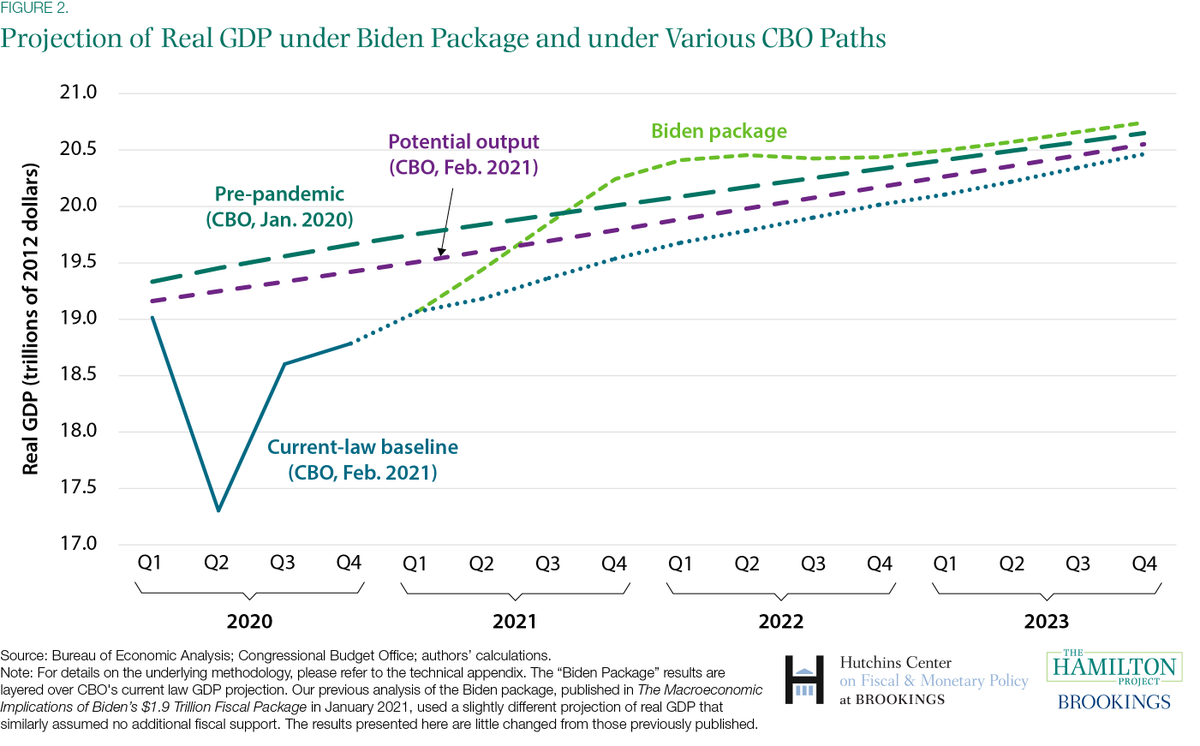

. @lsheiner and I estimate that under $1.9 T package, the + output gap relative to CBO’s potential peaks at 2.6%. As we write, many of the economic effects of the package would be welcome, but would create the risk of a harder landing than we project. 1/8 https://www.hamiltonproject.org/blog/a_macroeconomic_analysis_of_a_senate_republican_covid_relief_package

Concerns about inflation risk are not to be totally dismissed, but concerns are misplaced focusing on inflation narrowly. If we get a surge in output & big supply constraints, inflation will pop. But if it’s a surge, the increase won’t be sustained. 2/8

Still, a surge in activity boosting inflation is the same factor that could lead to a harder landing. And, the surge could be even bigger than we project if we underestimated effects of consumer spending out of pent-up savings & the increase in the stock market.3/8

In our piece, we worry about people & firms taking actions that are too permanent in response to surge (expanding into the space next door, quitting a stable job and taking new offer that turns out to be based on the surge…), leading to pain when the economy slows.4/8

Given the pop to inflation would be temporary and the Fed’s goal of average inflation targeting, it seems unlikely that Fed would slam the brakes. But, their efforts may not be enough to achieve a soft landing. The landing post-surge is really the issue: 5/8

The risks are more salient if we talk NOT about the surge – which doesn’t sound so bad – but the possibility of tumbling down the mountain on the other side. 6/8

Highest priority is passing something very quickly that is large enough to meet the crisis. Ask me what my perfect package looks like: I will suggest something too technical that we can’t implement quickly. So, that's not so helpful. 7/8

Realistic changes to $1.9T plan that lessen risks but still ensure critical relief & support? I’m no expert in piloting political crosscurrents. Still: pin more parts to recovery (make enhanced UI depend on labor mkt recovery) & slow the fed outlays not targeting urgent needs.8/8

Read on Twitter

Read on Twitter