A brief thread on why I have spent recent months buying a big stake in Games Workshop/ #GAW. If nothing else, I can look back at this later as a checklist and if any of it no longer seems true I should at least *think* about selling. In no particular order:

1. Consistently good ROCE since 2015 (and especially since 2017).

2. Revenue growth has been very inconsistent, but the trajectory is clear. I am (or want to become!) a long-term, patient investor, so that trend is what counts.

2. Revenue growth has been very inconsistent, but the trajectory is clear. I am (or want to become!) a long-term, patient investor, so that trend is what counts.

3. Great cash conversion. It doesn't matter if you look at profits or cash flow really because they tell much the same story.

4. Relatedly, Games Workshop's CROCI - the cash version of ROCE - is phenomenal.

4. Relatedly, Games Workshop's CROCI - the cash version of ROCE - is phenomenal.

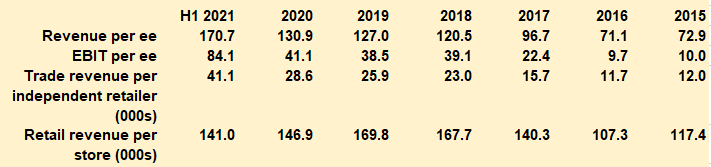

5. As below, they seem to be getting better all the time at generating more money (however measured) per employee and per retailer.

6. Great operating margins - and very high capital turnover. On average 27% OPM 2015-2020 and 222% capital turnover. Hence the high ROCE (avg 61%!).

6. Great operating margins - and very high capital turnover. On average 27% OPM 2015-2020 and 222% capital turnover. Hence the high ROCE (avg 61%!).

7. Very encouraging royalties income growth. Yes, H1 2021 looked mildly discouraging but the decline was in one off royalties revenue (contract revenue up front). Ongoing regular revenues from royalties continued to grow.

8. Ultimately some non-financial considerations like ...

8. Ultimately some non-financial considerations like ...

... a sense that it has a lot of potential to grow the world, especially overseas, and that it is a genuinely rewarding hobby for so many people in spite of the cost.

Read on Twitter

Read on Twitter