In case you are wondering what this is.

1/ If you lock CRV tokens in the Curve DAO, you get back veCRV tokens. The longer you lock, the more veCRV tokens you get. Those veCRV tokens let you claim a portion of the admin fees generated by *all* Curve pools https://twitter.com/iearnfinance/status/1357868798796324864

1/ If you lock CRV tokens in the Curve DAO, you get back veCRV tokens. The longer you lock, the more veCRV tokens you get. Those veCRV tokens let you claim a portion of the admin fees generated by *all* Curve pools https://twitter.com/iearnfinance/status/1357868798796324864

2/ The yveCRV vault takes your CRV tokens, and essentially locks them forever, but still allows you to claim your share of those fees

3/ The "38% more" above comes from the mutually beneficial relationship between yveCRV and the other CRV auto-farm yearn vaults like y3crv.

The yveCRV locks CRV to boost returns of the auto-farms, and the auto-farms lock some CRV which gives more veCRV to the yveCRV vault

The yveCRV locks CRV to boost returns of the auto-farms, and the auto-farms lock some CRV which gives more veCRV to the yveCRV vault

4/ But in the yveCRV vault, your principal is locked up...forever.

That's where the WETH-yveCRV pool comes in. At any point, you can swap your yveCRV for WETH and get your principal back (assuming market price for yveCRV stays near CRV)

That's where the WETH-yveCRV pool comes in. At any point, you can swap your yveCRV for WETH and get your principal back (assuming market price for yveCRV stays near CRV)

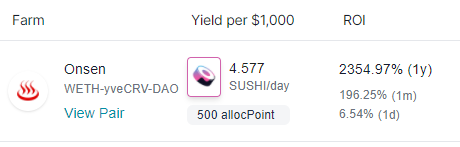

5/ And at the moment, the Sushi team has added some ridiculously high incentives in the form of SUSHI token rewards for providing initial liquidity in that pool

Note: As liquidity builds up in there, I'd expect those numbers to come down to parity with the other Onsen farms.

Read on Twitter

Read on Twitter