In this post, I'm summarizing my thought process before buying any SPAC warrants. Yesterday, I initiated a position into warrants of $CND $CTAQ $KINZ and $MOTV. Last week, many of the quality warrants were at a reasonable value (thanks to red days) but not anymore.

All the above ones passed eye test (good management + decent trust value (>$200M) + good target focus). All these are good NOT great but can definitely pull a winner. These are warrants trading under my comfort zone ($1-$2.5), I don't want very cheap ones and not expensive either

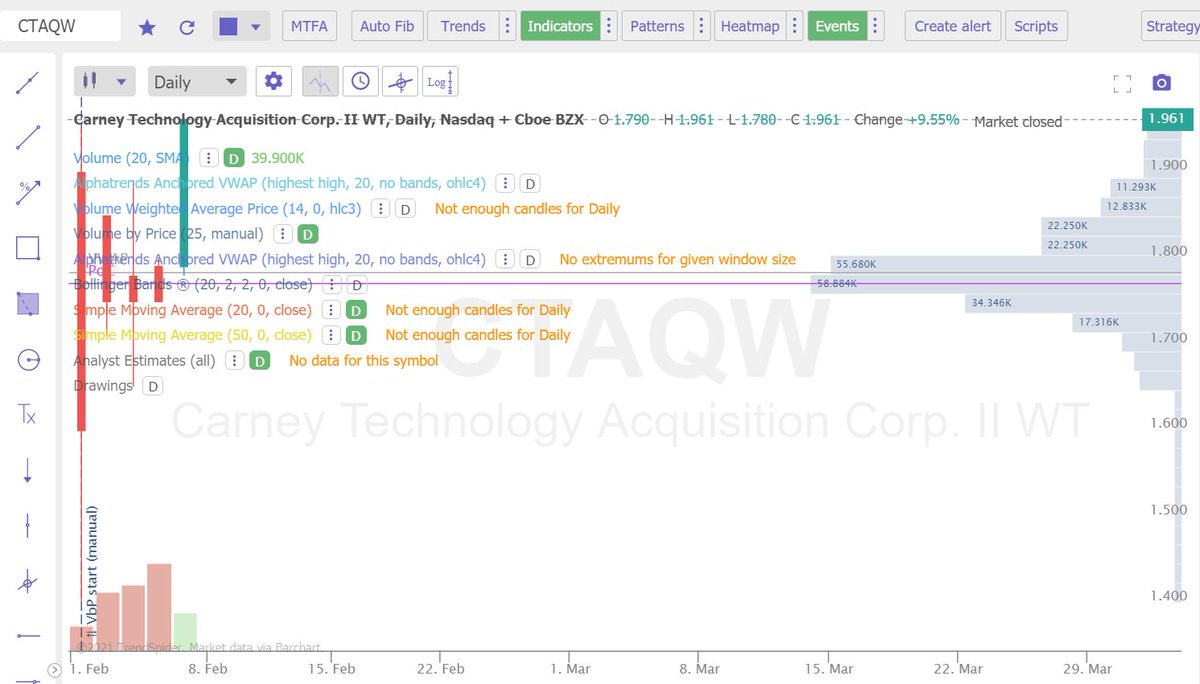

These are newly split SPACs, so, not much data. Nevertheless, I checked their chart. Let me discuss about $CTAQW (warrants of $CTAQ). (1) See the attached chart from marketwatch where we can see real time prices. It didn't spike on day 1, that gives an indication still unexplored

(2) Price is holding in $1.60-$1.80 range. Then comes a better chart, see attached. Y-axis on right side is volume by price. There is not much volume and very volatile space, so, I doubt one can use chart (true for most of the SPAC warrants in their initial days).

However, this confirms the marketwatch chart that not many people are into this one (VERY GOOD sign). (3) I NEVER ever buy on Day 1 (when units split) because warrants generally spike on Day 1 (4) My cost avg for $CTAQW is $1.78, I've a decent amount of warrants.

Since, this is not a GREAT SPAC rather a good one. So, I'm still not fully invested (5) This is in an early stage (not many people are here), so, my downside risk is in the lower end. In case, they didn't pull a winner then also I will gain something.

If they will pull a winner then this can be easily >3x (6) I'm heavily diversified, so, I don't mind even if they won't have a merger within a yr or so (PAYtience). These days mergers rumor/DA are very fast, a good thing :) In the worst case scenario, there won't be any merger.

In that case, amount allocated to this warrants will go to 0. This is a reason that I go for quality SPACs. I truly believe in buying quality SPAC warrants at a reasonable price. (7) $AGCWW (warrants of $AGC), $IPODWS (warrants of $IPOD), $IPOFWS (warrants of $IPOF)

are trading at an insanely high premium without any rumor. These are the ones in which my fund allocation is minimum. Unless they gonna pull a monster, ROI gonna be very low or people will lose money IF planning to buy now. Look at $DGNR, it was >$5 at one time, now at $3.20

(8) Most of the focus these days is into $CCIV, best time to hunt for quality warrants ;)

Disclaimer: This post is ABSOLUTELY not a recommendation to buy the above-mentioned stocks. Do your DD because then only you will build a conviction to buy/hold/trim/sell.

Disclaimer: This post is ABSOLUTELY not a recommendation to buy the above-mentioned stocks. Do your DD because then only you will build a conviction to buy/hold/trim/sell.

If you are seeing a lot of pumping, you know what to do...Just RUN away. A recent example is $CLOV (in past it was $IPOC), had an insane amount of pumping. Right now, people are doing the same thing for $CCIV. If Lucid, this will be amazing....

However, there is no DA yet. In case (low possibility though), if this merger won't materialize then are you prepared? You know the answer better than anyone. I'm out of warrants a couple days back but still holding all my commons from $13s.

If Lucid, this will be a long hold for me (at least a couple of years). FOMO is very strong for $CCIV, commons can easily spike to $50-60 if the DA will come. Fundamentals won't play a role in the short term, imo. It will post merger, for sure.

SPAC warrants are risky but very rewarding IF played intelligently. Never invest into any particular SPAC warrants searching for a merger if you cannot afford to lose. Focus on quality SPAC commons where there is a safety net. There is no safety net for warrants.

SPAC warrants looks very enticing but once it dips by 20-30%, we all get anxious (human nature). However, if you have a stomach to handle the volatility then you will be handsomely rewarded from quality SPAC warrants. Many people only focus on EV centric SPACs, not me.

Winner always win, irrespective of the target focus (EV, fintech, healthcare etc.). There is a very good possibility that $CMLF $HAAC $HIGA (though in healthcare kinda target focus) gonna pull a winner. Will they? No body knows. Summing up, happy hunting and best of luck.

Feel free to post/DM if you are interested in knowing my opinion on any SPAC searching for a merger, other than PT or what to buy/sell. You will receive an unbiased opinion AND of course FREE :)

Read on Twitter

Read on Twitter