Livechat Software $LVC $LVCP

@LiveChat

SaaS company under the radar

SaaS company under the radar

unbelievable profit margins

unbelievable profit margins

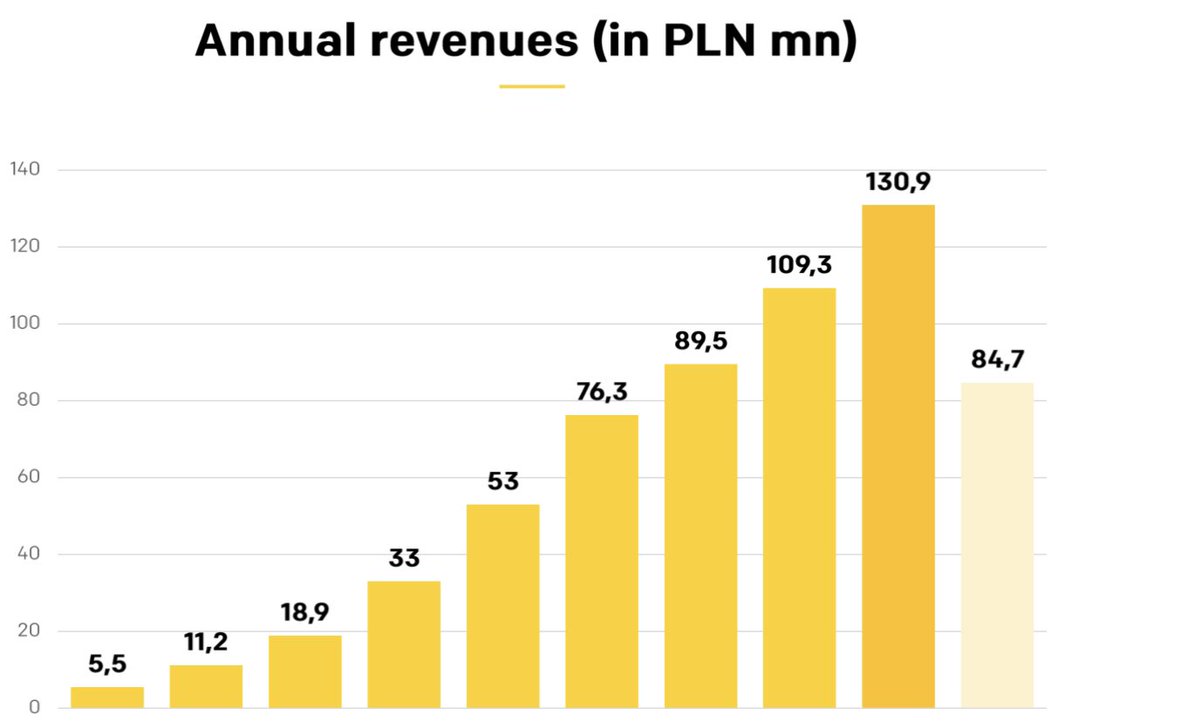

Revenue growth 45 %

Revenue growth 45 %

Rule of 40 > 90

Rule of 40 > 90

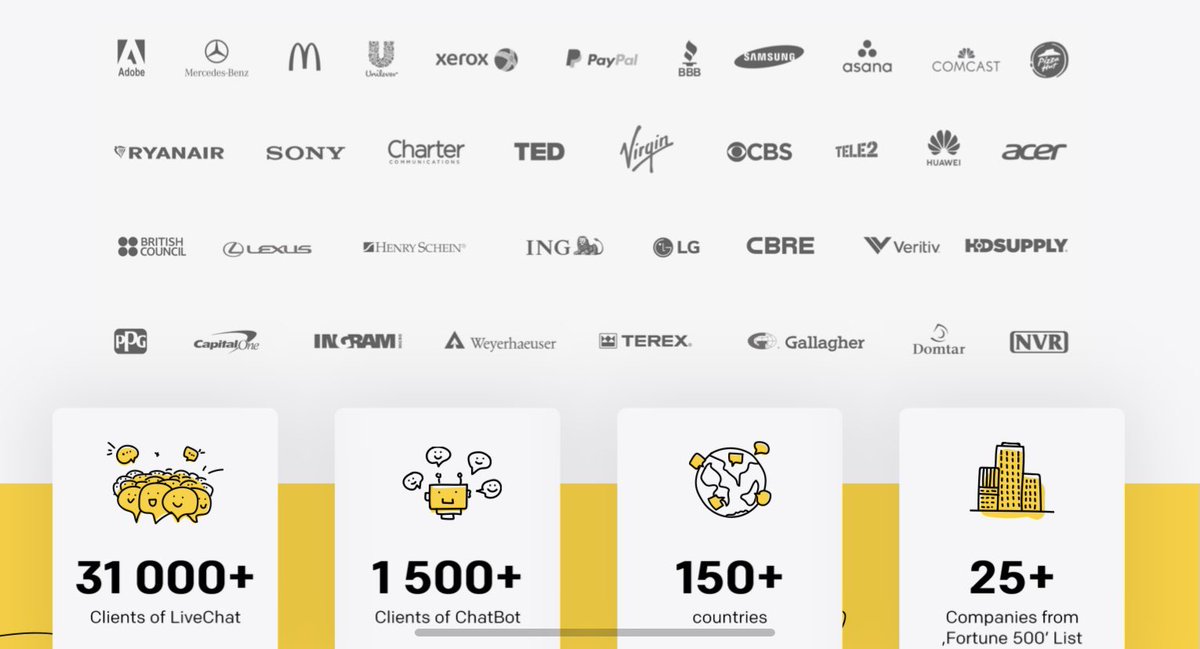

31.000 customers in over 150 countries

31.000 customers in over 150 countries

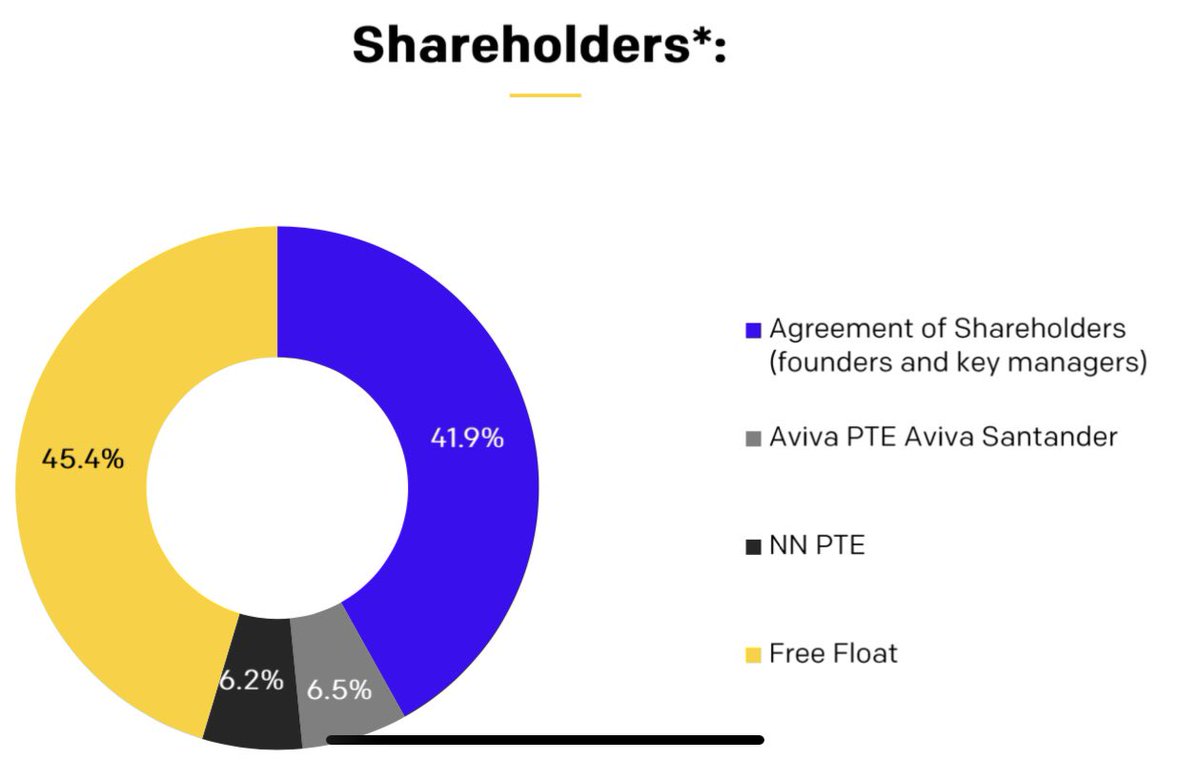

management with skin in the game

management with skin in the game

still cheap

still cheap

A Thread

@LiveChat

SaaS company under the radar

SaaS company under the radar unbelievable profit margins

unbelievable profit margins  Revenue growth 45 %

Revenue growth 45 % Rule of 40 > 90

Rule of 40 > 90 31.000 customers in over 150 countries

31.000 customers in over 150 countries management with skin in the game

management with skin in the game still cheap

still cheap

A Thread

The company:

based in Poland

based in Poland

Founder-operator management with ~ 41% of shares

Founder-operator management with ~ 41% of shares

Market cap ~ $800m USD

Market cap ~ $800m USD

went public on Warsaw stock exchange in 2014

went public on Warsaw stock exchange in 2014

25+ customers from Fortune 500 list: Unilever, McDonalds, Adobe, Samsung, Paypal, Sony, Mercedes...

25+ customers from Fortune 500 list: Unilever, McDonalds, Adobe, Samsung, Paypal, Sony, Mercedes...

Next Products

based in Poland

based in Poland

Founder-operator management with ~ 41% of shares

Founder-operator management with ~ 41% of shares  Market cap ~ $800m USD

Market cap ~ $800m USD went public on Warsaw stock exchange in 2014

went public on Warsaw stock exchange in 2014 25+ customers from Fortune 500 list: Unilever, McDonalds, Adobe, Samsung, Paypal, Sony, Mercedes...

25+ customers from Fortune 500 list: Unilever, McDonalds, Adobe, Samsung, Paypal, Sony, Mercedes...Next Products

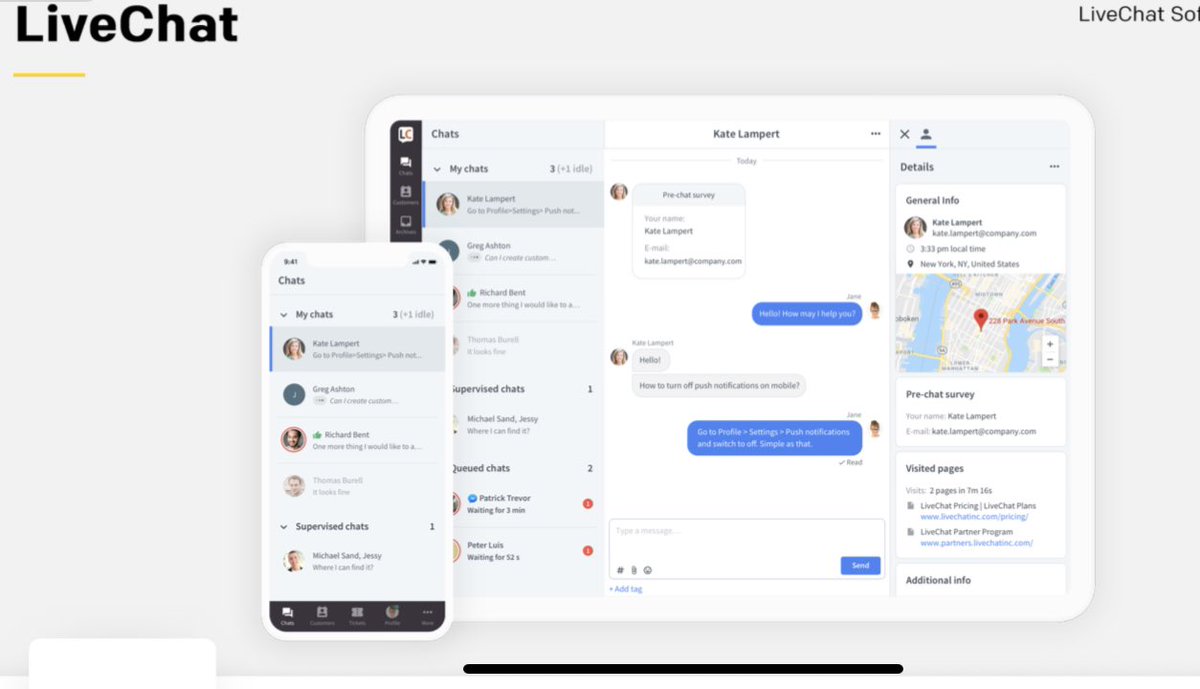

Live Chat

a tool for quick contact between clients and the company

a tool for quick contact between clients and the company

using chat application

using chat application

embedded on the companies website

embedded on the companies website

for customer service or online sales

for customer service or online sales

companies flagship product

companies flagship product

a tool for quick contact between clients and the company

a tool for quick contact between clients and the company using chat application

using chat application embedded on the companies website

embedded on the companies website for customer service or online sales

for customer service or online sales  companies flagship product

companies flagship product

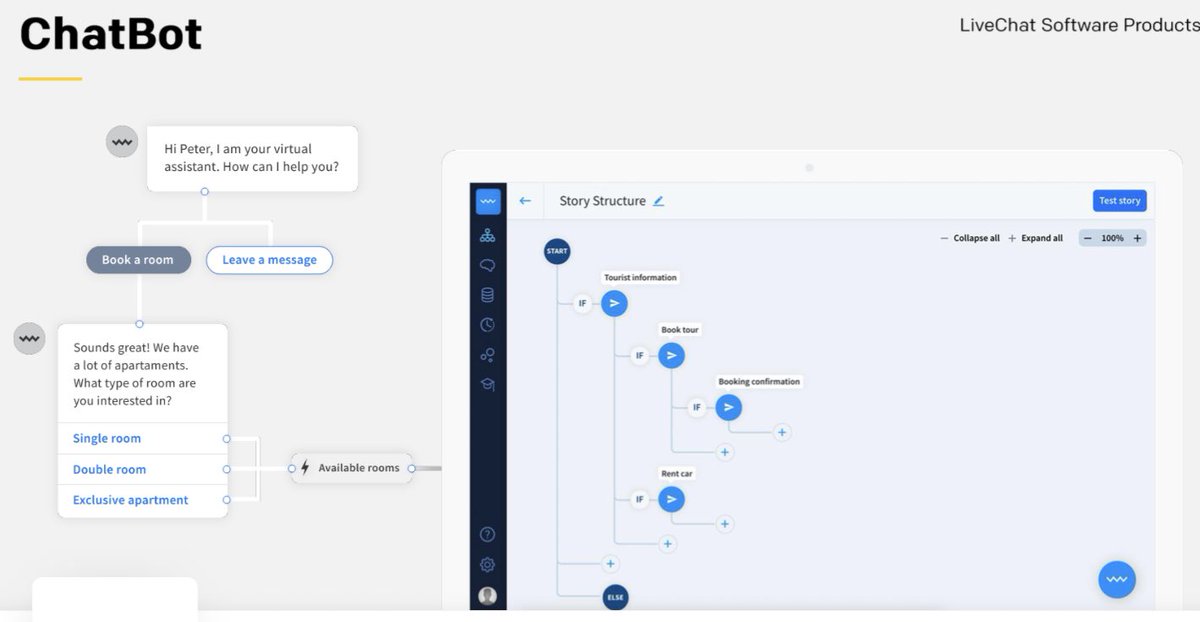

ChatBot

a product which allows the creation of conversational chatbots

a product which allows the creation of conversational chatbots

to handle various business scenarios

to handle various business scenarios

integrated with LiveChat but also other tools like Facebook Messenger

integrated with LiveChat but also other tools like Facebook Messenger

growing exponentially off a small base

growing exponentially off a small base

a product which allows the creation of conversational chatbots

a product which allows the creation of conversational chatbots  to handle various business scenarios

to handle various business scenarios integrated with LiveChat but also other tools like Facebook Messenger

integrated with LiveChat but also other tools like Facebook Messenger  growing exponentially off a small base

growing exponentially off a small base

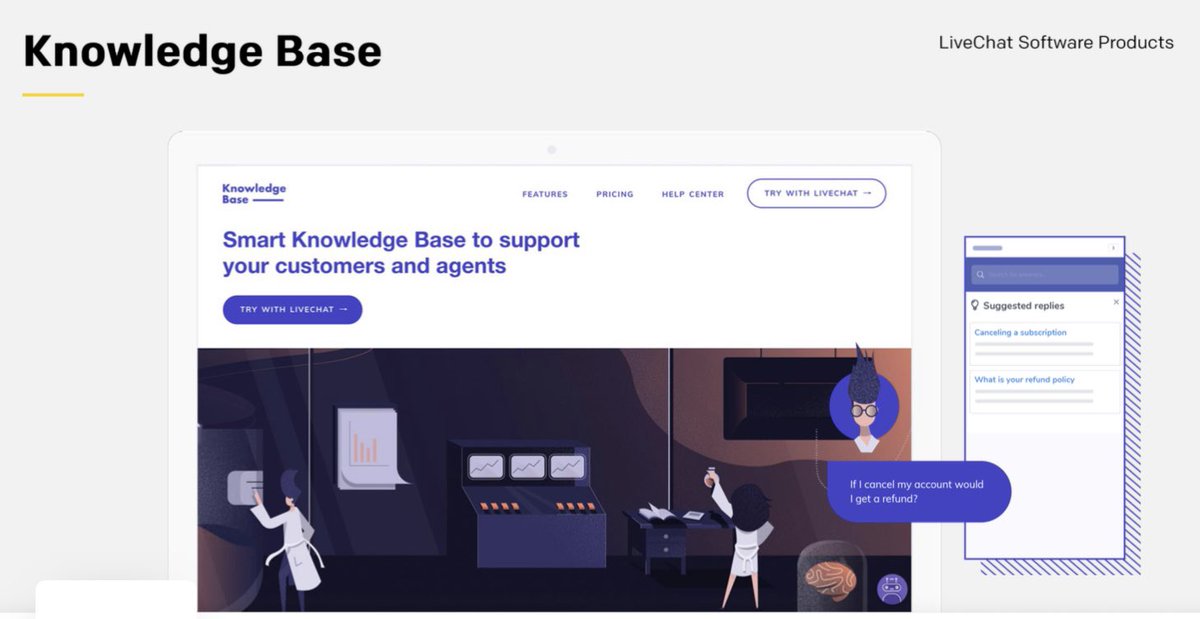

Knowledge Base

platform that allows companies to create their own knowledge bases

platform that allows companies to create their own knowledge bases

which can accessed by employees and clients

which can accessed by employees and clients

to organize and quickly retrieve information that require more explanation

to organize and quickly retrieve information that require more explanation

platform that allows companies to create their own knowledge bases

platform that allows companies to create their own knowledge bases  which can accessed by employees and clients

which can accessed by employees and clients  to organize and quickly retrieve information that require more explanation

to organize and quickly retrieve information that require more explanation

Help Desk

ticketing system

ticketing system

helps to solve all customer cases in an easy way

helps to solve all customer cases in an easy way

So LiveChat Software offers different products for text based business communication tools. And in this market there is a well known competitor with @Zendesk

ticketing system

ticketing system  helps to solve all customer cases in an easy way

helps to solve all customer cases in an easy waySo LiveChat Software offers different products for text based business communication tools. And in this market there is a well known competitor with @Zendesk

Zendesk is the market leader for live chat products

Zendesk is the market leader for live chat products  But @LiveChat is growing faster than Zendesk and is capturing market share

But @LiveChat is growing faster than Zendesk and is capturing market share  In the last quarter LiveChat grew with 45% in revenues while the livechat segment of zendesk decreased

In the last quarter LiveChat grew with 45% in revenues while the livechat segment of zendesk decreased

Zendesk is a good company but also highly valued right now

Zendesk is a good company but also highly valued right now  While the EV/Sales of Zendesk and Livechat is nearly the same, LiveChat is already highly profitable and Zendesk reports losses

While the EV/Sales of Zendesk and Livechat is nearly the same, LiveChat is already highly profitable and Zendesk reports lossesSo let‘s take a look at the margins and financials of LiveChat

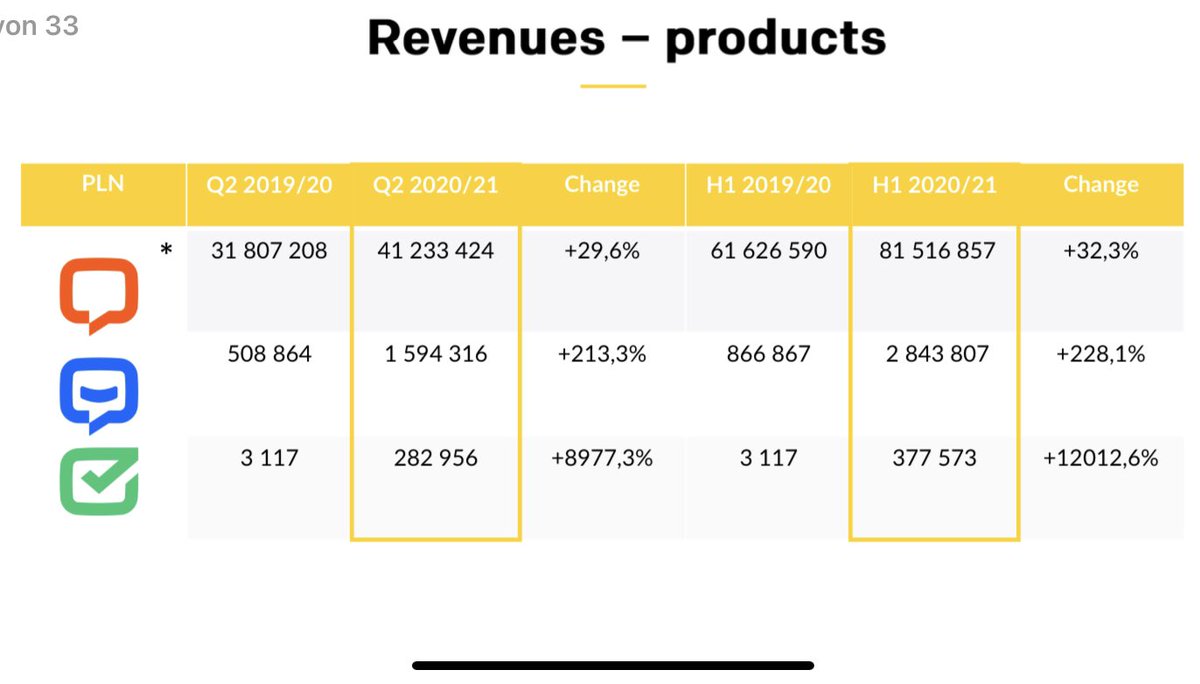

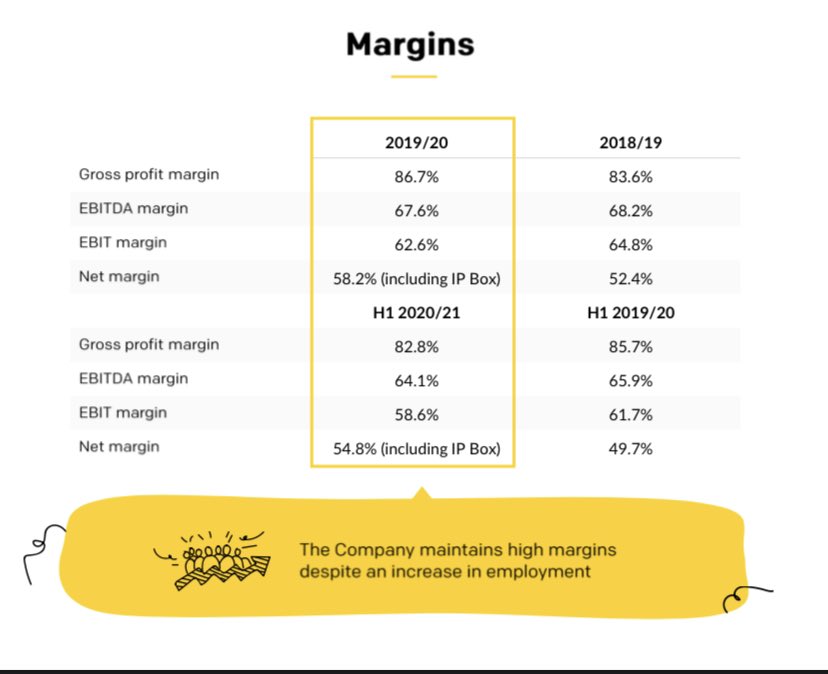

Margins

Gross Profit 82.8 %

Gross Profit 82.8 %

EBITDA 64.1 %

EBITDA 64.1 %

EBIT 58.6 %

EBIT 58.6 %

Net Income 54.8 %*

Net Income 54.8 %*

*incl. tax benefits; without these benefits the net income margin would be 47%

Gross Profit 82.8 %

Gross Profit 82.8 % EBITDA 64.1 %

EBITDA 64.1 % EBIT 58.6 %

EBIT 58.6 % Net Income 54.8 %*

Net Income 54.8 %**incl. tax benefits; without these benefits the net income margin would be 47%

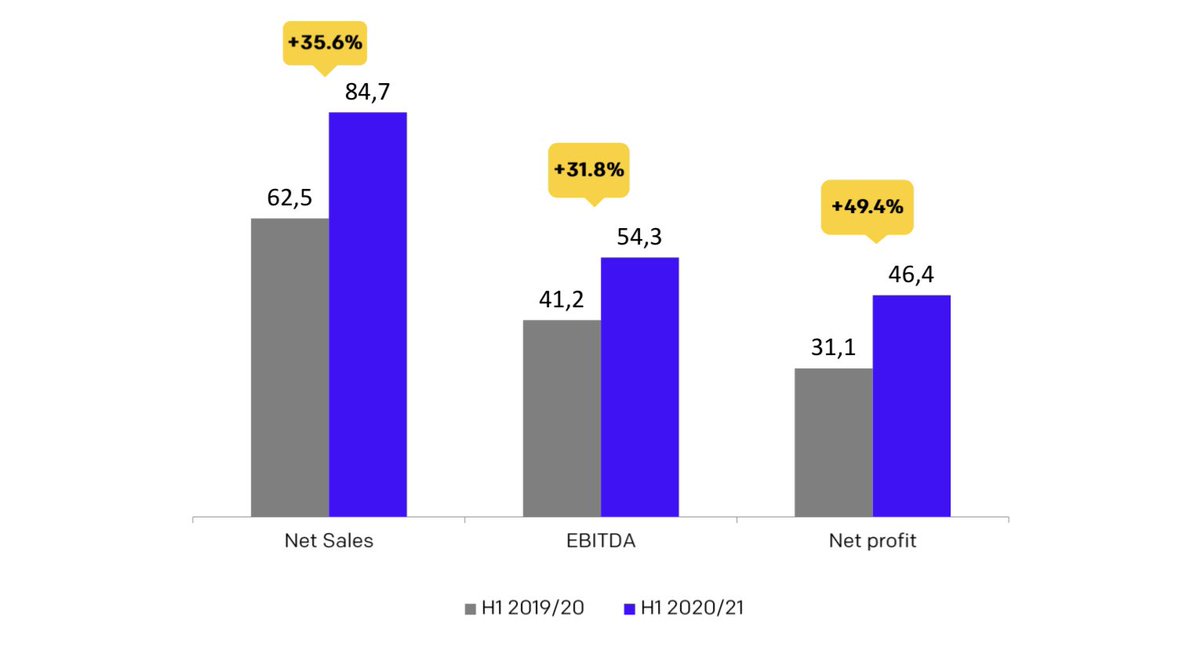

Financial Results H1 20/21

Revenue +35.6 %, in Q3 20/21 even 45 %

Revenue +35.6 %, in Q3 20/21 even 45 %  growth is accelerating due to Covid

growth is accelerating due to Covid

EBITDA +31.8 %

EBITDA +31.8 %

Net Profit +49.4 % *

Net Profit +49.4 % *

*incl. tax benefits; without it ~30%

Revenue +35.6 %, in Q3 20/21 even 45 %

Revenue +35.6 %, in Q3 20/21 even 45 %  growth is accelerating due to Covid

growth is accelerating due to Covid EBITDA +31.8 %

EBITDA +31.8 % Net Profit +49.4 % *

Net Profit +49.4 % **incl. tax benefits; without it ~30%

Valuation (TTM)

EV/Sales 17

EV/Sales 17

PE 28

PE 28

PEG < 1

PEG < 1

Rule of 40 > 90

Rule of 40 > 90

You get a highly profitable company for 28x net earnings a clean balance sheet (no debt), growing with 45 % in top line and over 30 % bottom line, over 60 % operating margin and 120 % ROC

EV/Sales 17

EV/Sales 17 PE 28

PE 28 PEG < 1

PEG < 1  Rule of 40 > 90

Rule of 40 > 90

You get a highly profitable company for 28x net earnings a clean balance sheet (no debt), growing with 45 % in top line and over 30 % bottom line, over 60 % operating margin and 120 % ROC

@GetBenchmarkCo i recognized you have this great company also on your list. I hope you guys are also taking a look at this under-the-radar stock @LiveChat_IR. It deserves more attention

For further information here is a great SA article

LiveChat Software: Overlooked European SaaS Story With A Rare Combination Of Growth And Profitability https://seekingalpha.com/article/4371117-livechat-software-overlooked-european-saas-story-rare-combination-of-growth-and-profitability

LiveChat Software: Overlooked European SaaS Story With A Rare Combination Of Growth And Profitability https://seekingalpha.com/article/4371117-livechat-software-overlooked-european-saas-story-rare-combination-of-growth-and-profitability

Read on Twitter

Read on Twitter