Pinterest: The Future Is Bright

On February 5, $PINS reported outstanding 4Q20 results. Revenue of $706M (+76% y/y) crushed the consensus of $646M. Adjusted EPS of $0.43 beat the consensus of $0.32. Monthly active users grew 37% y/y to 459M compared to estimates of 449M.

On February 5, $PINS reported outstanding 4Q20 results. Revenue of $706M (+76% y/y) crushed the consensus of $646M. Adjusted EPS of $0.43 beat the consensus of $0.32. Monthly active users grew 37% y/y to 459M compared to estimates of 449M.

$PINS is a social media platform based on posting images and videos to virtual pin boards. It's geared toward sharing interests and ideas rather than personal posts or news. The content provides inspiration for events and activities, like dinner parties, weddings, or home design.

With its visually engaging, action-oriented platform, $PINS has been able to grow its user base and revenue at impressive rates for the last four years. Notably, its growth has been strongest with younger demographics with users under 25 growing twice as fast as users over 25.

The growing user base attracts advertisers. As with $FB, advertisers can target specific audiences with tailored ads (e.g. “men 30-40 interested in weight lifting”). Users also browse $PINS to search specific products, making them a more attractive audience for marketers.

Over time, $PINS could be the leading platform for social commerce. Users come to the site for inspiration – to find a new hobby or for ideas for an activity – $PINS identifies products to make that inspiration a reality, and enables consumers to purchase them.

$PINS is investing in technology to improve search, discovery, and purchase. For example, it recently launched Try On, an application that enables users to “try on” lipstick and makeup through an augmented reality application. This feature increases purchase intent by 5x.

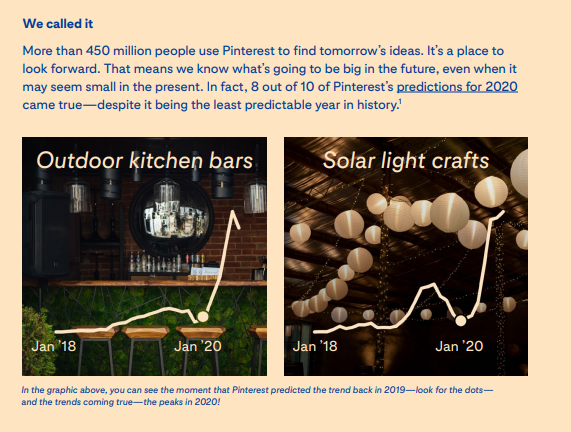

$PINS also touts its ability to forecast coming trends. In many cases, users are searching out ideas or trends that are early-stage, but growing. They come to $PINS to discover and plan. This data helps advertisers position products early on to capture shifts in consumer trends.

$PINS doesn’t need to worry about ad boycotts or congressional inquiries. With visual and activity-based content, $PINS has avoided criticisms that platforms like $FB and $TWTR have faced over false information and hate speech. This makes $PINS a safe choice for advertisers.

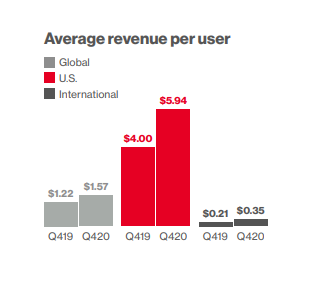

$PINS has several growth opportunities, one of which is international users. 361M of $PINS’ 459M users live outside of the US. Yet in 4Q20, the ARPU for non-US users was $0.35 compared to $5.95 for US users. $PINS is investing in its international sales team to close this gap.

Shopping is another opportunity. In May 2020, $PINS partnered with $SHOP to enable over 1M $SHOP merchants to upload their catalogs to $PINS. The partnership increases the inventory of products on $PINS and makes it easier for users to discover and purchase new products.

$PINS has also invested in video content. To this end, it launched new and improved publishing tools that make it easier to create video content. $PINS benefits from video content because 1) it keeps users engaged for longer and 2) ad rates are higher than for image or text ads.

$PINS has a rock solid balance sheet that will enable it to invest in growth opportunities. As of 4Q20, $PINS has $1.7B in cash and equivalents and no long-term debt. It also appears to be on the cusp of consistent profitability, reporting net income of $208M in 4Q20.

In several respects, $PINS is well positioned for future growth. It has created a positive online space with growing users and engagement and it is investing in offerings that will make its platform more attractive to users and advertisers alike. The future is bright for $PINS.

Read on Twitter

Read on Twitter