We have started to like $OPEN after the recent dip. Some analysis

@jablamsky @LDRcalital @OysonMike @saxena_puru @MadMraket @chamath @Dividend_Dollar @GetBenchmarkCo @ryelvigi

@jablamsky @LDRcalital @OysonMike @saxena_puru @MadMraket @chamath @Dividend_Dollar @GetBenchmarkCo @ryelvigi

Business Model

@Opendoor is an online real estate platform that aims to be a one-stop digital shop to buy, sell, and finance real estate.

The process is simple. Submit your house address and information, make a video call from your phone to show your home, and receive an offer

@Opendoor is an online real estate platform that aims to be a one-stop digital shop to buy, sell, and finance real estate.

The process is simple. Submit your house address and information, make a video call from your phone to show your home, and receive an offer

Is timing right for RE disruption?

Lack of resale inventory and new home expansion - constrained supply.

Lack of resale inventory and new home expansion - constrained supply.

Increasing state taxes and elimination of SALT deductions - creating relocation decisions.

Increasing state taxes and elimination of SALT deductions - creating relocation decisions.

WFH

WFH

Millennials entering housing market.

Millennials entering housing market.

Near-Zero interest rate for long

Near-Zero interest rate for long

Lack of resale inventory and new home expansion - constrained supply.

Lack of resale inventory and new home expansion - constrained supply. Increasing state taxes and elimination of SALT deductions - creating relocation decisions.

Increasing state taxes and elimination of SALT deductions - creating relocation decisions. WFH

WFH Millennials entering housing market.

Millennials entering housing market. Near-Zero interest rate for long

Near-Zero interest rate for long

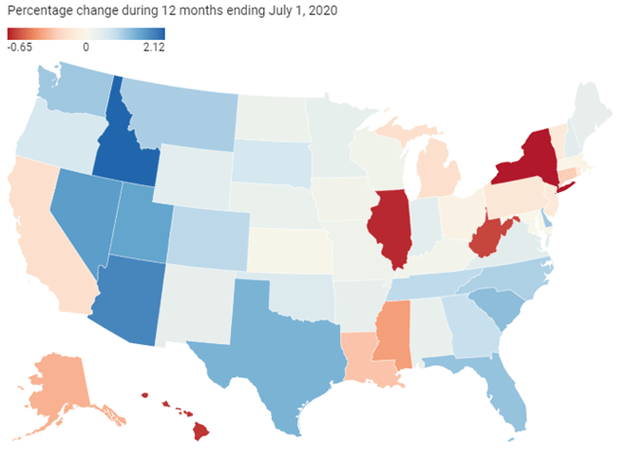

Big highly-populated and expensive estates like New York, Illinois, and California have lost people due to the moving of part of the population to other states Opendoor can use this tailwind to grow

Big highly-populated and expensive estates like New York, Illinois, and California have lost people due to the moving of part of the population to other states Opendoor can use this tailwind to grow Post-COVID recovery

Post-COVID recovery

Opendoor is leading this race selling 4.4x more houses than the second competitor in 2019. Zillow, Honesnap, etc

Opendoor is leading this race selling 4.4x more houses than the second competitor in 2019. Zillow, Honesnap, etc First mover advantage doesn't guarantee moat, we are at risk of going into a very competitive space.

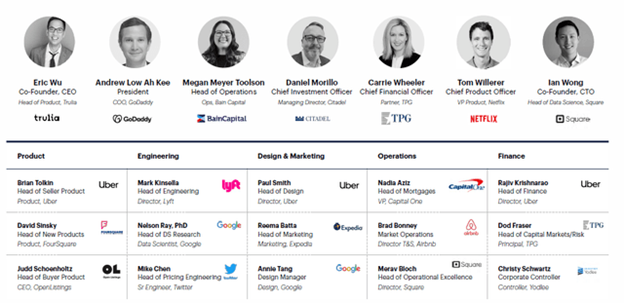

First mover advantage doesn't guarantee moat, we are at risk of going into a very competitive space.  Solid Management- Wu co-founded RentAdvisor and Movity

Solid Management- Wu co-founded RentAdvisor and Movity

Currently, the company is present in 21 cities with a market share of 2%. They aim to get into 100 new markets and obtain a 4% market share.

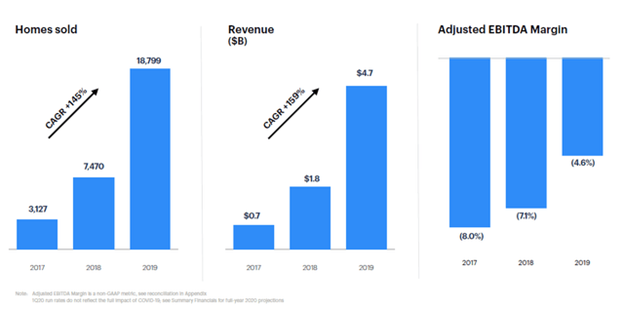

Currently, the company is present in 21 cities with a market share of 2%. They aim to get into 100 new markets and obtain a 4% market share. Excellent annual growth rate of +145% homes sold and +159% in 2020 revenues

Excellent annual growth rate of +145% homes sold and +159% in 2020 revenues The company is expected to be EBITDA positive in 2023

The company is expected to be EBITDA positive in 2023

Some themes to monitor

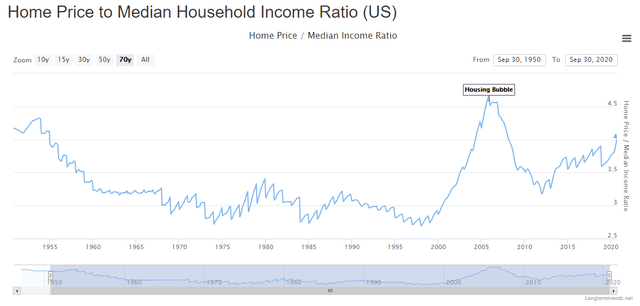

Opendoor margins are too tight, and variations in property prices could drastically affect them

Opendoor margins are too tight, and variations in property prices could drastically affect them

House prices are typically three times the average annual income. Amidst the housing bubble of 2006, the ratio reached 4.65. The ratio is currently at 3.99

House prices are typically three times the average annual income. Amidst the housing bubble of 2006, the ratio reached 4.65. The ratio is currently at 3.99

Opendoor margins are too tight, and variations in property prices could drastically affect them

Opendoor margins are too tight, and variations in property prices could drastically affect them House prices are typically three times the average annual income. Amidst the housing bubble of 2006, the ratio reached 4.65. The ratio is currently at 3.99

House prices are typically three times the average annual income. Amidst the housing bubble of 2006, the ratio reached 4.65. The ratio is currently at 3.99

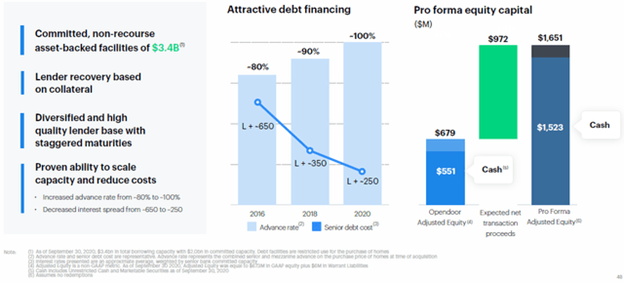

The core business of OPEN requires lots of cash. While debt management seems currently well structured, it is an element that we have to keep reviewing along with the average hold time of owned listed properties that is presently three to four months.

The core business of OPEN requires lots of cash. While debt management seems currently well structured, it is an element that we have to keep reviewing along with the average hold time of owned listed properties that is presently three to four months.

Valuation Assumption

$3,5bn revenues in 2021

$9,8bn revenues and EBITDA Breakeven in 2028

We are factoring 60% EBITDA to FCFE (Free Cash Flow to Equity) - "flipping housing" in the Open business model. means a higher level of operating leverage and working capital

$3,5bn revenues in 2021

$9,8bn revenues and EBITDA Breakeven in 2028

We are factoring 60% EBITDA to FCFE (Free Cash Flow to Equity) - "flipping housing" in the Open business model. means a higher level of operating leverage and working capital

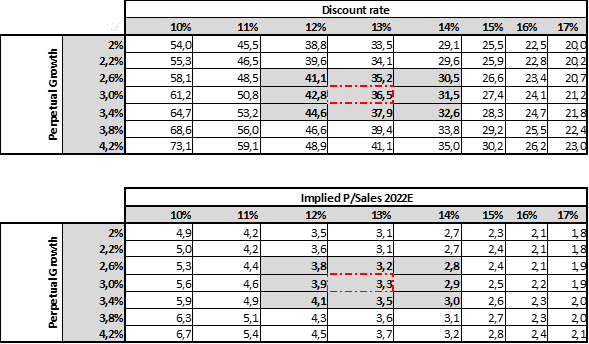

Discount rate at 10%, and an additional equity risk premium at 3% to weigh future execution risks.

The perpetual growth rate of 3%, given the high growth nature of the business.

TP of $36 per fully diluted share

For complete valuation model RT+DM us and we will provide you.

The perpetual growth rate of 3%, given the high growth nature of the business.

TP of $36 per fully diluted share

For complete valuation model RT+DM us and we will provide you.

Sensitivity Analysis

Our valuation delivers 3.3x P/sales 2022E, which is a reasonable multiple given the nature of the business and growth expected.

Assuming a discount rate between 12%-14% and a perpetual growth rate between 2.6%-3.4%, the fair value is $30.5 and $44.6/share

Our valuation delivers 3.3x P/sales 2022E, which is a reasonable multiple given the nature of the business and growth expected.

Assuming a discount rate between 12%-14% and a perpetual growth rate between 2.6%-3.4%, the fair value is $30.5 and $44.6/share

All in all, we remain bullish and think the company is well-positioned to surf the disruptive trend in RE

If you have enjoyed this - RT

Join our Telegram chat for trade ideas: https://cutt.ly/dkwWcLi

Subscribe to our Youtube Channel for stock Deep-Dives https://www.youtube.com/channel/UCP0BX-hodOY6a84l4beIetQ

If you have enjoyed this - RT

Join our Telegram chat for trade ideas: https://cutt.ly/dkwWcLi

Subscribe to our Youtube Channel for stock Deep-Dives https://www.youtube.com/channel/UCP0BX-hodOY6a84l4beIetQ

Read on Twitter

Read on Twitter