$PACE: Talk Nerdy to Me

I am long $PACE because it offers a way to play into online education which has experienced tailwinds from Covid (online private tutoring). $PACE is projecting 30% YoY growth this year and agreed to merge with Nerdy.

A thread

I am long $PACE because it offers a way to play into online education which has experienced tailwinds from Covid (online private tutoring). $PACE is projecting 30% YoY growth this year and agreed to merge with Nerdy.

A thread

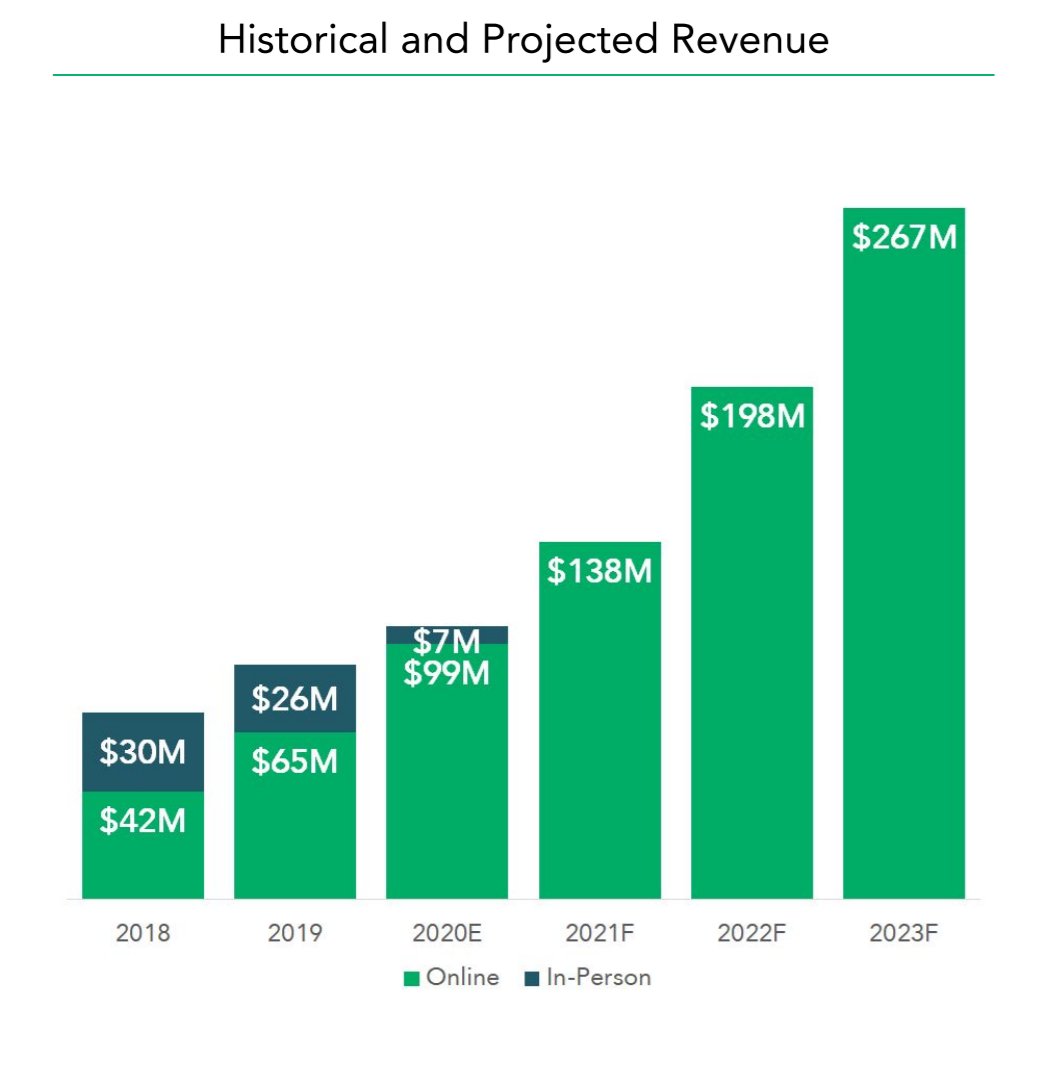

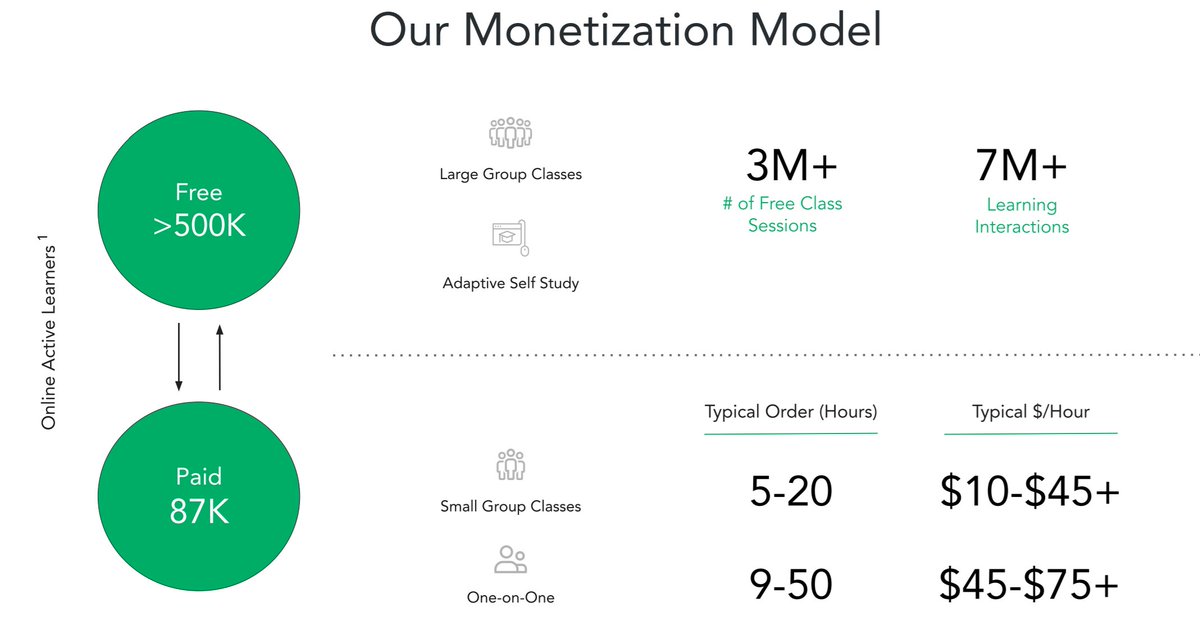

$PACE offers 1on1, small, and large group tutoring classes which exploded during Covid. The business is growing 30% YoY and valued at $1.7 billion at $12/share. That implies a multiple of 12x on $138m of 2021 revenue. $CHGG trades at ~20x today. I think 15x is fair.

$PACE has a freemium model that attracts students and is converting them well. YoY conversions are up 167% and the conversion rate is impressive at nearly 20%. This is their secret sauce. Coursera and others have conversion rates in the mid single digits.

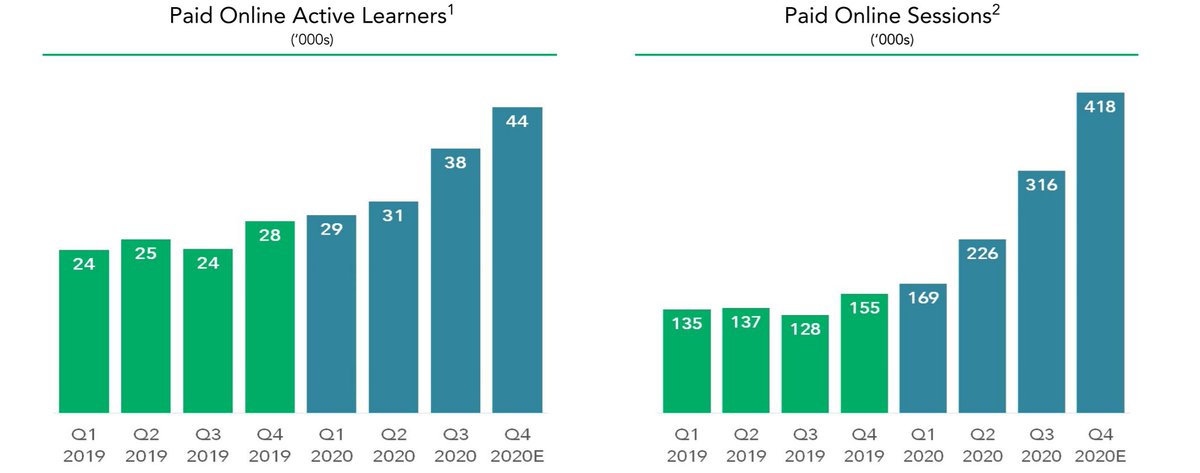

I always look below the hood. Active online learners is growing 57% YoY and paid online sessions exploded. The real questions is can 1H'21 hold up. I would say yes given that education dynamics haven't changed.

At this reasonable valuation, with some tailwinds, a founder/CEO, and a resilient market, I am long $PACE

Read on Twitter

Read on Twitter