Are stocks expensive?

Shocking news: I am a bear

People came to challenge my "19th century view on market valuations"

I will try with this thread to challenge my bias

Shocking news: I am a bear

People came to challenge my "19th century view on market valuations"

I will try with this thread to challenge my bias

1/

Assumption: rates always have gone down.

Assumption: rates always have gone down.

Yields at 0 are not a surprise.

Yields at 0 are not a surprise.

Therefore all my analysis will be de-trended to adjust to this parameter

Therefore all my analysis will be de-trended to adjust to this parameter

Read this thread to understand more https://twitter.com/TheMarketDog/status/1336239467447812096?s=20

https://twitter.com/TheMarketDog/status/1336239467447812096?s=20

Assumption: rates always have gone down.

Assumption: rates always have gone down. Yields at 0 are not a surprise.

Yields at 0 are not a surprise. Therefore all my analysis will be de-trended to adjust to this parameter

Therefore all my analysis will be de-trended to adjust to this parameterRead this thread to understand more

https://twitter.com/TheMarketDog/status/1336239467447812096?s=20

https://twitter.com/TheMarketDog/status/1336239467447812096?s=20

2/

Some history

The logic behind the stock market is that investors provide capital in return for a dividend

The logic behind the stock market is that investors provide capital in return for a dividend

Companies generate these dividends through positive cash flows

Companies generate these dividends through positive cash flows

Some history https://twitter.com/TheMarketDog/status/1357902743088730112?s=20

https://twitter.com/TheMarketDog/status/1357902743088730112?s=20

Some history

The logic behind the stock market is that investors provide capital in return for a dividend

The logic behind the stock market is that investors provide capital in return for a dividend Companies generate these dividends through positive cash flows

Companies generate these dividends through positive cash flowsSome history

https://twitter.com/TheMarketDog/status/1357902743088730112?s=20

https://twitter.com/TheMarketDog/status/1357902743088730112?s=20

3/

What are 2 main ways to do company valuation

DCF - IMHO the most logical as it computes the future projected cash flow & includes cost of capital

DCF - IMHO the most logical as it computes the future projected cash flow & includes cost of capital

Comparable company ratio (e.g. P/E, EV/EBITDA)

Comparable company ratio (e.g. P/E, EV/EBITDA)

What are 2 main ways to do company valuation

DCF - IMHO the most logical as it computes the future projected cash flow & includes cost of capital

DCF - IMHO the most logical as it computes the future projected cash flow & includes cost of capital Comparable company ratio (e.g. P/E, EV/EBITDA)

Comparable company ratio (e.g. P/E, EV/EBITDA)

5/

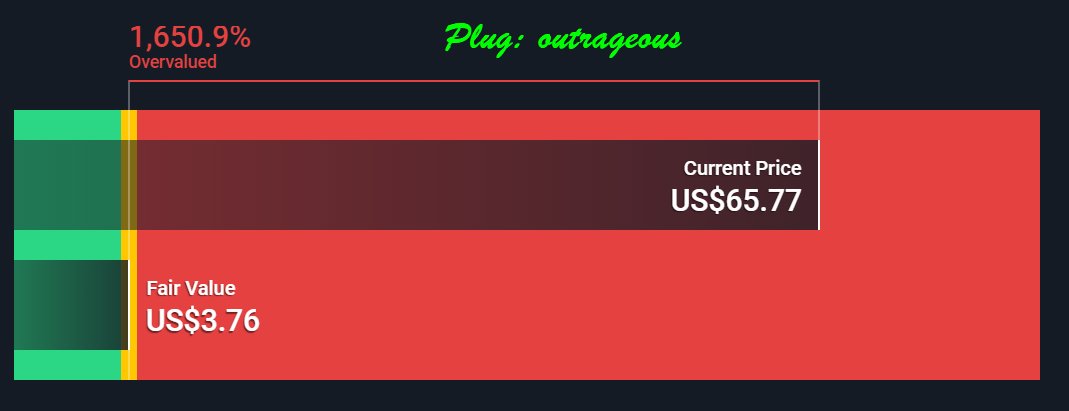

Examples of DCF (or fair value)

Tech

Tech

$AAPL: market leader

$GOOG: pure tech

Industrials

Industrials

$TSLA: retail favorite

$PLUG: small cap leader

Tech is "cheaper". So the thesis that the market is high because we're investing in tech doesn't make sense.

Tech is "cheaper". So the thesis that the market is high because we're investing in tech doesn't make sense.

Examples of DCF (or fair value)

Tech

Tech$AAPL: market leader

$GOOG: pure tech

Industrials

Industrials$TSLA: retail favorite

$PLUG: small cap leader

Tech is "cheaper". So the thesis that the market is high because we're investing in tech doesn't make sense.

Tech is "cheaper". So the thesis that the market is high because we're investing in tech doesn't make sense.

6/

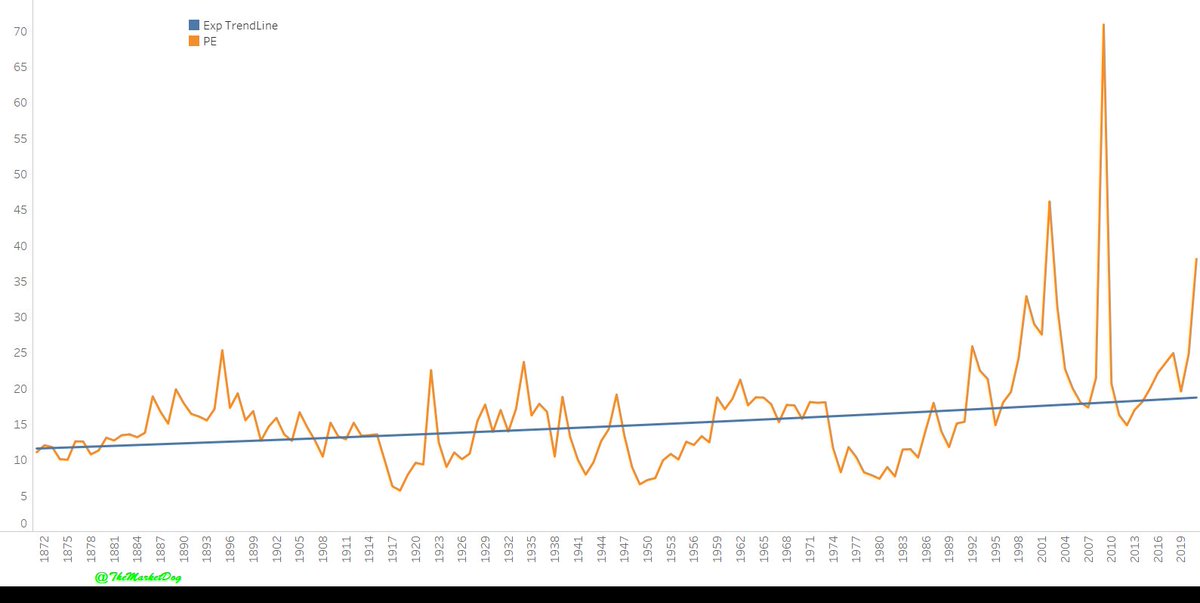

Let me challenge your view on P/E

Interest rates always go down. The long-term impact of low rates is priced in the market at any time

Interest rates always go down. The long-term impact of low rates is priced in the market at any time

Detrending the P/E will solve the problem of lowering bonds yields

Detrending the P/E will solve the problem of lowering bonds yields

Here is the S&P P/E & the exponential trendline since 1870

Here is the S&P P/E & the exponential trendline since 1870

Let me challenge your view on P/E

Interest rates always go down. The long-term impact of low rates is priced in the market at any time

Interest rates always go down. The long-term impact of low rates is priced in the market at any time Detrending the P/E will solve the problem of lowering bonds yields

Detrending the P/E will solve the problem of lowering bonds yields Here is the S&P P/E & the exponential trendline since 1870

Here is the S&P P/E & the exponential trendline since 1870

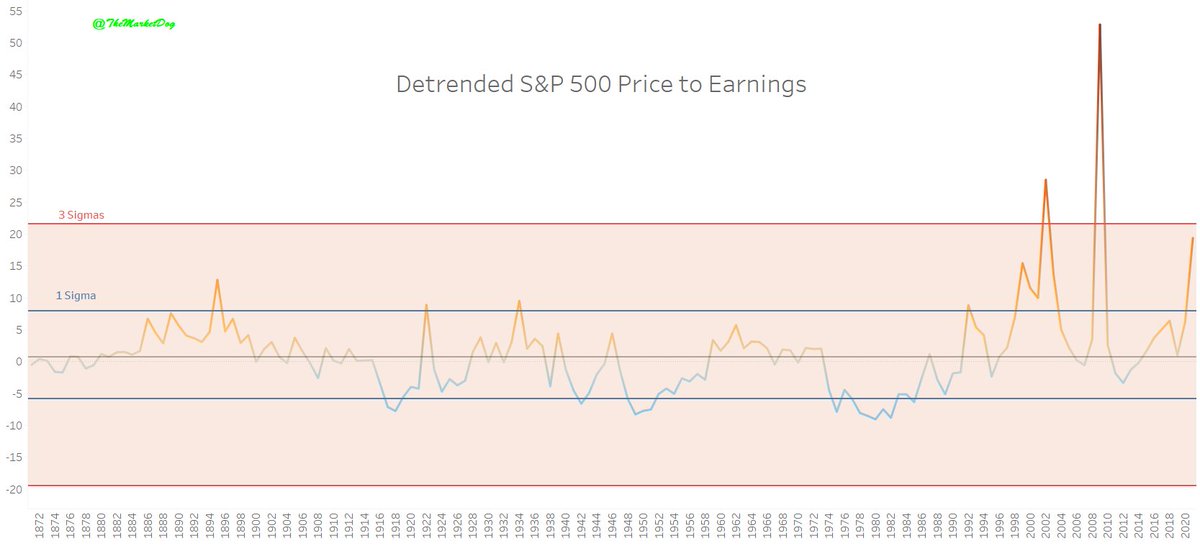

7/

Now let's look at the variance to the exponential trendline

Now let's look at the variance to the exponential trendline

There are always periods of manias. Fortunately for the sounds investor, these period usually followed by periods where stocks are "cheap"

There are always periods of manias. Fortunately for the sounds investor, these period usually followed by periods where stocks are "cheap"

Temporary periods of high ratios are not new

Temporary periods of high ratios are not new

Now let's look at the variance to the exponential trendline

Now let's look at the variance to the exponential trendline There are always periods of manias. Fortunately for the sounds investor, these period usually followed by periods where stocks are "cheap"

There are always periods of manias. Fortunately for the sounds investor, these period usually followed by periods where stocks are "cheap" Temporary periods of high ratios are not new

Temporary periods of high ratios are not new

8/

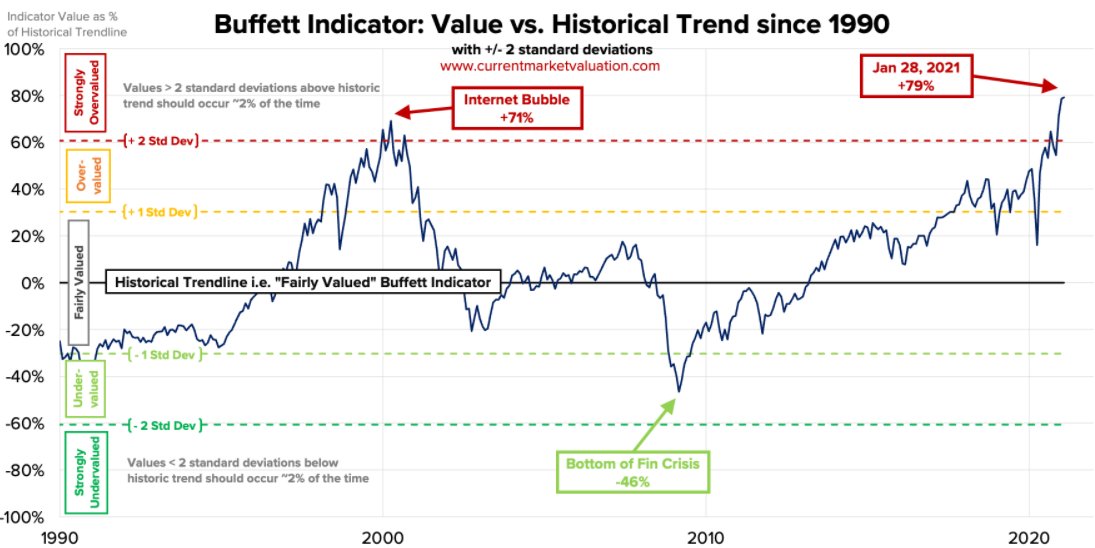

From time to time P/E is high due to a very big "blip" in the earnings. 2009 is a good example. Stocks were "cheap" but the price earning was high.

I look at the "Buffet indicator" (Stocks/GDP) to assess this. Also de-trended.

We can see that P/E wasn't relevant in 2009.

From time to time P/E is high due to a very big "blip" in the earnings. 2009 is a good example. Stocks were "cheap" but the price earning was high.

I look at the "Buffet indicator" (Stocks/GDP) to assess this. Also de-trended.

We can see that P/E wasn't relevant in 2009.

9/

So let's remove the "blip" of 2020 (& 2021, 2022)

So let's remove the "blip" of 2020 (& 2021, 2022)

To do this I will look at the Shiller Ratio - CAPE. De-trended with an exp. regression

To do this I will look at the Shiller Ratio - CAPE. De-trended with an exp. regression

Avg inflation-adjusted earnings from the previous 10 years

Avg inflation-adjusted earnings from the previous 10 years

34.6% above the trend. Only in '99, stocks were more expensive

34.6% above the trend. Only in '99, stocks were more expensive

So let's remove the "blip" of 2020 (& 2021, 2022)

So let's remove the "blip" of 2020 (& 2021, 2022) To do this I will look at the Shiller Ratio - CAPE. De-trended with an exp. regression

To do this I will look at the Shiller Ratio - CAPE. De-trended with an exp. regression Avg inflation-adjusted earnings from the previous 10 years

Avg inflation-adjusted earnings from the previous 10 years 34.6% above the trend. Only in '99, stocks were more expensive

34.6% above the trend. Only in '99, stocks were more expensive

In conclusion, through history people always found reason to justify sky high valuations. But more often than these sky-high valuations are not justified.

Thank you for reading & to re-tweet if you were interest

Thank you for reading & to re-tweet if you were interest

@threadreaderapp unroll

link to the top: https://twitter.com/TheMarketDog/status/1357918284100763654?s=20

Read on Twitter

Read on Twitter