I believe the main reason the market has hated $KALA so much is because of the mediocre launch of Inveltys, $KALA's first product for post-surgical inflammation. However, I believe there are justifiable reasons for this:

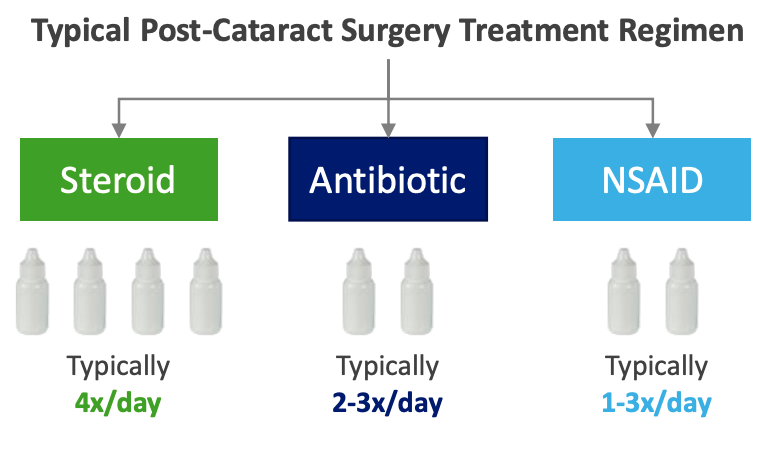

$KALA Inveltys is not all that superior to competitors like Durezol in efficacy or safety. The main advantage of Inveltys is the twice-daily dosing vs 3x or 4x for competitors, which isn't a great reason for switching

$KALA The market for treating post-surgical was also very small and competitive, with several generics and other corticosteroids available like Durezol, Lotemax, etc fighting for a pool of just 8.6mil ocular surgeries a year, with just 17% being branded prescriptions

$KALA COVID-19 did not help matters - It really derailed the momentum that Inveltys was seeing as many governments put restrictions on elective surgeries. Prior to the pandemic, Inveltys was outperforming the market substantially (4% increase vs 14% decline for the market)

$KALA Overall, I don't think Inveltys did too bad considering all the factors above. Inveltys managed to capture around an 11% share of the branded prescription market as of Q3 2020

$KALA Eysuvis is a completely different story, and I think it will be far more successful compared to Inveltys for several reasons

$KALA The market for dry eye disease is far larger - 38mil people in the USA have dry eye and 75-90% suffer from flares. The market is also very underserved, as there is no FDA approved product to treat dry eye flare

$KALA Patients are often treated by artificial tears(which do not address inflammation) and off label steroids, both of which don't work most of the time. For chronic sufferers, the ECP will put these patients on chronic prescription therapy, but these only make up 10% of patient

$KALA There is a large unmet need for a safe product that provides fast-acting relief, as one physician put it:

$KALA This pretty much describes Eysuvis, Kala's product for dry eye flare that was approved a few months ago. Eysuvis addresses inflammation, provides fast acting relief, and is safe, making it suitable for the vast majority of dry eye flare patients

$KALA as the first to market product with a large unmet need, Eysuvis has the potential for massive success - In a survey done by $KALA, the vast majority of patients and ECPs would be interested

$KALA is a story of how the market is basing future expectations on past results(the mediocre launch of Inveltys). The valuation at around $9 is just $350mil Enterprise Value, incredibly low for a company with 2 commercially ready products

Read on Twitter

Read on Twitter