1/ With connectivity solved by @Chainlink and scalability in progress of being solved by L2 Rollups like @Arbitrum, I truly believe the next large hurdle for the adoption of smart contracts is solving Miner Extractable Value (MEV)

A thread https://research.paradigm.xyz/MEV

https://research.paradigm.xyz/MEV

A thread

https://research.paradigm.xyz/MEV

https://research.paradigm.xyz/MEV

2/ MEV is the value miners can extract from users through their ability to manipulate the ordering and inclusion of transactions within a block

MEV is mostly taken by third party bots today but miners will inevitably begin taking all the MEV opportunities

https://arxiv.org/abs/1904.05234

MEV is mostly taken by third party bots today but miners will inevitably begin taking all the MEV opportunities

https://arxiv.org/abs/1904.05234

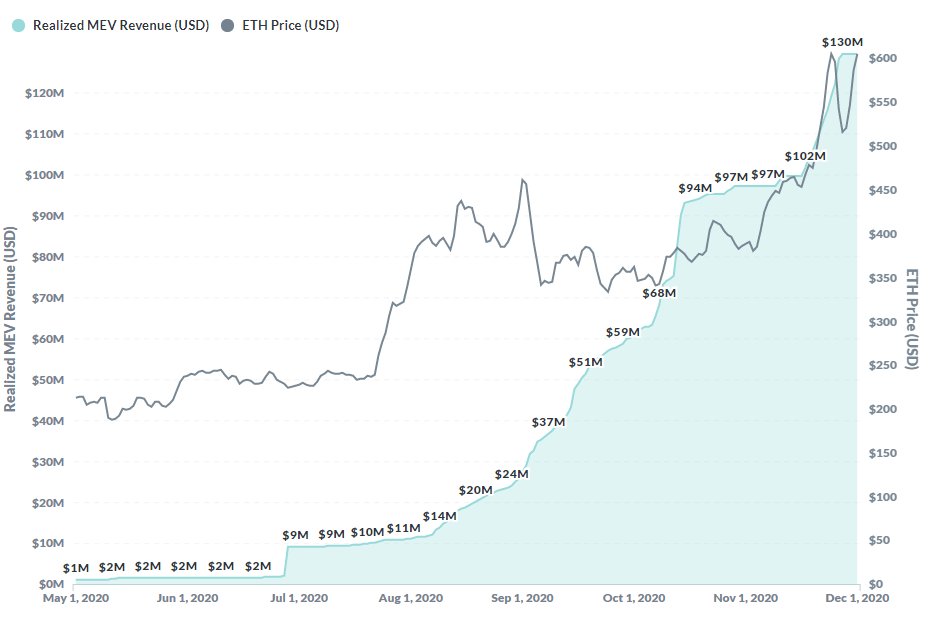

3/ MEV presents itself in various forms including arbitrage opportunities between DEXs after a large trade, as well as directly frontrunning DEX trades causing unnecessary slippage

This degrades the user experience and creates an invisible tax on users

This degrades the user experience and creates an invisible tax on users

4/ Bots compete to capture this MEV through gas price bidding wars because miners *usually* order transactions with the highest gas price first to optimise their revenue

Once miners start to take this MEV, they may begin to re-org the blockchain causing consensus instability

Once miners start to take this MEV, they may begin to re-org the blockchain causing consensus instability

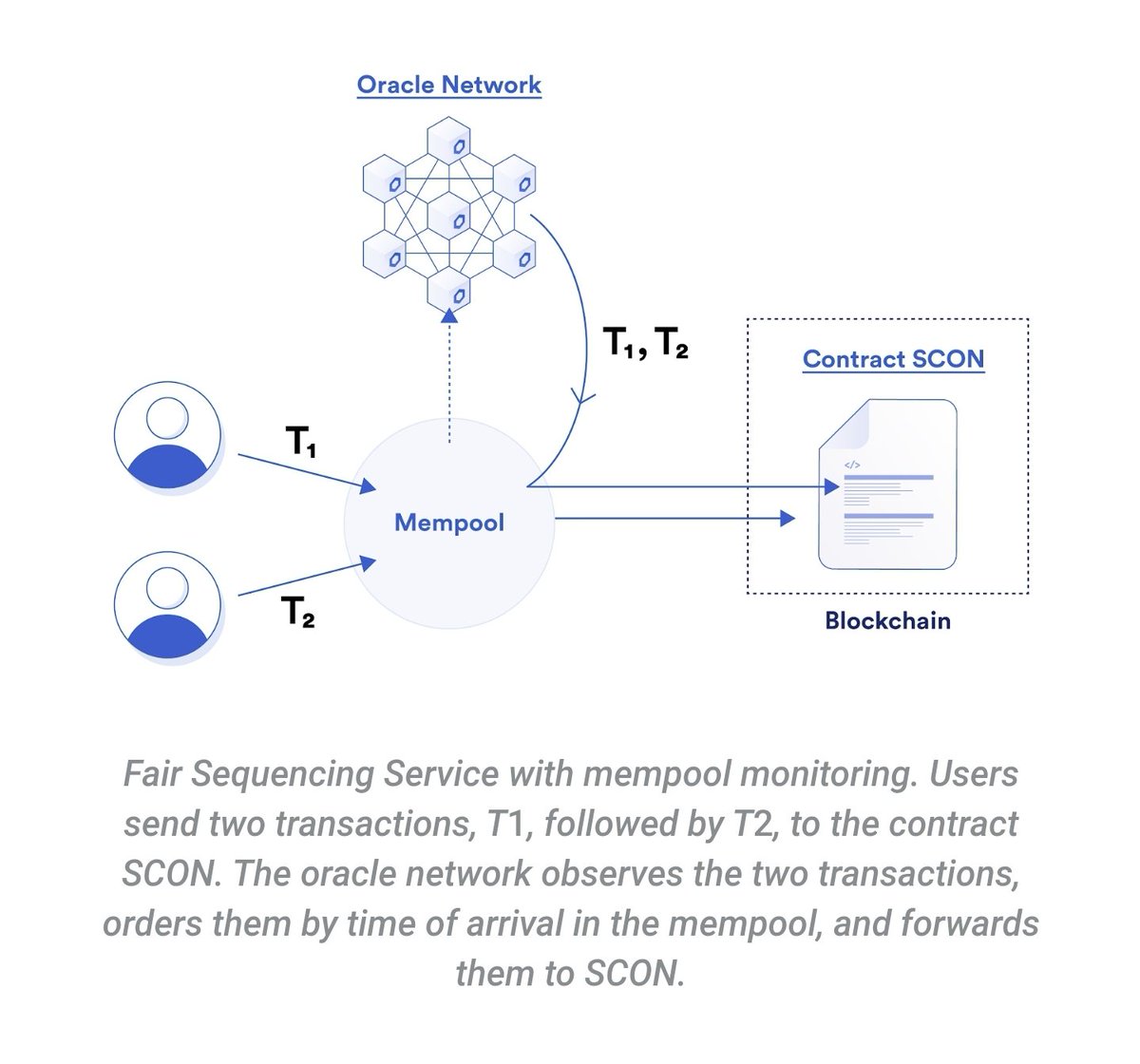

5/ A promising solution to MEV is using external oracles to determine the ordering of transactions based on an predetermined policy

This is exactly what #Chainlink Fair Sequencing Services (FSS) aims to provide for the smart contract ecosystem http://blog.chain.link/chainlink-fair-sequencing-services-enabling-a-provably-fair-defi-ecosystem

This is exactly what #Chainlink Fair Sequencing Services (FSS) aims to provide for the smart contract ecosystem http://blog.chain.link/chainlink-fair-sequencing-services-enabling-a-provably-fair-defi-ecosystem

6/ Chainlink FSS uses a decentralized oracle network to order transactions and operates without any changes to the L1 blockchain on which a smart contract operates

Unlike MEV auctions which centralizes unfair transaction ordering, FSS prevents it https://medium.com/offchainlabs/mev-auctions-considered-harmful-fa72f61a40ea

Unlike MEV auctions which centralizes unfair transaction ordering, FSS prevents it https://medium.com/offchainlabs/mev-auctions-considered-harmful-fa72f61a40ea

7/ Chainlink FSS can use any ordering policy including 'time of arrival' as well as more complex strategies such as ordering encrypted transactions which are only decrypted after

FSS is essentially a framework for implementing any ordering policy a developer wants for their SC

FSS is essentially a framework for implementing any ordering policy a developer wants for their SC

8/ FSS supports various ways in which users can submit their transactions to be ordered

The first provides legacy compatability where users make their transactions like usual to the blockchain and the oracles monitor the mempool where transactions wait to get mined on-chain

The first provides legacy compatability where users make their transactions like usual to the blockchain and the oracles monitor the mempool where transactions wait to get mined on-chain

9/ As long the transaction hits the mempool it doesn't matter how quickly the transaction is mined, as long as it *eventually* does

This allows users to submit transactions with much lower gas prices as the oracles will resubmit the transaction in an ordered batch right away

This allows users to submit transactions with much lower gas prices as the oracles will resubmit the transaction in an ordered batch right away

10/ Secondly, users can send their transactions directly to the oracle network, skipping the mempool all together

As the oracles batch ordered transactions together into a single transaction, the per-user costs are greatly reduced and can even be implemented as a Rollup

As the oracles batch ordered transactions together into a single transaction, the per-user costs are greatly reduced and can even be implemented as a Rollup

11/ Chainlink FSS supports ordering transactions for smart contracts on any L1 blockchain or L2 network

On L1, ordering is done on a contract by contract basis, but an L2 network (e.g. Arbitrum) can use FSS to order *all* transactions, enforcing fair ordering by default

On L1, ordering is done on a contract by contract basis, but an L2 network (e.g. Arbitrum) can use FSS to order *all* transactions, enforcing fair ordering by default

12/ Using Chainlink FSS to order transactions, smart contracts can prevent the frontrunning of DEX trades as well as reduce network gas costs by preventing the gas price bidding wars caused by arbitrage opportunitie

Less slippage, lower fees, and more fair applications

Less slippage, lower fees, and more fair applications

13/ Hopefully by this point it's become clear that #Chainlink oracles provide value far beyond reference price feeds

Chainlink is really a framework for creating decentralized, generalized, and trust-minimized off-chain services to boost the capabilities of any smart contracts

Chainlink is really a framework for creating decentralized, generalized, and trust-minimized off-chain services to boost the capabilities of any smart contracts

Read on Twitter

Read on Twitter