Liquid funds, An ideal place to park your short-term cash.

//THREAD//

//THREAD//

Liquid funds come under the family of debt funds.

They invest in debt papers with a maturity period of *up to 91 days only*

This single feature eliminates most of the risks related to debt investing.

They invest in debt papers with a maturity period of *up to 91 days only*

This single feature eliminates most of the risks related to debt investing.

1. Risks:

You take 3 risks when you invest in a debt fund.

Credit risk: Risk of losing either principal or interest or both.

Though liquid funds have a very low credit risk, it has occurred in the past.

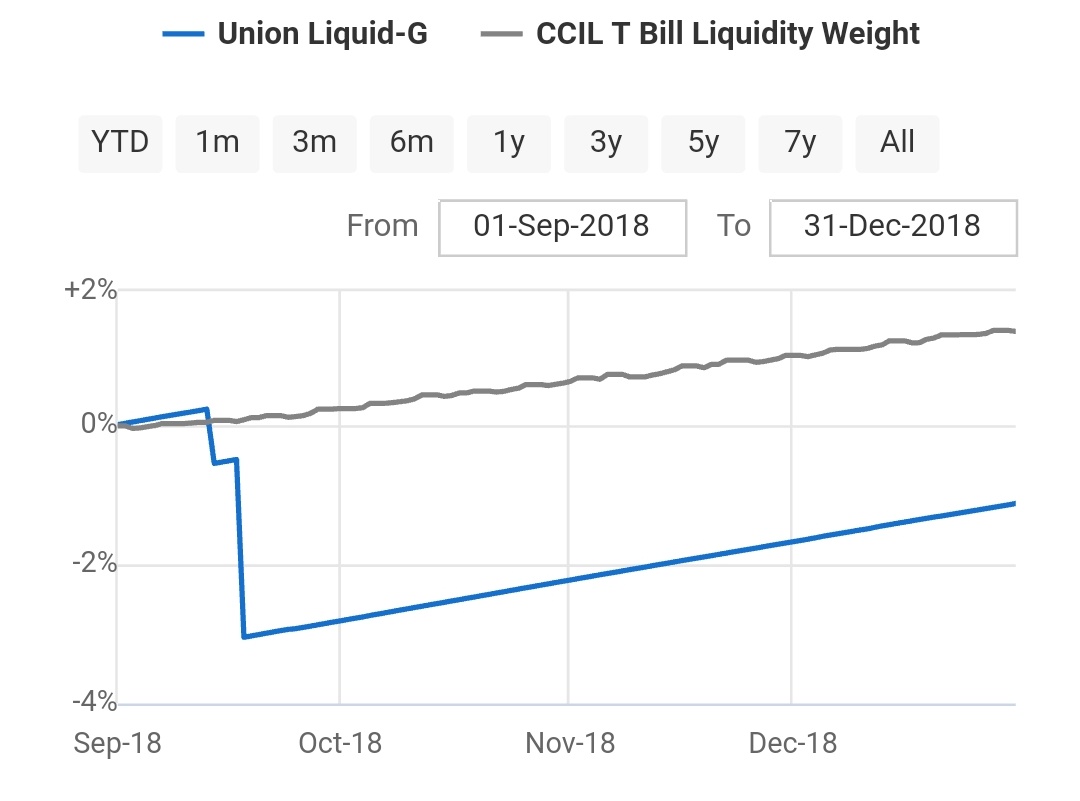

For eg, the Union liquid fund lost 3% during the IL&FS crisis.

You take 3 risks when you invest in a debt fund.

Credit risk: Risk of losing either principal or interest or both.

Though liquid funds have a very low credit risk, it has occurred in the past.

For eg, the Union liquid fund lost 3% during the IL&FS crisis.

Interest rate risk:

Say, you bought a 5 year 1000/- bond with an interest rate of 5%.

Next year, interest rates rose to 6%.

And now, people are selling those old 5% bonds and buying new 6% bonds.

This reduces the demand for your old bonds and your bond value decline.

Say, you bought a 5 year 1000/- bond with an interest rate of 5%.

Next year, interest rates rose to 6%.

And now, people are selling those old 5% bonds and buying new 6% bonds.

This reduces the demand for your old bonds and your bond value decline.

Vice versa happens when interest rates decrease.

The longer the term of a bond, the higher the interest rate risk.

Since liquid funds invest in very short-term debt papers, they have very low-interest rate risk.

The longer the term of a bond, the higher the interest rate risk.

Since liquid funds invest in very short-term debt papers, they have very low-interest rate risk.

Liquidity risk:

Liquidity is all about how quickly you can convert your assets into cash.

Say, you invested in the NSC scheme. Your money gets locked in for 5 years.

However, when you invest in a liquid fund, you can redeem your cash within 24 hours.

Liquidity is all about how quickly you can convert your assets into cash.

Say, you invested in the NSC scheme. Your money gets locked in for 5 years.

However, when you invest in a liquid fund, you can redeem your cash within 24 hours.

2. Returns:

Liquid funds make returns majorly from interest income.

More or less, they give similar returns to bank fixed deposits.

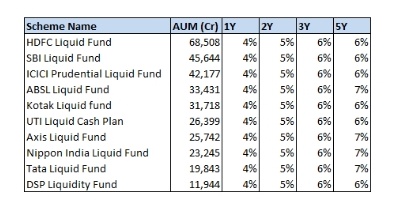

Here is a snapshot of returns of top funds based on fund size.

Liquid funds make returns majorly from interest income.

More or less, they give similar returns to bank fixed deposits.

Here is a snapshot of returns of top funds based on fund size.

3. Taxation:

When you sell liquid funds within 36 months, you will be taxed at your Income-tax slab rate.

When you sell funds after 36 months, you get an indexation benefit (your cost price gets adjusted for inflation) and the tax rate is 20%.

When you sell liquid funds within 36 months, you will be taxed at your Income-tax slab rate.

When you sell funds after 36 months, you get an indexation benefit (your cost price gets adjusted for inflation) and the tax rate is 20%.

4. Why invest in liquid funds?

Flexibility: You can start with an amount as low as 500 and invest whatever amount you want.

Insta redemption: This is a striking feature. You can get your cash within 30 minutes. You pay small exit fees only if you redeem within 7 days.

Flexibility: You can start with an amount as low as 500 and invest whatever amount you want.

Insta redemption: This is a striking feature. You can get your cash within 30 minutes. You pay small exit fees only if you redeem within 7 days.

TDS: No tax will be deducted at the time of payment.

Diversification: Since the fund invests in various debt papers, you get diversification benefit.

Diversification: Since the fund invests in various debt papers, you get diversification benefit.

5. How to choose a liquid fund?

Look for a good fund house + good fund size.

Look for a low expense ratio.

Look at the portfolio in detail. Make sure the fund has high credit rating papers.

AAA, A1+ is the best credit ratings, and so on.

Pic credit: @KirtanShahCFP

Look for a good fund house + good fund size.

Look for a low expense ratio.

Look at the portfolio in detail. Make sure the fund has high credit rating papers.

AAA, A1+ is the best credit ratings, and so on.

Pic credit: @KirtanShahCFP

Finally, if you want the safest liquid funds out there, go for funds that invest the majority of cash in govt securities.

Eg: @QuantumAMC @PPFAS

Eg: @QuantumAMC @PPFAS

To conclude, low risk + high liquidity make liquid funds a great option to park your idle cash.

That's all I got for you on this topic. Like and retweet this original thread if you find it value-added. Have a great day. https://twitter.com/money_theory/status/1358382891747561474?s=19

That's all I got for you on this topic. Like and retweet this original thread if you find it value-added. Have a great day. https://twitter.com/money_theory/status/1358382891747561474?s=19

Read on Twitter

Read on Twitter