing" -1% or Progressive growing at 14.7%

1. $INAQ (Metromile) $2.9B, $100M direct premium Q3, growing at -2% for 2020 (miles driven is down)

2. $LMND $8.7B, $188M IFP, growing 140%

3. $ROOT $5.4B, $600M IFP growing 41%

Older P&C insurers (e.g. Statefarm "growing" -1% or Progressive growing at 14.7%

Given the 3 things:

1. Super star board - Reid, Mark Pinkus

2. Previous round valuation of $3.5B

3. Growth and IFP

4. Technology platform

I "expect" it to be valued at < $5B - $7B Pro Forma OR EV

1. Super star board - Reid, Mark Pinkus

2. Previous round valuation of $3.5B

3. Growth and IFP

4. Technology platform

I "expect" it to be valued at < $5B - $7B Pro Forma OR EV

If $RTP Hippo is valued at $5 - $7B in EV, then with $1B in raised capital to the balance sheet expect Pro forma to be $6B - $8B

They are "slightly" to "very much" bigger than $LMND with some good differentiation in technology, so expect them to get a premium over $LMND

They are "slightly" to "very much" bigger than $LMND with some good differentiation in technology, so expect them to get a premium over $LMND

I like $LMND but I also have an "opinion" based on data that is is over valued. That does not mean anything however. The stock is at $144.

So I expect that $RTP because of my valuation to hit $17 - $18 if the merger is announced and Pro Forma Valuation is < $6B

So I expect that $RTP because of my valuation to hit $17 - $18 if the merger is announced and Pro Forma Valuation is < $6B

Risks:

1. Valuation. Valuation. Valuation.

2. Dont know lots of their metrics - underwriting profitability

3. Reinsurance costs. Every insurer "reinsurers" - we dont know how much they pay for that

4. Marketing & growth - will get be able to acquire customers fast?

1. Valuation. Valuation. Valuation.

2. Dont know lots of their metrics - underwriting profitability

3. Reinsurance costs. Every insurer "reinsurers" - we dont know how much they pay for that

4. Marketing & growth - will get be able to acquire customers fast?

Read on Twitter

Read on Twitter