Twitter offers up great opinions (and more importantly questions your own).

I made a comment @DPogrebinsky post ealier about how I believe $PINS will destroy estimates for 2021 - he thankfully pushed back and made me question my model to see how outlandish it is:

Thread

I made a comment @DPogrebinsky post ealier about how I believe $PINS will destroy estimates for 2021 - he thankfully pushed back and made me question my model to see how outlandish it is:

Thread

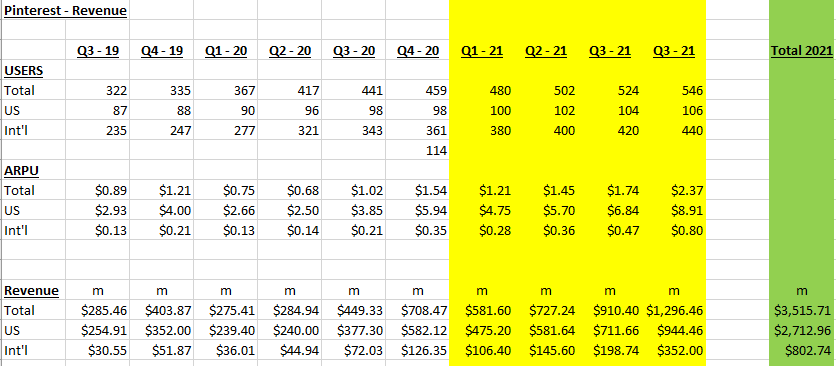

The screenshot below is my model for how $PINS could reach $3.5bn in 2021

Remember as George Box says "All models are wrong, but some are useful"

I welcome anyones opinion on this (we all want to learn)

Assumptions

Remember as George Box says "All models are wrong, but some are useful"

I welcome anyones opinion on this (we all want to learn)

Assumptions

Int'l Users

- 20m additions per Q - reach 440m end of FY21

- 79m net additions in FY21E, 114m in FY20

- FY21E YoY growth 21% - FY20 YoY 46%

US Users

- 2m additions per Q - reach 106m end of FY21

- 8m net additions in 2021, 10m added in FY20

- FY21E YoY growth 8% - FY20 YoY 11%

- 20m additions per Q - reach 440m end of FY21

- 79m net additions in FY21E, 114m in FY20

- FY21E YoY growth 21% - FY20 YoY 46%

US Users

- 2m additions per Q - reach 106m end of FY21

- 8m net additions in 2021, 10m added in FY20

- FY21E YoY growth 8% - FY20 YoY 11%

ARPU Trends:

- No global pandemic in FY21 causing online advertising $$ to collapse (look at Q2/Q3 2020 ARPU)

- Advertising $$ is shifting online (ARPU will accelerate)

- Advertisers looking to $PINS over $FB

- $PINS in early stages of monetisation (long runway)

- Social shopping

- No global pandemic in FY21 causing online advertising $$ to collapse (look at Q2/Q3 2020 ARPU)

- Advertising $$ is shifting online (ARPU will accelerate)

- Advertisers looking to $PINS over $FB

- $PINS in early stages of monetisation (long runway)

- Social shopping

ARPU - Int'l:

- Q4 FY21 to reach $.80 from $.35 in Q4 FY20

- FY21E - YoY growth of 128% - Current growth rate of 66%

- Q1 FY21 ARPU to drop 20% from Q4 FY21 - QoQ growth of 30% in FY21

In comparison:

- $FB Q4 FY20 int'l ARPU: $6

- $SNAP Q4 FY20 int'l ARPU: $1.5

- Q4 FY21 to reach $.80 from $.35 in Q4 FY20

- FY21E - YoY growth of 128% - Current growth rate of 66%

- Q1 FY21 ARPU to drop 20% from Q4 FY21 - QoQ growth of 30% in FY21

In comparison:

- $FB Q4 FY20 int'l ARPU: $6

- $SNAP Q4 FY20 int'l ARPU: $1.5

ARPU - US:

- Q4 FY21 ARPU YoY growth of 50% to $8.91,

- Q4 FY20 YoY growth of 49% from $4 to $5.96

- Q1 FY21 ARPU to drop 20% from Q4 FY21 - QoQ growth of 20% in FY21

In comparison:

- $FB Q4 FY20 int'l ARPU: $53.56

- $SNAP Q4 FY20 int'l ARPU: $7.19

- Q4 FY21 ARPU YoY growth of 50% to $8.91,

- Q4 FY20 YoY growth of 49% from $4 to $5.96

- Q1 FY21 ARPU to drop 20% from Q4 FY21 - QoQ growth of 20% in FY21

In comparison:

- $FB Q4 FY20 int'l ARPU: $53.56

- $SNAP Q4 FY20 int'l ARPU: $7.19

I understand how stupid it is to predict Revenue to grow from $1.6bn in FY20 to $3.5bn in FY21 (YoY 118%).

Due to Covid19, ARPU collapsed in 2020 & gives easy YoY comps for FY21.

If $PINS kept ARPU at $1 during Q2/Q3, $2bn Rev in 2020.

- FY21 Analyst Est of $2.34bn is too low

Due to Covid19, ARPU collapsed in 2020 & gives easy YoY comps for FY21.

If $PINS kept ARPU at $1 during Q2/Q3, $2bn Rev in 2020.

- FY21 Analyst Est of $2.34bn is too low

Read on Twitter

Read on Twitter