Well, it appears that this is going to be another weekend of #Bitcoin  #FUD.

#FUD.

Let's address the weak and false arguments in this note from #GoldmanSachs https://www.yahoo.com/lifestyle/goldman-sachs-investment-strategy-group-advice-to-clients-163129306.html

#FUD.

#FUD.Let's address the weak and false arguments in this note from #GoldmanSachs https://www.yahoo.com/lifestyle/goldman-sachs-investment-strategy-group-advice-to-clients-163129306.html

1) The general statement: " #Bitcoin  is not an investable asset"

is not an investable asset"

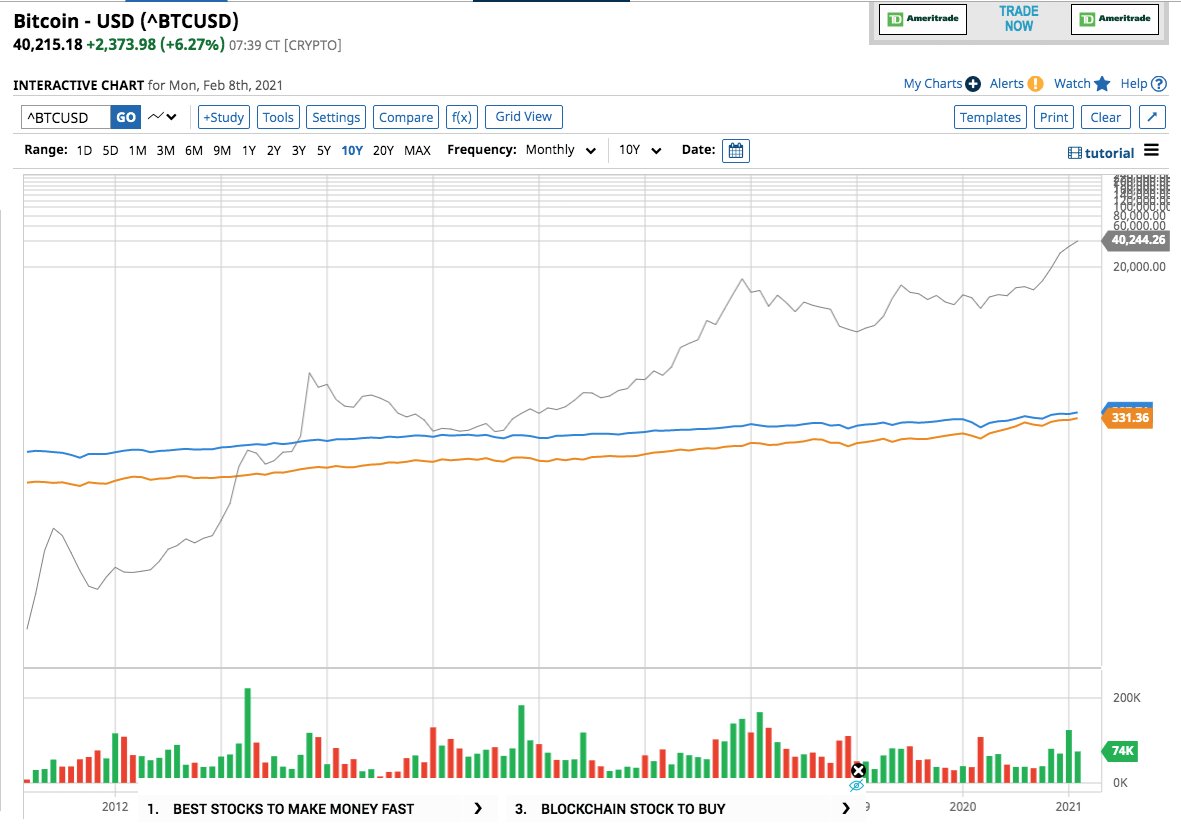

No "bubble" lasts 10+ years https://twitter.com/BitcoinCurious/status/1344296125545783296?s=20

is not an investable asset"

is not an investable asset"No "bubble" lasts 10+ years https://twitter.com/BitcoinCurious/status/1344296125545783296?s=20

#BTC  number go up for 10+ years and a lot more than $SPY or $QQQ

number go up for 10+ years and a lot more than $SPY or $QQQ

So much so that you need a log chart to get a realistic picture

number go up for 10+ years and a lot more than $SPY or $QQQ

number go up for 10+ years and a lot more than $SPY or $QQQSo much so that you need a log chart to get a realistic picture

More infrastructure and regulatory clarity than ever, including fiat onramps, exchanges, and ...

US banks approved to be #Crypto custodians https://www.coindesk.com/us-banks-could-seek-to-partner-with-or-buy-crypto-custodians-occs-brooks-says

US banks approved to be #Crypto custodians https://www.coindesk.com/us-banks-could-seek-to-partner-with-or-buy-crypto-custodians-occs-brooks-says

Clear trend: speculative  bordering on breach of fiduciary responsibility to not have at least 1%

bordering on breach of fiduciary responsibility to not have at least 1%

#Bitcoin is clearly "investable"

is clearly "investable"

bordering on breach of fiduciary responsibility to not have at least 1%

bordering on breach of fiduciary responsibility to not have at least 1%#Bitcoin

is clearly "investable"

is clearly "investable"

2) " #Bitcoin  is not a medium of exchange" due to volatility

is not a medium of exchange" due to volatility

Volatility is a feature of free markets and price discovery, it is not a bug https://twitter.com/BitcoinCurious/status/1355970844430884871?s=20

is not a medium of exchange" due to volatility

is not a medium of exchange" due to volatilityVolatility is a feature of free markets and price discovery, it is not a bug https://twitter.com/BitcoinCurious/status/1355970844430884871?s=20

The #Bitcoin  network is arguably the cheapest, most secure, most convenient way to transfer large sums of money.

network is arguably the cheapest, most secure, most convenient way to transfer large sums of money.

https://jeangalea.com/cryptocurrencies-vs-fiat-currencies/

AND it is accepted by a long list of merchants, with the list growing every day. https://99bitcoins.com/bitcoin/who-accepts/

network is arguably the cheapest, most secure, most convenient way to transfer large sums of money.

network is arguably the cheapest, most secure, most convenient way to transfer large sums of money.https://jeangalea.com/cryptocurrencies-vs-fiat-currencies/

AND it is accepted by a long list of merchants, with the list growing every day. https://99bitcoins.com/bitcoin/who-accepts/

3) #Bitcoin  is "not a unit of value"

is "not a unit of value"

$GS compared #BTC to $GME

to $GME

They compared a 3 day pump to 10 years of history and 3 successive bull-bear cycles with an overall gain of more than 300x since 2013

(see log chart above)

is "not a unit of value"

is "not a unit of value"$GS compared #BTC

to $GME

to $GME

They compared a 3 day pump to 10 years of history and 3 successive bull-bear cycles with an overall gain of more than 300x since 2013

(see log chart above)

4) $GS suggests that #Bitcoin  's hard cap supply of 21 million is not proprietary or unique, and that #ETH could adopt a similar hard cap

's hard cap supply of 21 million is not proprietary or unique, and that #ETH could adopt a similar hard cap

They obviously don't know how #Ethereum works and haven't seen the gas fees lately

's hard cap supply of 21 million is not proprietary or unique, and that #ETH could adopt a similar hard cap

's hard cap supply of 21 million is not proprietary or unique, and that #ETH could adopt a similar hard cap They obviously don't know how #Ethereum works and haven't seen the gas fees lately

However, both #BTC  and #ETH do benefit from being first movers in their respective specialties.

and #ETH do benefit from being first movers in their respective specialties.

Metcalfe's Law makes it unlikely that #Bitcoin could simply be displaced by "all other #cryptocurrencies" and that there is "nothing unique" about it.

could simply be displaced by "all other #cryptocurrencies" and that there is "nothing unique" about it.

and #ETH do benefit from being first movers in their respective specialties.

and #ETH do benefit from being first movers in their respective specialties.Metcalfe's Law makes it unlikely that #Bitcoin

could simply be displaced by "all other #cryptocurrencies" and that there is "nothing unique" about it.

could simply be displaced by "all other #cryptocurrencies" and that there is "nothing unique" about it.

The massive, decentralized distribution of #Bitcoin  nodes around the globe make it unique!!

nodes around the globe make it unique!!

https://bitnodes.io/

Missing this core principle alone disqualifies this analysis, but let's keep going because this is fun

nodes around the globe make it unique!!

nodes around the globe make it unique!!https://bitnodes.io/

Missing this core principle alone disqualifies this analysis, but let's keep going because this is fun

Quick aside: @RaoulGMI had a nice thread about Metcalfe's Law and its application to #BTC  and #ETH

and #ETH

https://twitter.com/RaoulGMI/status/1347013567799848961?s=20

Is Metcalfe's Law "not investable"?

and #ETH

and #ETHhttps://twitter.com/RaoulGMI/status/1347013567799848961?s=20

Is Metcalfe's Law "not investable"?

5) $GS argues that stocks are a better hedge against $USD inflation.

This is also

Purchasing power of constantly goes

constantly goes  BY DESIGN

BY DESIGN

#Bitcoin simply needs to win vs fiat over the long-term https://twitter.com/BitcoinCurious/status/1348102465951043585?s=20

simply needs to win vs fiat over the long-term https://twitter.com/BitcoinCurious/status/1348102465951043585?s=20

This is also

Purchasing power of

constantly goes

constantly goes  BY DESIGN

BY DESIGN#Bitcoin

simply needs to win vs fiat over the long-term https://twitter.com/BitcoinCurious/status/1348102465951043585?s=20

simply needs to win vs fiat over the long-term https://twitter.com/BitcoinCurious/status/1348102465951043585?s=20

For funsies, some back of the envelope math of #stonks vs #BTC

There has been 18% of inflation since 2010

$SPX up about 4x since 2010

Adjusted for inflation that's about 3.25x

#Bitcoin up 325x vs $USD since late 2013

up 325x vs $USD since late 2013

Comparing #BTC since 2010 wouldn't even be fair

since 2010 wouldn't even be fair

There has been 18% of inflation since 2010

$SPX up about 4x since 2010

Adjusted for inflation that's about 3.25x

#Bitcoin

up 325x vs $USD since late 2013

up 325x vs $USD since late 2013Comparing #BTC

since 2010 wouldn't even be fair

since 2010 wouldn't even be fair

6) $GS notes that proponents admit there is a chance #BTC  goes to 0.

goes to 0.

#Bitcoin is a free market with actual price discovery, unlike equities, so there is a much greater chance it will go to 0 than the S&P.

is a free market with actual price discovery, unlike equities, so there is a much greater chance it will go to 0 than the S&P.

That probably decreases with every passing day.

goes to 0.

goes to 0.#Bitcoin

is a free market with actual price discovery, unlike equities, so there is a much greater chance it will go to 0 than the S&P.

is a free market with actual price discovery, unlike equities, so there is a much greater chance it will go to 0 than the S&P.That probably decreases with every passing day.

And it certainly won't happen overnight. Even 80% bear markets have taken about a year.

The COVID black swan event of March 2020 (50% drop in 1 day) was gobbled up so quickly it turned into a 50% gain in 1 week.

Free market, price discovery

Free market, price discovery

The COVID black swan event of March 2020 (50% drop in 1 day) was gobbled up so quickly it turned into a 50% gain in 1 week.

Free market, price discovery

Free market, price discovery

7) Lastly, the climate and energy argument against #Bitcoin

How much energy does $GS and the global banking system use? Has anyone done a thorough analysis?

@Danheld did a rough estimate in his post refuting several common sources of #FUD https://danheld.substack.com/p/bitcoin-fud

How much energy does $GS and the global banking system use? Has anyone done a thorough analysis?

@Danheld did a rough estimate in his post refuting several common sources of #FUD https://danheld.substack.com/p/bitcoin-fud

A report from 2020 found that 39% of #BTC  hashing power is supported by renewable energy:

hashing power is supported by renewable energy:

https://www.jbs.cam.ac.uk/wp-content/uploads/2021/01/2021-ccaf-3rd-global-cryptoasset-benchmarking-study.pdf

$GS purchases renewable energy for 98% of what it needs and that is definitely praiseworthy

https://www.goldmansachs.com/what-we-do/sustainable-finance/documents/reports/2019-sustainability-report.pdf

hashing power is supported by renewable energy:

hashing power is supported by renewable energy:https://www.jbs.cam.ac.uk/wp-content/uploads/2021/01/2021-ccaf-3rd-global-cryptoasset-benchmarking-study.pdf

$GS purchases renewable energy for 98% of what it needs and that is definitely praiseworthy

https://www.goldmansachs.com/what-we-do/sustainable-finance/documents/reports/2019-sustainability-report.pdf

How many decades did it take for $GS to get to that level?

There will be innovation with #Bitcoin and #crypto as well

and #crypto as well

Bitcoin Zero, #BTC wrapped with carbon credits

wrapped with carbon credits

https://www.universalprotocol.io/bitcoinzero

#Bitcoin #cleanenergy Investment Initiative from @Square

#cleanenergy Investment Initiative from @Square

https://squareup.com/us/en/press/carbon

There will be innovation with #Bitcoin

and #crypto as well

and #crypto as wellBitcoin Zero, #BTC

wrapped with carbon credits

wrapped with carbon creditshttps://www.universalprotocol.io/bitcoinzero

#Bitcoin

#cleanenergy Investment Initiative from @Square

#cleanenergy Investment Initiative from @Square https://squareup.com/us/en/press/carbon

Tradeable #crypto carbon credits

https://universalcarbon.com/

Much more research and work is needed, but the concept is promising.

Makes it easier for the average person to offset their life just like a corporation.

https://universalcarbon.com/

Much more research and work is needed, but the concept is promising.

Makes it easier for the average person to offset their life just like a corporation.

In conclusion, $GS has provided a one-sided uninformed analysis that does a disservice to their clients.

One way or another, #Bitcoin will forever change money and investing as it is the base layer tech of which all #crypto has emerged from.

will forever change money and investing as it is the base layer tech of which all #crypto has emerged from.

One way or another, #Bitcoin

will forever change money and investing as it is the base layer tech of which all #crypto has emerged from.

will forever change money and investing as it is the base layer tech of which all #crypto has emerged from.

So #Bitcoin  is investable...

is investable...

Just ask #GoldmanSachs

https://www.coindesk.com/goldman-sachs-to-enter-crypto-market-soon-with-custody-play-source

Watch what they do, not what they say

is investable...

is investable... Just ask #GoldmanSachs

https://www.coindesk.com/goldman-sachs-to-enter-crypto-market-soon-with-custody-play-source

Watch what they do, not what they say

Read on Twitter

Read on Twitter